Bitcoin Lightning Payments: A New Era for Square Merchants

Bitcoin Lightning Payments are set to revolutionize the way we conduct transactions in the digital economy. With Jack Dorsey’s Block, Inc. leading the charge, Square’s innovative platform will soon enable businesses to process bitcoin transactions almost instantaneously and at minimal cost. Leveraging the powerful Lightning Network payments technology, merchants will have the opportunity to accept bitcoin directly, further streamlining the payment process. This exciting development not only enriches the Square ecosystem but also aligns with the growing trend of digital currencies, encouraging more users to adopt cryptocurrency. As the rollout approaches in 2025, stakeholders are eager to see how these advancements will enhance Square bitcoin payments and empower small businesses worldwide.

The advent of Lightning Network technology is bringing a new wave of efficiency to cryptocurrency transactions, often referred to as immediate digital payments. Block, Inc. is pioneering this transformation by integrating swift bitcoin payment solutions into its Square platform, a move that holds great significance for small and medium-sized enterprises. By enabling rapid and affordable transfers, businesses can now optimize their operations, embracing the future of finance. This initiative not only reflects the evolving landscape of payment systems but also showcases the increased acceptance of digital currencies in mainstream commerce. As Jack Dorsey and his team push forward, the integration of alternative payment methods continues to gain momentum, promising a vibrant future for digital payment solutions.

Introduction to Bitcoin Lightning Payments

Bitcoin Lightning Payments have emerged as a groundbreaking solution for making faster and cheaper transactions on the Bitcoin network. This layer-2 protocol is designed to handle millions of transactions per second, addressing the scalability issues that have historically limited Bitcoin’s mainstream adoption. By using off-chain channels, Lightning Payments enable users to transact without the delays or high fees associated with regular Bitcoin transactions. This makes the technology particularly attractive for merchants like those using Square, as it allows for quick, reliable payments that can enhance customer experience.

The implementation of Bitcoin Lightning Payments is a leap forward in making cryptocurrency accessible for everyday use. Jack Dorsey’s Block, Inc., has recognized this potential by incorporating Lightning Network functionalities into their Square Point of Sale system. This innovation aims to not only streamline payment processes for businesses but also encourages more users to explore and engage with Bitcoin. The empowerment of small businesses through advanced payment options represents a significant shift in the financial landscape, one that could redefine how consumers interact with money.

Impact of Block Inc.’s Bitcoin Initiatives

Block Inc. has been at the forefront of promoting Bitcoin as a legitimate payment method with innovative features like Bitcoin Conversions and now Lightning Payments. These initiatives underscore the company’s commitment to fostering a more robust bitcoin ecosystem. With features that allow merchants to seamlessly convert a percentage of sales into Bitcoin, small businesses using Square can leverage cryptocurrency’s advantages without fully committing to it. This flexibility is crucial in today’s evolving payment landscape, where digital transactions are becoming increasingly prevalent.

Furthermore, the strategy behind Jack Dorsey’s initiatives reflects an understanding of the market dynamics and the growing acceptance of cryptocurrencies. By creating an environment where businesses can accept Bitcoin effortlessly, Block is not only enhancing its service offerings but also building consumer trust in digital payments. This push could potentially lead to increased transactions over the Lightning Network, amplifying its usability and importance in the broader context of cryptocurrency payments.

Future Prospects for Square Bitcoin Payments

As Block Inc. gears up for the rollout of Bitcoin Lightning Payments on Square, the impact on the future of transactions is potentially transformative. Scheduled to start in late 2025, this move signals a broader trend that could reshape how consumers and merchants engage with Bitcoin. The anticipation of faster transaction times and reduced fees could attract more businesses to adopt Bitcoin as a payment option, thereby increasing its acceptance in everyday scenarios.

Moreover, with regulatory approvals likely influencing the timeline, the eagerness of companies to embrace this technology will be closely watched. The Square platform, known for its user-friendly interface, is uniquely positioned to facilitate Bitcoin transactions, offering an integrated approach that could set the standard for other payment platforms. It is a strategic advantage for Block, potentially leading to increased market share among competing fintech companies, as Bitcoin continues to gain traction.

The Role of Lightning Network in Modern Payments

The Lightning Network plays a critical role in modernizing how payments are processed within the Bitcoin ecosystem. By allowing multiple transactions to occur off the main Bitcoin chain, it alleviates congestion and enables faster clearing times. This feature is particularly valuable for businesses that rely on swift payment processing to maximize customer satisfaction—something that Square aims to achieve with its upcoming integration of Lightning Payments.

Additionally, the Lightning Network reduces transaction fees, making it economical for both merchants and consumers. This economic viability is essential for small to medium-sized businesses that often operate on tight margins. By adopting technologies like the Lightning Network, businesses not only save money but also position themselves as forward-thinking entities ready to embrace digital currency solutions.

User Experience and Financial Autonomy

With the introduction of Bitcoin Lightning Payments, user experience in cryptocurrency transactions is expected to improve significantly. For customers using Square’s services, the transition to Lightning Payments means less waiting time and instant payment confirmation, enhancing their overall interaction with the platform. Faster transactions can lead to higher customer satisfaction, which is crucial for businesses looking to thrive in a competitive environment.

Moreover, the potential financial autonomy afforded by Bitcoin payments cannot be underestimated. As more merchants adopt Bitcoin through Square, consumers will have greater control over their financial transactions, leading to a bottom-up approach to economic independence. This shift reflects a growing trend towards decentralization and user empowerment in financial dealings, aligning perfectly with the ethos behind Bitcoin and its foundational technology.

Square’s Strategy for Bitcoin Adoption

Square’s strategy for Bitcoin adoption is driven by the need to provide practical solutions for merchants and consumers alike. With the advancement into Lightning Payments, the company aims not just to facilitate transactions but to educate users about the benefits of Bitcoin. Understanding Bitcoin and blockchain technology can demystify digital currencies for many, paving the way for broader acceptance.

Additionally, Jack Dorsey has been a vocal advocate for Bitcoin, often expressing his belief in its potential to revolutionize the financial system. This perspective undoubtedly influences Square’s strategic direction and reinforces the company’s role as a pioneer in integrating Bitcoin into everyday commerce. As Block continues to enhance its offerings, it is likely to attract a growing user base seeking alternative financial solutions.

Small Business Empowerment through Technology

One of the most significant aspects of Block’s Bitcoin initiatives, particularly through Square, is the empowerment it offers to small businesses. With tools that allow easy Bitcoin transactions and conversion features, entrepreneurs are given a viable alternative to conventional payment methods. This not only provides them with more options but can also enhance their bottom line by reducing transaction costs.

Empowering small businesses involves acknowledging their unique challenges and providing tailored solutions that address these needs. By incorporating Bitcoin payments, Square facilitates a more inclusive payment environment. This development allows small business owners to compete on a larger scale, navigating the digital payment landscape with confidence and innovation, supported by the backing of a trusted platform like Square.

Jack Dorsey’s Vision for a Bitcoin Future

Jack Dorsey’s vision for a Bitcoin future is centered around accessibility, simplicity, and user empowerment. His advocacy for Bitcoin as a primary payment method through platforms such as Square positions this cryptocurrency not merely as an investment asset but as a functional currency for daily transactions. This shift is indicative of Dorsey’s long-term goal to integrate financial systems with advanced technology that enhances user experience and financial autonomy.

Through initiatives like the Lightning Payments on Square, Dorsey is pushing the envelope for what cryptocurrencies can achieve in the real world. The potential for Bitcoin to serve as a more stable, reliable payment method for consumers and businesses is an idea that resonates strongly within his overall strategy. Dorsey’s commitment continues to fuel innovation at Block, directly impacting how Bitcoin is viewed within the broader financial ecosystem.

Conclusion: Embracing the Future of Bitcoin Transactions

In conclusion, the anticipated rollout of Bitcoin Lightning Payments on Square marks a crucial step towards mainstream Bitcoin adoption. Through innovative features that leverage the Lightning Network, Block Inc. is poised to transform how transactions occur, making them faster and more economical. The implications for small businesses are profound, as they gain access to cutting-edge payment solutions that can enhance their operations.

Ultimately, as technologies like the Lightning Network become integrated into everyday payment systems, they offer a glimpse into the future of finance—a future where Bitcoin and other cryptocurrencies play a significant role. With leaders like Jack Dorsey championing these advancements, the journey towards a decentralized financial landscape is not just a possibility but an impending reality.

Frequently Asked Questions

What are Bitcoin Lightning Payments and how do they work on Square?

Bitcoin Lightning Payments refer to a second-layer scaling solution built on the Bitcoin network that enables fast and low-cost transactions. On Square, powered by Block Inc., these payments leverage the Lightning Network, allowing merchants to accept bitcoin payments instantly through their Point of Sale app, enhancing the transaction experience for both businesses and customers.

How does Block Inc. plan to implement Bitcoin Lightning Payments in Square?

Block Inc. is set to integrate Bitcoin Lightning Payments into its Square platform by allowing merchants to accept bitcoin through their hardware. This implementation is anticipated to start in the second half of 2025, enabling seamless and efficient transactions that enhance the payment options for small businesses.

What benefits do Bitcoin Lightning Payments offer for Square merchants?

With Bitcoin Lightning Payments on Square, merchants benefit from instantaneous transaction processing and minimal fees, thanks to the Lightning Network. This innovation aims to empower small businesses by increasing customer payment options and enabling quicker cash flow, thus enhancing overall operational efficiency.

Is there a timeline for the rollout of Bitcoin Lightning Payments on Square?

Yes, Block Inc. plans to roll out Bitcoin Lightning Payments on Square starting in the second half of 2025, with a goal of reaching all eligible Square sellers by 2026, pending regulatory clearances. This timeline is part of Block’s broader strategy to enhance its bitcoin ecosystem.

How do Square’s Bitcoin Conversions relate to Lightning Payments?

Square’s Bitcoin Conversions feature, introduced in 2024, allows merchants to convert a portion of their sales into bitcoin. This functionality complements Bitcoin Lightning Payments by enabling businesses to seamlessly accept and convert bitcoin, thereby creating a comprehensive payment solution for merchants using Square.

Who is Jack Dorsey in relation to Bitcoin Lightning Payments and Block Inc.?

Jack Dorsey, co-founder of Block Inc., has been a prominent advocate for bitcoin and its adoption. Under his leadership, Block is advancing the integration of Bitcoin Lightning Payments into Square, emphasizing the importance of providing small businesses with innovative payment solutions and a more expansive ecosystem for bitcoin transactions.

What other products is Block Inc. developing alongside Bitcoin Lightning Payments?

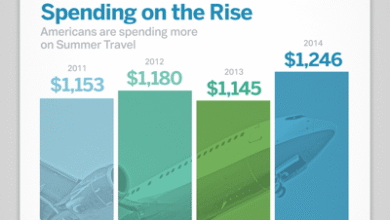

In addition to Bitcoin Lightning Payments on Square, Block Inc. is also expanding its bitcoin ecosystem with products like the Bitkey self-custody wallet, which offers users control over their bitcoin, and Proto bitcoin mining initiatives, further demonstrating the company’s commitment to advancing bitcoin technology.

| Key Point | Details |

|---|---|

| Company Announcement | Block, Inc. will roll out Bitcoin payments on Square. |

| Technology Used | The Lightning Network will facilitate low-cost, near-instantaneous payments. |

| Launch Timeline | Rollout to start in the second half of 2025 and complete by 2026, pending regulatory approvals. |

| Target Users | All eligible Square sellers will be able to accept Bitcoin payments. |

| Existing Feature | Square’s Bitcoin Conversions feature was launched in 2024 for converting sales to Bitcoin. |

| Goal of Initiative | To empower small businesses with more payment options and faster transactions. |

| Additional Products | Block is expanding its ecosystem with products like a self-custody wallet and bitcoin mining. |

Summary

Bitcoin Lightning Payments represent a significant advancement in the way transactions can be handled on platforms like Square. As Block, Inc. prepares to implement this innovative payment system, small businesses stand to benefit from faster and more affordable payment options. With the rollout set to expand by 2026, this initiative not only enhances payment flexibility but also reinforces the growing integration of cryptocurrency in everyday business operations.