Best Crypto Signals: How to Identify the Real Ones

In the dynamic world of cryptocurrency, finding the best crypto signals can be the difference between achieving fortune and facing significant losses. Many traders flock to various crypto signal providers, but few offer the long-term profitability and reliability necessary for sustainable success. While it’s tempting to chase fleeting gains during market surges, truly effective trading signal strategies focus on stability and strategic risk management. When seeking guidance, it’s essential to have a crypto signals checklist that helps filter out the noise of inferior signals from those that are backed by proven methodologies. This introduction sets the stage for understanding how to identify and leverage the best crypto signals to enhance your trading journey.

As the allure of digital currencies grows, effective channels of communication such as crypto trading signals have emerged, guiding investors through the ever-evolving market landscape. Navigating this complex environment requires keen insight into the qualities provided by reputable crypto signal providers, who prioritize sustainable growth over short-lived trends. Emphasizing structured long-term crypto trading practices can provide a roadmap for success, helping traders avoid common pitfalls. With an arsenal of trading signal strategies, investors can identify opportunities and make informed decisions. Utilizing a comprehensive crypto signals checklist can streamline the process of distinguishing valuable signals from the myriad of misleading advice online.

Understanding Crypto Trading Signals

Crypto trading signals are notifications that traders use to make informed decisions about buying or selling cryptocurrencies. These signals can be based on technical analysis, market sentiment, or fundamental factors. However, discerning reliable crypto signals from misleading ones can be daunting. It’s crucial to assess the source of these signals and consider the strategies they promote. While many platforms claim to provide high-quality signals, not all are created equal. Evaluating a signal’s consistency, success rate, and the transparency of the provider is essential for long-term profitability.

To maximize your benefits from crypto trading signals, leverage a mix of strategies, including market trends, price movements, and historical data analysis. By employing multiple methodologies, you can create a robust trading plan that allows you to identify good entry and exit points while managing risk effectively. Reliable signal providers often highlight the importance of a well-defined trading strategy, ensuring their signals align with your investing style, whether it be aggressive day trading or a more conservative long-term investing approach.

Identifying the Best Crypto Signal Providers

Finding the best crypto signal providers requires thorough research and understanding of their trading methodologies. Look for providers who employ structured risk management tactics and offer a variety of trading signals to cater to different market conditions. An ideal signal provider should not only give you entry and exit points but also educate you on the reasoning behind their recommendations. This educational approach can significantly enhance your trading skills and confidence.

Furthermore, consider utilizing a checklist to evaluate crypto signal providers. Key indicators include their win rate, transparency in strategy, and ability to adapt to changing market conditions. Since the crypto market is volatile, a versatile approach in trading signal strategies will often yield better long-term results. Providers that emphasize education and discipline will also help you avoid common pitfalls, reinforcing good trading habits over time.

Utilizing a Crypto Signals Checklist for Success

A crypto signals checklist is a vital tool for traders aiming for consistent success in the dynamic cryptocurrency market. It typically includes criteria for evaluating trade setups, such as analyzing entry points, stop-loss levels, and exit strategies. Sticking to a structured checklist helps maintain discipline and reduces the likelihood of emotional decision-making, which can often lead to losses. By focusing on specific criteria, traders can better navigate complex market trends and identify trustworthy signals.

Moreover, a well-built crypto signals checklist should encompass risk management strategies, including the risk-to-reward ratio. Professional traders often target a minimum of 2:1 on their trades. This means for every dollar risked, they aim to gain two dollars, thereby ensuring long-term growth in their portfolios. By using a checklist that emphasizes such strategies, traders not only protect their investments but also cultivate a mindset geared towards sustainable trading practices.

Long-Term Growth vs. Short-Term Gains in Crypto Trading

In the world of crypto trading, distinguishing between long-term growth and short-term gains is paramount. Many novice traders focus on quick profits during bullish markets, often leading to impulsive and unstructured trading. In contrast, successful traders understand that employing well-defined strategies over a longer horizon generally yields better results. They use detailed analysis and insights from credible signal providers to craft trades that align with their long-term financial goals.

Long-term crypto trading involves being patient and waiting for the right market conditions. While short-term trades can be exciting, they carry a higher level of risk and require constant market monitoring. By adopting a long-term perspective, traders can develop a stable strategy that incorporates the best crypto signals, ensuring their investment decisions are based on sound analysis rather than fleeting market trends.

Understanding Risk/Reward Dynamics

Risk/reward dynamics are fundamental concepts in crypto trading that every trader must master. The goal is to achieve a favorable payout for the risk undertaken in each trade. Experienced traders often seek trades that offer at least a 2:1 reward-to-risk ratio, ensuring that their potential profits outweigh the losses. This principle not only enhances the probability of maintaining a successful trading record but also aligns with the core strategies used by leading crypto signal providers.

To effectively manage risk, traders should also diversify their positions and strategically allocate capital across various trades. This approach minimizes potential detrimental impacts on the portfolio should a particular trade not perform as expected. Understanding where to place stop-loss orders and when to take profits is crucial, as these decisions significantly influence profitability over time. Being able to navigate these dynamics can mean the difference between a thriving trading account and one that suffers frequent losses.

The Role of Emotional Control in Trading

Emotional control is a critical aspect of successful trading, especially in the highly volatile crypto market. Traders who allow their emotions to dictate their decisions often fall prey to impulsive actions, leading to significant losses. Professional traders emphasize the importance of maintaining composure and sticking to their trading plan, regardless of market fluctuations. By focusing on well-established trading signal strategies, traders can shield themselves from emotional biases and maintain a disciplined approach.

Furthermore, cultivating emotional control involves understanding the psychology of trading. Real professionals train themselves to view wins and losses objectively, treating both as educational experiences rather than personal judgments. This mindset fosters resilience and prepares them to handle the inevitable ups and downs of trading. By adopting such an approach, traders enhance their overall performance and develop a long-term perspective crucial for success in the crypto space.

Analyzing Markets: The Foundation of Crypto Signals

Comprehensive market analysis is the cornerstone of effective crypto signaling. Professional traders analyze various aspects of the market, including technical indicators, price movements, and sentiment analysis. This multi-faceted approach allows them to identify potential trading opportunities and provide actionable signals. Those interested in crypto trading should cultivate the ability to interpret market data critically, ensuring their decisions are based on solid analyses rather than speculation.

Additionally, thorough market analysis often includes keeping an eye on both macroeconomic factors and individual coin performance. By understanding broader market trends, traders can adjust their strategies and align their investments with prevailing conditions. Gaining insights into historical performance, trading volumes, and market news can also contribute to developing a more complete picture. Coupling this analysis with signals from reputable providers ensures a well-rounded trading strategy aimed at long-term success.

Visual Validation as a Best Practice

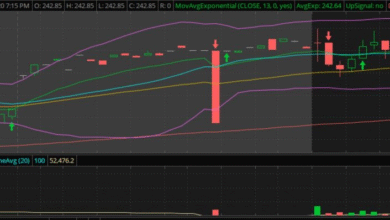

Visual validation is an essential aspect of professional trading practices, particularly in crypto. Traders should always aim for clarity, and including charts that demonstrate entry points, stop-losses, and take-profit levels is a critical component of a robust trading strategy. This visual representation enhances accountability, providing clear guidelines for executing trades based on signals. Successful traders rely on this practice to reduce ambiguity in their decisions and improve overall outcomes.

The importance of visual validation extends beyond mere documentation; it serves as an effective training tool. When traders analyze past trades with accompanying charts, they can identify patterns and learn from both successes and mistakes. This educational aspect not only improves individual trading acumen but also fosters a community of responsible traders who value transparency and continuous learning. By prioritizing visual validation, traders can enhance their skills and cultivate a more disciplined trading environment.

Position Sizing: A Key Element of Risk Management

Position sizing is a fundamental principle of effective risk management in crypto trading. Determining the appropriate amount to invest in a trade relative to your overall portfolio is crucial for safeguarding capital. Professional traders often calculate position sizes based on their risk tolerance and the specific dynamics of the trade at hand, ensuring they never overextend their exposure. This strategy is especially important in a volatile market where shifts can happen rapidly.

Furthermore, having a clear position sizing strategy helps traders maintain discipline and avoid emotional trading decisions. By adhering to a predefined plan, traders can prevent substantial losses caused by reckless overtrading. This disciplined approach is one of many factors that differentiate successful traders from those who struggle. Emphasizing position sizing helps foster a long-term mindset focused on steady portfolio growth.

Final Thoughts on Professional Crypto Trading Strategies

Professional crypto trading isn’t just about making the quickest profits; it involves employing a disciplined, strategic approach that incorporates a variety of factors. Understanding the nuances of different trading signal strategies, maintaining emotional control, and emphasizing a long-term perspective are all crucial components of successful trading. By prioritizing these elements, traders can create a sustainable trading practice that upholds their capital over time.

Ultimately, best crypto signals come from providers who uphold a commitment to their clients’ educational growth and empowerment. By finding a reputable signal provider that emphasizes strategy, risk management, and discipline, traders will be positioned for long-term success. With the right tools and mindset in place, anyone can navigate the complex world of cryptocurrency trading and establish a healthy, profitable trading portfolio.

Frequently Asked Questions

What are the best crypto signals for long-term trading?

The best crypto signals for long-term trading come from established crypto signal providers that prioritize consistent profitability over short-term wins. These providers use structured trading strategies and focus on risk management to help maintain your portfolio’s growth over time.

How can I identify a reliable crypto signal provider?

To identify a reliable crypto signal provider, look for those who follow a systematic approach, provide a clear trading strategy, and maintain emotional discipline. They should also prioritize risk/reward metrics over flashy win rates and offer visual validation for their trades.

What should I look for in a crypto trading signals checklist?

A crypto trading signals checklist should include criteria like market context analysis, risk management practices, clear entry and exit strategies, and communication of position sizes. Make sure the checklist emphasizes quality trades over quantity.

Why is risk management crucial in crypto signal strategies?

Risk management is crucial in crypto signal strategies because it helps protect your capital during volatile market conditions. A structured approach to risk ensures that your gains from successful trades outweigh the losses from unsuccessful ones, leading to long-term profitability.

What types of trading signal strategies do professional traders use?

Professional traders often use strategies that include trend following, breakout trading, and market analysis across multiple timeframes. They adapt their strategies based on market conditions, leveraging high-probability setups while maintaining disciplined risk management.

How does the winning rate relate to the quality of crypto trading signals?

The winning rate alone does not determine the quality of crypto trading signals. What’s more important is the risk/reward ratio; a strategy may have a lower winning rate but still be profitable if the gains from winning trades far exceed the losses from losing ones.

What is the importance of emotional control in crypto signal trading?

Emotional control is vital in crypto signal trading as it allows traders to make rational decisions without being swayed by fear or greed. Professional traders maintain focus and discipline, which helps them stick to their trading plans, ultimately leading to better outcomes.

Can I rely on text-only crypto signals for successful trading?

Relying solely on text-only crypto signals can be risky as it lacks accountability and visual validation. Successful trading signals typically come with detailed charts including entry points, stop losses, and take-profit levels to support decision-making.

How often should I trade based on crypto signals?

It’s essential to prioritize quality over quantity when trading based on crypto signals. Overtrading can lead to significant losses, so focus on waiting for high-probability setups that align with your trading strategy.

What role does position sizing play in effective crypto trading?

Position sizing plays a critical role in effective crypto trading as it involves determining the appropriate amount of capital to allocate to each trade. Properly sized positions help manage risk and maximize potential returns in line with your overall trading strategy.

| Key Points | Explanation |

|---|---|

| Recognizing Real Traders vs. Fake Providers | Real traders focus on long-term strategies while many signal providers are inconsistent and capitalize on temporary market conditions. |

| Checklist for Best Signals | Includes strategies like risk/reward assessment, market context analysis, and avoiding overtrading to maintain portfolio health. |

| Key Characteristics of Professional Signals | Professional providers demonstrate emotional control, structured trading strategies, and are transparent in their trade setups. |

| Risk Management | Effective risk management and position sizing are critical to successful long-term trading. |

Summary

The best crypto signals are those that prioritize structured trading strategies and risk management over the hype of quick profits. In today’s saturated market of crypto signal providers, distinguishing between genuine professionals and amateurs is crucial to ensure long-term profitability. By focusing on key characteristics such as emotional control, clear trading strategies, and disciplined execution, traders can effectively grow and preserve their capital, steering clear of impulsive decisions driven by market emotions.