Bitcoin Liquidity: Understanding Market Dynamics and Trends

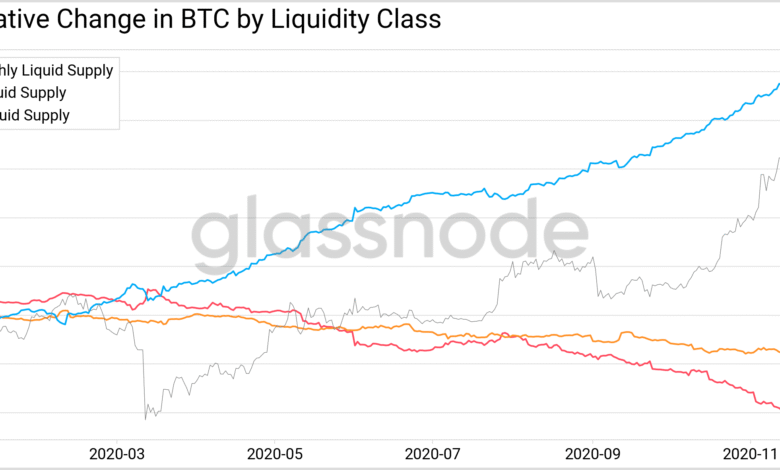

Bitcoin liquidity is a crucial metric in understanding the dynamics of the cryptocurrency market, reflecting how easily Bitcoin can be bought or sold without affecting its price. As the global economy evolves and the M2 money supply shifts, the connection between liquidity and Bitcoin price correlation becomes increasingly intricate. Financial market liquidity plays a significant role here, as it governs how readily investors can maneuver within the market, leveraging cryptocurrency statistics to guide their investing strategies. Major fluctuations in liquidity often lead to volatile price movements in Bitcoin, making it an essential factor for both short-term traders and long-term holders. Thus, grasping the nuances of Bitcoin liquidity can empower investors to better navigate the complexities of cryptocurrency trading and market trends.

The concept of Bitcoin liquidity encompasses the ease with which this digital asset can be exchanged in the market, highlighting its importance in the financial landscape. Understanding how liquidity impacts the cryptocurrency ecosystem is vital for investors seeking to navigate the often turbulent waters of digital currencies. Additionally, terms like market depth and trading volume also come into play when evaluating liquidity, providing insights into how Bitcoin’s value can fluctuate in response to changes in market sentiment and external economic factors. As investors analyze the intricate relationship between currency supply and Bitcoin’s trading behavior, they can develop more effective and informed investing strategies tailored to the unique challenges of the crypto market. The ongoing dialogue about Bitcoin liquidity continues to shape perceptions of its viability as a hedge and investment vehicle in a rapidly changing financial environment.

Understanding Bitcoin Liquidity: A Deep Dive

Bitcoin liquidity is a crucial aspect of the cryptocurrency market that determines how easily Bitcoin can be bought or sold without causing significant price fluctuations. As Raoul Pal famously states, “It’s all about liquidity.” Understanding the liquidity dynamics behind Bitcoin can help investors navigate the complexities of the financial landscape. When evaluating Bitcoin liquidity, it’s important to consider various factors including the M2 money supply, which has a historical correlation with Bitcoin price movements. As the M2 money supply increases, many investors observe a lagging rise in Bitcoin prices, highlighting a potential relationship between the two.

However, the concept of liquidity goes beyond just the M2 money supply. Financial experts argue that true liquidity is influenced by the overall state of the financial markets, investor sentiment, and the behavior of institutional players. For instance, liquidity can also be assessed through measures like the repo market and the quality of collateral available. Hence, while Bitcoin liquidity is significantly impacted by macroeconomic factors, it’s essential for investors to analyze a broader range of indicators to gain a clearer picture of market dynamics.

The M2 Money Supply and Bitcoin Price Correlation

The relationship between the M2 money supply and Bitcoin price is often touted as a strong indicator of future movements in the cryptocurrency market. When the M2 money supply increases, many traders anticipate a corresponding rise in Bitcoin prices. This trend has been observed by several analysts, who note that during periods of expanding money supply, Bitcoin often experiences upward price momentum. Nevertheless, it’s essential to approach this correlation with caution, as correlation does not imply causation. There are numerous factors at play that can affect Bitcoin’s price unrelated to M2 fluctuations.

Moreover, the reliance on M2 as a liquidity indicator is critiqued by financial experts. The metrics used to measure the M2 money supply can vary by region and may not capture the true liquidity conditions affecting Bitcoin. For example, variations in how countries define and calculate M2 can lead to misleading statistics. Presenting findings without context can create a false narrative around Bitcoin price predictions. As such, investors should consider diversifying their metrics of liquidity beyond just the M2 money supply to include factors like the overall credit landscape and investor behavior.

Decoding Financial Market Liquidity for Bitcoin Investors

Understanding financial market liquidity is essential for Bitcoin investors aiming to develop effective investing strategies. Financial market liquidity refers to the ability to quickly buy or sell assets in the market without causing drastic price changes. For Bitcoin, fluctuations in financial market liquidity can significantly impact price volatility. As the international economy experiences shifts, the liquidity available to Bitcoin trading can reflect broader market trends, which investors must actively monitor.

To gain a competitive edge, Bitcoin investors should look beyond just observing the M2 money supply. Key indicators like the balance sheets of major central banks and movements within the derivatives market can provide deeper insights into liquidity conditions. Additionally, metrics such as the MOVE index, which indicates market-implied volatility, serve as crucial benchmarks. By synthesizing these various indicators, investors can make more informed decisions about when to enter or exit positions in Bitcoin, thus optimizing their investment strategies.

The Role of Cryptocurrency Statistics in Bitcoin Trading

Cryptocurrency statistics play an integral role in shaping the strategies of Bitcoin traders. By analyzing trends and patterns revealed through statistical data, traders can better understand market dynamics and make smarter trading decisions. Important statistics include trading volumes, price correlations with major assets, and even social media sentiment analysis. With the rapid development within the cryptocurrency space, these statistics can provide investors unique insights into potential price movements of Bitcoin.

However, as with any statistical analysis, it is vital to recognize that not all data is created equal. Many statistics can be manipulated or misinterpreted, and it’s crucial for investors to approach these figures with a critical mindset. Data from varying sources may present discrepancies, making it necessary for traders to corroborate findings with reliable information before acting on impulse. Keeping abreast of the latest cryptocurrency statistics can empower Bitcoin investors to learn from past trends, but they must prioritize accuracy and context in their analyses.

Evolving Investing Strategies for Cryptocurrency Enthusiasts

As Bitcoin continues to evolve, so do the investing strategies employed by enthusiasts and institutional investors alike. The rise of alternative metrics for gauging market liquidity, alongside traditional approaches such as the M2 money supply, has led to innovative investment methodologies. Enthusiasts now blend technical analysis, on-chain metrics, and sentiment data to devise comprehensive investment strategies, allowing them to stay ahead of market trends.

Additionally, the increasing sophistication of trading platforms and the growing accessibility of data analytics tools have empowered investors to make more informed decisions. With these resources, traders can finely tune their investment strategies, identifying optimal entry and exit points while managing risk more effectively. As Bitcoin becomes more entrenched in the mainstream financial ecosystem, the dynamic nature of investing strategies will require traders to adapt continuously in order to navigate the shifting landscape.

Liquidity and Price Dynamics: Key Takeaways for Investors

As Bitcoin’s relationship with liquidity becomes increasingly scrutinized, it is crucial for investors to assimilate these findings into their trading practices. Notably, liquidity is not static; it is influenced by external economic factors as well as the evolving behavior of market participants. Thus, understanding that Bitcoin price movements can be swayed by local and global liquidity conditions empowers investors to act strategically.

Investors should prioritize monitoring liquidity indicators beyond the M2 money supply alone. With insights gathered from a mix of financial metrics, historical patterns, and expert analysis, market participants can better position themselves for market fluctuations. Ultimately, the ability to discern changes in liquidity will enhance investors’ chances of navigating Bitcoin’s volatile environment successfully.

Correlation vs. Causation: Insights for Cryptocurrency Investors

In the world of finance and investing, the principle that ‘correlation does not imply causation’ evokes significant importance, particularly in the context of Bitcoin and its market dynamics. While traders observe certain correlations, such as the historical relationship between increased liquidity – as gauged by metrics like the M2 money supply – and rising Bitcoin prices, one must exercise caution before jumping to conclusions about causality.

Investors should remain vigilant of the potential pitfalls of over-reliance on correlations, recognizing that multiple independent variables can influence market movements simultaneously. For example, macroeconomic conditions, regulatory changes, and even market sentiment can contribute to price fluctuations independently of liquidity metrics. Therefore, successful Bitcoin investing hinges on comprehensive analysis that encompasses both quantitative metrics and qualitative factors, allowing for more holistic decision-making.

The Transformative Nature of Bitcoin in Financial Systems

As the financial landscape continues to evolve, Bitcoin stands out as a revolutionary asset that challenges traditional norms within monetary systems. Investors who recognize Bitcoin’s potential as a hedge against monetary inflation have begun reevaluating how liquidity affects their holdings. This has led to a broader discussion about Bitcoin’s role within the financial system and its implications for economic stability.

The unique characteristics of Bitcoin, accompanied by the intricate relationship it holds with liquidity metrics, prompt a shift in how investors perceive value. No longer merely a speculative asset, Bitcoin is gradually being viewed as a valid alternative currency amidst changing economic parameters. Thus, understanding Bitcoin’s transformative nature within the broader context of financial market liquidity will be vital for savvy investors looking to leverage its potential as a long-term wealth preservation tool.

Short-Term vs. Long-Term Strategies: Understanding Bitcoin Price Movements

Navigating the Bitcoin market can be a complex challenge, particularly when distinguishing between short-term and long-term investing strategies. Short-term price movements are typically influenced by immediate market trends and speculative bubbles, making them less predictable and more volatile. In contrast, long-term strategies often incorporate deeper analyses rooted in macroeconomic trends, including the assessment of liquidity metrics.

Investors must realize that while short-term analyses can uncover quick trading opportunities, they are often driven by Bitcoin-specific factors rather than broader liquidity conditions. Therefore, understanding the interplay between short-term market fluctuations and long-term liquidity trends is essential for developing a coherent investment strategy. Ultimately, blending these approaches can provide Bitcoin investors with a more comprehensive outlook, allowing them to profit from both immediate and sustained price movements.

Frequently Asked Questions

How does Bitcoin liquidity correlate with the M2 money supply?

Bitcoin liquidity often shows a positive correlation with the M2 money supply, indicating that as the M2 money supply rises, Bitcoin prices tend to increase as well. However, this relationship is complex and includes a lag effect, suggesting that the changes in Bitcoin price may not instantly reflect the fluctuations in M2.

What is the significance of financial market liquidity in relation to Bitcoin?

Financial market liquidity is crucial for Bitcoin as it facilitates smooth transactions and trade. Higher liquidity can reduce volatility and improve price stability, allowing investors to enter and exit positions more effectively, impacting overall Bitcoin market dynamics.

Can Bitcoin liquidity be accurately measured by M2 money supply statistics?

Using M2 money supply statistics to measure Bitcoin liquidity can be misleading. This metric is often inconsistent and influenced by various external factors, such as currency fluctuations, which can obscure the true picture of liquidity within financial markets.

What are some alternative metrics to assess Bitcoin liquidity beyond M2?

Alternative metrics for evaluating Bitcoin liquidity include analyzing the balance sheets of central banks, following market-implied volatility indices like the MOVE index, and observing liquidity conditions in overnight lending markets, such as the difference between secured and unsecured loan rates.

Why is understanding Bitcoin price correlation with global liquidity important for investors?

Understanding Bitcoin’s price correlation with global liquidity helps investors make informed decisions by recognizing that shifts in liquidity conditions can influence Bitcoin prices. This awareness can guide strategies for investment and risk management in volatile market environments.

How often should investors check the M2 money supply when considering Bitcoin investments?

Investors should be cautious about checking the M2 money supply too frequently for short-term investments, as it can be misleading. Instead, focusing on longer-term trends and a broader range of liquidity indicators may provide a clearer understanding of Bitcoin’s potential price movements.

What role does market sentiment play in Bitcoin liquidity?

Market sentiment significantly influences Bitcoin liquidity, as positive or negative perceptions can lead to either increased trading activity or reduced market participation. Factors such as investor confidence and risk appetite can thus impact overall liquidity and price stability.

Is there a direct causation between M2 money supply changes and Bitcoin prices?

There is no direct causation between M2 money supply changes and Bitcoin prices. While they may correlate, this relationship does not imply that changes in M2 directly cause movements in Bitcoin prices, highlighting the importance of careful analysis of market dynamics.

What factors, aside from liquidity, affect Bitcoin pricing?

In addition to liquidity, Bitcoin pricing is influenced by a variety of factors, including macroeconomic conditions, investor behavior, regulations, technological developments, and the overall state of the cryptocurrency market. Understanding these elements can help provide context for Bitcoin price movements.

How can the MVRV Z Score be used to assess Bitcoin market conditions?

The MVRV Z Score is a useful tool for assessing Bitcoin market conditions, as it measures the current market value against the realized value, indicating whether Bitcoin is overvalued or undervalued. This metric can assist investors in identifying potential market corrections and profit-taking opportunities.

| Key Point | Description |

|---|---|

| M2 Money Supply and Bitcoin Price Correlation | When M2 rises, historically, Bitcoin price tends to rise with a lag. However, this assertion is debated among financial experts. |

| Criticism of M2 as a Metric | Critics argue that M2 data is often inconsistent and mainly reflects exchange rate fluctuations rather than true liquidity. |

| Definition of M2 Money Supply | M2 includes cash, checking account balances, small time deposits, and retail money market funds, representing the monetary assets of households and small businesses. |

| Impact of Financial Institutions | Today’s liquidity dynamics are influenced more by institutions and shadow banking than traditional banks. |

| Liquidity Measurement Alternatives | Experts recommend observing central bank balance sheets and other indicators like the MOVE index and SOFR/EFFR spread for better liquidity insights. |

| Correlation Versus Causation | While liquidity may correlate with Bitcoin prices, correlation does not imply causation. Prices can rise based on other factors as well. |

| Investment Strategy Advice | Investors should watch broader indicators rather than focusing solely on M2, especially considering short-term price movements that may misrepresent trends. |

Summary

Bitcoin liquidity is a crucial concept in understanding its price dynamics and market behavior. This analysis indicates that while the correlation between Bitcoin and global liquidity exists, investors should approach metrics like M2 with caution. As financial environments shift, focusing on a diverse set of liquidity indicators will lead to more informed investment decisions. By doing so, one can appreciate the nuanced relationship between market conditions and Bitcoin’s valuation.