Bitcoin Consolidation: Profit-Taking and Liquidity Slowdown

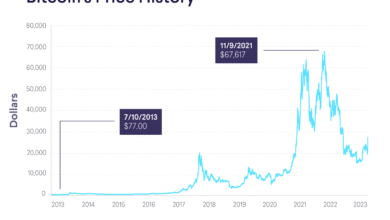

Bitcoin consolidation is currently under the spotlight as the cryptocurrency market experiences a significant shift following its peak of $123,000. According to a recent Cryptoquant analysis, this period marks a “bullish cooldown,” where investor sentiment is tempered by heavy profit-taking and a slowdown in liquidity. The decline in Bitcoin’s momentum is evident as the Bull Score Index dipped to 60, indicating a pause in its upward trajectory. Furthermore, the market is experiencing decreasing BTC price movement coupled with reduced inflows at major exchanges like Coinbase, suggesting a softer demand. As this consolidation phase takes hold, traders and investors are on the lookout for signs that could ignite the next bullish rally in the fluctuating crypto landscape.

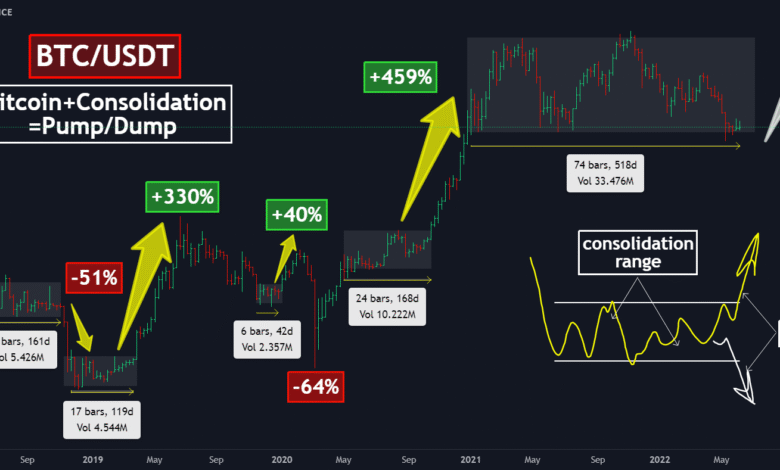

In the realm of cryptocurrency, the current status of Bitcoin can be described as a period of price stabilization, often referred to as market consolidation. This phase typically occurs after a substantial price surge, where traders engage in profit-locking behaviors while liquidity begins to dwindle. The analysis from Cryptoquant highlights how this cooling-off process is reflected in various indicators, such as diminishing network activity and shifting sentiment among investors. As the market grapples with a potential bearish shift, the focus turns to the conditions that might reignite bullish drivers and alter the trajectory of Bitcoin’s ongoing price fluctuations.

Understanding Bitcoin’s Bullish Cooldown Phase

Bitcoin’s recent rise to an all-time high of $123,000 has led to a period described by Cryptoquant as a “bullish cooldown.” This phase is characterized by a significant dip in the Bull Score Index, which dropped from 80 to 60. During this time, it’s essential for investors to understand the dynamics at play. The slowdown in momentum has been attributed to several factors, including profit-taking strategies employed by traders who wish to safeguard their gains. As uncertainty looms, the market is at a pivotal crossroads where bullish and bearish sentiments are tightly interwoven.

In addition to profit-taking, the market is experiencing a notable liquidity slowdown. This drop in liquidity could further exacerbate the cooldown phase. Fresh capital inflow has diminished significantly, as evidenced by declining stablecoin liquidity and reduced BTC exchanges, particularly on platforms like Coinbase. These developments suggest that while the bullish sentiment is still present, the foundation that supports it is weakening, leaving the market vulnerable to corrections.

Frequently Asked Questions

What is Bitcoin consolidation and how does it relate to current profit-taking trends?

Bitcoin consolidation refers to a period where the price stabilizes and shows less volatility following a significant price movement, such as the recent peak at $123,000. During this phase, profit-taking by investors is prevalent as many lock in gains, contributing to a slowdown in trade volume and network activity. This creates an environment where Bitcoin can consolidate as it prepares for potential future price movements.

How does liquidity slowdown affect Bitcoin consolidation?

Liquidity slowdown impacts Bitcoin consolidation by reducing the available capital for new investments and making it harder for prices to gain upward momentum. As observed in recent Cryptoquant analyses, a decrease in stablecoin liquidity points to a softer demand for Bitcoin, which can lead to prolonged periods of consolidation as traders await more favorable market conditions.

What is the bullish cooldown phase in relation to Bitcoin consolidation?

The bullish cooldown phase, as described by Cryptoquant, signifies a transitional period where Bitcoin’s price movement pauses after reaching a high, like the recent $123,000 mark. This phase is characteristic of a consolidation period, where investor profit-taking and declining momentum contribute to a softer price action, allowing for stabilization before potential resumption of the bullish trend.

What indicators suggest Bitcoin is in a consolidation phase after profit-taking?

Several indicators signal that Bitcoin is currently in a consolidation phase following profit-taking. The Bull Score Index has decreased from 80 to 60, and slowing liquidity expansion, especially in stablecoins, reflects reduced market activity. Additionally, on-chain profit margins turning negative indicate that many traders have realized their profits, leading to decreased volatility and price consolidation.

How can Cryptoquant analysis help traders understand Bitcoin consolidation?

Cryptoquant analysis provides insights into on-chain metrics and liquidity conditions that are crucial for understanding Bitcoin consolidation. By examining factors such as the Bull Score Index, liquidity trends, and trading volumes, traders can gauge market sentiment and potential future movements, helping them make informed decisions during periods of consolidation.

Will Bitcoin price movement continue to consolidate in light of recent market trends?

Given recent market trends indicating profit-taking and slowing liquidity, it is likely that Bitcoin’s price movement will continue to consolidate. Analysts suggest that without fresh capital influx or bullish drivers, Bitcoin may experience ongoing stabilization as traders assess market conditions before making significant investment decisions.

| Key Point | Details |

|---|---|

| Bullish Cooldown Phase | Bitcoin is entering a cooldown phase after reaching $123,000. |

| Bull Score Index Drop | The index decreased from 80 to 60, signaling weaker momentum. |

| Weakening On-Chain Trends | Slowing liquidity growth and reduced network activity indicate cooling demand. |

| Profit-Taking | Many traders have locked in gains, contributing to reduced unrealized profits. |

| Market Cycle Status | Valuation indicators are close to bearish territory. The outlook remains cautiously neutral. |

| Need for Fresh Drivers | The market requires new bullish catalysts for further price increases. |

Summary

Bitcoin consolidation marks a significant phase as the leading cryptocurrency experiences a bullish cooldown after its record high. This period is characterized by profit-taking and decreased liquidity, signaling a pause in the market’s upward momentum. With crucial indicators hovering near pivotal levels, the outlook remains cautiously neutral, emphasizing the need for fresh market drivers to propel Bitcoin back into its growth trajectory. Understanding the factors influencing this consolidation can help investors navigate their strategies amid changing market conditions.