Bitcoin Market Prediction: Saylor Says $1 Million Ahead

In the ever-evolving landscape of cryptocurrency, Bitcoin market prediction continues to capture the attention of investors and analysts alike. Michael Saylor, the co-founder of Strategy, confidently asserts that Bitcoin is not just recovering, but is on an unstoppable trajectory toward a staggering $1 million price point. With a strong investment strategy involving Bitcoin-backed financial instruments, Saylor’s vision places significant faith in long-term holdings and institutional interest to drive demand. Given that he has accumulated a substantial reserve of 582,000 BTC, valued over $60 billion, his views on Bitcoin price forecast hold considerable weight. As the market matures and clarity emerges, many are closely analyzing Bitcoin’s potential, seeing it as not only a store of value but also a lucrative investment opportunity.

The analysis of Bitcoin’s future landscape revolves around various factors that contribute to its projected ascension. One might refer to Bitcoin’s climb as a mix of market speculation and fundamental shifts in global finance, leading enthusiasts to explore concepts like a Bitcoin price breakthrough. Notably, this discourse has been heightened by influential figures, such as Saylor, who assert that the digital currency is shedding its past volatility to emerge as a stable financial asset. The conversation extends to include strategic positioning within the crypto economy, with many looking at innovative investment techniques tailored to maximize returns. Overall, the compelling narrative surrounding Bitcoin reaching one million is intertwined with broader themes of technological advancement and financial evolution.

The Future of Bitcoin: Market Predictions from Michael Saylor

In the realm of cryptocurrency, few voices are as influential as Michael Saylor, who confidently asserts that Bitcoin is not only recovering from its recent downturn but is also poised for staggering growth. Saylor’s bold prediction that Bitcoin could hit the $1 million mark is supported by a combination of institutional interest and innovative financial models. As businesses and financial institutions begin to recognize the potential for Bitcoin as a stable asset, the foundational shifts in market perception are leading many to rethink their Bitcoin investment strategies. Wellspring of optimism from Saylor’s remarks highlights a particularly significant moment for Bitcoin as it transitions from a speculative asset to a recognized store of value mainstream investors are willing to bet on.

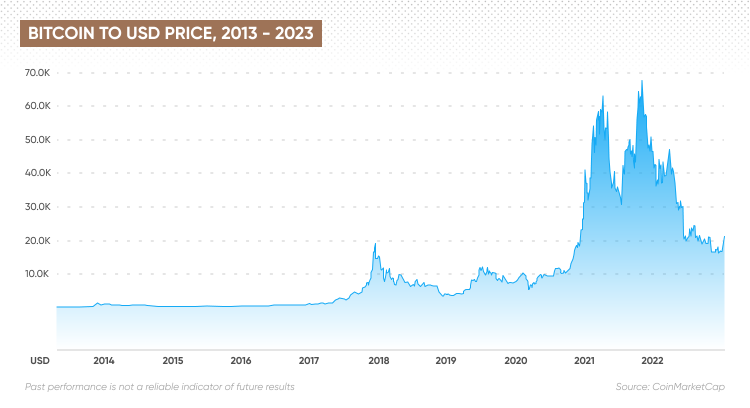

Furthermore, as the dynamics within the Bitcoin ecosystem evolve, factors such as reduced daily supply and increasing participation in ETFs play crucial roles in shaping price movements. This phenomena aligns with Saylor’s claims, indicating that with the current inflow of capital into Bitcoin-related financial products, the path to $1 million becomes not just a possibility, but a likely event. Critics may argue that such a price target is far-fetched, but historical patterns show that Bitcoin’s ability to rally beyond all-time highs can never be underestimated.

Saylor emphasizes that the Bitcoin market is at the cusp of a new era, one where institutional investment and innovation in cryptocurrency technology will drive its value to unforeseen heights. His projection depends on the notion that as Bitcoin integrates further into traditional financial systems, the overall demand will escalate. The Bitcoin price forecast, especially under the expert guidance of proponents like Saylor, highlights key factors driving the bullish sentiment, such as advancements in blockchain technology and the undeniable shift towards digital currencies. With a proper Bitcoin investment strategy in place, investors could leverage these insights to maximize their opportunities as Bitcoin approaches its potential price milestones.

As we observe the supply chain dynamics of Bitcoin and the parallels between its limited availability and rising demand, the stage seems set for a dramatic price rally. Therefore, it’s critical for both seasoned and new investors to remain informed about these prevailing trends and market predictions that could solidify Bitcoin’s status as a financial game-changer.

Michael Saylor: Revolutionizing Bitcoin Backed Investments

Michael Saylor’s influence on Bitcoin-backed financial instruments cannot be overstated. His company, Strategy, revolutionizes how businesses interact with Bitcoin by issuing various credit instruments—like STRIKE, STRIDE, and STRIFE—allowing capital raising while protecting shareholder value. This strategic maneuver positions the firm as a leader in the crypto space, enhancing its credibility while attracting discerning investors who are looking for more than just a volatile asset but a rooted investment in the future of finance. By stating that they are the largest issuer of bitcoin-backed credit instruments globally, Saylor emphasizes an innovative approach that many believe could shape the future landscape of cryptocurrency investments.

Additionally, the incorporation of traditional financial practices with digital assets offers investors new vehicles to harness Bitcoin’s potential, making it attractive even to skeptics of digital currencies. The mechanism of creating value through Bitcoin holdings presents a clear opportunity for long-term investments. By adding 1,045 bitcoins to their reserves recently, Saylor exemplifies a clear commitment to harnessing Bitcoin’s potential, showcasing the firm’s proactive stance in capturing Bitcoin’s inevitable appreciation as the market stabilizes.

This integration of traditional investment strategies with cutting-edge blockchain technology indicates that Bitcoin is in a transformative phase. Saylor’s willingness to address criticisms while simultaneously promoting their financial model illustrates a level of transparency that invites investor confidence. His forecast of generating BTC-related earnings upwards of $15 billion by 2025 further cements his belief in the continuing relevance and growth of Bitcoin as a revenue-generating asset. For those considering Bitcoin investment strategy, Saylor’s insights become crucial in understanding how integrating proven financial methodologies with digital currency can yield beneficial outcomes.

By leveraging essential tools and strategies to fuel growth in Bitcoin, Saylor is not merely predicting a brighter future—he’s laying the groundwork for a new investment paradigm that could redefine how assets are perceived, especially in a volatile economic climate.

The Impact of Quantum Computing on Bitcoin’s Future

In discussions about the future of Bitcoin and digital currencies, concerns regarding quantum computing frequently arise. Michael Saylor dismisses these worries, arguing that major corporations, like Microsoft and Google, would face severe economic repercussions should they threaten global cryptography—a foundation upon which Bitcoin is built. The consensus among experts aligns with Saylor’s confidence, suggesting that any potential advancements in quantum technology would be communicated well in advance, allowing the Bitcoin network ample time to implement necessary security upgrades. Thus, just as Bitcoin adapts to regulatory changes and technological shifts, it stands equipped to handle the challenges posed by quantum advancements.

The relationship between Bitcoin and quantum computing underscores the resilience of decentralized systems. Saylor’s assertion aims to assure investors that Bitcoin’s infrastructure is robust enough to withstand such existential threats. In this way, as AI and quantum technology evolve, Bitcoin remains an adaptive currency, poised to integrate new solutions that enhance its security and utility. Investors can take comfort in Saylor’s projections, which emphasize Bitcoin’s enduring capacity to thrive despite technological changes, allowing Bitcoin to remain a compelling asset in a diversified investment strategy.

Moreover, as Saylor highlights the powerful convergence of AI and Bitcoin, it suggests a future where AI-driven systems enhance the operational efficiencies of cryptocurrency transactions. This could lead to a surge in demand for Bitcoin, making it essential for modern investments. The anticipation of greater integration of AI across financial applications further underlines Bitcoin’s potential to not just survive, but flourish in an increasingly digital and technologically advanced landscape.

Understanding Bitcoin: Investment Strategies for 2023

As Bitcoin continues to capture the attention of investors worldwide, understanding the intricacies of the cryptocurrency market is crucial for those looking to capitalize on its potential. Michael Saylor’s strategies serve as insightful guidelines for navigating the complexities of Bitcoin investments. With the emergence of institutional interest and ETF inflows, investors are increasingly encouraged to consider Bitcoin not just as a speculative asset, but as a forward-thinking part of their financial portfolios. Savvy investors this year are looking to analyze BTC price trends meticulously to devise strategies that can yield significant long-term gains, particularly as confidence in Bitcoin stabilizes following the recent market corrections.

Crafting a Bitcoin investment strategy in 2023 hinges on comprehensive analysis, encompassing everything from historical price movements to current market events. The anticipation of Bitcoin reaching new heights, potentially culminating in the much-discussed $1 million mark, serves as a compelling narrative for many. Investors are advised to keep track of market indicators and stay informed on Saylor’s projections as they may influence market sentiment. Additionally, with the landscape continually evolving, proactive education around digital assets becomes paramount in developing a sustainable investment framework.

In this regard, institutional capital flow into Bitcoin presents a defining opportunity for investors wishing to strengthen their brace against market volatility. Approaching Bitcoin investment with a methodical and research-oriented mindset can significantly enhance the likelihood of positive outcomes. Consequently, knowing how to discern shifts within the market can lead to more robust, strategic investments that not only weather downturns but capitalize on potential surges driven by market fundamentals and trends.

For those jumping into Bitcoin’s market, diversification strategies should also be considered. By balancing Bitcoin investments with other cryptocurrencies or traditional assets, investors can potentially hedge against volatility. Saylor’s optimistic outlook on Bitcoin leads into considering future innovations, encapsulating the potential for Bitcoin’s growth to be not just a speculative endeavor, but a calculated venture drawing on both technological advancement and market evolution.

The Dynamics of Bitcoin Supply and Demand

The intricate dance of supply and demand plays a critical role in shaping Bitcoin’s price trajectory, a concept that Michael Saylor has articulated in various discussions. With a diminishing daily supply of newly minted Bitcoin, coupled with a growing interest from institutional and retail investors, the market dynamic suggests a tightening ecosystem. Each day, only 450 BTC are created through mining, while demand continues to grow exponentially, especially with the rise of new investment strategies that emphasize Bitcoin as a critical asset. This limited supply juxtaposed with dynamic demand leads to inevitable price increases, bolstering Saylor’s claim of Bitcoin’s journey toward the $1 million mark.

Market analysts point out that understanding these supply-demand metrics can prove invaluable for investors aiming to position themselves advantageously. As Bitcoin enters a recovery phase, the potential for price surges underscores the necessity for investors to stay informed about macroeconomic factors that influence supply chains. Saylor’s insights illuminate how external factors, such as regulatory shifts or technological advancements, can impact investor sentiment and overall demand for Bitcoin. Investors looking to enter or bolster their positions in Bitcoin must remain agile in their strategies to address the shifting landscapes caused by these unique supply-demand relationships.

Additionally, as supply becomes more constrained in the face of escalating institutional interest, Bitcoin’s value is likely to reflect these fundamental dynamics more plainly. This presents a key opportunity for investors to apply historical BTC price analysis techniques in assessing market entry points and gauging the right moments to capitalize on price fluctuations. As Bitcoin price forecasts improve, understanding the fundamental laws of supply and demand could very well enable investors to ride the next wave of Bitcoin growth.

Coping with Market Volatility: Bitcoin Investment Strategies

In a world where financial markets are frequently turbulent, Bitcoin’s volatility presents both risks and opportunities. As highlighted by Michael Saylor, understanding and accepting these fluctuations is part of crafting an effective Bitcoin investment strategy. Investors must not only anticipate sharp changes in Bitcoin’s price but also develop conditions under which they would act—be it profit-taking during a price surge or strategic buying during downturns. This approach hinges on a solid Bitcoin price analysis, allowing investors to capitalize on market psychology and timing.

In the volatile crypto landscape, employing risk management strategies can prove beneficial. Dollar-cost averaging, for instance, allows investors to spread out their investment over time, minimizing the impact of volatility. With thoughts of Bitcoin reaching a million dollars actively circulating, an unwavering focus on disciplined investing emerges as a critical tactic. Saylor’s projected scenarios can provide lucrative cues, urging investors to remain calm in the face of market unpredictability while maximizing their exposure to Bitcoin’s upward potential.

Moreover, diversifying portfolios to include a mixture of cryptocurrencies could help mitigate the overall risk. This encompasses evaluating lesser-known altcoins alongside Bitcoin, thus balancing risks across a wider spectrum of digital assets. As investor confidence gradually returns to the cryptocurrency market, the intrinsic characteristics of Bitcoin, coupled with comprehensive risk analysis, provide a suitable framework for thriving amidst volatility while still aiming for those bold price projections.

The Role of Institutional Investment in Bitcoin’s Valuation

Institutional investment has become increasingly pivotal in Bitcoin’s journey towards mainstream acceptance and valuation. As financial powerhouses begin to allocate more capital to Bitcoin, the overall market perception shifts, propelling the cryptocurrency into the spotlight. Michael Saylor’s understanding of this trend has positioned his company to attract institutional interest. He mentions that the ongoing inflow into Bitcoin as ETFs will support supply and ultimately lead to significant price elevations, reinforcing the argument that Bitcoin’s future valuation relies heavily on institutional momentum.

Moreover, participating in Bitcoin as an institutional investor means positioning oneself at the forefront of what many believe is a once-in-a-lifetime investment opportunity. With Saylor predicting that Bitcoin could soar significantly higher than current values due to increased institutional uptake, stakeholders are urged to recognize the broader implications this trend has on Bitcoin’s price dynamics. As more institutions adopt Bitcoin into their portfolios, the cumulative influence on Bitcoin’s valuation structures could help stabilize its price, mitigating some of the wild fluctuations commonly associated with cryptocurrency markets.

This urgency for institutional players to reassess their investment strategies with Bitcoin underlines the currency’s significance as a hedge against inflation and uncertainty. Through mechanisms like Bitcoin-backed assets and innovative financial products, institutional acceptance not only drives demand but solidifies Bitcoin’s status as a legitimate investment. With Saylor leading this charge, the pathway for Bitcoin’s acceptance into traditional finance seems ever more accessible.

Bitcoin: The Intersection of AI Technology and Cryptocurrency

The convergence of artificial intelligence (AI) and Bitcoin technology presents an intriguing landscape for future investment strategies. As Michael Saylor predicts, the increasing reliance on AI could significantly affect Bitcoin’s demand, creating a symbiotic relationship between the two innovations. Intelligent systems, capable of performing thousands of transactions per minute, will require efficient settlement mechanisms, which Bitcoin is uniquely positioned to provide. In this sense, the integration of AI could pave the way for broader adoption and utilization of Bitcoin, as industries adopt solutions that cater to their operational efficiencies.

There’s an increasing recognition that the legacy banking systems may not cater adequately to the requirements of modern technological advancements. Bitcoin, alongside layer two solutions, promises the instantaneous and transparent transactional capabilities required by AI technologies. Investors banking on Bitcoin’s potential need to comprehend this evolutionary synergy—recognizing how AI could drive daily Bitcoin transactions and overall market demand. Saylor’s assertions about the trajectory of Bitcoin amidst rapid technology changes reinforce the notion that investors should remain agile and informed, ready to navigate the future intersection of fin-tech and cryptocurrency confidently.

Frequently Asked Questions

What is Michael Saylor’s Bitcoin price forecast for the future?

Michael Saylor predicts that Bitcoin is on a trajectory to reach $1 million, citing increasing institutional interest and limited daily supply as key factors driving this bullish Bitcoin market prediction.

How does Michael Saylor justify his Bitcoin investment strategy?

Michael Saylor’s Bitcoin investment strategy involves leveraging bitcoin-backed financial instruments, which allows his company, Strategy, to raise capital while maintaining Bitcoin reserves. This approach is bolstered by a projected $15 billion in bitcoin-related earnings for 2025.

What are the implications of Bitcoin reaching one million according to Michael Saylor?

According to Michael Saylor, if Bitcoin reaches one million, it could potentially experience volatility but emphasizes that the initial gains would profoundly benefit the broader crypto economy, making Bitcoin resilient against market fluctuations.

What recent actions has Michael Saylor taken regarding Bitcoin market predictions?

Recently, Michael Saylor’s company acquired an additional 1,045 BTC, affirming its position as the largest issuer of bitcoin-backed credit instruments, which he believes supports a strong Bitcoin market prediction of reaching $1 million.

What factors does Michael Saylor highlight in his Bitcoin price analysis?

In his Bitcoin price analysis, Michael Saylor points to increased institutional interest, regulatory advancements like ETF inflows, and a decline in daily Bitcoin supply as major factors contributing to a positive Bitcoin market outlook.

| Key Point | Details |

|---|---|

| Michael Saylor’s Stance | Believes Bitcoin will reach $1 million, dismisses Wall Street skepticism. |

| Bitcoin Holdings | Strategy holdings increased to 582,000 BTC worth over $60 billion after a recent purchase of 1,045 BTC. |

| Short Selling Risk | Saylor warns against short selling Strategy’s stock, suggesting it’s a losing bet. |

| Forecast for Earnings | Projected $15 billion in bitcoin-related earnings for 2025. |

| Concerns on Quantum Computing | Tech giants unlikely to undermine cryptography, allowing Bitcoin to adapt to future threats. |

| Impact of Artificial Intelligence | Claims AI will drive Bitcoin demand, with AI needing fast transactions that Bitcoin can offer. |

Summary

Bitcoin market prediction looks highly optimistic according to Michael Saylor, who confidently states that the era of Bitcoin winter is over and predicts prices could soar to $1 million. Citing strong institutional interest, a limited supply of Bitcoin, and innovative financial strategies, Saylor highlights the potential for significant growth in the market. His bullish outlook is further reinforced by anticipated advancements in AI and technology, which he believes will increase Bitcoin’s demand and utility, securing its position in the financial landscape.