Bitcoin Market Reaction Remains Flat Despite Economic Boost

In the ever-evolving landscape of cryptocurrency, the Bitcoin market reaction has been unexpectedly muted in response to recent economic developments. Despite encouraging jobless claims data from the Department of Labor and a surge in stock market performance, Bitcoin (BTC) has remained relatively flat, causing concern among investors. While altcoins thrived during this optimistic shift, seeing notable gains, Bitcoin’s stagnant performance led to a decline in its dominance within the cryptocurrency market. The lack of movement in BTC price fluctuations contrasts sharply with the rising enthusiasm surrounding cryptocurrency market trends. As analysts dive into Bitcoin price analysis, they are left pondering the disconnect between favorable economic data and Bitcoin’s resilience amidst growing altcoin performance.

In the dynamic arena of digital currencies, the response of Bitcoin to market stimuli has drawn considerable attention from enthusiasts and investors alike. Recent economic indicators have sparked a notable uptick in stock values, yet Bitcoin’s performance remained unusually steady, indicating a potential deviation from its typical volatility. As the cryptocurrency market reacts to external economic factors, particularly the influence of recent job reports, it has become clear that Bitcoin’s influence may be waning against the backdrop of altcoin prominence. Thorough examination of BTC’s resilience leads to a deeper understanding of its future trajectory. Ultimately, the nuances of market response and economic data’s effect on Bitcoin present an intriguing narrative for the cryptocurrency sector.

Economic Data’s Impact on Bitcoin Prices

Recent economic reports indicate extraordinary resilience in the U.S. labor market, with jobless claims dropping to their lowest levels in three months. While traditionally, such data tends to instigate bullish reactions across financial markets, Bitcoin’s price dynamics revealed a different narrative. Despite the positive underlying fundamentals reflected in the stock indices, Bitcoin remained stagnant, raising questions about its sensitivity to macroeconomic indicators. This disconnect illustrates that Bitcoin’s behavior may not correlate directly with traditional market trends, suggesting investors are refraining from rushing towards the cryptocurrency amid broader market optimism.

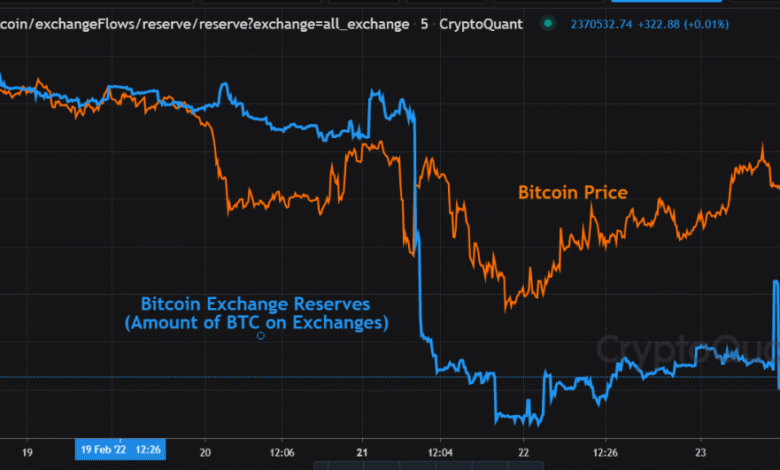

Analysts have noted that the lack of significant reaction in Bitcoin could suggest market participants are still cautious regarding its long-term viability in times of fluctuating economic conditions. The resilience of altcoins—such as Ether and XRP—highlights an intriguing trend where investors might be shifting focus from Bitcoin to other cryptocurrencies that are currently outperforming BTC. This shift could reflect speculation on alternative investments, leading to Bitcoin’s dominance in the cryptocurrency market dipping below 63%, as traders seek opportunities that promise higher returns.

Bitcoin Market Reaction to Economic Indicators

The flat performance of Bitcoin despite positive economic data raises critical questions about its current market sentiment. Typically, when favorable economic indicators emerge, it tends to bolster investor confidence, driving up prices. However, in this instance, Bitcoin’s muted response might indicate a broader reevaluation of its role as a safe haven asset. As traders analyze BTC price fluctuations, the apparent disconnect with the stock market performance implies that Bitcoin might be experiencing a phase where its correlation with traditional markets is weakening, leading investors to explore altcoins that exhibit more robust price behavior.

Furthermore, the decline in Bitcoin’s price and trading volumes contrasts with the gains in the altcoin sector, suggesting a potential shift in investor focus. As altcoins began to surge, many traders may be reallocating capital away from Bitcoin, which is seen as static amid rising volatility in other cryptocurrencies. This reaction reflects a growing trend where market participants adapt their strategies based on evolving economic data, pointing toward an environment where liquidity and momentum in the broader cryptocurrency market significantly influence Bitcoin’s immediate future.

Analyzing Bitcoin’s Trading Volume and Market Capitalization

The recent trading performance of Bitcoin reveals a significant decline in both its trading volume and market capitalization. As Bitcoin was quoted at approximately $118,744.37, a mere 0.02% drop from the previous day, this stagnation underscores a pressing trend where reduced trading activity could hinder potential price recoveries. A decrease in trading volume often translates to lower market engagement, suggesting that traders may be uncertain about future price movements or await further market catalysts before re-entering positions.

Moreover, Bitcoin’s overall market capitalization has also witnessed a decrease, which could signify waning investor confidence. With a market cap now standing at $2.35 trillion, the slight dip adds to the narrative that investors are shifting their interests towards altcoins. As BTC struggles to gain traction, traders are closely monitoring economic signals and market trends to gauge the potential for future price surges or declines in Bitcoin prices. This analysis highlights the critical interplay between economic data impact on Bitcoin and the fluctuations observed in altcoins, laying the groundwork for informed investing strategies.

Understanding Cryptocurrency Market Trends

The current cryptocurrency market trends showcase a division in performance between Bitcoin and altcoins. As Bitcoin continues to grapple with stagnant prices, altcoins have exhibited a remarkable rally, drawing investor attention away from BTC. This trend reflects a broader pattern within the crypto ecosystem, where innovations and unique use cases of altcoins garner enthusiasm and result in substantial price movements, thus creating opportunities that resonate more with current market conditions.

Understanding these trends is vital for investors aiming to navigate the complexities of the cryptocurrency landscape. By analyzing competitive price trajectories and market sentiment, crypto enthusiasts can better position themselves within a space characterized by rapid changes. As Bitcoin’s supremacy is challenged by rising altcoin valuations, market participants are compelled to remain vigilant and adapt to evolving dynamics that typify the cryptocurrency sector.

Bitcoin’s Position Amidst Economic Upturns

As the economy appears to be on an upward trajectory following favorable job reports and corporate earnings, Bitcoin’s role within this context raises intriguing questions. With many stocks soaring due to positive economic indicators, Bitcoin’s lack of corresponding performance draws attention. This divergence signals a potential misalignment between Bitcoin as an investment vehicle and the current economic landscape, prompting analysts to consider whether market perceptions of Bitcoin are shifting.

Positioning Bitcoin within the broader economic recovery illustrates the cryptocurrency’s fluctuating appeal. As investors typically seek assets that can thrive amid economic resurgence, Bitcoin’s static performance may require fresh narratives to attract purchasing interest. Market developments around alternative cryptocurrencies that demonstrate solid growth during times of economic optimism could also lead to a reevaluation of Bitcoin’s unique value proposal as a leading digital asset.

The Ripple Effect of Altcoin Performance

The soaring performance of altcoins relative to Bitcoin has sparked discussions about the resilience of the cryptocurrency market. With altcoins like Ether and XRP recording impressive gains while Bitcoin remains flat, it highlights the diversified interests of traders actively engaging in this innovative financial landscape. The rise of altcoins can be seen as a ripple effect resulting from Bitcoin’s ongoing price challenges as traders move to capitalize on opportunities presented by other tokens that outperform BTC.

Moreover, the altcoin rally underscores a notable shift in market sentiment where investors are increasingly favoring diversification rather than concentrating their portfolios in Bitcoin. This trend could reshape the hierarchy within the cryptocurrency ecosystem and may entice new participants looking for higher potential returns. As the performance of altcoins continues to capture attention, it raises questions about Bitcoin’s long-term dominance and whether it can reclaim its position among a growing array of competitive digital currencies.

Evaluating Bitcoin’s Market Sentiment

Market sentiment surrounding Bitcoin has shifted considerably in recent weeks, particularly given the mixed responses to economic data. The flattening price of Bitcoin, juxtaposed with other asset classes expressed through financial indices, suggests heightened skepticism among investors regarding BTC’s prospects. Understanding this sentiment is crucial for navigating Bitcoin’s performance, as psychological factors heavily sway investor decisions, often leading them to favor short-term opportunities in the altcoin arena.

This evolving dynamic illustrates how market participants are recalibrating their expectations based on both technical and fundamental analyses. As traders evaluate potential returns, Bitcoin must compete for attention amidst a surge of innovative altcoins that are winning favor among speculative investors. Continuous observation of market sentiment, bolstered by concrete economic indicators, will shape strategies for buying or holding Bitcoin in a landscape increasingly defined by opportunistic financial maneuvers within the cryptocurrency sector.

The Future of Bitcoin in a Changing Economy

Amidst changing economic conditions, the future of Bitcoin remains uncertain as investors and market analysts grapple with its volatility and price behavior. Current economic data have led to increased confidence in traditional markets, yet Bitcoin’s inability to capitalize on such optimism could be indicative of deeper systemic issues. As digital currencies continue to evolve, Bitcoin’s standing as the original cryptocurrency will be put to the test, particularly if it fails to attract traders amidst rising interest in altcoins.

The trajectory of Bitcoin’s future hinges not only on its inherent cryptocurrency market trends but also on macroeconomic factors that influence investor behavior. The focus on altcoins’ robust performance raises the prospect that Bitcoin could either innovate or find itself sidelined in favor of alternatives that offer distinct advantages. For Bitcoin to thrive, it will need to realign with the broader economic environment and resonate with the needs of a diversifying investor base eager for new opportunities.

Implications of Bitcoin’s Market Dominance Decline

Bitcoin’s decline in market dominance, dropping below 63% at a time of economic upturn, has significant implications for the entire cryptocurrency market. As altcoins gain traction, this shift indicates a potential turning point in how investments are allocated within the digital currency realm. If Bitcoin’s position continues to weaken, it could provoke reactions from investors who perceive altcoins as more viable options, thus leading to further capital inflows away from Bitcoin.

The implications of this trend could affect Bitcoin’s perceived value proposition as the leading digital asset; if investors begin to favor altcoins resulting from their impressive returns, Bitcoin risks being viewed simply as another cryptocurrency. The ongoing dialogue about BTC’s sustainability in an evolving market will depend heavily on its ability to regain market confidence as well as the strategic moves it undertakes to maintain relevance amidst rising competition.

Frequently Asked Questions

What was the Bitcoin market reaction to the latest economic data report?

Despite positive economic indicators showing a drop in U.S. jobless claims and strong corporate earnings, Bitcoin’s market reaction was notably subdued. While stocks rallied, Bitcoin remained flat, illustrating a divergence in market trends as BTC price fluctuations were less responsive to bullish economic data.

How do economic data impacts on Bitcoin correlate with Bitcoin price analysis?

Economic data play a crucial role in influencing Bitcoin price analysis. However, recent reports indicate that even as economic conditions improve, Bitcoin’s price showed minimal reaction, suggesting that other factors may currently weigh more heavily on BTC’s performance than traditional economic indicators.

Why did Bitcoin experience limited movement despite a rise in the cryptocurrency market trends?

Although the broader cryptocurrency market saw a rise, attributed mainly to altcoins, Bitcoin’s limited movement can be attributed to its market dominance decreasing and a potential recalibration of investor sentiment towards altcoins rather than BTC.

What are the implications of BTC price fluctuations on altcoins performance?

BTC price fluctuations can significantly impact altcoins performance, as a strong or weak Bitcoin often dictates market sentiment. In the current environment, Bitcoin’s stability has allowed altcoins to surge, leading to increased investor interest and movement within those assets.

What does a stable Bitcoin market reaction mean for future cryptocurrency market trends?

A stable Bitcoin market reaction, particularly in the face of strong economic data, suggests a potential shift in cryptocurrency market trends. It may indicate that altcoins are gaining ground, and investors might be diversifying their portfolios, which could lead to a broader market evolution beyond Bitcoin.

| Key Points | Details |

|---|---|

| Economic Data Impact | U.S. jobless claims fell to a 3-month low, boosting stock markets but Bitcoin remained flat. |

| Market Metrics | Bitcoin traded at $118,744.37, down by 0.02%, with altcoins gaining ground instead. |

| Trading Volume | Trading volume decreased by 7.22% to $68.05 billion. |

| Market Capitalization | Bitcoin’s market cap stands at $2.35 trillion, and dominance fell to 62.65%. |

| Liquidation Trends | Bitcoin liquidations totaled $66.73 million, with a balanced ratio of bears to bulls. |

Summary

The Bitcoin market reaction to recent economic data has been surprisingly tame despite positive developments in the broader economy. While traditional markets soared after U.S. jobless claims hit a three-month low and numerous companies surpassed earnings expectations, Bitcoin remained largely stagnant. This lack of responsiveness indicates a potential shift in market dynamics, affecting Bitcoin’s dominance in the cryptocurrency space as altcoins rallied, showcasing their strength. Going forward, investors may need to reassess their strategies regarding Bitcoin in light of these developments.