Bitcoin ETF Outflow: $964 Million Lost in Massive Red Friday

In a shocking turn of events for the cryptocurrency market, Bitcoin ETF outflow has surged to an unprecedented $812 million, marking a historic second-largest loss ever recorded. This dramatic decrease signals a worrying shift in cryptocurrency investment trends, especially as investor confidence dwindles amid fluctuating market conditions. Coupled with a significant $152 million outflow in ether ETFs, August 1st turned into a ‘Red Friday’ for these vehicles, prompting serious crypto market analysis regarding the motivations behind such withdrawals. The latest Bitcoin ETF news reveals substantial losses from major players like Fidelity and Ark 21shares, further highlighting the distress in institutional confidence in crypto. As investors scramble to reassess their strategies, it has become crucial to understand the broader implications this outflow may have on the future of digital assets and ETF liquidity.

Recent events in the cryptocurrency landscape have unfolded dramatically, particularly with regard to exchange-traded funds (ETFs) specific to Bitcoin and ether. With staggering outflows recorded—most notably, Bitcoin ETFs faced a massive reduction of $812 million—this shift raises critical questions about investor sentiments and market dynamics. The ether ETF sector also faced a sharp decline, marking the end of a robust inflow period. Such turbulence calls for a deeper examination of current cryptocurrency investment trends and the underlying factors driving these withdrawals. As we delve into this topic, it’s essential to explore the broader implications for market stability and institutional engagement within the realm of digital finance.

Understanding the Recent Bitcoin ETF Outflow

In a shocking turn of events, Bitcoin ETFs experienced an outflow of $812 million, marking one of the largest drops in their history. This substantial exit from crypto funds indicates a shift in investor confidence, as many were initially optimistic about the upward trend seen in the previous weeks. Notably, major players like Fidelity and Ark 21shares spearheaded the outflow, which raises questions about the current sentiment in the cryptocurrency market. Analysts are pondering whether this outflow signifies a temporary market correction or a more profound trend of diminishing institutional interest in Bitcoin and cryptocurrencies at large.

The dynamics of cryptocurrency investment trends play a crucial role in shaping these markets. As BTC and ETH prices fluctuate dramatically, investor behavior shifts—leading to rapid changes in capital allocation. This latest outflow serves as a wake-up call for investors to closely monitor Bitcoin ETF news and the actions of institutional players. These developments not only impact Bitcoin’s long-term outlook but also resonate across the broader cryptocurrency market, where confidence can shift quickly, driving investment strategies and market volatility.

The Impact of Ether ETF Outflow on Market Sentiment

After a remarkable 20-day run, ether ETFs faced a sudden disruption with a $152 million outflow that caused ripple effects throughout the crypto ecosystem. This decline in net assets indicates a loss of momentum for Ethereum, reflecting a broader bearish sentiment that can extend beyond just the ether market. In a landscape where cryptocurrency investments are closely intertwined, the ether ETF outflow can shake the confidence of institutional and retail investors alike, leading to more cautious approaches moving forward. Market analysts suggest that this trend could discourage potential investors from entering the Ethereum ecosystem until stability resumes.

Moreover, the ending of the inflow streak for ether ETFs is a significant indicator of changing perspectives on cryptocurrency investments. Investors are now reevaluating their positions in light of increasing volatility and external market pressures. Cryptocurrency market analysis highlights that these outflows can influence the overall sentiment surrounding institutional confidence in crypto assets. With ether experiencing substantial withdrawals, it may serve as a case study for potential investors to consider the implications of short-term movements versus long-term holdings within the cryptocurrency landscape.

Institutional Investors and Their Role in Crypto Market Dynamics

The recent Bitcoin and ether ETF outflows can be interpreted as critical signals reflecting the current state of institutional investors in the cryptocurrency market. Historically, these investors have played a pivotal role in establishing market stability and encouraging widespread adoption. However, the outflow of nearly a billion dollars indicates a potential waning of that support. This may compel other institutional players to reassess their strategies regarding crypto allocations, which could have long-term implications for the market’s direction.

Institutional confidence in crypto investments has always been a focal point for market analysts. As major firms adjust their positions based on new data, the broader cryptocurrency investment trends shift as well. For instance, prolonged periods of outflow might lead institutions to withdraw from crypto investments or pivot toward more traditional asset classes. This potential reallocation of resources can cultivate uncertainty in the crypto market, causing both prices and investor sentiments to fluctuate dramatically in response to these shifts.

Analyzing Crypto Market Fluctuations and Their Causes

The sudden fluctuations in the cryptocurrency market, particularly the recent outflows from Bitcoin and ether ETFs, highlight the volatility inherent in these assets. Various factors contribute to these market shifts, including regulatory developments, macroeconomic conditions, and investor sentiment. A breakdown of these elements reveals how interconnected the cryptocurrency landscape is with mainstream financial trends, suggesting that external factors can significantly influence investor behavior and market stability.

Furthermore, deeper analysis points toward the importance of macro trends in driving investment decisions. As global markets experience uncertainty, investors often seek refuge in more traditional or stable assets, leading to patterns like the current outflow from Bitcoin ETFs. Crypto market analysis suggests that adjusting to these trends requires adaptability from both institutional and retail investors alike. Keeping a pulse on market movements may help inform future decisions regarding asset allocations and risk management, especially amidst a backdrop of shifting confidence levels.

Market Recovery: Is It Possible After Massive Outflows?

Following the unprecedented outflow of $964 million from Bitcoin and ether ETFs, many market participants are left questioning the potential for recovery. Historical market behavior suggests that while significant downturns can lead to panic selling and negative sentiment, they can also present opportunities for rebound. The cyclical nature of the cryptocurrency market typically showcases the potential for recovery after substantial corrections, provided that key indicators such as institutional investment begin to stabilize.

Nonetheless, the road to recovery in the crypto market may be challenging in the short term. Sustainable recovery will likely depend on a revival of institutional confidence in crypto assets, meaning that strong, positive Bitcoin ETF news would stimulate renewed investment activity. Furthermore, as the market’s turbulent history demonstrates, successful recoveries often require time and strategic positioning. Meaningful investments from both traditional finance players and new entrants can foster a healthier market environment following such significant outflows.

Long-Term Perspectives on Bitcoin and Ether Investments

The significant outflows experienced by Bitcoin and ether ETFs prompt a reevaluation of long-term investment strategies within the cryptocurrency sector. Investors often view these assets as future-oriented, capable of delivering substantial returns over time despite short-term volatility. This current outflow could be perceived as part of the typical ebb and flow of cryptocurrency investments, nudging long-term investors to consider the ultimate value proposition of Bitcoin and Ethereum in their portfolios.

Amid concerns over short-term performances, analysts encourage a focus on the fundamental aspects of cryptocurrencies that promote long-term growth—such as technological advancements, increased adoption rates, and macroeconomic influences. These factors play a crucial role in determining the feasibility of Bitcoin and ether as long-term investment vehicles. By maintaining a broader perspective, investors can better navigate the ups and downs of the market and potentially capitalize on pivotal moments that historically lead to recovery and increased asset values.

The Role of Investor Sentiment in Cryptocurrency Markets

Investor sentiment significantly impacts the volatility of cryptocurrency markets. The recent outflows from Bitcoin and ether ETFs illustrate how collective behavior can influence market prices and shifting trends. As investor mood shifts from confidence to caution, the market responds, sometimes erratically. This interplay is vital for understanding why sudden flows of capital out of these funds can resonate through the entire cryptocurrency landscape, affecting even those who may not directly invest in Bitcoin or ether.

Moreover, the importance of sentiment cannot be understated when analyzing broader cryptocurrency investment trends. Investors often react to news, regulatory changes, and market conditions, leading to a heightened state of alert within the community. Keeping an eye on sentiment indicators may help current and future investors gauge potential market movements before they occur. For example, understanding how institutional confidence fluctuates may provide insight into the resilience or fragility of crypto investments amidst ferocious market shifts.

The Future of Bitcoin and Ether: What Lies Ahead?

As we analyze the market landscape shaped by massive outflows from Bitcoin and ether ETFs, the pressing question remains: what does the future hold for these digital assets? The overarching trend suggests a critical moment of introspection for both investors and institutions navigating these turbulent waters. For some, the enduring fundamentals of Bitcoin and Ether provide reassurance that their values will recover, while others may view the current climate as a signal to retreat to less volatile investments.

Looking forward, optimism hinges on a combination of technological innovations, regulatory clarity, and renewed institutional commitment to cryptocurrency markets. A resurgence in confidence among institutional investors might pave the way for increased capital inflows, potentially reversing the negative trends witnessed in recent weeks. On a broader scale, the future of Bitcoin and Ether will likely depend on their ability to adapt and thrive in an ever-evolving financial ecosystem that increasingly embraces digital assets alongside traditional investments.

Conclusion: Navigating the New Landscape of Crypto Investments

The dramatic outflows from Bitcoin and ether ETFs signal a pivotal moment in cryptocurrency investments, revealing challenges as well as opportunities. Investors are faced with the task of navigating an increasingly complex market that requires not only an understanding of historical trends but also a keen awareness of prevailing investor sentiment and macroeconomic conditions. As the industry evolves, staying informed about developments in Bitcoin ETF news and broader market analyses becomes essential for sound investment strategies.

In conclusion, the current landscape reflects the inherent volatility characteristic of cryptocurrency investments, making it essential for investors to remain adaptable and strategic. By understanding the factors driving investor behaviors and consistently assessing the market, participants can better prepare for the potential ups and downs of the crypto ecosystem. The road ahead may be uncertain, but with diligence and informed decision-making, investors can position themselves to thrive amidst the fluctuations of the ever-changing market.

Frequently Asked Questions

What caused the recent Bitcoin ETF outflow?

The recent Bitcoin ETF outflow of $812 million, marking the second-largest in history, was primarily driven by a sudden shift in investor sentiment. Major funds like Fidelity’s FBTC and Ark 21shares’ ARKB led the outflows, reflecting a broader trend of declining institutional confidence in cryptocurrency investment.

How do Bitcoin ETF outflows impact the crypto market analysis?

Bitcoin ETF outflows have significant implications for crypto market analysis, often indicating reduced investor confidence and potential shifts in cryptocurrency investment trends. The record outflow of $812 million suggests a bearish sentiment and raises concerns about the overall stability of the crypto market.

Is the Bitcoin ETF outflow a sign of declining institutional confidence in crypto?

Yes, the massive Bitcoin ETF outflow of $812 million could be indicative of declining institutional confidence in cryptocurrency. Following weeks of positive momentum, the sudden reversal has prompted analysts to reassess investment trends and forecast the future trajectory of the crypto market.

What are the consequences of Bitcoin ETF outflows on ether ETF investments?

The consequences of Bitcoin ETF outflows can negatively influence ether ETF investments as well. After experiencing significant inflows, ether ETFs faced a $152 million outflow, suggesting that investor concerns regarding Bitcoin may also extend to other cryptocurrency assets, impacting overall market sentiment.

How does the Bitcoin ETF news affect cryptocurrency investment trends?

Recent Bitcoin ETF news highlighting a historic outflow of $812 million can alter cryptocurrency investment trends by affecting investor psychology. A growing perception of risk may lead investors to redirect their funds away from both Bitcoin and ether ETFs, which could shift the landscape of crypto investments significantly.

What were the major factors surrounding the Bitcoin ETF outflow this August?

Several factors contributed to the Bitcoin ETF outflow this August, including a sudden market correction and shifts in institutional sentiment. Reports of significant losses in multiple major ETFs, like Fidelity’s FBTC and Ark’s ARKB, contributed to an overall bearish market perception, influencing investor behavior.

How do massive outflows from Bitcoin ETFs affect overall trading volume?

Massive outflows from Bitcoin ETFs often lead to increased overall trading volume, as seen with the $6.14 billion in transactions following the recent outflow. High trading volumes can amplify market volatility and affect liquidity, impacting pricing strategies for other cryptocurrencies.

What trends can we expect after the significant Bitcoin ETF outflow?

Following the significant Bitcoin ETF outflow of $812 million, we may expect ongoing bearish trends in the cryptocurrency market. Continued scrutiny of institutional confidence in crypto investments and further adjustments in market strategies could shape the near future of both Bitcoin and ether ETFs.

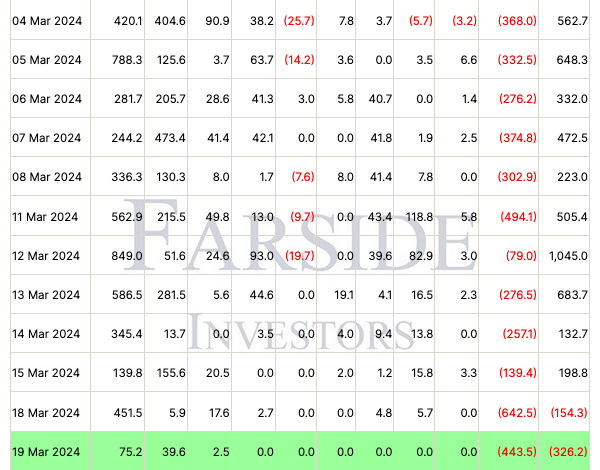

| ETF Type | Outflow Amount | Leading Fund | Notable Losses | Total Trading Volume | Net Assets |

|---|---|---|---|---|---|

| Bitcoin ETFs | $811.25 million | Fidelity’s FBTC | Ark 21shares ARKB: $327.93 million Grayscale GBTC: $66.79 million |

$6.14 billion | $146.48 billion |

Summary

Bitcoin ETF outflow marked a significant moment in the cryptocurrency market, as both Bitcoin and ether ETFs experienced unprecedented losses totaling $964 million. This event reflects a dramatic shift in investor behavior and sentiment, prompting discussions on the future of institutional investments in crypto. The striking outflow from top funds like Fidelity’s FBTC and Ark’s ARKB raises concerns about market stability and confidence, indicating that investors are reassessing their positions after a prolonged bullish period. The downturn serves as a critical reminder of the inherent volatility in cryptocurrency investments.