Bitcoin Edges Up as Altcoins Lose Momentum in Market

Bitcoin edges up in a fluctuating market landscape, showcasing its resilience even as altcoins like ether (ETH) and XRP experience a noticeable decline. The dominant cryptocurrency appreciated by 0.81%, subtly defying the overall market trend as an altcoin rally begins to wane. BTC market performance is becoming a focal point, particularly amidst the shifting dynamics of cryptocurrency dominance where Bitcoin continues to reclaim its share. This upward movement in Bitcoin’s price stands in stark contrast to the drops seen in other altcoins, indicative of a potential pivot back to Bitcoin’s reliance as a market leader. As investors keenly monitor Bitcoin price analysis, the implications of this slight surge could set the tone for future trading behaviors in the ever-evolving landscape of digital assets.

As the digital asset landscape continues to evolve, Bitcoin is currently carving out a unique position amid a backdrop of declining altcoins. Recent trends reveal that as Ethereum (ETH) and Ripple (XRP) face setbacks, Bitcoin’s recent upswing may reflect a strategic shift in cryptocurrency investment. This growing interest in BTC, highlighted by its recent positive movement, could be a signal for traders analyzing the current altcoin season. The observations regarding cryptocurrency dominance indicate a potential resurgence in Bitcoin’s market influence, especially as altcoins lose steam after a vigorous phase. Overall, Bitcoin’s latest performance is an important focal point against the backdrop of fluctuating cryptocurrency dynamics.

Bitcoin Edges Up Amidst Altcoin Decline

As the cryptocurrency market experiences fluctuations, Bitcoin (BTC) has managed to show slight resilience, edging upwards while altcoins like Ether (ETH) and XRP take a downturn. Following an impressive altcoin rally that had investors buzzing, the overall market appears to be adjusting, leading to declines in prominent altcoins. Bitcoin’s recent performance, showing a 0.81% increase, reflects its ability to maintain dominance despite these temporary setbacks in the altcoin sector. In contrast, ETH and XRP have suffered losses of 1.40% and 2.20%, respectively, indicating a shift in market sentiment favoring BTC over its rivals.

The market’s dynamics highlight Bitcoin’s continual status as the leading cryptocurrency, often termed the ‘digital gold,’ especially during periods when altcoins lose momentum. The decrease in altcoin values can amplify Bitcoin’s allure as a safer investment, driving traders to reposition their portfolios toward BTC. With BTC dominance currently at 60.91%, its increase by 0.58% over the past 24 hours showcases Bitcoin’s strengthened market position. Such trends suggest that while altcoins may experience volatility, Bitcoin remains a resilient player in the ever-changing cryptocurrency landscape.

Understanding the BTC Market Performance

The current Bitcoin price analysis reveals a robust market performance for the leading cryptocurrency, despite the recent dip in altcoin prices. Trading at approximately $118,711.71, Bitcoin’s value has seen a 1.09% increase since last week, indicative of sustained interest from both retail and institutional investors. This dynamic paints a picture of a highly competitive market environment where Bitcoin not only holds its ground during altcoin dips but also capitalizes on the moment to reclaim market share. As traders assess their strategies, BTC’s impressive recovery may continue to attract investments that prioritize stability and long-term growth.

Analyzing Bitcoin’s market performance also involves looking at its trading volume and liquidity metrics, which reveal heightened interest. With a 9.54% rise in trading volume to $76.18 billion, traders are showing a robust engagement, potentially bucking any negative sentiment that arises from altcoin fluctuations. Additionally, the rise in BTC futures contracts indicates that confidence in Bitcoin’s resurgence remains strong, with total open contracts increasing to $85.13 billion. Therefore, understanding Bitcoin’s market performance involves considering the interplay of trading activities and market trends, especially as investors navigate through altcoin volatility.

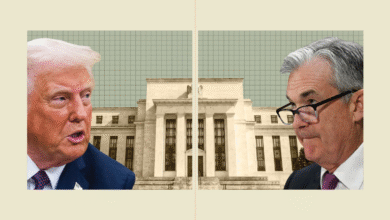

The Impact of Altcoin Rally on Bitcoin’s Dominance

The recent altcoin rally significantly impacted the cryptocurrency market, encouraging many investors to diversify their portfolios with altcoins like ETH and XRP. The shift saw altcoins gaining attention and capital, which inadvertently contributed to a temporary decrease in BTC dominance. However, as the altcoin rally pauses, Bitcoin’s dominance has begun to recover, currently sitting at 60.91%. This drop in altcoin prices has allowed BTC to reclaim a larger slice of the market, demonstrating its importance as a primary investment in the crypto sector.

As altcoins fluctuate, Bitcoin remains a beacon of stability, compelling investors to reconsider their allocations. The Altcoin Season Index, while witnessing a peak of 56, provides insights into BTC’s overarching market narrative. Investors often look to expand into altcoins during bullish market phases but tend to revert to Bitcoin when market conditions stagnate or decline. Thus, understanding the relationship between Bitcoin’s dominance and the altcoin rally is crucial for grasping market trends and making informed investment decisions.

Cryptocurrency Dominance: BTC Leads the Way

Cryptocurrency dominance is a key indicator of market health and investor sentiment, with Bitcoin frequently serving as the benchmark. Currently, BTC’s dominance of 60.91% signifies its critical role as a market leader amidst fluctuations in other cryptocurrencies. This metric not only reflects Bitcoin’s substantial market cap but also its purview over investor preferences in turbulent times. With increasing skepticism towards altcoins like Ether and XRP following their recent declines, Bitcoin’s standing as the dominant cryptocurrency becomes more pronounced.

In terms of cryptocurrency dominance, BTC’s ability to withstand market corrections highlights its historical stability and reliability as a long-term investment. As traders analyze market performance, Bitcoin’s consistent incremental growth sets it apart from the more volatile altcoins. The allure of BTC, particularly in descending markets, often stimulates renewed investment interest, thus reinforcing its dominant market share over time. Understanding these trends can provide valuable insights for investors looking to navigate the nuanced cryptocurrency landscape effectively.

The Future Outlook for Bitcoin and Altcoins

Looking ahead, the future outlook for Bitcoin appears optimistic, especially in light of its recent performance compared to altcoins. With the crypto market constantly evolving, Bitcoin has been adept at leveraging opportunities presented during altcoin downturns. The current conditions favor BTC as it continues to solidify its position as the go-to asset for investors seeking stability amidst speculation surrounding altcoins. As Bitcoin edges up and expands its market share, this trend may encourage more investors to flock back to the original cryptocurrency as a hedge against potential losses.

Conversely, altcoins will need to demonstrate resilience and innovation to regain footing in the market. Many investors may currently be hesitant to diversify with altcoins given their recent volatility. However, altcoins that can show compatibility with emerging technologies, such as decentralized finance (DeFi) or non-fungible tokens (NFTs), could recapture investor interest. The unique growth potential in altcoins remains evident, but investors must remain cautious and informed, balancing their portfolios effectively between Bitcoin and altcoins as the market evolves.

Analyzing Bitcoin’s Price Movement

When conducting a Bitcoin price analysis, it’s essential to consider both technical indicators and fundamental metrics. Recent price movements have shown BTC oscillating between $116,233.23 and $119,603.76, reflecting its responsiveness to market conditions. Such volatility, although typical for cryptocurrencies, indicates traders are vigilant and responsive, adjusting their positions based on market trends. With trading volume increasing, the pressure to break out of the current price range could lead to significant movements in either direction, prompting traders to watch closely for breakouts.

Furthermore, Bitcoin’s price analysis must incorporate its relationship with other cryptocurrencies. As altcoins fluctuate, Bitcoin often acts as a stabilizing agent, absorbing the impact of market corrections. This is crucial for understanding its price behavior; for instance, while ETH declines, BTC evaluates its next moves with a cautious optimism. Understanding these correlations can offer traders better insights into potential future price actions, allowing them to leverage market trends effectively. Thus, Bitcoin continues to warrant substantial attention for both its standalone performance and its impact on the broader cryptocurrency ecosystem.

Market Metrics and Bitcoin’s Performance

Understanding market metrics is vital for assessing Bitcoin’s performance against other cryptocurrencies. With a current trading volume increase of 9.54% to $76.18 billion, traders are actively engaging with Bitcoin, showcasing its importance in the current market landscape. Bitcoin’s market capitalization also reflects its health, rising to $2.36 trillion, further solidifying its position as a market leader. This increase in both trading volume and market cap signifies a growing confidence from investors, as they consider BTC a more reliable asset during uncertain times.

Additionally, analyzing the total value of open BTC futures contracts, which increased by 0.44% to $85.13 billion, provides insights into market sentiment and investor expectations. These contracts allow traders to speculate on the future price of Bitcoin, often impacting its current price movement. The relatively balanced liquidation between longs and shorts indicates a cautious but active trading environment, where sentiment remains mixed. Overall, monitoring these market metrics is crucial for understanding Bitcoin’s resilience and potential in navigating shifts in cryptocurrency dynamics.

Investor Sentiment During Altcoin Volatility

Investor sentiment often shifts rapidly during periods of altcoin volatility, as seen in the recent decline of major altcoins like ETH and XRP. With altcoins showcasing erratic price movements, many investors turn their attention to Bitcoin, viewing it as a more stable investment choice. This mentality can create a self-reinforcing cycle where Bitcoin benefits from altcoin dips, prompting more funds to flow into it. The current positive shift in BTC’s market performance exemplifies how investor behavior can dramatically influence market dynamics during volatile episodes.

As altcoins face pressures, the safe-haven narrative for Bitcoin becomes particularly pronounced. Investors tend to seek refuge in Bitcoin during downturns, leading to an increase in demand. This not only affects Bitcoin’s price positively but also enhances its dominance in the market. Therefore, understanding the correlation between investor sentiment and altcoin volatility is essential to navigating the cryptocurrency market. Investors must remain alert to shifts in sentiment, ensuring they position their assets to maximize returns amidst the changing tides of altcoin performance.

Frequently Asked Questions

How did Bitcoin edges up amidst the recent altcoin rally?

Bitcoin edged up by approximately 0.81% while altcoins like ETH and XRP showed declines, indicating BTC’s resilience in the current market. As altcoins slowed after a substantial rally, Bitcoin maintained its dominance, gaining market share and benefiting from the overall cooling of the altcoin space.

What is the significance of BTC market performance in relation to altcoin dominance?

BTC market performance is crucial as it influences cryptocurrency dominance. Recently, Bitcoin edged up while altcoins like ETH and XRP lost momentum, reflecting BTC’s strength and ability to reclaim market share during periods of altcoin decline.

What does Bitcoin price analysis reveal about current market trends?

Recent Bitcoin price analysis shows BTC appreciating by 0.81%, contrasting with a downturn in major altcoins. This upward movement demonstrates Bitcoin’s stability and potential to lead market trends, especially when altcoins exhibit weaker performance.

How does cryptocurrency dominance affect the price of Bitcoin?

Cryptocurrency dominance impacts Bitcoin’s price significantly. As Bitcoin edges up in value, it signals stronger dominance over the market, especially when leading altcoins like ETH and XRP experience declines. This can boost investor confidence in BTC, further enhancing its price.

What can we expect from Bitcoin’s performance as altcoin rally fades?

As the altcoin rally fades, we can expect Bitcoin’s performance to become more pronounced. Historically, BTC tends to edge up during altcoin corrections, suggesting it may regain further dominance and market share, influencing pricing trends positively.

Why is Bitcoin’s dominance important during altcoin fluctuations?

Bitcoin’s dominance is important because it often dictates the overall market sentiment. When Bitcoin edges up and gains dominance, it can stabilize the market and attract more investments as altcoins struggle, indicating a shift in crypto market dynamics.

What indicators show Bitcoin’s edge over altcoins recently?

Recent indicators show Bitcoin edging upwards with a 0.81% gain while major altcoins like ETH and XRP face declines. Bitcoin’s increased trading volume and market capitalization further indicate its strengthening position against competing cryptocurrencies.

How does the Altcoin Season Index relate to Bitcoin’s recent performance?

The Altcoin Season Index, which is currently at 50, reflects that Bitcoin’s performance is favorable compared to altcoins. As Bitcoin edges up while altcoins retreat, this index highlights BTC’s potential to lead the market, especially with future movements.

| Metric | Value | Change (%) |

|---|---|---|

| Bitcoin (BTC) | $119,052 | +0.89% (since yesterday) +1.09% (since last week) +0.81% (24 hours) +0.44% (BTC Futures) |

Summary

Bitcoin Edges Up as altcoins like Ether and XRP lose momentum in the cryptocurrency market. As Bitcoin continues to show resilience, rising by approximately 0.81%, it begins to reclaim its position in the market amidst a cooling altcoin rally. Cryptocurrencies are known for their volatility, but Bitcoin’s slight increase indicates a stabilization period while others face declines. As the market evolves, Bitcoin’s dominance remains a focal point, and its upward trend may signal a strategic movement for investors looking for solid returns.