Bitcoin Forecast: Standard Chartered Revises Predictions

The Bitcoin forecast is capturing the attention of investors and analysts alike as the cryptocurrency surges past the $100K mark, prompting a reassessment of previous predictions. Recently, Standard Chartered’s head of digital assets, Geoffrey Kendrick, admitted his earlier estimate of $120K was overly conservative, given the robust momentum driven by institutional investments. As Bitcoin price predictions shift, the landscape of Bitcoin market dynamics is evolving rapidly, fueled by significant inflows into U.S. spot Bitcoin exchange-traded funds (ETFs). The ongoing BTC price surge is not just a fleeting moment; it indicates a genuine interest from large-scale investors who are increasingly diversifying their portfolios. This makes the Bitcoin forecast more than just a number—it’s a reflection of the changing tides in the financial markets.

As we delve into the forthcoming trends surrounding cryptocurrency, the projections for Bitcoin’s value are becoming increasingly compelling. With the recent performance of Bitcoin drawing critical attention, investors and market analysts are eager to understand its trajectory. The optimistic outlook is bolstered by a wave of institutional backing, where firms are strategically reallocating assets towards Bitcoin. Moreover, the recent uptick in Bitcoin’s valuation showcases significant shifts in trading behaviors and investor confidence. Understanding these vital changes will be essential for those looking to navigate the evolving world of digital currencies.

Revising Bitcoin Forecast: Unrealized Potential

Standard Chartered’s recent admissions regarding their bitcoin forecast highlight the stark difference between predicted and actual market performance. When the bank initially pegged Bitcoin’s future value at $120,000, the crypto world had yet to witness the full force of institutional involvement that would soon materialize. As large-scale investments began flooding into bitcoin, propelled by attractive regulatory frameworks and institutional confidence, it became clear that previous forecasts underestimated the cryptocurrency’s robust trajectory. The dramatic price surge past $100K wasn’t just a speculative bubble; it signified a crucial shift in the market’s fundamentals fueled by unprecedented institutional investments.

The acknowledgment from Standard Chartered’s head of digital assets, Geoffrey Kendrick, emphasizes a responsive reassessment critical in financial forecasting. With asset managers and sovereign funds increasingly integrating bitcoin into their portfolios, it is evident that the dynamics governing Bitcoin’s price movement are evolving. Kendrick’s revised outlook reflects an understanding that market sentiment and investor behaviors are now key components driving BTC prices, ultimately reshaping the overall market landscape and its future projections.

Bitcoin Price Prediction: New Heights Ahead

As Bitcoin experiences rapid appreciation, investors and analysts alike are reevaluating their price predictions. The previously conservative estimate of $120K set by Standard Chartered is now being regarded as potentially obsolete. Factors like macroeconomic trends and strategic asset reallocation have shown their capability to propel Bitcoin prices far beyond initial forecasts, particularly with fresh investments flowing into Wall Street-backed ETFs. These developments suggest a bullish sentiment surrounding Bitcoin, paving the way for upward revisions to price targets and laying a foundation for potential new all-time highs.

With analysts like Kendrick emphasizing the importance of institutional investment and market dynamics, the Bitcoin price prediction landscape has become substantially more optimistic. Investors are closely watching the influx of capital into Bitcoin, with significant contributions from major firms showcasing the cryptocurrency’s increasing acceptance. As institutional flows accelerate, Bitcoin’s trajectory could maintain its upward momentum, reinforcing the narrative that it has become an essential asset class in diversified portfolios—thereby supporting more aggressive price forecasts.

The Role of Institutional Investment in Bitcoin’s Surge

The surge in Bitcoin’s price can largely be attributed to the growing interest from institutional investors, a sentiment echoed by Standard Chartered. Institutional backing adds a layer of legitimacy and stability to cryptocurrency markets—a critical factor that has influenced retail investor confidence. The influx of over $5.3 billion into U.S. spot bitcoin ETFs demonstrates that institutional money is not just a passing trend but a significant force reshaping the crypto landscape. Investment from heavyweight financial institutions encourages a cascading effect as more companies and funds consider Bitcoin as a viable asset.

Moreover, this alignment of interests among institutional players creates a virtuous cycle; as more investments come in, Bitcoin’s price continues to rise, reinforcing its appeal as both a hedge against inflation and an alternative investment. This shift in investment patterns is not merely a fleeting moment but signifies the evolving perception of Bitcoin in the broader financial market. As organizations like Microstrategy and sovereign wealth funds increase their exposure, they validate Bitcoin’s viability further as an asset class, leading to more strategic investments and market stability.

Understanding Bitcoin Market Dynamics

The recent changes in Bitcoin’s market dynamics illustrate a profound transformation in how the cryptocurrency is perceived and valued. Traditional correlations, we once relied on for market forecasts, are being overshadowed by new patterns primarily driven by institutional investments and macroeconomic factors. As noted by Kendrick, the narrative surrounding Bitcoin has shifted from merely seeing it as a risk asset to considering its role in strategic asset allocation, suggesting a maturity in how Bitcoin interacts with global financial markets.

This evolution in Bitcoin’s market dynamics calls for a deeper understanding of asset flows and their implications on price movements. Rather than only tracking speculative trends, investors now must consider the entrance of institutional capital as a critical component in forecasting Bitcoin’s trajectory. As organizations like the Swiss National Bank and sovereign funds engage in buying Bitcoin or related assets, it strengthens the market’s foundation and hints at longevity and increased resilience against market volatility.

The Future of Bitcoin: Market Predictions

Looking towards the future, Bitcoin’s market position appears increasingly robust with several analysts predicting continued gains. The potential for Bitcoin to reach or exceed the revised forecast of $200,000 by year-end reflects growing consensus on its place in the financial ecosystem. This optimism is fueled not only by anticipated declines in competition from altcoins but also by Bitcoin’s established reputation as a store of value amidst global economic uncertainty. As large institutionals continue to round out their portfolios with Bitcoin, their confidence could very well propel the cryptocurrency to unprecedented heights.

Moreover, the ongoing innovation in product offerings, such as Bitcoin ETFs, signifies a strong bullish sentiment surrounding its future. With these products open to a broader array of investors, the market is projected to welcome not just individual investors, but also those previously hesitant about cryptocurrencies. Therefore, the future of Bitcoin appears bright as anticipation for price appreciation builds among diverse investor classes, potentially leading to a paradigm shift in how digital currencies are cultivated and valued in the financial space.

Impact of Bitcoin ETFs on Market Growth

Exchange-traded funds (ETFs) have emerged as pivotal investment vehicles that significantly impact Bitcoin’s market growth. The recent $5.3 billion inflow into U.S. spot bitcoin ETFs serves as a testament to their role in attracting institutional investment and validating Bitcoin as a mainstream asset class. These funds simplify exposure to Bitcoin for investors shy of engaging with cryptocurrencies directly, presenting a more familiar format that resonates with traditional investors.

As Bitcoin ETFs continue to attract capital, the implications for market growth are both broad and positive. ETFs not only increase accessibility for everyday retail investors but also enhance market liquidity, which can mitigate volatility and encourage stable price appreciation. This trend underscores a growing acceptance for Bitcoin within institutional spheres, promoting sustained engagement and higher levels of investment that could fundamentally reshape its market landscape.

Bitcoin’s Surge: The Importance of Market Sentiment

Market sentiment plays a crucial role in Bitcoin’s price movements, especially with the recent forecasts indicating a shift towards greater optimism. Institutional investors’ confidence often reflects broader sentiment within the market, which can dictate the direction of Bitcoin’s price on a day-to-day basis. As Standard Chartered revises its forecasts, it highlights the importance of aligning market expectations with real-time developments in Bitcoin’s trading patterns.

Investor psychology surrounding Bitcoin can exacerbate price action in ways that traditional markets might not. Positive press coverage, high-profile investments, and significant price movements create a feedback loop that further entices both retail and institutional investors. As more individuals and organizations observe the sustained price surge and bullish forecasts, fear of missing out (FOMO) can further elevate demand, establishing a more pronounced upward trajectory for Bitcoin.

Technological Innovations: Enabling Bitcoin Growth

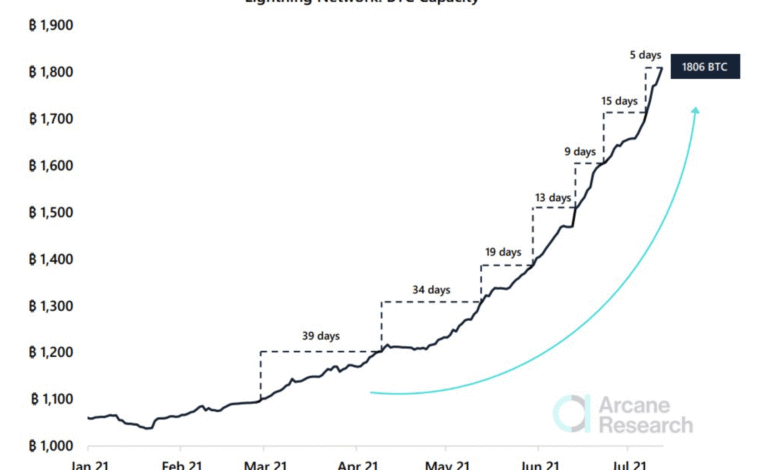

Technological innovations within the cryptocurrency space are essential catalysts for Bitcoin’s ongoing growth and institutional adoption. Improvements in blockchain technology, custodial services, and security frameworks are fostering an environment where large-scale investments can flourish. Enhanced protocols allow for greater confidence among institutional investors, knowing their assets are secure while also ensuring compliance with regulatory standards.

Furthermore, advancements such as Layer 2 solutions address scalability issues, enabling Bitcoin to process transactions more efficiently and at lower costs. These innovations pave the way for broader usability and acceptance of Bitcoin as a transactional currency – not just a speculative asset. As technology continues to evolve and bolster Bitcoin’s infrastructure, it set the stage for sustained price appreciation and heightened market involvement from a diverse array of institutional players.

Bitcoin’s Resilience in Market Fluctuations

One of the most compelling observations regarding Bitcoin is its remarkable resilience amidst market fluctuations. Historical data illustrates that Bitcoin, despite facing numerous price corrections and regulatory challenges, tends to recover and often achieves new highs. This resilience is now becoming a focal point for institutional investors who recognize the potential long-term profitability inherent in cryptocurrency, especially during uncertain economic periods.

As market conditions grow increasingly dynamic, Bitcoin’s perceived reliability as a store of value stands in stark contrast to traditional assets that may falter under pressure. Large institutions backing Bitcoin aim to leverage this resilience to their advantage, reinforcing the idea that BTC could serve as a hedge against economic instability. The ability of Bitcoin to rebound and ascend following significant downturns underpins current bullish predictions for its future value, suggesting the cryptocurrency has solidified its place as a critical component of modern investment strategies.

Frequently Asked Questions

What is the latest Bitcoin price prediction from Standard Chartered?

Standard Chartered recently revised its Bitcoin price prediction, stating that their previous forecast of $120K may be too low. With Bitcoin’s current trading level surpassing $100K and continued institutional investment, the bank’s analysts suggest that even higher values are achievable by year-end.

How does institutional investment affect Bitcoin market dynamics?

Institutional investment significantly impacts Bitcoin market dynamics, driving prices higher due to increased demand. Recently, Standard Chartered highlighted $5.3 billion in net inflows into U.S. BTC exchange-traded funds as a key factor, illustrating how large investors are reshaping the market.

What are the key factors driving the recent Bitcoin surge according to analysts?

Analysts attribute the recent Bitcoin surge to several factors, including rising institutional interest, macroeconomic shifts favoring cryptocurrencies, and significant inflows into Bitcoin ETFs. These elements not only support higher prices but also contribute to a reassessment of Bitcoin’s potential in the market.

Is $200,000 a realistic Bitcoin forecast for the year?

According to Standard Chartered’s latest insights, a Bitcoin price of $200,000 by year-end is considered achievable due to current market momentum and institutional demand. As analysts reconsider their forecasts in light of recent price trends, this optimistic outlook reflects the strength of Bitcoin’s rally.

What role does the changing correlation of Bitcoin with risk assets play in its forecast?

The changing correlation of Bitcoin with risk assets influences its forecast by affecting investor behavior and market flows. Analysts from Standard Chartered indicate that as Bitcoin shifts from being seen primarily as a risk asset to a strategic allocation tool, demand from institutional investors is likely to rise, supporting higher price predictions.

How has the Bitcoin forecast changed in light of recent trends?

The Bitcoin forecast has changed significantly as recent trends show Bitcoin surpassing initial price predictions. Standard Chartered’s head of digital assets admitted their prior $120K forecast underestimated the market’s momentum, leading to a more bullish outlook reflecting the explosive growth seen in recent weeks.

What is influencing Standard Chartered’s revised Bitcoin forecast?

Standard Chartered’s revised Bitcoin forecast is influenced by a combination of factors, including robust institutional investment, recent record inflows into Bitcoin ETFs, and positive macroeconomic conditions. These factors are contributing to a stronger than anticipated rally, prompting analysts to adjust their price targets upward.

How do Bitcoin price predictions evolve amidst market changes?

Bitcoin price predictions evolve as market dynamics shift, often influenced by institutional investment trends, regulatory developments, and macroeconomic factors. For instance, Standard Chartered has adjusted their forecasts in response to significant bullish momentum and increased market participation from large investors.

| Key Point | Details |

|---|---|

| Standard Chartered’s Forecast | Originally projected Bitcoin to reach $120K by Q2. |

| Market Performance | Bitcoin recently surged past $100K, prompting a revision of forecasts. |

| New Assessments | Geoffrey Kendrick acknowledged underestimation of Bitcoin’s momentum and apologized for the previous forecast. |

| Institutional Investment Growth | The influx of $5.3 billion in net inflows into U.S. Bitcoin ETFs highlights increasing institutional interest. |

| Future Projections | Kendrick suggests that while his previous forecast of $120K may be low, there’s potential for Bitcoin to reach $200K by year-end. |

| Market Dynamics | Current drivers for Bitcoin’s rise include institutional flows and strategic reallocations away from U.S. assets. |

Summary

The Bitcoin forecast has dramatically changed as Standard Chartered acknowledged that their previous estimate of $120K was too low. After Bitcoin’s remarkable rise above $100,000, the financial institution has reassessed market conditions, recognizing the significant impact of institutional investments. With continued large-scale inflows into Bitcoin ETFs and other institutional activities, analysts are now considering projections that are even higher than before, with possibilities of Bitcoin reaching $200,000 by the end of the year. This evolving narrative around Bitcoin underscores its growing acceptance and importance in the investment landscape.