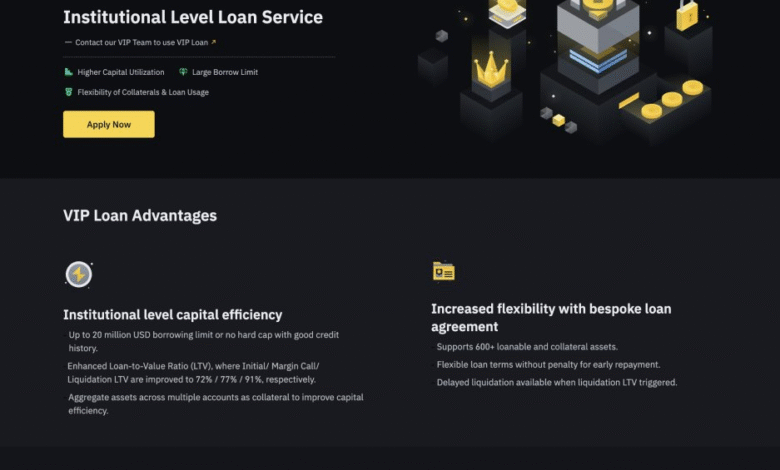

Binance Institutional Loans: Up to 4x Leverage Available

In the rapidly evolving landscape of cryptocurrency trading, **Binance Institutional Loans** stand out as a groundbreaking solution for institutional investors seeking enhanced liquidity. Offering up to 4x leverage, these loans simplify access to significant trading power across pooled Spot, Margin, and Portfolio accounts. Designed specifically for verified corporate users, Binance loans reimagine how institutions engage in capital-efficient trading, supporting complex strategies with ease. With access to over 400 crypto assets, firms can effectively utilize their resources while taking advantage of competitive interest rates and sophisticated risk management. This innovative service not only enhances institutional trading capabilities but also elevates the overall trading experience on the Binance platform.

The launch of Binance’s latest offering promises to transform the way large investors interact with digital currency markets. By leveraging **crypto loans**, institutions can now access up to four times the value of their existing assets, thus amplifying their trading strategies. The ability to utilize a cross-collateralized credit line across multiple accounts sets this feature apart from traditional financing methods, enabling more seamless operations. Furthermore, this new service caters specifically to the needs of high-volume traders, offering them unique advantages in **leverage trading** while managing **crypto assets** efficiently. Through this initiative, Binance continues to solidify its position as a leader in institutional finance within the blockchain ecosystem.

Understanding Binance Institutional Loans and Their Benefits

Binance Institutional Loans are specifically designed to cater to the needs of corporate clients, enabling them to leverage their crypto assets efficiently. With the option of up to 4x leverage, institutions can capitalize on market fluctuations without exhausting their capital reserves. This allows traders to implement a variety of strategies, from short-term speculative trades to long-term investments, all while maintaining control over their portfolio management.

The integration of pooled collateral from multiple accounts further enhances the utility of Binance Institutional Loans. This feature not only simplifies the borrowing process but also maximizes lending potential by allowing institutions to aggregate assets from Spot, Cross Margin, and Portfolio Margin accounts. Such flexibility in liquidity management is crucial for institutional traders who rely on swift access to funds for executing high-volume transactions.

The Mechanics of Pooled Collateral in Crypto Loans

Pooled collateral is a game-changer in the landscape of crypto loans, particularly within institutional trading. When institutions borrow through Binance Institutional Loans, they can consolidate the value of their accounts into a unified credit line. This means that risk is collectively assessed, and traders can access larger amounts of liquidity without each account being independently evaluated. This system lowers the barriers to entry for smaller firms and increases overall market participation.

Additionally, the diversification of collateral types—ranging from Bitcoin (BTC) to Ethereum (ETH) and stablecoins like USDT—ensures that institutions have flexibility in how they manage their risk. The cross-collateralization aspect means that traditional concerns regarding asset volatility are mitigated as firms can balance their exposure across various crypto assets, further enhancing the stability of their trading operations.

How Binance’s Loans Support Institutional Trading Strategies

The launch of Binance Institutional Loans signifies a pivotal shift in how professional traders approach leverage trading. Traditional trading often involves stringent collateral requirements and limited access to credit based on the asset at hand. However, Binance’s innovative structure allows institutions to leverage their entire portfolio, thus reducing the obstacles to quick, strategic trading.

Institutional trading strategies benefit immensely from this dynamic lending model, with seamless access to funds fostering the ability to exploit market opportunities as they arise. By providing immediate trading access across Margin and Futures markets, Binance solidifies its position as a key player in the crypto financial ecosystem, empowering institutional clients to engage in more sophisticated trades with reduced financial burdens.

Leveraging Credit: A New Era in Crypto Assets Management

One of the most significant benefits of Binance Institutional Loans is the ability to leverage credit across a diverse portfolio of crypto assets. With the option to select from over 400 supported cryptocurrencies, institutions can diversify their investments while using their holdings as collateral. This strategic management of assets allows firms to optimize their positions and manage risk effectively.

The introduction of features such as the 0% interest financing opportunity for high-performance traders underscores Binance’s commitment to creating value for its institutional clients. As firms are incentivized to meet performance criteria, they can enhance their trading outcomes while minimizing associated costs. This progressive financial model not only supports the growth of individual institutions but also contributes to the broader expansion of the crypto markets.

The Advantages of Accessing Immediate Trading Power

Immediate trading access is pivotal for institutions operating in the fast-paced world of cryptocurrency. Binance Institutional Loans facilitate this need by allocating funds directly into a dedicated sub-account, streamlining the trading process across various markets, including Margin and Futures. This level of immediate access empowers traders to react quickly to market changes, maximizing their opportunities without unnecessary delays.

In this regard, the practical advantages of Binance’s loans extend beyond just financial benefits; they contribute to a more agile and responsive trading environment. Institutions can engage in high-frequency trades, capitalize on short-lived market trends, and adjust their strategies in real-time. This operational efficiency aligns well with the demands of institutional trading, setting a new standard for liquidity access in the crypto space.

Risk Management with Binance Institutional Loans

Risk management is at the forefront of any trading strategy, particularly in the volatile world of cryptocurrency. Binance Institutional Loans enhance risk management through their cross-collateralization feature, which allows institutions to use a collective pool of assets as collateral. This aggregation mitigates the impact of fluctuations in individual asset values, thus providing a buffer against potential losses.

Moreover, the flexibility afforded by Binance’s institutional lending product enables firms to adjust their collateral dynamically based on market conditions. This responsive approach to risk is essential for maintaining profitability and sustainability in trade operations, particularly for high-volume firms that must navigate significant market volatility.

Binance Institutional Loans and Market Liquidity

Market liquidity plays a crucial role in the efficiency of trading, particularly in the highly liquid cryptocurrency exchange. By offering institutional loans, Binance actively contributes to increasing liquidity across digital asset markets. This influx of capital from institutions utilizing loans allows for more vigorous trading volume, tighter bid-ask spreads, and enhanced market stability.

Furthermore, with the ability to borrow against pooled collateral, institutions can now participate more actively in market-making activities. This participation not only benefits the individual firms leveraging the loans but also strengthens the market as a whole, attracting additional traders and fostering a more robust ecosystem for crypto trading.

The Regulatory Landscape and Binance’s Institutional Loans

As the cryptocurrency industry grows, so does the scrutiny from regulatory bodies around the world. Binance, being a leading exchange, understands the importance of compliance. By offering structured institutional loans that adhere to regulatory guidelines, the company showcases its commitment to creating a secure trading environment for institutional clients. This not only protects the interests of its users but also enhances its reputation in the market.

Navigating the regulatory landscape is vital for the longevity of crypto financial products. Binance’s proactive approach to developing its Institutional Loans helps align its offerings with compliance standards, ensuring that institutional firms can engage with these products confidently. This assurance is crucial for attracting larger entities to participate in the rapidly evolving crypto space.

Future Developments in Binance’s Institutional Loan Offerings

Looking forward, Binance is likely to continue refining its Institutional Loans products, potentially incorporating additional features that address the evolving needs of institutional clients. Innovations such as lower rates for high-volume borrowing or expanding the range of supported collateral assets could further entice institutions to utilize Binance as their primary trading platform.

Furthermore, as the financial landscape evolves with more advanced technological integrations, Binance may explore offering tailored financial products that adapt to specific trading strategies or market conditions. By doing so, Binance can ensure it remains at the forefront of the competitive landscape in crypto loans, constantly enhancing the value it provides to its institutional clientele.

Frequently Asked Questions

What are Binance Institutional Loans, and how do they enhance crypto trading for institutions?

Binance Institutional Loans provide up to 4x leverage and pooled collateral access across various account types, designed specifically for institutional trading. This innovative solution allows verified corporate users, like VIP 5+ clients, to efficiently access liquidity across their entire crypto assets portfolio without the complexity of transferring funds manually.

How does the leverage offered by Binance loans benefit institutional investors?

Institutional investors can benefit significantly from the 4x leverage offered by Binance loans, as it enables them to amplify their trading positions on crypto assets. This leverage facilitates capital-efficient strategies, allowing top-tier traders to execute high-volume trades while maintaining a unified collateral framework across multiple accounts.

What is the process for obtaining a Binance Institutional Loan?

To obtain a Binance Institutional Loan, corporate users must be verified by Binance and typically need to be VIP 5 or higher. The loan process involves assessing the aggregated value of linked Spot, Cross Margin, and Portfolio Margin accounts to establish the available credit, up to 4x leverage.

Are there specific criteria for collateral when taking out a Binance Institutional Loan?

Yes, Binance Institutional Loans allow collateral to be pooled from up to ten linked sub-accounts, including Spot, Cross Margin, and Portfolio Margin accounts. Standard haircut policies apply, but primary Spot assets such as BTC and ETH can qualify without haircuts, enhancing borrowing power.

Can institutions benefit from 0% interest financing with Binance loans?

Yes, institutions can access 0% interest financing through Binance loans if they meet specific performance criteria under the interest rebate program. If these criteria are not met, standard Binance interest rates will apply, ensuring transparent cost management for high-volume traders.

What types of assets can be used as collateral for Binance Institutional Loans?

Binance Institutional Loans support over 400 crypto assets as collateral, ranging from major cryptocurrencies like BTC, ETH, and BNB to various altcoins. This extensive selection allows institutions to leverage their total net equity effectively for trading purposes.

How does Binance’s approach to crypto loans differ from traditional lending methods?

Unlike traditional margin lending, Binance’s approach to crypto loans emphasizes cross-collateralization and a unified credit structure, allowing institutions to borrow against the combined value of multiple accounts seamlessly. This method enhances liquidity access and reduces the complexity typically associated with manual fund transfers.

What potential advantages do Binance Institutional Loans offer for high-volume trading strategies?

The primary advantages of Binance Institutional Loans for high-volume trading strategies include enhanced liquidity through pooled collateral, the possibility of utilizing 4x leverage, immediate fund access for trading across Margin and Futures markets, and potential 0% interest financing based on performance, all of which cater to the specific needs of institutional traders.

| Feature | Details |

|---|---|

| Leverage | Up to 4x leverage across Spot, Margin, and Portfolio accounts. |

| Eligibility | Available for VIP 5+ corporate users or case-by-case evaluation. |

| Collateral Structure | Cross-collateralized credit line allowing borrowing against pooled assets from multiple accounts (up to 10 linked sub-accounts). |

| Asset Variety | Select from over 400 supported crypto assets; certain assets exempt from haircut policies. |

| Interest Rates | Possibility of 0% interest financing through a rebate program; standard rates apply otherwise. |

| Immediate Access | Funds allocated to a sub-account for trading across Margin and Futures markets immediately. |

Summary

Binance Institutional Loans provide an innovative solution for institutional traders by allowing them to leverage up to 4x through pooled collateral across various crypto assets. This unique offering simplifies trading for large-scale investors by providing seamless access to liquidity and diverse asset allocation, solidifying Binance’s position as a leader in the crypto lending space. By catering directly to VIP clients and offering competitive interest structures, Binance Institutional Loans aim to enhance trading strategies and promote capital efficiency for high-volume trading operations.