Bitcoin ETF Inflows Reach $260M Driven by Blackrock’s IBIT

Bitcoin ETF inflows surged dramatically recently, as investors demonstrate a robust appetite for exposure to this leading cryptocurrency. On May 16 alone, spot bitcoin exchange-traded funds amassed $260.27 million in net inflows, overshadowing the $22.12 million brought in by ether ETFs. Leading the charge, Blackrock’s highly anticipated Bitcoin ETF, the Ishares Bitcoin Trust (IBIT), contributed a remarkable $129.73 million to these totals. The strong performance of bitcoin fund inflows highlights the market’s confidence in cryptocurrency investments, particularly as institutional players like Fidelity and Ark Invest also reported significant contributions. As bitcoin continues to dominate the ETF landscape, the buzz around Bitcoin ETF news, including developments like the Blackrock Bitcoin ETF, reflects a shifting tide in investor sentiment toward digital assets.

The recent surge in capital directed towards Bitcoin-themed exchange-traded funds (ETFs) reflects a growing trend in the financial markets, with institutional and retail investors increasingly favoring these investment vehicles. This notable influx of funds signals a clear preference for Bitcoin over other options, such as Ethereum ETFs, which have seen a muted response from investors. As the landscape of cryptocurrency investments continues to evolve, the competitive dynamics among various funds—including those managed by prominent firms like Blackrock—are worth exploring. The significant inflows into Bitcoin products provide insights into market sentiment and potential strategic shifts among cryptocurrency investors. This emerging trend around Bitcoin ETF inflows positions the asset class at the forefront of discussions surrounding digital finance and investment opportunities.

Significant Bitcoin ETF Inflows: A Look at Recent Trends

On Friday, May 16, Bitcoin ETFs experienced remarkable inflows, amounting to $260.27 million in net investments. This surge in funds demonstrates a growing institutional appetite for cryptocurrency investments, particularly in Bitcoin. The dominant player in this market segment was Blackrock’s Ishares Bitcoin Trust (IBIT), which alone secured a substantial $129.73 million. Other prominent funds such as Fidelity’s Wise Origin Bitcoin Fund (FBTC) and Ark Invest’s ARKB also contributed significantly, highlighting the trend towards Bitcoin as a preferred asset among investors.

Despite the impressive performance of Bitcoin ETFs, Ethereum ETFs lagged far behind, attracting only $22.12 million in inflows on the same day. This stark contrast underscores not just a disparity in investor confidence but also a broader trend in the market. Many investors are increasingly looking to secure their positions within Bitcoin, recognizing its historical performance and dominance amid the expanding cryptocurrency landscape. As more participants enter the crypto market, Bitcoin’s ETF inflows might continue to grow, potentially setting new records.

Blackrock Bitcoin ETF Leads the Way in Fund Reserves

With Blackrock’s Ishares Bitcoin Trust (IBIT) holding an impressive 631,962 BTC as of May 15, 2025, it solidifies its position as a leader in the Bitcoin ETF market. This substantial reserve not only reflects investor confidence but also reinforces Blackrock’s strategic vision in capturing the growing appetite for Bitcoin among institutional investors. The sheer amount of Bitcoin locked in IBIT strengthens its market credibility and positions it favorably against emerging competitors in the ETF domain.

As the cryptocurrency investments landscape evolves, the significance of a well-established fund like IBIT cannot be overstated. Its impressive inflows make Blackrock’s offering an attractive choice for institutional players seeking Bitcoin exposure. The ability to secure vast amounts of Bitcoin through an easily accessible ETF structure positions IBIT as a pivotal player in the ongoing growth of Bitcoin-related investments. This positions Blackrock advantageously as the ETF landscape continues to mature.

Comparative Analysis: Bitcoin vs Ethereum ETF Performance

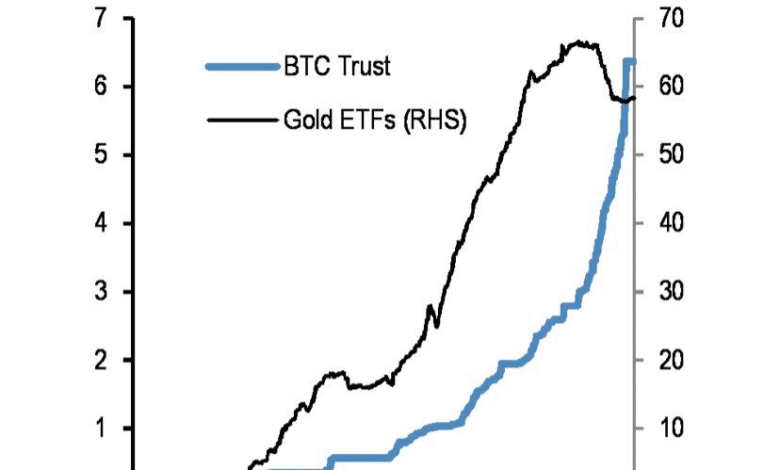

When comparing Bitcoin and Ethereum ETFs, the recent inflow data highlights a clear preference among investors for Bitcoin products. On Friday, Bitcoin ETFs collectively gathered $260 million in funds, whereas their Ethereum counterparts only managed to pull in about $22 million. This discrepancy suggests that many investors still consider Bitcoin the leading cryptocurrency and a more stable investment, despite the innovative developments within the Ethereum space.

The contrasting performance also hints at a probable investor sentiment where Bitcoin is seen as a ‘digital gold’ while Ethereum is still grappling with its position among cryptocurrency investments. Although Ethereum offers advanced capabilities such as smart contracts and decentralized applications, the recent data shows that it has not yet captured the same level of institutional interest that Bitcoin has commanded. This ongoing trend raises questions about the future of Ethereum ETFs and their potential to attract significant capital.

Institutional Demand for Bitcoin: Key Drivers Behind ETF Inflows

The substantial inflows into Bitcoin ETFs are largely driven by a surge in institutional interest. Investors are increasingly recognizing the potential of Bitcoin as a hedge against inflation and a superior store of value compared to traditional assets. This trend has been accelerated by economic uncertainties and a prevailing environment of low interest rates, prompting many institutions to reallocate funds into cryptocurrencies as part of a diversified investment strategy.

Moreover, the growing acceptance of Bitcoin by mainstream financial institutions further bolsters its appeal. Companies like Blackrock and Fidelity are establishing themselves as key players in the cryptocurrency market, providing investors with trusted and secure avenues to invest in digital assets. As institutional demand for Bitcoin continues to grow, it is likely that we will see even greater inflows into Bitcoin ETFs, reflecting the asset’s increasing legitimacy in the global financial ecosystem.

The Impact of ETF Premiums on Investor Sentiment

On May 16, most Bitcoin and Ethereum ETFs traded at slight premiums to their net asset values, with Bitcoin funds like IBIT and FBTC showing premiums between +0.29% and +0.39%. These premiums can serve as an essential indicator of investor sentiment and demand within the cryptocurrency markets. When ETFs trade at a premium, it suggests that investors are willing to pay more than the underlying asset value, signaling confidence in future price appreciation.

Conversely, the trading dynamics of Ethereum ETFs, which expressed a more subdued interest, raise questions about long-term institutional commitment to these products. For instance, Hashdex’s DEFI ETF was the only one trading at a discount, indicating potential investor hesitance. Such dynamics can influence future flows and the broader adoption of cryptocurrency-based ETFs, as they reflect the ongoing reassessment of value within these digital assets.

Future Outlook for Bitcoin ETFs Amid Market Evolution

As we look ahead, the future of Bitcoin ETFs appears robust, buoyed by strong inflows and institutional backing. The continued acceptance of cryptocurrencies by mainstream financial frameworks suggests that Bitcoin may solidify its footprint as a core asset class going forward. The potential introduction of more types of ETFs, such as leveraged and inverse Bitcoin ETFs, could attract new subsets of investors, further enhancing market liquidity.

Additionally, competition among fund managers is likely to intensify as more firms seek to enter the Bitcoin ETF landscape. This increased competition can lead to a diversification of offerings and potentially lower fees for investors, thereby making Bitcoin ETFs even more attractive. The evolution of Bitcoin ETFs, alongside the broader cryptocurrency investment narrative, indicates that this sector is poised for significant growth in the coming years.

How Blackrock’s Bitcoin ETF Influences the Market

Blackrock’s entry into the Bitcoin ETF market has marked a significant pivot for institutional investments in cryptocurrencies. As one of the world’s largest asset management firms, Blackrock’s activity not only legitimizes Bitcoin as a viable investment vehicle but also attracts additional institutional capital to this market. The sheer scale of inflows seen in Blackrock’s IBIT is a testament to this influence, suggesting that other institutions may follow suit and reconsider their allocations toward Bitcoin and potentially other cryptocurrencies.

Furthermore, Blackrock’s strategic positioning within the Bitcoin ETF space can instigate a ripple effect, resulting in greater adoption of digital assets across different sectors. Increased inflows may lead to enhanced liquidity, further stabilizing the market prices of Bitcoin. With more institutional investors looking to Blackrock as a trustable leader, the environment for Bitcoin ETFs could become increasingly favorable, giving rise to new innovations and future regulatory frameworks in the cryptocurrency realm.

Regulatory Considerations for Bitcoin ETFs

As Bitcoin ETFs gain traction, the regulatory landscape surrounding these financial instruments will inevitably play a crucial role. Regulatory bodies across the world are increasingly scrutinizing cryptocurrency markets to ensure investor protection and market integrity. The approval of new Bitcoin ETFs hinges significantly on compliance with these regulations, emphasizing the need for transparency and sound governance within the funds.

Additionally, as more firms consider launching Bitcoin ETFs, they will need to navigate a complex regulatory environment that varies from region to region. This necessity could slow down the pace of new ETF launches but could also solidify the market’s credibility in the long run. Ensuring regulatory compliance may ultimately encourage more cautious and long-term investment strategies among institutions and individual investors alike.

Investor Education: Understanding the Bitcoin ETF Landscape

As interest in Bitcoin ETFs rises, the need for comprehensive investor education becomes increasingly salient. Many potential investors may be unfamiliar with how ETFs function, especially within the cryptocurrency context. Education on the mechanics of Bitcoin ETFs, including their benefits and risks, helps demystify these investment vehicles, paving the way for broader adoption among retail investors.

Furthermore, understanding the differences between Bitcoin and Ethereum ETF offerings is crucial for investors looking to navigate the evolving market. Informative resources—such as guides, webinars, and expert analyses—can empower individuals to make informed decisions based on their financial goals and risk tolerance. As education spreads, we can expect a more informed investor base ready to participate in the burgeoning world of cryptocurrency investments.

Frequently Asked Questions

What were the recent Bitcoin ETF inflows, particularly for Blackrock’s Bitcoin ETF?

On Friday, May 16, Bitcoin ETFs experienced a remarkable $260.27 million in net inflows. Blackrock’s Bitcoin ETF, the Ishares Bitcoin Trust (IBIT), led with $129.73 million in inflows, highlighting its dominance in Bitcoin ETF inflows.

How do Bitcoin ETF inflows compare to Ethereum ETF inflows?

On the same day, Ethereum ETFs attracted only $22.12 million in total inflows, which shows a significant disparity compared to Bitcoin ETF inflows, reaffirming Bitcoin’s status as the more popular cryptocurrency investment.

What role does Blackrock’s Bitcoin ETF play in cryptocurrency investments?

Blackrock’s Bitcoin ETF, particularly IBIT, has become a key player in the cryptocurrency investments landscape by securing substantial inflows and currently holding 631,962 BTC, making it one of the largest Bitcoin ETFs.

Why are Bitcoin fund inflows significant for investors?

Bitcoin fund inflows are essential as they indicate strong institutional demand and positive market sentiment toward Bitcoin, potentially leading to increased prices and broader acceptance of cryptocurrency in investment portfolios.

How do recent Bitcoin ETF inflows affect the cryptocurrency market?

The considerable Bitcoin ETF inflows suggest a positive trend for the cryptocurrency market, as institutions increasingly seek exposure to Bitcoin, often resulting in price stabilization or growth in Bitcoin’s value.

What are the implications of Blackrock’s Bitcoin ETF success for other cryptocurrency ETFs?

Blackrock’s success with its Bitcoin ETF may set a benchmark for other cryptocurrency ETFs, increasing competition and encouraging innovation among Ethereum and other asset ETFs to attract more investment.

When comparing Bitcoin ETF news, what current trends are most noteworthy?

Recent Bitcoin ETF news highlights the strong inflows into Bitcoin ETFs compared to lower interest in Ethereum ETFs, reflecting a broader trend where Bitcoin remains a favored choice for institutional investors.

What can investors learn from the recent Bitcoin ETF inflow trends?

Investors can learn that Bitcoin ETF inflows signify growing institutional confidence and interest in Bitcoin, suggesting that it remains the leading cryptocurrency for long-term investments compared to its competitors.

| ETF Name | Net Inflows (in millions) | BTC Held |

|---|---|---|

| Blackrock’s IBIT (Ishares Bitcoin Trust) | $129.73 | 631,962.23 BTC |

| Fidelity’s Wise Origin Bitcoin Fund (FBTC) | $67.95 | N/A |

| Ark Invest’s ARKB | $57.98 | N/A |

| Grayscale’s Bitcoin Mini ETF | $4.61 | N/A |

| Overall Total for Bitcoin ETFs | $260.27 | N/A |

Summary

Bitcoin ETF inflows reached an impressive $260 million on Friday, marking a significant moment for the cryptocurrency investment landscape. The strong inflows, driven primarily by Blackrock’s IBIT, showcase a clear preference among investors for bitcoin over ethereum, highlighting ongoing institutional demand for bitcoin products. With these figures, it is evident that the bitcoin ETF market continues to lead the charge in attracting investor interest, solidifying bitcoin’s status as the preferred digital asset in the ETF domain.