Bitcoin Bull Phase: Institutional Demand Fuels New Growth

The Bitcoin bull phase is turning heads as the cryptocurrency market experiences a surge fueled by unprecedented institutional demand and tightening supply metrics. With a wave of new capital poised to enter the market, the long-term outlook for Bitcoin has become increasingly optimistic amid favorable Bitcoin price predictions. Influencers like David Bailey highlight that adoption is reaching new heights as fewer than 1% of institutions currently hold Bitcoin, indicating tremendous growth potential ahead. Moreover, the juxtaposition of supply constraints against burgeoning institutional interest creates a perfect storm for escalation in value. As more sovereign funds, banks, and corporate investors engage with Bitcoin, the dynamics of the crypto market trends seem poised for a seismic shift that could reshape financial landscapes globally.

As Bitcoin navigates through a noteworthy bullish trend, its ascent can be attributed to a combination of escalating interest from institutions and a limited supply of the asset. This phase, often referred to as the crypto boom, showcases how renewed enthusiasm for digital currencies is transforming traditional investment strategies. The anticipation around Bitcoin’s integration into mainstream finance is indicative of a broader acceptance, which could prove advantageous as more institutions begin to allocate funds towards this decentralized currency. The bullish sentiment echoes with escalating price expectations, with market observers closely analyzing cryptocurrency movements as indicators of financial evolution. In this exciting landscape, the strategic absorption of Bitcoin by institutional giants suggests a paradigm shift in how wealth is preserved and grown in the digital age.

Understanding the Bitcoin Bull Phase

The current Bitcoin bull phase signifies much more than just a price increase; it represents a profound shift in how institutional investors view cryptocurrency. As major players in finance begin to step into the Bitcoin arena, we witness a wave of institutional interest unlike any before. With entities like sovereign funds and large corporations making significant allocations, the narrative around Bitcoin is evolving rapidly. This phase is underpinned by strong fundamentals, including growing acceptance of Bitcoin as a legitimate asset class and increasing infrastructure development to support its integration into mainstream finance.

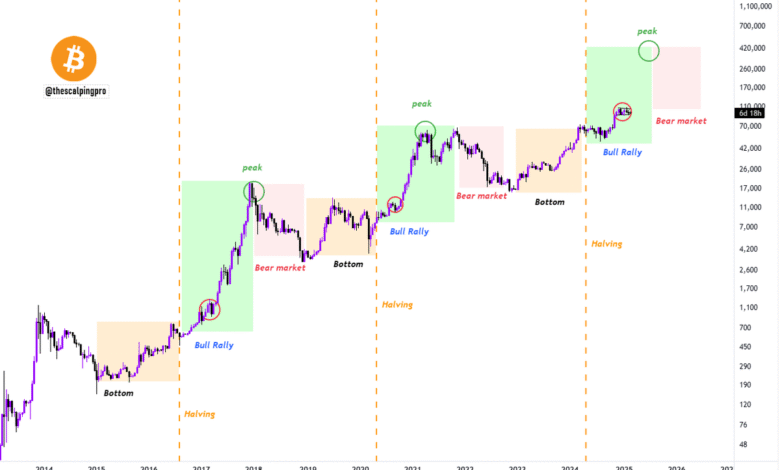

Moreover, analysts are predicting that this bull phase isn’t just a short-term rally, but a sustained period of growth driven by structural changes in demand and supply dynamics. With only a limited supply of Bitcoin available and an ever-growing appetite among institutional investors, the potential for price escalation is immense. As David Bailey pointed out, the current cycle may herald the end of bear markets for Bitcoin, suggesting a transformative era for its adoption within institutional portfolios.

Frequently Asked Questions

What is the significance of Bitcoin’s bull phase for institutional demand?

Bitcoin’s bull phase is marked by surging institutional demand, indicating a significant shift in market dynamics. As more institutions recognize Bitcoin’s potential as a store of value, their participation is expected to create upward pressure on prices and reduce volatility. This institutional influx is seen as a driving force behind the current bull cycle.

How is Bitcoin adoption contributing to the current bull phase?

Bitcoin adoption is critical to its current bull phase as it encourages more investors and institutions to enter the market. With only a small percentage of institutions currently holding Bitcoin, there is vast potential for growth. Increased adoption is expected to lead to greater price stability and upward momentum in the long term.

What role do crypto market trends play in Bitcoin’s bull phase?

Crypto market trends, particularly those reflecting institutional interest and macroeconomic conditions, greatly influence Bitcoin’s bull phase. Trends such as increased demand from sovereign wealth funds and banks highlight growing confidence. Positive trends in regulatory clarity also support the ongoing bullish sentiment in the market.

Can we predict Bitcoin’s price during this bull phase?

Bitcoin price predictions during this bull phase vary, but there is growing optimism among analysts and industry leaders. Predictions range from substantial growth due to ongoing institutional buying and supply constraints to notable figures such as Brian Armstrong’s forecast of Bitcoin reaching $1 million by 2030, driven by increasing allocations from major institutions.

What are Bitcoin supply constraints and how do they affect the bull phase?

Bitcoin supply constraints refer to the limited supply of Bitcoin available for purchase, which is capped at 21 million coins. These constraints become more significant during a bull phase as increasing demand from institutions can outpace supply, potentially driving prices higher. This dynamic is a key factor behind the current bullish outlook.

How does institutional demand impact the sustainability of the Bitcoin bull phase?

Institutional demand is pivotal for the sustainability of the Bitcoin bull phase as it introduces substantial capital into the market, which helps stabilize prices and mitigate volatility. Increased allocations from a variety of institutions signify a shift toward mainstream acceptance, solidifying Bitcoin’s position as a significant financial asset.

Why is the low percentage of Bitcoin held by institutions significant during this bull phase?

The low percentage of Bitcoin held by institutions (less than 1% of portfolios) is significant because it suggests there’s ample room for growth. As confidence among institutions builds and more allocate larger portions of their portfolios to Bitcoin, this could lead to considerable price increases, reinforcing the current bull phase.

What external factors could pose risks to Bitcoin’s bull phase despite growing institutional interest?

Despite growing institutional interest, external factors such as regulatory pressures, macroeconomic uncertainties, and market volatility could pose risks to Bitcoin’s bull phase. Ascertainable shifts in regulation or economic instability could deter investment and impact market confidence, thus influencing price movements.

| Key Points | Description |

|---|---|

| Bitcoin Bull Phase | Bitcoin is entering a prolonged bull market due to increased institutional interest and limited supply. |

| Institutional Demand | Surging demand from institutions, with claims that 99.99% of future demand is still poised to emerge. |

| Supply Constraints | Current liquidity options are under $1 trillion, limiting potential inflows despite high demand. |

| Expert Insights | David Bailey predicts no bear market in the near future, emphasizing the foundational changes in bitcoin adoption. |

| Future Predictions | Coinbase CEO Armstrong suggests bitcoin may reach $1 million by 2030, driven by large institutional investments. |

Summary

The Bitcoin bull phase marks a transformative period for the cryptocurrency, characterized by an influx of institutional investment and strong supply constraints. As influential figures in the crypto space highlight the growing optimism around Bitcoin’s future, it’s clear that the foundations are being laid for a significant shift in market dynamics. With many major institutions currently holding only a fraction of their potential allocations to Bitcoin, the untapped demand could propel prices to new highs, ensuring a bullish outlook for the years to come.