Binance Trump Crypto Ties: Senators Launch Serious Investigation

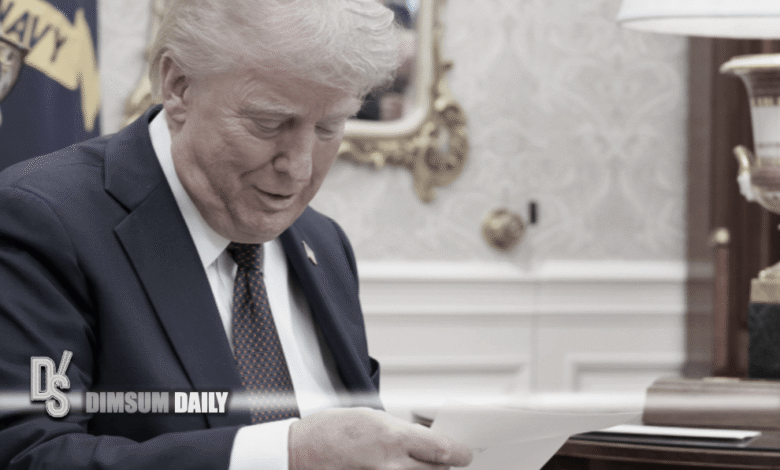

In the whirlwind world of cryptocurrency, the emergence of Binance Trump Crypto Ties has captivated not only investors but also lawmakers on Capitol Hill. Recent scrutiny surrounding Binance, a leading cryptocurrency exchange, has intensified as allegations link it to cryptocurrency ventures associated with former President Donald Trump. Such connections have ignited the Binance controversy, prompting Senate investigations into potential regulatory rollbacks and undisclosed negotiations that could impact the U.S. economy. As these inquiries unfold, the exchange’s departure from the U.S. market raises critical questions about compliance and oversight amid growing crypto regulatory scrutiny. The intersection of politics and cryptocurrency underscores the urgency for clarity on Trump cryptocurrency connections and their implications for future market stability.

Within the complex landscape of digital assets, discussions around Binance and its ties to Trump’s financial endeavors pose significant ramifications for the broader cryptocurrency market. This controversial nexus, often referred to as Binance Trump Crypto Ties, has caught the attention of Senate panels, resulting in rigorous investigations focusing on the exchange’s operations. Moreover, concerns are mounting regarding potential collusion between Binance and Trump-associated crypto initiatives, such as the new stablecoin venture. As regulatory bodies tighten their grip on the industry, the implications of these connections raise essential questions about the future of Binance in the U.S. and the overall health of cryptocurrency innovation amid increasing regulatory scrutiny.

The Binance Controversy: A Deep Dive into Trump Crypto Ties

The recent Binance controversy revolves around the connection between the cryptocurrency exchange and a venture reportedly linked to former President Donald Trump. With U.S. Senators demanding inquiries into these ties, especially concerning the implications for regulatory compliance, the focus on the legitimacy and oversight of Binance has intensified. The exchange’s history of legal issues, including a guilty plea for money laundering and violating U.S. laws, raises significant questions about the appropriateness of its partnerships, particularly if they involve influential political figures like Trump.

This scrutiny is not merely a political stunt; it draws attention to the broader implications for the cryptocurrency market as regulatory bodies strive to catch up with the rapid evolution of digital currencies. The Senators are particularly concerned about the potential rollbacks in regulations that could arise from any cozy relationships between Binance and Trump’s associates. This situation underscores the need for transparency in how cryptocurrency interactions with political figures are managed to maintain a fair and compliant crypto landscape.

Senate Investigation into Binance’s Regulatory Compliance

The Senate’s investigation into Binance centers on the exchange’s compliance with existing regulatory frameworks. Lawmakers are pressing for clarity on Binance’s adherence to the settlement terms following its 2023 guilty plea, emphasizing the importance of maintaining rigorous oversight to protect investors and uphold U.S. laws. As Binance attempts to navigate its exit from the U.S. market while minimizing scrutiny, the implications of this investigation could have lasting effects on the crypto industry. Regulators are particularly vigilant about ensuring that past violations are not repeated, especially concerning money laundering and financial compliance.

Moreover, this Senate investigation shines a light on the larger issue of how cryptocurrency exchanges operate within the legal framework of the U.S. The findings could not only impact Binance’s future operations but could also set a precedent for how other cryptocurrency entities are regulated. With increasing alarms over potential ties between Binance and politically significant figures like Trump, it’s essential for regulators to respond swiftly to uphold the integrity of the financial system.

Implications of Trump Cryptocurrency Connections for Binance

The implications of the alleged connections between Binance and Trump’s cryptocurrency initiatives are complex and multifaceted. These ties could influence everything from regulatory scrutiny to public perception of both Binance and the wider cryptocurrency industry. If lawmakers find substantial evidence linking Binance to the Trump-supported stablecoin USD1, it could lead to increased legal ramifications for the exchange, exacerbating its already precarious standing due to prior legal challenges.

Furthermore, the intertwining of cryptocurrency with politics raises questions about bias and control in the evolving digital currency market. As Binance faces scrutiny, it is vital for the exchange and similar entities to navigate their relationships carefully to avoid potential backlash that could hinder their operations. The Senate’s attention could result in stricter regulations and renewed calls for transparency, redefining the landscape for how cryptocurrencies interact with political power and influence.

Regulatory Scrutiny: Binance’s Battle with Compliance

As Binance faces mounting regulatory scrutiny, compliance has become a focal point of concern among U.S. lawmakers. The exchange’s history of legal troubles, including its guilty plea to various charges, places it under an unforgiving magnifying glass. With assurances that Binance would adhere to a multi-year oversight mandate, the fear looms that failure to meet these stipulations could lead to harsher penalties or a complete shutdown of operations within the U.S. market.

This regulatory landscape is constantly evolving, influenced by both legislative pressures and public opinion. As Binance tries to remain competitive, the necessity for compliance is not only a legal requirement but a critical factor in retaining user trust and market credibility. The road ahead is fraught with challenges, as regulators increasingly demand that crypto-firms adhere to rules designed to prevent financial crimes and protect consumers from fraud.

The Future of Binance: Exit from the U.S. Market

Binance’s mandated exit from the U.S. market highlights a significant shift in strategy due to regulatory pressures. Following its guilty plea, the exchange faces the daunting task of reorganizing its operations, which could result in substantial changes to its business model. The implications of leaving the U.S. market not only affect Binance but also raise alarms about the potential brain drain from the U.S. crypto industry if firms feel stifled by compliance burdens.

The exit may lead to increased competition in less regulated markets, but it also sets a precedent for how regulators can influence the operational landscapes of cryptocurrency exchanges. As Binance attempts to reposition itself, the repercussions could serve as a wake-up call for other exchanges to reassess their compliance strategies and risk management protocols.

Understanding Crypto Regulatory Scrutiny: The Role of Legislation

The role of legislation in shaping the landscape of cryptocurrency compliance cannot be underestimated. The scrutiny faced by platforms like Binance is driven by a legislative environment aimed at safeguarding the financial ecosystem from illicit activities. Lawmakers are consistently evaluating how cryptocurrencies operate and their impact on traditional finance, aiming to create robust frameworks that prevent abuse while fostering innovation.

As legislators adapt to the rapid changes within the crypto space, maintaining a balance between regulation and innovation will be crucial. New laws or amendments to existing legislation could emerge from investigations like those into Binance, influencing how companies navigate their responsibilities in a global, digital economy. Should Binance succeed in proving its commitment to compliance, it might help pave the way for more favorable regulatory environments, benefiting the entire cryptocurrency sector.

The Bitcoin Connection: Binance and Market Dynamics

The connection between Binance and Bitcoin plays a significant role in shaping market dynamics, especially given the exchange’s size and influence within the industry. As one of the leading platforms for buying and trading Bitcoin, Binance can dictate trends that ripple through the cryptocurrency market. However, its alleged ties to controversial figures, such as Donald Trump, complicate its association with Bitcoin and could potentially affect investor confidence.

Market watchers are keenly observing how these affiliations could play out for Bitcoin prices and trading volume on Binance. Should regulatory pressures continue to mount, it might lead to increased volatility in Bitcoin and other cryptocurrencies, challenging the broader market. Investors are left to ponder how much of Binance’s performance and reputation will be impacted by ongoing scrutiny and investigations, especially if the exchange fails to demonstrate a robust commitment to legal compliance.

Potential Impacts of Senate Investigations on Crypto Policies

Senate investigations into Binance could significantly shape future cryptocurrency policies in the United States. As regulatory bodies ramp up their scrutiny of exchanges, the outcomes of these inquiries could lead to new laws aimed specifically at addressing the unique challenges posed by digital currencies. In light of recent controversies surrounding Binance, policymakers are likely to consider the necessity of comprehensive regulations that ensure transparency and accountability in crypto operations.

Moreover, these investigations signal to crypto firms that compliance issues will be met with serious consequences, potentially deterring bad actors from entering the market. However, there is also a risk that overly harsh regulations could stifle innovation and drive businesses overseas, resulting in a loss of competitive edge for the United States in the rapidly evolving crypto landscape. It is crucial for lawmakers to strike the right balance to foster an environment conducive to growth while ensuring that the public and market interests are adequately protected.

Navigating the Future of Crypto: Lessons from Binance

The challenges faced by Binance serve as critical lessons for the entire cryptocurrency industry as it navigates future developments. The importance of regulatory compliance cannot be understated, as demonstrated by Binance’s ongoing struggles, including their exit from the U.S. market and involvement in a settlement. These events underscore how firms must prioritize legal and ethical standards in order to maintain operational integrity and avoid detrimental repercussions.

As the cryptocurrency sector evolves, firms must learn to adapt to shifting regulatory landscapes while remaining competitive. The lessons gleaned from Binance’s controversial journey could steer other crypto exchanges towards more responsible practices, enhancing their resilience against scrutiny and legal challenges. As the industry matures, fostering a culture of compliance could prove essential to ensuring the long-term viability of cryptocurrency firms.

Frequently Asked Questions

What are the latest developments in the Binance controversy related to Trump cryptocurrency connections?

The latest developments in the Binance controversy involve a Senate investigation into Binance’s alleged ties to a Trump-supported cryptocurrency venture, particularly concerning the compliance failures that led to Binance’s 2023 guilty plea. Lawmakers are demanding transparency regarding Binance’s communications with officials in the Treasury Department and the implications of this relationship on regulatory oversight.

How is Binance’s exit from the US market connected to the Trump cryptocurrency connections?

Binance’s exit from the US market is linked to ongoing scrutiny regarding its connections to the Trump family’s cryptocurrency endeavors, specifically the investigations by U.S. Senators into Binance’s compliance with federal regulations post-settlement. The inquiry raises questions about the potential use of Trump-supported stablecoins in Binance’s foreign investment initiatives.

What impact does the Senate investigation into Binance have on crypto regulatory scrutiny?

The Senate investigation into Binance amplifies crypto regulatory scrutiny by highlighting concerns over the exchange’s disregard for compliance and its connections to Trump-related ventures. This scrutiny may influence future regulations and enforcement actions against cryptocurrency entities, emphasizing the need for accountability within the industry.

What are the implications of Binance’s compliance issues for Trump’s cryptocurrency connections?

The implications of Binance’s compliance issues for Trump’s cryptocurrency connections include increased political and legal scrutiny, as lawmakers express concerns about potential lax oversight that might benefit Binance’s interests in the Trump-supported stablecoin initiative. This scrutiny aims to ensure that companies like Binance adhere to federal laws following serious violations.

How did recent allegations affect Binance’s relationship with the Trump family and cryptocurrency ventures?

Recent allegations have cast doubts on Binance’s relationship with the Trump family over their involvement in cryptocurrency ventures, particularly the potential use of Trump-backed stablecoin USD1. These concerns are part of a broader narrative surrounding regulatory compliance failures, prompting inquiries into how these relationships might undermine enforcement and market integrity.

| Key Points | Details |

|---|---|

| Binance Scrutiny | U.S. Senate probes Binance’s ties to Trump-supported crypto venture following a 2023 guilty plea. |

| Senators Involved | Five Democratic Senators led by Chris Van Hollen, Elizabeth Warren, Richard Blumenthal, Sheldon Whitehouse, and Mazie Hirono raised concerns. |

| Compliance Concerns | Questions over Binance’s compliance with laws after 2023 guilty plea involving money laundering and sanctions violations. |

| Trump Family Connection | Senators are worried about Binance’s possible partnership with Trump-supported World Liberty Financial. |

| Regulatory Rollbacks | Concerns about Binance attempting to lessen regulatory scrutiny amidst ongoing investigations. |

Summary

Binance Trump Crypto Ties are at the center of a controversy as recent Senate inquiries demand clarity on the cryptocurrency exchange’s connections to a venture supported by Donald Trump’s family. The scrutiny follows serious allegations concerning Binance’s regulatory compliance and previous guilty pleas. Lawmakers have raised alarms about potential backtracking on oversight amid fears that the Trump involvement could complicate the regulatory landscape further. As the investigation continues, it remains to be seen how these developments will affect the future of Binance and its operations in the U.S.