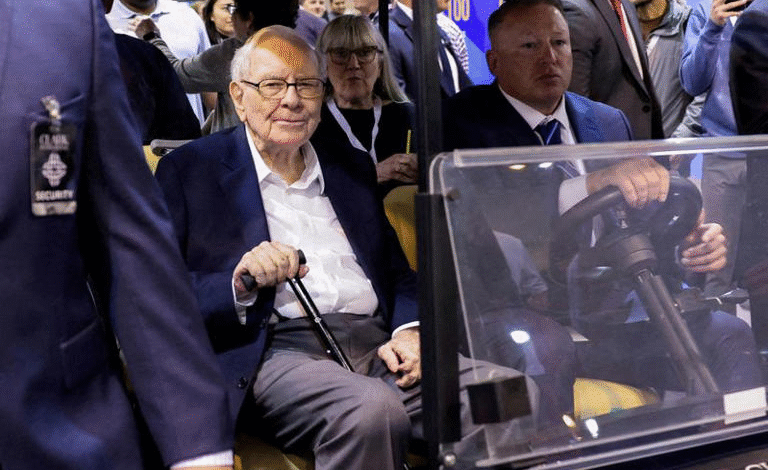

Berkshire Hathaway Meeting 2024: What Will Buffett Say?

As the anticipation builds for the Berkshire Hathaway meeting 2024, all eyes are on Warren Buffett as he addresses shareholder concerns amid an uncertain economic outlook. Set against the backdrop of escalating tariffs and their impact on market dynamics, this year’s gathering is especially significant, marking Buffett’s 60th year at the helm of the conglomerate. Thousands of enthusiastic investors will converge in Omaha, eager to glean insights from the investment maestro whose opinions often steer market sentiment. With recent turmoil leaving many questioning the stability of their investments, Buffett’s thoughts will be highly sought after as they can provide invaluable guidance regarding the current state of affairs. Shareholders are particularly keen on understanding how Buffett plans to navigate through the shifting landscape shaped by tariffs and evolving economic indicators.

As investors gear up for the 2024 Berkshire Hathaway shareholder meeting, the excitement is palpable as Warren Buffett prepares to share his insights on critical economic challenges. Dubbed the ‘Woodstock for Capitalists,’ this iconic event will see thousands flock to Omaha to hear Buffett’s take on market conditions influenced by recent tariff policies. With a legacy spanning six decades, Buffett’s words are more than just commentary; they hold the potential to sway investor attitudes and reflect broader economic realities. Amid fears of a potential recession and uncertainties in financial markets, participants are keen to comprehend Buffett’s strategy for managing Berkshire’s substantial cash reserves. Ultimately, the meeting serves as a beacon for those navigating the turbulent waters of today’s investment climate.

Warren Buffett’s Insights on Tariffs and Economic Outlook at Berkshire Hathaway Meeting 2024

At the upcoming Berkshire Hathaway meeting in 2024, all eyes will be on Warren Buffett as he finally addresses the tariff situation impacting the markets. With his wealth of experience in investment and deep analysis of economic factors, Buffett’s insights are highly anticipated by shareholders who are navigating through turbulent times. Many are interested to hear how he interprets the effects of Trump’s aggressive tariff policies on both Berkshire’s operations and the broader economy. Given that this annual gathering is often referred to as the Super Bowl for investors, Buffett’s take on the economic outlook could significantly shift investor sentiment.

Buffett’s comments could also provide crucial guidance as the market faces increasing fears of recession driven by the fallout from these tariffs. Investors are eager for reassurance that despite the economic strains, Berkshire’s diverse range of subsidiaries can weather the storm. By addressing these concerns head-on, Buffett could help alleviate anxieties and foster renewed confidence in the markets.

The Significance of Shareholder Sentiment amid Economic Uncertainty

As the 2024 Berkshire Hathaway meeting approaches, the significance of shareholder sentiment cannot be overstated. Investors heavily rely on Buffett’s wisdom for insights into current market dynamics, particularly in light of the economic uncertainty stemming from tariff implications. This meeting presents a unique opportunity for shareholders to gauge not just Buffett’s mood, but also the strategic direction he intends to take amidst a potential economic slowdown.

Additionally, the collective mood of shareholders can significantly influence market trends. If Buffett communicates a proactive and optimistic strategy despite the obstacles, it may act as a beacon of hope for investors looking for stability. Conversely, any hint of a bearish outlook could heighten concerns about economic instability, reflecting directly on investor sentiment and potentially leading to a shift in trading behaviors.

Buffett’s Investment Strategy: Cash Reserves and Market Timing

This year’s Berkshire Hathaway meeting is poised to shed light on one of the most talked-about topics: Warren Buffett’s enormous cash reserves, which have soared to a record $334.2 billion. Many shareholders are eager to grasp his investment strategy moving forward, especially in light of the recent market downturn. Investors are questioning whether Buffett will capitalize on current market conditions to make strategic acquisitions, as many view him as a barometer of market resilience.

With a significant cash pile at his disposal, Buffett holds the power to send strong signals to the market. Past actions have indicated a cautious approach with his significant stock sales; however, now could also represent a pivotal moment to identify attractive investment opportunities. Insights regarding when and how he plans to deploy this capital could reshape market sentiments and perceptions regarding the future economic landscape.

Understanding the Impact of Berkshire’s Stock Sales

In the lead-up to the 2024 Berkshire Hathaway meeting, the extent of Buffett’s stock sales has garnered considerable attention and speculation among shareholders. Having sold over $134 billion worth of stock, investors are keen to unravel the reasoning behind this continued offloading, especially regarding major equity holdings like Apple and Bank of America. Analyzing this activity could offer stakeholders critical insight into Buffett’s outlook on market conditions and the companies within his portfolio.

The consistency of stock sales over nine quarters might signal a strategic pivot or a risk management approach designed to protect Berkshire’s financial health. As shareholders gather in Omaha, examining these trends will be essential in comprehending both Buffett’s philosophy and the implications for overall investor sentiment. The transparency of his decision-making process surrounding such significant sales is likely to spark discussions and influence future investment strategies.

Looking Ahead: A New Chapter in Berkshire’s Legacy after Munger

With the passing of long-time partner Charlie Munger, this year proves to be a significant milestone in Berkshire Hathaway’s history as it marks the beginning of a new chapter under Buffett’s leadership. Investors are particularly interested in understanding how Buffett’s approach may shift without Munger’s mentorship. The question remains whether Buffett will uphold the same strategic vision or pivot to adapt to contemporary market challenges, particularly in an environment impacted by tariffs.

Shareholders are conscious of the legacy Munger has left and are curious to see if Buffett will embrace different investment philosophies or tweak existing strategies. Munger was well-known for his forthright nature and business acumen, and investors are now looking to Buffett to reassure them that Berkshire’s principles will remain intact as the company navigates through unpredictable economic conditions.

The Role of Media and Broadcasting at Berkshire Hathaway’s Shareholder Meeting

The 2024 Berkshire Hathaway shareholder meeting is set to be a highly publicized event, with live broadcasts on CNBC available in both English and Mandarin. This media coverage amplifies Buffett’s insights and strategies, making them accessible to a wider audience beyond just the attendees in Omaha. As millions of viewership can influence market movements, the role of media becomes critical in shaping perceptions regarding Berkshire’s performance and Buffett’s messages.

Through live broadcasts, shareholder queries and Buffett’s responses can resonate with a global audience of potential investors. The insights he provides may not only influence current investor sentiment but can also attract new investment interest. With international audiences increasingly attuned to economic developments, this meeting’s discussions are likely to impact global market trends and perceptions about the future.

Berkshire Hathaway’s Response to Economic Indicators Ahead of the Meeting

As Berkshire Hathaway prepares for its highly anticipated meeting, the economic indicators leading up to the event are causing a stir among investors and analysts alike. With growing concerns about a potential recession, these indicators, influenced by tariffs, are critical in shaping shareholder expectations and the overall economic sentiment. Buffett’s analysis of these data points could provide clarity on how external factors are impacting Berkshire’s expansive business portfolio.

The relevance of timely economic indicators makes this meeting even more crucial. Following Buffett’s guidance on these matters may not only affect the immediate investor sentiment but could also set the tone for Berkshire’s strategic direction moving forward. Many shareholders will be listening for detailed insights that link current economic conditions with operational strategies, seeking reassurance amid the turbulence.

Buffett and the Ethics of Investment during Economic Turmoil

The ethical dimensions of investment are put under the spotlight as shareholders gather for the 2024 meeting. Considering the market turbulence caused by tariff implications, investors are keen to assess Buffett’s take on ethical investment strategies during challenging times. How companies navigate economic pressures while remaining committed to ethical practices is a vital concern for many shareholders.

Buffett’s longstanding views on ethical investing could provide a moral compass, guiding investors in their own decision-making processes during this uncertain period. His reflections on this topic may help cultivate a thoughtful discourse on the necessity of ethical approaches in investing, especially under the strain of economic volatility caused by external factors like tariffs.

The Influence of Berkshire Hathaway Meeting on Global Investor Sentiment

The 2024 Berkshire Hathaway meeting is expected to have a profound influence on global investor sentiment. As Buffett shares his vision and insights, the reactions from attendees and viewers worldwide can create ripples across financial markets. Investors often look to Buffett as a barometer of confidence; any assertive statements regarding economic recovery will likely send positive signals to the market.

Conversely, if Buffett expresses caution in his analysis of market conditions, particularly with the looming tariff consequences and recession threats, it could dampen investor spirits. The outcomes of this significant meeting are likely to resonate well beyond the immediate Berkshire shareholder community, impacting investor strategies and market trends on a global scale.

Frequently Asked Questions

What key insights can we expect from the Berkshire Hathaway meeting 2024 related to Warren Buffett’s views on the economy?

At the Berkshire Hathaway meeting 2024, shareholders anticipate Warren Buffett will share crucial insights regarding the economic outlook amidst current market uncertainties and tariff impacts. Given his extensive experience, Buffett is likely to address how these factors are influencing Berkshire’s business and future strategies.

How will the Berkshire Hathaway meeting 2024 address the impacts of tariffs on the economy?

During the Berkshire Hathaway meeting 2024, tariffs will be a significant topic of discussion. Warren Buffett’s analysis may provide clarity on how ongoing tariffs are affecting market conditions and investor sentiment, offering shareholders guidance on navigating this turbulent economic landscape.

What are shareholders hoping to learn from Warren Buffett at the Berkshire Hathaway meeting 2024?

Shareholders attending the Berkshire Hathaway meeting 2024 are eager to hear Warren Buffett’s perspective on economic trends, particularly concerning tariffs and their effects on investment strategies. Many are looking for reassurances about the stability of the U.S. economy during these unpredictable times.

How has Warren Buffett’s approach to investments changed leading up to the Berkshire Hathaway meeting 2024?

Leading up to the Berkshire Hathaway meeting 2024, Warren Buffett has notably sold more stock than purchased, raising cash reserves significantly. Shareholders are keen to discover his rationale for these decisions, especially regarding his major holdings and how he plans to utilize the cash pile amidst current market challenges.

What should attendees expect from the question-and-answer session at the Berkshire Hathaway meeting 2024?

The question-and-answer session at the Berkshire Hathaway meeting 2024 will feature Warren Buffett, his successor Greg Abel, and insurance chief Ajit Jain. Attendees can expect discussions surrounding key business strategies, responses to market fluctuations, and Buffett’s insights on tariffs and their economic implications.

Will the Berkshire Hathaway meeting 2024 provide updates on the company’s major investments like Apple?

Yes, the Berkshire Hathaway meeting 2024 will likely cover updates on major investments, particularly Buffett’s stance on the Apple stake, which has remained stable at 300 million shares. Shareholders are curious about the reasoning behind this decision and whether Buffett sees further growth in Apple’s valuation.

How is the Berkshire Hathaway meeting 2024 significant for investor sentiment and market trends?

The Berkshire Hathaway meeting 2024 is crucial for investor sentiment, as Warren Buffett’s comments often shape market trends. With economic indicators in focus, investors are looking for signals that could clarify the overall economic outlook and inform their investment decisions amid tariff-related uncertainties.

| Key Points | Details |

|---|---|

| Annual Meeting | Berkshire Hathaway’s annual shareholder meeting in 2024 in Omaha. |

| Buffett’s Silence | Warren Buffett has not commented on recent tariffs and market volatility. |

| Tariffs Impact | President Trump’s high tariffs causing market uncertainty and concerns about a recession. |

| Investors’ Expectations | Investors are looking for clarity and guidance from Buffett regarding the economic situation. |

| Berkshire’s Stock Sales | Berkshire has sold more stock than purchased for nine quarters, totaling over $134 billion in 2024. |

| Cash Reserves | Cash reserves have increased to $334.2 billion. |

| Future Investments | Shareholders are interested in how Buffett will deploy Berkshire’s cash reserves. |

| Buffett’s Rationale on Apple | Speculation on Buffett waiting to sell his Apple stake to avoid taxes or due to stock valuation. |

| Record Cash Holdings | Buffett’s comments will likely influence investor sentiment and market trends. |

Summary

The Berkshire Hathaway meeting in 2024 is a key event for investors as they anticipate Warren Buffett’s insights amidst economic uncertainty and tariff-related issues. With market volatility affecting economic forecasts, investors are hopeful that Buffett will provide clarity and guidance on Berkshire’s significant cash reserves and investment strategies. His upcoming remarks at the meeting will be crucial in shaping market sentiment and may influence future trends in the economy as shareholders look for reassurances on the impacts of tariffs and overall market health.