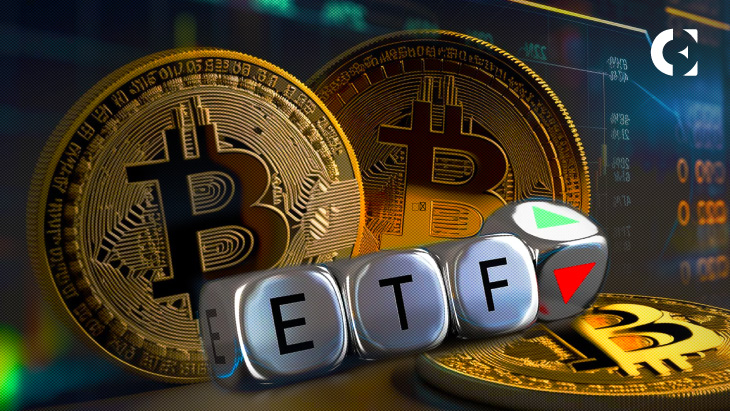

Bitcoin ETFs Continue Strong Run with $603 Million Inflows

Bitcoin ETFs have been on an impressive streak, marking their fifth consecutive week of net inflows with a whopping $603.74 million, solidifying their position in the growing landscape of cryptocurrency investments. Notably, Blackrock’s Bitcoin ETF, designated as IBIT, has led this surge with significant interest from institutional investors. As the Bitcoin ETF inflows persist, they not only reflect the robust demand for cryptocurrency exposure but also highlight the increasing acceptance of digital assets in mainstream finance. Meanwhile, Ether ETFs are also gaining traction, showcasing promising inflows that further bolster the appeal of crypto ETFs as legitimate investment vehicles. With the overall market sentiment shifting towards institutional cryptocurrency investment, the momentum for Bitcoin and Ether ETFs appears to be unwavering.

In recent weeks, exchange-traded funds linked to cryptocurrencies, particularly Bitcoin and Ether, have witnessed remarkable inflows, capturing the attention of investors and analysts alike. The surge in these financial products underscores a broader trend of growing interest in digital assets, especially among institutional players looking to diversify portfolios. With leading firms like Blackrock stepping into the fray with their Bitcoin ETF offerings, the landscape for crypto-related investments is rapidly evolving. Furthermore, the performance of Ether ETFs adds another layer of complexity and opportunity for those pursuing market exposure. As these innovative investment vehicles gain traction, they are shaping the future of cryptocurrency investment strategies.

Understanding Bitcoin ETFs and Their Recent Performance

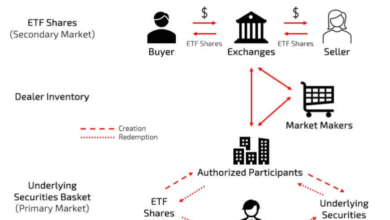

Bitcoin ETFs have increasingly become a popular investment vehicle, allowing traditional investors to gain exposure to Bitcoin without the complexities of managing digital wallets. Over the past week, Bitcoin ETFs attracted a remarkable $603.74 million in net inflows, reflecting an upward trend that has persisted for five consecutive weeks. The surge can be largely attributed to major players like Blackrock’s IBIT, which alone garnered $841.76 million in inflows, establishing itself as a dominant force in the market. This consistent inflow showcases not only investor confidence but also the growing acceptance of cryptocurrencies in mainstream finance.

In addition to the substantial inflows, Bitcoin ETFs have helped increase the total net assets in this space to a staggering $122.67 billion. Such figures indicate a strong institutional interest in cryptocurrencies, marking a significant transition in investment paradigms. With the potential for Bitcoin ETFs to revolutionize investment strategies, controlled risk, and enhanced liquidity, it’s evident that they are here to stay and continue to attract attention from both retail and institutional investors.

The Role of Institutional Investment in Crypto ETFs

Institutional investment is playing a pivotal role in the growth of crypto ETFs, particularly Bitcoin and Ether ETFs. Institutions are increasingly looking towards cryptocurrency as a means to diversify their portfolios and hedge against traditional market volatility. The recent influx into Bitcoin ETFs is indicative of a broader trend where large financial entities are not only investing in cryptocurrencies directly but are also favoring these ETFs as a vehicle for exposure. For instance, the inflows into Blackrock’s Bitcoin ETF have set a benchmark, underlining the crucial role that institutional players have in legitimizing and stabilizing the crypto market.

Moreover, this institutional shift is not limited to Bitcoin alone; Ether ETFs are also experiencing significant attention, with a collective inflow of $41.59 million last week. As funds like Blackrock’s ETHA lead the charge, they provide a safe and regulated means for institutions to gain access to smart contract platforms and broader blockchain technologies. This transition suggests that if the current trend persists, we could witness a further maturation of the cryptocurrency market as institutional investment continues to drive demand and innovation.

Analyzing the Performance of Ether ETFs

Ether ETFs have positioned themselves as a unique investment opportunity in the cryptocurrency landscape, capturing the attention of both retail and institutional investors. This past week showed Ether ETFs recording inflows amounting to $41.59 million, signaling a strong demand for exposure to Ethereum amidst the overall bullish sentiment in the crypto ETF market. Blackrock’s ETHA emerged as a frontrunner, attracting $66.04 million, which underscores the growing reliability and interest surrounding Ether as a leading digital asset next to Bitcoin.

As the market evolves, Ether ETFs are also benefiting from increased recognition for the utility and potential of Ethereum’s blockchain technology. Unlike Bitcoin, which is often seen primarily as a store of value, Ethereum offers a platform for innovations like decentralized finance (DeFi) and non-fungible tokens (NFTs). This versatility translates into an increasing appetite among institutional investors for Ether ETFs, further enhancing their performance and stability within a diversified investment portfolio. With the current trajectory, Ether ETFs may soon witness enhanced market activity as more players recognize the dual opportunities present in both Bitcoin and Ethereum.

Key Insights from Recent Bitcoin ETF Inflows

The recent surge in Bitcoin ETF inflows offers critical insights into the evolving perceptions of cryptocurrency among investors. Notably, the inflow of $603.74 million marks a pivotal moment, as it highlights growing confidence in Bitcoin amidst a varied market landscape. While some traditional funds, like Fidelity’s FBTC and Grayscale’s GBTC, faced net outflows, the performance of Blackrock’s IBIT demonstrates the potential for certain ETFs to outperform and attract significant capital in times of uncertainty within the broader crypto market.

Furthermore, these inflows suggest a recalibration of investor sentiment where risk tolerance appears to be gradually increasing. Investors are willing to place larger bets on Bitcoin-adjacent investment vehicles, based on the belief in their long-term potential. This trend aligns with recent studies indicating that institutional investors are considering allocation to cryptocurrencies as a viable option, contributing to the overall dominance of Bitcoin ETFs as a leading choice for gaining exposure to the digital asset class.

Impact of Market Trends on Crypto ETFs

Market trends play a crucial role in shaping the performance of crypto ETFs, especially in times of volatility. The recent scenario, where Bitcoin ETFs logged significant inflows while individual funds exhibited mixed results, illustrates the impact of broader market conditions on investment decisions. As investors navigate through unpredictable market environments, those seeking stability and reliable long-term growth gravitate towards established Bitcoin ETFs, exemplified by Blackrock’s IBIT, which continues to lead in attracting new capital.

In addition, this dynamic highlights the importance of being selective in the ETF investments that cater to institutional preferences. As the general market grapples with turbulent conditions, crypto ETFs like Grayscale’s Bitcoin Mini Trust have also managed to post gains, reinforcing the notion that certain funds possess qualities that can withstand market fluctuations. As trends continue to unfold, monitoring these performance metrics will give valuable insights into how cryptocurrency investments are evolving in response to market forces.

Future of Bitcoin and Crypto ETFs in Institutional Portfolios

The future outlook for Bitcoin and crypto ETFs in institutional portfolios appears promising as financial markets increasingly embrace digital assets. As we’ve witnessed throughout the past weeks, with Bitcoin ETFs enjoying consistent inflows, it is clear that institutions are beginning to view these investment vehicles as integral components of a diversified portfolio. The sustained interest reflects a shift in the traditional investment mindset, where cryptocurrencies are viewed not just as speculative assets but rather as viable investments with the potential to provide substantial returns.

As more institutional players pivot towards engaging with cryptocurrency markets, the infrastructure supporting Bitcoin ETFs will likely continue to improve, making them even more accessible. Enhanced regulatory frameworks and the development of products that cater to specific investment strategies will further fortify this trend. Looking ahead, the growth trajectory of Bitcoin ETFs could set the stage for increased adoption and acceptance of crypto investments at significant institutional levels, influencing future investment strategies across the board.

Comparative Performance: Blackrock Bitcoin ETF vs. Others

When comparing the performance of various Bitcoin ETFs, Blackrock’s IBIT stands out as a remarkable leader in the market. With an eye-catching inflow of $841.76 million, IBIT has decisively outperformed competitors like Grayscale’s Bitcoin Mini Trust and Vaneck’s HODL, which showed much lower inflow numbers. Such discrepancies in performance often highlight differences in management strategies, brand trust, and marketing efforts that resonate with institutional investors. In an environment where confidence is pivotal, trends indicate that well-established brands may attract larger inflows.

The strong performance of Blackrock’s Bitcoin ETF also underscores a strategic approach to product management and investor engagement, setting a benchmark for future ETFs entering the market. As more investors seek to align themselves with leading funds, the focus will likely shift toward ETFs that can provide not only reliable performance but also the perceived stability and trust of an established financial institution. This comparative analysis points to the potential of becoming a preferred choice for those institutional investors seeking exposure to the crypto market.

Navigating Risks in Cryptocurrency Investment

As institutional interest in cryptocurrency investments, particularly through ETFs, increases, it is vital to address the inherent risks associated with investing in digital assets. Bitcoin and Ether ETFs, while offering a regulated environment, still carry risks related to market volatility, liquidity, and regulatory changes. Investors should be aware that while ETFs provide a simplified method to gain exposure, the underlying assets remain volatile, and significant swings can impact overall fund performance.

Mitigating these risks may require a diversified approach, where institutions balance their cryptocurrency holdings with traditional assets to hedge against potential downsides. Monitoring emerging trends in the crypto space, investor sentiment, and regulatory developments will be crucial in navigating these risks. By adopting sound investment strategies, institutional investors can better position themselves to capitalize on the growing trend of cryptocurrency investments while safeguarding against market fluctuations.

Exploring the Long-Term Outlook for Crypto ETFs

The long-term outlook for crypto ETFs appears increasingly bright as more investors and institutions seek to diversify their portfolios with digital assets. As the world becomes more digital and technology-driven, cryptocurrencies are poised to play a significant role in shaping future investment landscapes. With Bitcoin and Ether ETFs gaining momentum and attracting substantial net inflows, this trend suggests a robust framework for the continued evolution of crypto funds.

Furthermore, with firms like Blackrock paving the way for institutional engagement, the potential for additional financial products specifically tailored to cryptocurrency investments seems promising. As the regulatory landscape matures and institutional frameworks are solidified, crypto ETFs may not only stabilize but also become mainstream investment vehicles, signifying a new era of growth and acceptance for digital assets within traditional finance.

Frequently Asked Questions

What are Bitcoin ETF inflows and why are they significant?

Bitcoin ETF inflows refer to the net investments into Bitcoin exchange-traded funds, which have marked a growing trend in institutional cryptocurrency investment. Recent data shows that Bitcoin ETFs have attracted $603.74 million in inflows over five weeks, highlighting increasing investor confidence in Bitcoin and the broader crypto market.

How does the performance of Bitcoin ETFs influence the cryptocurrency market?

The performance of Bitcoin ETFs, particularly those like Blackrock’s IBIT, significantly impacts the cryptocurrency market by demonstrating institutional interest and boosting investor confidence. With a remarkable inflow of $841.76 million, Bitcoin ETFs are becoming key players in the market, potentially driving further adoption and stability.

What is the difference between Bitcoin ETFs and Ether ETFs?

Bitcoin ETFs, such as Blackrock’s IBIT and Grayscale’s Bitcoin Mini Trust, primarily invest in Bitcoin, whereas Ether ETFs focus on Ether, the cryptocurrency of the Ethereum network. Both types of ETFs have shown strong inflows recently, with Bitcoin ETFs receiving $603.74 million and Ether ETFs attracting $41.59 million, reflecting the differing investor interests in these cryptocurrencies.

Why did some Bitcoin ETFs experience net outflows while others thrived?

While Bitcoin ETFs like Blackrock’s IBIT saw significant inflows, others, such as Fidelity’s FBTC, faced net outflows due to varied investor sentiment. Factors influencing these trends can include fund performance, market conditions, and investor confidence in specific management teams, leading to disparities in the popularity of different Bitcoin ETFs.

What role do institutional cryptocurrency investments play in Bitcoin ETF success?

Institutional cryptocurrency investments play a crucial role in Bitcoin ETF success by providing significant capital inflows and validating the asset class’s credibility. The recent surge in Bitcoin ETF inflows indicates increased interest from institutional investors, contributing to a total net asset growth of $122.67 billion in Bitcoin ETFs.

Are Ether ETFs performing well compared to Bitcoin ETFs?

Ether ETFs are performing positively but at a smaller scale compared to Bitcoin ETFs. While Bitcoin ETFs recorded $603.74 million in inflows, Ether ETFs saw $41.59 million. However, both categories show a healthy interest from investors, with key players like Blackrock’s ETHA contributing to growth in the Ether ETF sector.

What factors contribute to the increasing inflows in Bitcoin ETFs?

Factors contributing to increasing inflows in Bitcoin ETFs include rising investor confidence, institutional adoption of cryptocurrencies, favorable market conditions, and the backing of reputable financial institutions like Blackrock. This positive momentum highlights a growing acceptance of Bitcoin as an investment vehicle.

| Category | Details |

|---|---|

| Bitcoin ETFs | Marked fifth consecutive week of net inflows, attracting $603.74 million. |

| Key Performance (Wednesday, May 14) | Inflow of $319.56 million on a single day. |

| Top Performers | Blackrock’s IBIT with $841.76 million; Grayscale’s Bitcoin Mini Trust +$39.84 million; Vaneck’s HODL +$7.32 million. |

| Underperformers | Fidelity’s FBTC -$122.07 million; Grayscale’s GBTC -$72 million; ARKB -$68.91 million. |

| Total Net Assets | Total net assets for bitcoin ETFs reached $122.67 billion. |

| Ether ETFs | Concluded week with inflows of $41.59 million, following $63.47 million on May 14. |

| Top Ether ETFs | Blackrock’s ETHA with $66.04 million; Grayscale’s Ether Mini Trust +$15.91 million; Franklin’s EZET +$3.06 million; Vaneck’s ETHV +$2.95 million. |

| Ether Outflows | Fidelity’s FETH -$20.16 million; Grayscale’s ETHE -$26.22 million. |

Summary

Bitcoin ETFs have showcased impressive momentum, marked by their sustained inflows over the past five weeks. This consistent growth reflects strong investor confidence in the cryptocurrency market, underscored by significant inflows from leading funds like Blackrock’s IBIT. Moreover, Ether ETFs have also enjoyed a notable increase, contributing to the broad appeal of cryptocurrency investment vehicles. As more investors seek institutional exposure to digital assets, Bitcoin ETFs are set to remain a focal point in the evolving financial landscape.