Bitcoin ETF Inflows Surge: $390 Million in 8 Days

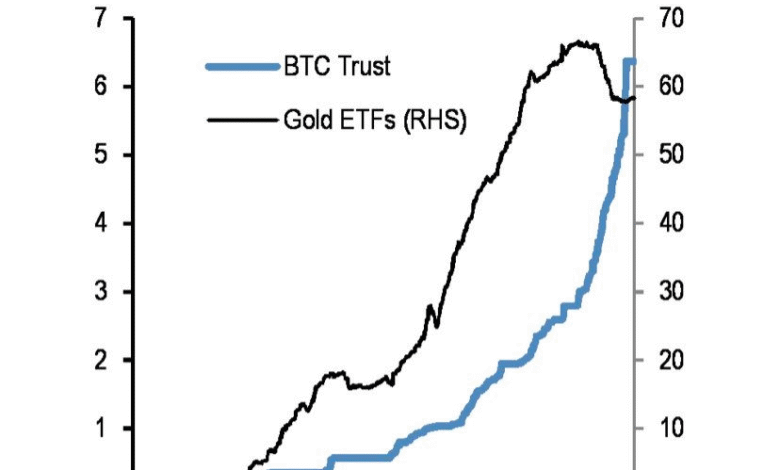

Bitcoin ETF inflows have surged impressively, marking an exhilarating 8th straight day of positive gains with $390 million absorbed into the market. This remarkable trend underscores burgeoning institutional investment, led by heavyweights like Blackrock and Fidelity, which have significantly influenced the Bitcoin ETFs landscape. As investors increasingly look for secure ways to tap into the cryptocurrency boom, these exchange-traded funds have become pivotal in driving market momentum. The recent figures not only reflect a strong bullish sentiment but also highlight a broader acceptance of Bitcoin investment strategies by institutional entities. With Ether ETFs following suit, displaying their own net inflow of $19.1 million, the overall ETF inflow scenario is showcasing solid growth in the digital asset sector.

The recent wave of investment into Bitcoin fund vehicles, particularly Bitcoin ETFs, has captivated the attention of financial analysts and investors alike. As these exchange-traded funds consistently record remarkable capital inflows, they signal a robust shift toward digital asset adoption in institutional portfolios. Moreover, the rising interest in Ether-linked ETFs illustrates a broader trend of diversifying cryptocurrency investments among market players. With large financial institutions paving the way, the increase in capital directed towards these funds emphasizes a significant endorsement of cryptocurrencies as viable long-term investment options. The growing confidence in these investment vehicles points to a transformative period in the financial markets, where traditional practices are intertwining with the revolutionary potential of blockchain technologies.

Bitcoin ETF Inflows Point to Rising Institutional Interest

The recent surge in Bitcoin ETF inflows signals a significant shift in investor sentiment and institutional interest in cryptocurrency. With an impressive net gain of $390 million, Bitcoin ETFs have now secured their 8th consecutive day of inflows. This trend is led primarily by major players like Blackrock and Fidelity, which are drawing substantial capital into the market. Such consistent inflows not only indicate strong demand for Bitcoin investment products but also suggest that institutional investors are increasingly viewing Bitcoin as a viable asset class.

The strong performance of Bitcoin ETFs is a clear reflection of growing confidence among institutional investors. As larger firms allocate more resources into Bitcoin, the momentum of inflows may continue, bolstered by positive price movements and increased market acceptance. Moreover, institutions are likely to diversify their portfolios through Bitcoin and Ether ETFs, paving the way for advanced strategies and a more robust crypto market overall.

The Role of Institutional Investment in Bitcoin ETFs

Institutional investment has vastly influenced the growth of Bitcoin ETFs in recent months. The participation of considerable financial entities not only brings credibility to the cryptocurrency landscape but also facilitates increased market liquidity. Given the substantial capital employed by firms such as Blackrock and Fidelity, their investment choices carry weight, affecting overall market dynamics. Their engagement signifies a monumental shift from traditional perceptions of Bitcoin, positioning it as a legitimate investment vehicle.

As institutional investors continue to explore Bitcoin ETFs, the flow of capital into these products is likely to enhance price stability and reduce volatility in the market. This influx of institutional investment can also provide retail investors with more confidence, knowing that leading financial entities are backing Bitcoin products. Consequently, this trend could fuel a virtuous cycle where increased investments lead to better product offerings and further market expansion.

Ether ETFs Also Experience Positive Inflows

Parallel to the strong performance of Bitcoin ETFs, Ether ETFs have also shown significant resilience, marking a positive inflow of $19.1 million over three consecutive days. This is indicative of sustained investor interest in Ether as a counterpart to Bitcoin, reflecting its growing acceptance in the investment community. As Ether’s underlying technology continues to evolve, its appeal to both retail and institutional investors is likely to grow, establishing a clear trend in diversified cryptocurrency investments.

The robust inflows into Ether ETFs demonstrate a notable shift where the cryptocurrency landscape is not solely dominated by Bitcoin. As investors become increasingly knowledgeable about the benefits of holding Ether, including its utility in decentralized finance (DeFi), more capital is expected to flow into Ether-related products. This trend suggests a more balanced market where both Bitcoin and Ether can coexist, potentially leading to new investment strategies that encompass a wider array of digital assets.

Impact of Market Sentiments on Bitcoin and Ether ETFs

Market sentiments play a critical role in driving the inflows in Bitcoin and Ether ETFs. The current bullish sentiment surrounding Bitcoin, backed by institutional investments, has contributed significantly to the record inflows. As market observers note the ongoing macroeconomic signals, the general sentiment indicates an increasing appetite for crypto exposure among investors, demonstrating a shift toward digital assets amid volatility in traditional markets.

Similarly, Ether ETFs are benefiting from the overall positive sentiment in the cryptocurrency market. The confidence expressed by investment firms in adopting products like Ether ETFs demonstrates a growing belief in the future of cryptocurrency assets. This synergistic relationship between investor sentiment and ETF inflows underscores the importance of market dynamics that can either propel or hinder investment in digital currencies.

Understanding the Growth of Bitcoin and Ether ETFs

The rapid growth of Bitcoin and Ether ETFs can be attributed to several factors, including increased adoption of cryptocurrencies and the development of clearer regulatory frameworks. Investors are increasingly seeking exposure to digital assets, and ETFs present an accessible means to do so. This growing acceptance signals a maturing market for cryptocurrencies, attracting both retail and institutional clients who are looking for innovative investment opportunities.

Moreover, the evolution of financial products like Bitcoin and Ether ETFs reflects a significant transformation in how digital currencies are perceived and traded. With traditional finance increasingly intertwining with digital assets, many investors are finding comfort in the structured environment and liquidity that ETFs offer, which is encouraging a broader base of participation in the crypto market.

Trading Volume Insights for Bitcoin and Ether ETFs

The total trading volume witnessed in Bitcoin and Ether ETFs provides valuable insights into the health of these financial instruments. On the given day, Bitcoin ETFs achieved a remarkable trading volume of $2.94 billion, marking it as a significant indicator of investor engagement and market activity. Such high trading volumes are typically associated with increased investor participation, reflecting growing confidence in cryptocurrency investments.

Similarly, Ether ETFs are also thriving with a commendable trading volume of $380.08 million. This level of activity highlights the robust interest in not just Bitcoin, but also Ether as a credible asset within the ETF landscape. When trading volumes for both cryptocurrencies remain strong, it suggests that the market is not only active but also that investors are willing to engage consistently, which can lead to further price appreciation and market development.

The Future of Bitcoin and Ether ETFs

Looking forward, the future of Bitcoin and Ether ETFs appears promising as they continue to gain acceptance among institutional and retail investors alike. The ongoing inflows into these assets help solidify their positions in the financial markets, suggesting that they may become integral parts of diversified investment strategies. As ETF products evolve and more options become available, including leverage and different strategies, investors may find even more compelling reasons to allocate their funds into these assets.

Additionally, as regulatory frameworks become clearer and more supportive of digital asset trading, it is expected that both Bitcoin and Ether ETFs will see a surge in demand. Innovative financial solutions, improved market infrastructure, and heightened investor education will further propel the growth trajectory of these instruments, helping to demystify cryptocurrencies and ultimately enhancing their adoption.

Risk Management Considerations for Bitcoin and Ether Investments

As investors flux into Bitcoin and Ether ETFs, understanding the inherent risks associated with cryptocurrency investments becomes paramount. Volatility remains a defining characteristic of the crypto market, and while ETFs offer a more structured way to invest in digital assets, they are not immune to price fluctuations. Investors must conduct thorough research and consider their risk tolerance before committing substantial capital to Bitcoin and Ether ETFs.

Implementing risk management strategies is crucial for sustaining investments in Bitcoin and Ether. Diversification, for instance, can help mitigate exposure to the volatility of a single asset class. By including a mix of asset types alongside Bitcoin and Ether ETFs, investors can achieve a balanced portfolio that rides out market fluctuations while still taking advantage of potential upside in the dynamic cryptocurrency landscape.

Analyzing Bitcoin ETF Performance Against Market Trends

Analyzing the performance of Bitcoin ETFs in the context of broader market trends helps investors gauge the effectiveness of their strategies. In a bullish market, Bitcoin ETFs often exhibit strong performance metrics, as seen in the recent inflow surge of $390 million. Conversely, in bearish conditions, Bitcoin ETFs may lag behind, reflecting market pressures and investor hesitance. Keeping track of these performance metrics enables better timing for entry and exit points.

Moreover, comparing Bitcoin ETF performance with tech stocks or traditional assets can provide essential insights into market behavior. Such analyses can reveal correlations and divergences, assisting investors in making informed decisions. By understanding how Bitcoin ETFs react to market trends, investors can better align their portfolios to capitalize on bullish phases while protecting against downturns.

Frequently Asked Questions

What are Bitcoin ETF inflows and why are they significant?

Bitcoin ETF inflows refer to the net capital that is invested into Bitcoin exchange-traded funds (ETFs). These inflows are significant because they indicate institutional and retail investor interest in Bitcoin, showcasing broader acceptance of cryptocurrency as an investment vehicle. Recently, Bitcoin ETFs have seen a sustained inflow, highlighting growing confidence in the asset class.

How much did Bitcoin ETFs record in inflows recently?

Bitcoin ETFs recorded a remarkable inflow of $390 million, marking their 8th consecutive day of net inflows. This surge primarily resulted from investments in leading funds like Blackrock’s IBIT and Fidelity’s FBTC, indicating strong institutional demand for Bitcoin investments.

Which companies are leading in Bitcoin ETF inflows?

The leading companies in Bitcoin ETF inflows are Blackrock, which attracted $278.93 million, and Fidelity, which brought in $104.38 million. These figures underscore their roles as major players in the Bitcoin ETF market, attracting significant institutional investment.

What impact do Bitcoin ETF inflows have on the overall cryptocurrency market?

Bitcoin ETF inflows contribute positively to the overall cryptocurrency market by increasing Bitcoin’s price stability and liquidity. As more capital enters through ETFs, investor confidence strengthens, further legitimizing Bitcoin as a viable investment option.

Are Ether ETFs experiencing similar inflows as Bitcoin ETFs?

Yes, Ether ETFs are experiencing similar positive trends, with reported inflows of $19.1 million recently. This reflects growing interest in Ether investments and complements the bullish sentiment already surrounding Bitcoin ETFs.

What is the importance of institutional investment in Bitcoin ETFs?

Institutional investment in Bitcoin ETFs is crucial as it signals greater acceptance and credibility of Bitcoin in the financial markets. High levels of institutional inflows often correlate with price increases and a more stable investment environment for cryptocurrencies.

What can investors expect from future Bitcoin ETF inflows?

Investors can expect ongoing interest in Bitcoin ETF inflows, driven by a strong institutional presence and positive market sentiment. As more financial institutions launch or invest in Bitcoin ETFs, the inflow trend may continue, benefiting Bitcoin investment strategies.

How do Bitcoin ETF inflows compare to traditional investment vehicles?

Bitcoin ETF inflows have shown to be robust in comparison to traditional investment vehicles, particularly in periods of bullish market sentiment. The ability to trade Bitcoin through ETFs makes it accessible to a wider range of investors, attracting significant capital inflow relative to traditional assets.

Can fluctuations in Bitcoin ETF inflows affect Bitcoin’s price?

Yes, fluctuations in Bitcoin ETF inflows can significantly affect Bitcoin’s price. Increased inflows typically indicate heightened demand, which can drive prices up. Conversely, outflows can signal reduced interest, potentially leading to price declines.

| ETF Provider | Bitcoin Inflows ($ Million) | Ether Inflows ($ Million) | Total Trading Volume ($ Million) | Net Assets ($ Billion) |

|---|---|---|---|---|

| Blackrock IBIT | $278.93 | $15.11 | $2.94 Billion | $127.43 |

| Fidelity FBTC | $104.38 | $3.99 | ||

| Bitwise BITB | $11.32 | |||

| Grayscale Bitcoin Mini Trust | $10.12 | |||

| Hashdex DEFI Fund | $1.17 | |||

| Grayscale GBTC | -$16.36 |

Summary

Bitcoin ETF inflows have reached new heights with the latest data revealing an impressive 8th consecutive day of inflows totaling $390 million. This strong inflow demonstrates a clear confidence in the cryptocurrency market, particularly with institutional players like Blackrock and Fidelity making significant contributions. As Bitcoin ETFs consistently draw in substantial investment, it reflects an undeniable bullish sentiment, attracting more investors eager to capitalize on the growing crypto asset class.