Bitcoin Liquidation Wave: BTC and ETH Drop Causes Chaos

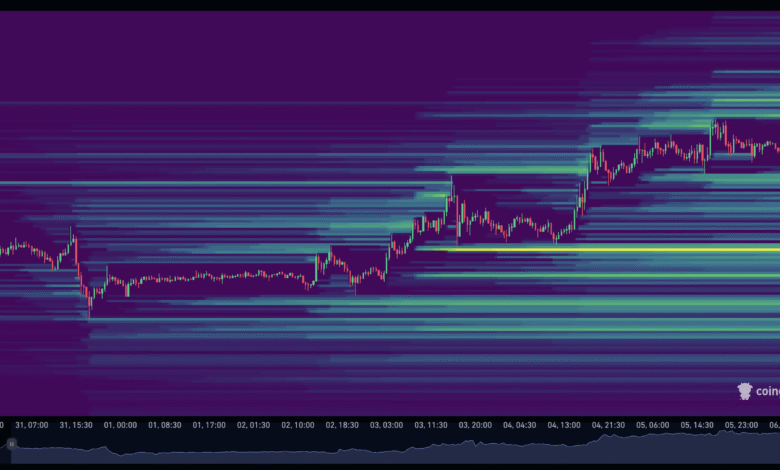

The recent Bitcoin liquidation wave has left traders shaken as the cryptocurrency experienced a significant price drop, briefly falling to $113,547. As the dust settles, many in the crypto market are analyzing the implications of this BTC liquidation, which contributed to a staggering total of approximately $863 million in forced liquidations across various digital assets. With ETH long positions also feeling the strain, the broader cryptocurrency market downturn has prompted concerns and strategic reassessments among investors. This tumultuous period highlights the volatility inherent in crypto trading, especially for those who are overleveraged. As Bitcoin’s market capitalization dips to $2.26 trillion, market observers are keenly watching how the landscape will shift in response to ongoing economic pressures and market sentiment changes.

The ongoing turmoil in the digital currency realm has been characterized by a pronounced wave of liquidations, particularly affecting Bitcoin and Ethereum traders. As the cryptocurrency sector grapples with a significant downturn, forced sell-offs signal a period of heightened risk and urgency among investors. This tumult is not only evident in Bitcoin and ETH positions but resonates throughout the entire crypto landscape as participants recalibrate their strategies in light of the sharp price declines. Market analysts are focusing on the broader implications of these liquidation events, as they often reflect the underlying volatility that can impact overall market health. The fluctuation in Bitcoin prices and subsequent market responses are sparking crucial discussions around risk management in the cryptocurrency sphere.

Understanding the Recent Bitcoin Liquidation Wave

The recent turmoil in the cryptocurrency market has led to an unprecedented Bitcoin liquidation wave, sending shockwaves through trading communities. As Bitcoin briefly dropped below $114,000, many traders, particularly those holding long positions, found themselves in precarious situations. The resulting fallout has seen approximately $863 million in liquidations across the market, with a significant portion attributed to Bitcoin. This phenomenon highlights the critical nature of understanding market risks, especially during periods of heightened volatility.

In essence, the Bitcoin liquidation wave serves as a stark reminder of the perils associated with leveraged trading. As liquidations occur, forced selling can exacerbate price drops, leading to a vicious cycle of declining values and further liquidations. It is imperative for traders to stay informed about market trends and implement risk management strategies to mitigate the impact of such events. Analysis of recent market data shows that both BTC and ETH positions were significantly affected, resulting in a broad liquidating environment that caught many traders off guard.

Impact of the Bitcoin Price Drop on the Cryptocurrency Market

The Bitcoin price drop has had cascading effects on the overall cryptocurrency market. As Bitcoin struggles to maintain its value, many altcoins, including Ethereum, have also experienced sharp declines. This downturn underscores the interconnected nature of the crypto market, where a significant drop in a leading asset can lead to widespread panic and sell-offs. Among the notable impacts, we observed over $255 million in Ethereum long positions being liquidated, showcasing the ripple effects of Bitcoin’s instability.

Moreover, the decline in Bitcoin’s price has ignited discussions among investors regarding the long-term sustainability of the cryptocurrency sector. As some traders see this as an opportunity to buy the dip, others remain cautious, urging a careful reassessment of their positions. The combination of macroeconomic factors and shifting investor sentiment adds layers of complexity to market analysis. Understanding whether the current situation represents a short-term correction or a precursor to a more sustained downturn is crucial for anyone engaged in cryptocurrency trading.

Strategies to Navigate the Crypto Market Downturn

In light of the recent crypto market downturn, traders and investors are urged to adopt prudent strategies to safeguard their portfolios. One common approach is reducing leverage to withstand volatility better and avoid forced liquidations like we witnessed with the recent $863 million in liquidations. Implementing these risk management techniques can enable traders to preserve capital during downturns, especially when market sentiment is teetering and macroeconomic conditions are unstable.

Moreover, diversification remains a vital strategy as traders look to minimize risks across their holdings. By spreading investments across various cryptocurrencies, it becomes less likely for any single asset’s volatility to significantly impact the overall portfolio. Continuous monitoring of market trends and adapting to shifts in sentiment can also provide traders with insights to navigate challenges. Staying informed about potential triggers for price drops and responding accordingly can make a substantial difference in overall performance.

Key Insights from Cryptocurrency Market Analysis

A comprehensive cryptocurrency market analysis reveals critical insights into the dynamics currently at play, particularly during this Bitcoin liquidation wave. Analysts highlight that understanding the underlying factors contributing to the price movements—such as macroeconomic indicators and trader sentiment—is essential. Reports show increasing uncertainty among investors, reflecting concerns about potential continued downturns. Consequently, market analysis not only aids in identifying trends but also helps traders gauge potential entry and exit points.

Additionally, scrutiny of historical data during similar market conditions can provide context for what to expect moving forward. For instance, periods of high volatility typically witness quick recoveries, but they can also signal larger corrections down the line. As such, integrating technical and fundamental analysis becomes increasingly important in crafting an informed trading strategy. By synthesizing traditional market analysis with cryptocurrency trends, traders can improve their decision-making and adapt to the ever-evolving landscape.

The Role of Market Sentiment in Cryptocurrency Trading

Market sentiment plays an instrumental role in the cryptocurrency trading landscape, driving price movements and influencing trader behavior. The recent Bitcoin price drop has led to a clear shift in sentiment, with fears of a deeper downturn prompting many traders to re-evaluate their strategies. Sentiment analysis tools can reveal the psychological aspects affecting traders’ decisions, underscoring the importance of being aware of prevailing emotions in the market.

A dramatic shift in sentiment can lead to mass liquidations, as experienced with the recent cascade of forced sell-offs. The influence of social media, news reactions, and economic events weigh heavily on traders’ strategies. As such, successfully navigating the crypto market requires not only technical acumen but also an understanding of sentiment trends. Awareness of how collective psychology can impact asset prices is vital for both seasoned and novice traders in this volatile market.

Risk Management Techniques for Cryptocurrency Investors

Effective risk management techniques are more critical than ever for cryptocurrency investors, especially amidst turbulent market conditions like the current Bitcoin liquidation wave. Setting stop-loss orders, for instance, can help traders limit their potential losses if the market moves against them. In the recent scenario, many traders experienced forced liquidations due to a lack of protective measures in place, emphasizing the need for strategic resilience.

Additionally, it’s vital for investors to establish whether their trading objectives accommodate the inherent risks of cryptocurrency investments. Maintaining a diversified portfolio and allocating funds judiciously across different assets can significantly mitigate risks. Regularly re-evaluating one’s investment strategy in accordance with market changes is crucial to long-term success in an unpredictable environment like the cryptocurrencies.

Analysis of Major Liquidations in the Crypto Market

An analysis of major liquidations in the crypto market reveals striking data on how quickly significant movements can occur within this space. The recent statistic indicating over $863 million in liquidations demonstrates the immediate consequences of trader over-leverage, particularly on long positions. Cryptocurrency markets can be incredibly sensitive to price fluctuations, which makes understanding the mechanics of liquidation crucial for all participants.

Liquidations often occur not just due to price drops but are also influenced by external factors, such as regulatory announcements or significant market events. Understanding these elements reveals how a collective chain reaction can amplify losses. Traders can glean valuable lessons regarding risk exposure and market timing by studying these liquidations and their causes, thus empowering them to make more informed trading decisions in the future.

Future Projections for Bitcoin and the Crypto Market

As the cryptocurrency market grapples with the aftermath of the recent Bitcoin price drop, many traders and analysts are keenly focused on future projections. There’s a growing debate regarding whether Bitcoin will stabilize and recover or if a more extended market downturn awaits. Analysts are actively monitoring key support levels and market sentiment for signs of recovery, while speculative trading continues to influence price actions.

Furthermore, external factors such as macroeconomic conditions, regulatory frameworks, and technological advancements will play pivotal roles in shaping the future of Bitcoin and the broader crypto market. Investors must remain agile and informed, leveraging both market analysis and sentiment trends to navigate potential pitfalls. As new developments arise in the rapidly changing crypto landscape, the ability to adapt and anticipate shifts will be crucial for success in this industry.

Understanding the Ripple Effects of Liquidation Waves

The phenomenon of liquidation waves in the cryptocurrency market extends far beyond individual trader losses; it has a significant impact on overall market dynamics. When large volumes of liquidations occur, as seen with the recent Bitcoin decline, it can lead to increased volatility and can trigger further sell-offs among investors who panic reactively. This ripple effect can exacerbate downward pressure on prices, creating a vicious cycle that may take time to stabilize.

It is noteworthy that the liquidation wave can also affect market sentiment at large, with fear and uncertainty spreading among traders. This psychological component can prompt otherwise stable assets to lose value as participants respond to the actions of others. Understanding these ripple effects is essential for developing strategies that can weather the storm during market downturns, as well as identifying potential buying opportunities amidst the chaos.

Frequently Asked Questions

What caused the recent Bitcoin Liquidation Wave?

The recent Bitcoin Liquidation Wave was primarily triggered by a significant drop in Bitcoin’s price, falling to a low of $113,547. This sharp decline led to a forced liquidation of leveraged positions in the crypto market, amounting to around $863 million. Many traders, particularly those holding long positions in BTC and ETH, were caught off guard by the sudden downturn.

How does BTC liquidation relate to the broader cryptocurrency market downturn?

BTC liquidation is closely intertwined with the broader cryptocurrency market downturn. The forced liquidation of Bitcoin and Ethereum positions contributes to increased volatility and panic among investors. As BTC liquidations spiked, we observed a ripple effect across the crypto market, leading to a decline in prices and further liquidations across various assets.

What factors contribute to Ethereum liquidation alongside Bitcoin?

Ethereum liquidation often occurs alongside Bitcoin liquidations due to correlated price movements within the crypto market. When Bitcoin suffers a price drop, as seen in the recent wave of liquidations, it can inadvertently affect Ethereum (ETH) and other altcoins, leading to substantial liquidations. In this instance, a total of $255 million in ETH long positions were liquidated as traders reacted to the overall market downturn.

How do crypto market downturns influence trader behavior during a Bitcoin Liquidation Wave?

During a Bitcoin Liquidation Wave, crypto market downturns significantly influence trader behavior. Many traders may adopt a risk-averse strategy, either selling off assets or refraining from entering new positions to avoid further losses. This shift in sentiment can lead to heightened volatility, with a mix of traders either buying the dip in anticipation of recovery or fearing further declines, prompting more liquidations.

What should traders watch for after a Bitcoin price drop and liquidation event?

After a Bitcoin price drop and liquidation event, traders should closely monitor market sentiment, liquidity levels, and macroeconomic indicators. Observing how Bitcoin performs post-recovery, along with analyzing trading volumes and open interest in derivatives, can provide insights into potential price movements. Additionally, understanding the implications of trader positioning can help in forecasting future market trends.

How does increased leverage contribute to Bitcoin liquidations?

Increased leverage significantly contributes to Bitcoin liquidations by amplifying the effects of price fluctuations. High leverage allows traders to hold larger positions with minimal margin, which can lead to forced liquidations if the market moves against them. During a liquidative event like the recent Bitcoin price drop, overleveraged positions are vulnerable to getting wiped out as prices slide, resulting in a cascade of liquidations.

What is the impact of a Bitcoin Liquidation Wave on market capitalization?

A Bitcoin Liquidation Wave can have a profound impact on market capitalization. As Bitcoin price drops, the market capitalization of not just Bitcoin but also the entire cryptocurrency market may decline significantly. In this recent event, the Bitcoin market cap fell to approximately $2.26 trillion. Large liquidation events often create panic selling, further exacerbating the market downturn and potentially leading to larger price drops.

| Key Point | Details |

|---|---|

| Price Drop | Bitcoin plunged to a low of $113,547 and recovered slightly to $113,820. |

| Market Capitalization | Bitcoin’s market cap fell to $2.26 trillion. |

| Liquidation Wave | Total liquidations amounted to $863 million, with $215.83 million from Bitcoin longs and $255 million from Ethereum longs. |

| Market Sentiment | Traders are divided between buying the dip and anticipating further declines. |

Summary

The recent Bitcoin liquidation wave highlights the extreme volatility within the crypto market as Bitcoin’s price dramatically dropped to $113,547, prompting significant forced liquidations. As traders reassess their positions, the impact of macroeconomic factors continues to create uncertainty, showing the fragile nature of the current market environment.