Binance Coin Price Analysis: Short-Term Correction Ahead

In this Binance Coin price analysis, we delve into the current market dynamics that may signal a short-term correction for BNB. As it stands, the price is approaching critical support levels, specifically within the middle structural zone, where traders anticipate the potential for a rebound. This area shows a substantial concentration of open positions, highlighted by liquidity on the heatmap, making it a focal point for any upcoming trading strategies. Monitoring these Binance Coin support levels is essential, as they could provide the perfect backdrop for a continuation of the bullish trend following a healthy consolidation phase. Furthermore, with indicators suggesting a diminishing momentum and an overbought RSI, the need for a technical analysis of BNB becomes imperative for traders looking to navigate the evolving landscape of cryptocurrency.

Conducting an in-depth exploration of BNB’s market potential allows investors to understand its recent price movements and anticipate future trends. This analysis incorporates various technical indicators that highlight the possibility of a moderate pullback as traders evaluate their positioning. With a keen eye on the Binance Coin’s support zones and price prediction patterns, market participants can explore effective crypto trading strategies that capitalize on these fluctuations. By focusing on the potential for a short-term correction, we can unearth critical insights that guide decision-making in the overall bullish environment for Binance Coin. This exploration not only aids in risk management but also sets the stage for informed trading approaches leveraging technical analysis.

Understanding the Binance Coin Price Analysis

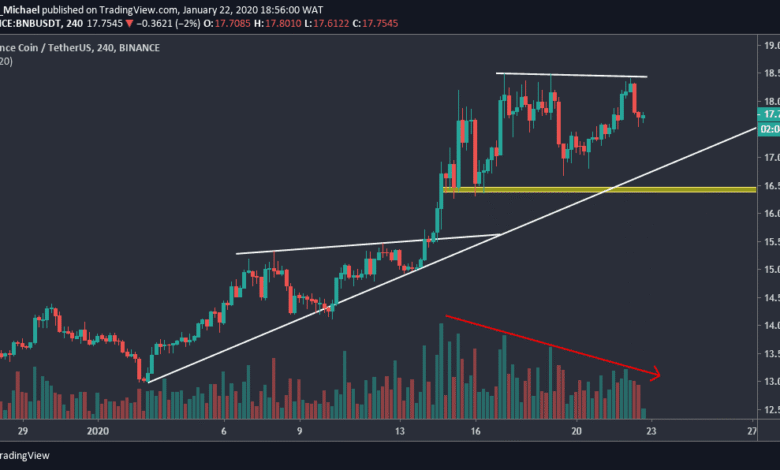

Binance Coin (BNB) has been exhibiting a fascinating price behavior in the market, showing significant potential for a short-term correction. Recent technical analysis indicates that BNB may revisit key support levels, particularly within the middle structural zone, which is highlighted on the daily chart. This area is crucial as it serves as a liquidity accumulation zone, underscoring the relevance of these support levels in the broader context of BNB price prediction. When analyzing the price movements, investors should look closely at how BNB interacts with these support zones to gauge future market behavior.

The importance of support levels cannot be overstated in the realm of crypto trading strategies. A healthy pullback to the 50 EMA or even the more significant 200 EMA can provide traders with ideal reentry points while fostering a more stable price environment. This technical consolidation phase can be advantageous for those looking to capitalize on BNB’s potential recovery. Moreover, keeping an eye on the MACD and RSI indicators could provide further insights into the momentum shifts that affect BNB prices, allowing traders to make more informed decisions.

BNB Support Levels and Their Importance

The Binance Coin support levels are vital for traders aiming to optimize their trading strategies and minimize risks. In the face of potential downturns, these support levels will act as crucial indicators of where buyers may step in, thus preventing further declines in the price of BNB. When assessing the 4-hour chart, the proximity of the 50 EMA to the green-marked support zone is particularly noteworthy. If the price retraces to this level, it may serve as an excellent opportunity for traders to consider entering or adding to their positions.

Additionally, the observation of a possible pullback towards the 200 EMA raises a significant consideration for Binance Coin’s price dynamics. These moving averages represent the market’s sentiment and can act as both support and resistance levels. Therefore, understanding how BNB interacts with these critical points will be instrumental in formulating short-term and long-term investment strategies. Properly identifying and utilizing these support levels can bolster traders’ confidence and enhance their overall performance in the volatile crypto market.

Analyzing Short-Term Corrections for BNB

In the realm of crypto trading, short-term corrections are often seen as necessary evils that provide traders with fresh opportunities. For Binance Coin, the current indications of a short-term correction suggest the market’s shift in momentum, reflecting the natural ebb and flow of trading activities. As BNB moves towards the established support levels, traders must reassess their positions to remain aligned with the market’s evolving sentiment.

These corrections can be beneficial as they allow for a clearer technical analysis of BNB, enabling traders to identify potential entry and exit points. Furthermore, by combining insights from the MACD and RSI with price action around critical support zones, traders can formulate effective strategies for capitalizing on the next upward movement. Such short-term fluctuations, while seemingly negative at first glance, often lay the groundwork for more sustainable growth trajectories in the long run.

Technical Analysis of BNB: Key Indicators to Watch

Conducting a thorough technical analysis of Binance Coin involves examining critical indicators such as the MACD and RSI. Currently, the MACD is hinting at diminishing momentum, which suggests that while a short-term correction may be in play, the overall bullish setup for BNB remains intact. Traders should pay attention to divergences in these indicators, as they often hint at potential trend reversals or continuations, providing valuable insights into future price movements.

Additionally, the RSI hovering around the overbought condition indicates a potential need for cooling off, reinforcing the likelihood of a short-term correction before the next bullish impulse. Understanding these technical indicators enables traders to develop more robust trading strategies, ensuring they remain well-prepared to act on the price movements and capitalize on BNB’s ongoing volatility.

Crucial Crypto Trading Strategies for BNB

To successfully navigate the volatile crypto landscape and effectively trade Binance Coin, implementing effective crypto trading strategies is essential. Strategies that embrace both long and short positions, particularly in the context of identified support levels, can yield favorable results. For instance, traders can utilize a strategy of ‘buy the dip’ when BNB approaches significant support areas, allowing them to maximize potential returns while minimizing risks.

Moreover, diversification of trading strategies based on market conditions is crucial. Employing different strategies, such as swing trading during periods of high volatility and scalping in fluctuating markets, can enhance trading outcomes. Incorporating risk management techniques, such as setting stop-loss orders just below critical support levels, will also safeguard capital and control losses, allowing traders to participate confidently in BNB’s ever-changing market.

Insights from BNB Liquidation Data

Liquidation data plays a pivotal role in understanding market dynamics and helps traders make informed decisions regarding Binance Coin’s price movements. The current data indicates a significant overweight of long positions, which could hint at a potential short-term pullback as traders may start to liquidate their positions to secure profits. This information serves as a crucial market sentiment indicator, guiding traders’ decisions on the timing of their trades.

An imbalance in the long/short ratio highlights the necessity for cautious trading, as it signals that the current market equilibrium is susceptible to shifts. Should there be a concentrated withdrawal of long liquidity, it may trigger price corrections, affecting BNB’s overall price trajectory. Utilizing this liquidation data can provide insights into market pressures, allowing traders to anticipate pullbacks and strategically position themselves ahead of potential price adjustments.

Monitoring BNB’s Volatility Amid Market Changes

Cryptocurrency markets are notorious for their volatility, and Binance Coin is no exception. Traders must be vigilant and prepare for potential fluctuations. The current technical setup indicates an environment where volatility could increase due to overbought signals and diminishing momentum in price movements. Understanding how to navigate this volatility is crucial for effective trading, particularly in optimizing entry and exit points.

Investors should incorporate volatility measures into their trading strategies to enhance decision-making processes. By utilizing tools such as Bollinger Bands or Average True Range (ATR), traders can better gauge market conditions and adjust their trades appropriately. Monitoring BNB’s volatility will not only help in managing risks but also in capitalizing on sudden price swings, ultimately contributing to improved trading performance.

The Role of Moving Averages in BNB Trading

Moving averages, particularly the 50 and 200 EMA, hold significant importance in the analysis of Binance Coin. These averages not only serve as reliable indicators of support levels but also help in assessing market trends. For traders, understanding where the price stands in relation to these moving averages is crucial for making informed trading decisions. The possibility of a pullback to the 50 EMA near the green-marked support zone presents a practical reference point for potential buy signals.

Incorporating moving averages into a trading strategy allows investors to create a dynamic framework that adapts to real-time market conditions. By observing how BNB reacts to these moving averages, traders can assess potential trend reversals and adjust their positions accordingly. Overall, moving averages are indispensable tools for anyone interested in successful Binance Coin trading, contributing significantly to a trader’s analytical repertoire.

Preparing for the Next Bullish Impulse with BNB

As Binance Coin navigates the current market landscape, preparing for the next bullish impulse becomes paramount. After a period of short-term correction, many traders await signs of a new upward trend. This anticipation is often predicated on the interactions with key support levels, where previous liquidity has been accumulated, suggesting readiness for the next move higher. Maintaining awareness of established support zones will guide traders in optimizing their entry and exit strategies.

Furthermore, fostering a solid understanding of the broader crypto market context will enhance the ability to forecast BNB’s potential movements. Traders should engage in comprehensive market analysis, considering both macroeconomic indicators and sentiment shifts within the crypto community. By preparing strategically for future bullish impulses, investors can position themselves effectively, fostering opportunities that align with their trading objectives.

Frequently Asked Questions

What are the key factors influencing Binance Coin price analysis at the moment?

Currently, Binance Coin (BNB) price analysis indicates a potential short-term correction as the price approaches key support levels. Indicators like the MACD suggest diminishing momentum, while the RSI is overbought, indicating a risk of a pullback. These technical signals combined with liquidity levels suggest that a revisit to the support zone could be imminent.

How does technical analysis of BNB support short-term price predictions?

Technical analysis of BNB reveals crucial support levels that may influence short-term price predictions. The 50 EMA and 200 EMA serve as essential markers where pullbacks might occur. A healthy correction in these zones is predictable, which could reinforce the ongoing bullish trend and lead to new upward impulses.

What is the likelihood of a short-term correction in BNB based on current analysis?

Based on current Binance Coin price analysis, the likelihood of a short-term correction appears increased. The RSI indicates an overbought condition while the MACD shows weakening momentum. These technical indicators suggest that a pullback to the support zones may be necessary to consolidate before further price advancements.

What role do moving averages play in Binance Coin price analysis?

Moving averages, particularly the 50 EMA and 200 EMA, play a critical role in Binance Coin price analysis. They act as important support levels during potential pullbacks. When prices approach these moving averages, it often signals reaccumulation zones that can help stabilize the market following a surge.

How can traders use BNB price prediction strategies to navigate the market?

Traders can utilize BNB price prediction strategies by analyzing technical indicators such as the MACD and RSI. Understanding support levels identified in Binance Coin price analysis allows traders to anticipate pullbacks and make informed decisions, potentially enhancing their crypto trading strategies during volatile phases.

What is the significance of liquidity in Binance Coin price behavior?

Liquidity plays a significant role in Binance Coin price behavior by influencing price movements and market stability. High liquidity areas, as identified in the BNB price analysis, often lead to price consolidations or reversals, providing traders with opportunities to enter or exit positions effectively during corrections.

How does the current RSI value affect the short-term outlook for Binance Coin?

The current RSI value for Binance Coin stands at around 75 points, indicating an overbought condition. This elevated RSI suggests a potential cooling-off period ahead, impacting the short-term outlook by increasing the likelihood of a price correction to more favorable levels that can support future growth.

| Key Points | Details |

|---|---|

| Short-term Correction | BNB may experience a short-term correction, testing the support area marked in green. |

| Accumulated Liquidity | The support zone has a significant concentration of open positions, indicating potential liquidity retrieval. |

| Technical Health | A pullback toward the 50 and 200 EMAs would be a healthy correction, allowing market consolidation. |

| Momentum Indicators | MACD indicates diminishing momentum; RSI remains overbought at 75 points, signalling possible cooling-off. |

| 4-Hour Chart Insights | Price is consolidating after a rise. Key support levels are around the 50 EMA, 200 EMA, and 800 EMA. |

| Volatility Expectations | Short-term volatility is anticipated due to overbought conditions and an imbalance in positions. |

| Overall Market Sentiment | The overarching sentiment remains constructive; a moderate correction could lead to the next upward impulse. |

Summary

Binance Coin price analysis indicates that a short-term correction might be on the horizon as the price is likely to test significant support zones. With accumulated liquidity and key technical indicators suggesting the need for a pullback, traders should prepare for potential volatility. This correction is not only necessary for market stabilization but also sets the stage for subsequent bullish movements.