Bitcoin Investment Strategy: The Rise Despite Death Claims

When it comes to mastering a Bitcoin investment strategy, understanding the nuances of this digital asset can be vital for success. Over the past 15 years, Bitcoin has transformed from a niche novelty into a formidable financial instrument, with its price history showcasing dramatic rises and falls. Those who ventured into crypto investments early on have witnessed unprecedented Bitcoin growth, turning initial investments into multi-million-dollar fortunes. Investing in Bitcoin requires careful planning and a solid cryptocurrency strategy, as market fluctuations can be both severe and unpredictable. As more institutions recognize Bitcoin’s legitimacy, crafting an effective investment strategy becomes essential for both novice and seasoned investors alike.

Diving into the realm of cryptocurrency, particularly Bitcoin investments, has become increasingly popular among those seeking to diversify their portfolios. The volatile nature of Bitcoin, characterized by its boom and bust cycles, draws in investors eager to capitalize on potential gains. With phrases like ‘digital gold’ often associated with Bitcoin, many are exploring various approaches to build wealth through this decentralized currency. Understanding terms like crypto trading strategy or digital currency risk management can aid investors in making informed decisions amid the ever-changing market landscape. As investors strategize their entry or continued participation in the Bitcoin ecosystem, embracing informed methods will be crucial for navigating its complexities.

The Resilience of Bitcoin Amidst Naysayers

Over the years, Bitcoin has faced an onslaught of skepticism, being declared ‘dead’ more than 400 times by various commentators and media outlets. Yet, despite the barrage of criticism, Bitcoin’s value has skyrocketed from an initial price of just eleven cents in 2010 to over $104,000 today. This remarkable transformation highlights a crucial lesson for investors: when it comes to cryptocurrency investments, especially in Bitcoin, patience and conviction can lead to exponential growth and wealth accumulation. The journey of Bitcoin is not just a reflection of its price value; it signifies an evolving financial revolution.

For new investors pondering whether to join the Bitcoin movement, the history of Bitcoin can be enlightening. Each time Bitcoin was declared a failure, it continued to grow stronger, showcasing its resilience in the face of adversity. Those who chose to invest during these critical junctions not only capitalized on great opportunities but also learned the value of long-term investing. As we look forward, understanding Bitcoin’s growth patterns will be vital for anyone looking to craft an effective cryptocurrency strategy.

Understanding Bitcoin Price History

The story of Bitcoin’s price history is one of dramatic highs and lows that fascinates and perplexes investors alike. Early skeptics and journalists doubted its longevity, often citing volatile price movements and negative press about its usability. Yet, the inherent volatility is part of the charm and the risk that Bitcoin presents to potential investors. Studying the various phases of Bitcoin’s price history can provide valuable insights for future investments. Each peak and trough offers lessons on market psychology and the potential for future price surges.

Additionally, historical data shows substantial price appreciation, suggesting that investing in Bitcoin is not merely speculation but a viable long-term investment strategy. The striking increase in its value over the years has proved many naysayers wrong. Investors who recognize the trends of Bitcoin price history understand that volatility is part and parcel of this market, which emphasizes the importance of strategic planning in cryptocurrency investments.

Crafting a Successful Bitcoin Investment Strategy

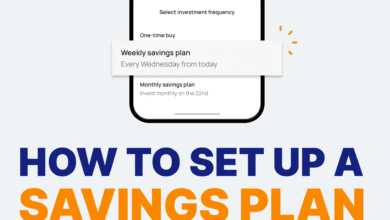

When developing a Bitcoin investment strategy, it is crucial to incorporate methods that allow for effective risk management and growth potential. One popular approach is the Dollar-Cost Averaging (DCA) method, which involves regularly investing a fixed amount of money into Bitcoin, regardless of its price. This strategy smooths out the impact of market volatility, allowing investors to accumulate Bitcoin over time without getting caught up in the emotional highs and lows that could lead to poor investment decisions.

Moreover, a successful Bitcoin investment strategy should also focus on diversification within cryptocurrencies. By exploring other frameworks and projects in the cryptocurrency space beyond Bitcoin, investors can manage risk and take advantage of various growth opportunities. This multi-faceted approach ensures that while Bitcoin remains the flagship investment, other digital assets can potentially enhance portfolio performance, ultimately contributing to a robust cryptocurrency strategy.

Exploring the Benefits of Investing in Bitcoin

Investing in Bitcoin offers a plethora of benefits that extend beyond potential financial returns. Primarily, Bitcoin serves as a hedge against inflation and currency devaluation, making it an attractive asset for those in economically unstable regions. Its decentralized nature means that it is not tied to any specific government policy, allowing individuals to retain value during socio-economic turmoil. As institutions like BlackRock recognize Bitcoin as a legitimate financial instrument, its role in diversified investment portfolios continues to grow.

Furthermore, the accessibility of Bitcoin has revolutionized how individuals engage in financial markets. With user-friendly applications and exchanges, even novice investors can easily purchase Bitcoin and participate in the crypto economy. This democratization of finance empowers individuals to take control of their financial futures, fostering a new generation of informed investors able to recognize opportunities and minimize risks within the ever-evolving landscape of digital currencies.

Strategies for Safeguarding Your Bitcoin Investments

As the value of Bitcoin continues to grow, safeguarding your investments becomes increasingly crucial. Adequate protection of your Bitcoin holdings requires adopting practices that bolster security against theft and loss. Using hardware wallets instead of online exchanges can significantly reduce the risk of hacking. Regularly updating passwords and utilizing two-factor authentication are essential practices in ensuring the protection of your digital assets.

Investors should also consider diversifying their cryptocurrency holdings as a means of risk management. By spreading investments across various cryptocurrencies rather than solely focusing on Bitcoin, investors can mitigate the potential adverse effects of price volatility. Tailoring your strategy around a diverse cryptocurrency portfolio not only enhances security but also opens up additional avenues for growth, as different coins may perform optimally in varying market conditions.

Learning from Bitcoin’s Market Fluctuations

Bitcoin’s market fluctuations provide a treasure chest of insights for current and prospective investors. Understanding these fluctuations empowers investors to develop a sharp eye for spotting trends and potential entry and exit points in the market. Market cycles also underscore the importance of timing in cryptocurrency investments, as buyers can take advantage of lower prices, especially after significant corrections.

The history of Bitcoin is rife with dramatic rallies and subsequent sell-offs, which can serve as both warnings and opportunities. Investors who study these historical fluctuations are better positioned to make informed decisions and avoid the pitfalls of impulsive trading. Implementing a disciplined approach to investing — including setting price targets and adhering to a well-defined strategy — can transform volatile markets into profitable ventures.

Future Trends in Bitcoin and Cryptocurrency Investments

As we look forward into 2025 and beyond, it’s essential to recognize the evolving landscape of Bitcoin and cryptocurrency investments. Innovations such as Bitcoin Spot ETFs are gaining traction, indicative of growing institutional adoption. Investors expect these developments to lead to smoother market operations and greater accessibility to crypto markets, potentially making Bitcoin a staple in diversified portfolios.

Moreover, technology advancements in blockchain are likely to enhance the usability and scalability of cryptocurrencies, making them more appealing to mainstream financial systems. Keeping an eye on these emerging trends will be invaluable for investors seeking to capitalize on new opportunities within the crypto space, allowing for strategic adjustments to be made in alignment with the market’s evolution.

The Impact of Influencers on Bitcoin’s Perception

The influence of well-known figures on Bitcoin’s perception cannot be overstated. From early skeptics like Michael Saylor, who famously predicted Bitcoin’s demise, to its current advocates, these influencers shape public opinion and market dynamics. Their comments can lead to quick shifts in investor sentiment, causing major movements in price and overall market behavior.

Thus, monitoring these influencers and understanding their perspectives on Bitcoin can provide insights into broader market psychology. Investors can align themselves with sentiments that resonate with their investment strategies, whether it be bullish or bearish, ultimately leading to better-informed investment decisions amidst the ever-changing discourse surrounding Bitcoin.

Navigating the Regulatory Landscape of Bitcoin Investing

As Bitcoin continues to gain acceptance, navigating the regulatory landscape is critical for investors. Governments around the globe are developing frameworks to oversee cryptocurrency trading and taxation, which can significantly impact investment strategies. Awareness of these regulations is vital to ensure compliance and understand potential tax implications, enabling investors to devise effective strategies that align with the existing legal requirements.

Additionally, regulatory developments often signal confidence or hesitance in the market, affecting public perception of Bitcoin’s legitimacy and stability. Staying informed about regulatory changes will enable investors to adjust their strategies proactively, maintaining a competitive edge as rules evolve in the rapidly developing world of cryptocurrency.

Frequently Asked Questions

What is the best Bitcoin investment strategy for long-term growth?

A proven Bitcoin investment strategy for long-term growth is dollar-cost averaging (DCA). This approach involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of the price fluctuations. By doing so, investors can mitigate the impact of volatility, making it an effective strategy for accumulating Bitcoin over time.

How does historical Bitcoin price history affect investment strategies?

Historical Bitcoin price history is crucial for shaping effective investment strategies. Analyzing past trends and price movements can give insights into investor behavior and market cycles, helping to develop strategies that optimize entry and exit points, as well as potential returns.

Can investing in Bitcoin be part of a broader cryptocurrency strategy?

Yes, investing in Bitcoin can be an essential component of a broader cryptocurrency strategy. Diversifying your portfolio with other cryptocurrencies alongside Bitcoin can reduce risk and enhance potential returns. However, it’s vital to conduct thorough research and understand each asset’s unique characteristics.

What strategies can help maximize Bitcoin growth in a volatile market?

To maximize Bitcoin growth in a volatile market, consider implementing strategies such as setting clear investment goals, utilizing technical analysis for timing trades, and remaining disciplined through market fluctuations. Additionally, leveraging secure wallets for storage can protect assets over the long term.

Is a Bitcoin investment strategy suitable for beginners?

A Bitcoin investment strategy can be suitable for beginners if approached carefully. Starting with a small investment amount and using dollar-cost averaging can help new investors gain exposure while minimizing risks. Educational resources and platforms that simplify the buying process are also beneficial for novices.

What is the significance of Bitcoin’s growth for investment strategies?

Bitcoin’s growth is significant for investment strategies as it often serves as a benchmark for the cryptocurrency market. Investors typically look at Bitcoin’s performance to gauge market trends and sentiment, allowing them to adapt their investment strategies accordingly.

How has the media influenced perceptions of Bitcoin investment strategies?

The media has significantly influenced perceptions of Bitcoin investment strategies, often swinging between bullish and bearish narratives. Reports on Bitcoin’s ‘deaths’ and price surges create a psychological impact on investor behavior, emphasizing the importance of staying informed and critically analyzing news sources when crafting investment strategies.

| Key Point | Details |

|---|---|

| Historical Death Sentences | Bitcoin has been declared dead over 400 times, starting with Sean Lynch’s July 2010 post. |

| Investment Value Growth | An initial investment of $100 in 2010 could have resulted in over $94 million today. |

| Comparison with Cigarette Spending | Over 15 years, a Bitcoin investor could gain $40,000 to $108 million, whereas a smoker could spend $21,000 to $42,000. |

| Advisory Figures | Prominent individuals like Michael Saylor and Larry Fink have publicly supported Bitcoin. |

| Investment Strategy | The Dollar-Cost-Average strategy is recommended for consistent investment without letting ‘death sentences’ deter. |

Summary

Bitcoin investment strategy is a unique approach that allows investors to capitalize on the volatility of the cryptocurrency market. Given the historical context of Bitcoin being pronounced dead repeatedly, those who held strong found immense financial rewards over time. This investment strategy highlights not only the importance of timing but also the power of perseverance and belief in Bitcoin’s potential. By understanding market fluctuations and employing methods such as Dollar-Cost-Averaging, investors can mitigate risks while aspiring to achieve significant returns.