Bitcoin Market Trends: Stocks Stumble as Bitcoin Follows

In recent weeks, Bitcoin market trends have shown a noticeable correlation with the stock market’s performance, particularly amid significant fluctuations. As the S&P 500 experienced a minor pullback, Bitcoin followed suit, registering a 1.50% decline to stabilize around $106,002.05. This Bitcoin price drop has raised eyebrows among investors, particularly since the trading volume has surged by 8.61%, indicating heightened activity in the cryptocurrency market despite the downward price action. Analysts are carefully monitoring these cryptocurrency trends as they relate to overall financial stability, especially given the substantial impact that the latest turns in stock market dynamics can have on Bitcoin’s valuation. The interaction between Bitcoin and traditional investments like those in the S&P 500 could provide critical insights into future trading volumes and the asset’s broader appeal alongside shifts in stock market impact.

The recent fluctuations in Bitcoin’s performance have sparked interest in its relationship with prevailing market dynamics, particularly as economic indicators shift. Observers note that as stock markets retreat from record highs, alternative monetary assets like Bitcoin have begun to reflect similar patterns, suggesting an interconnectedness in today’s financial landscape. Analysts are now closely watching cryptocurrency sentiment and trading activity, including Bitcoin’s volatility and trading volume, as these metrics offer clues to potential future movements. Such observations underscore the importance of understanding not just individual asset performance but also the broader context, as figures in the cryptocurrency space continue to navigate changing investor sentiment and external factors. As the financial ecosystem evolves, the interplay between digital currencies and traditional financial instruments remains a topic of significant analysis.

Analyzing Bitcoin Market Trends Amid Stock Declines

In recent days, there has been a notable correlation between the stock market’s performance and Bitcoin’s price trajectory. As major stock indices like the S&P 500 and Nasdaq faced declines, Bitcoin followed suit, reflecting a 1.50% dip alongside a broader bearish sentiment. Market analysts are currently assessing how fluctuations in Bitcoin trading volume might signal investor sentiment toward a potential recovery. These cryptocurrency trends often mirror traditional financial markets, indicating that even in the relatively young crypto space, investor behavior remains deeply intertwined with established stock performance.

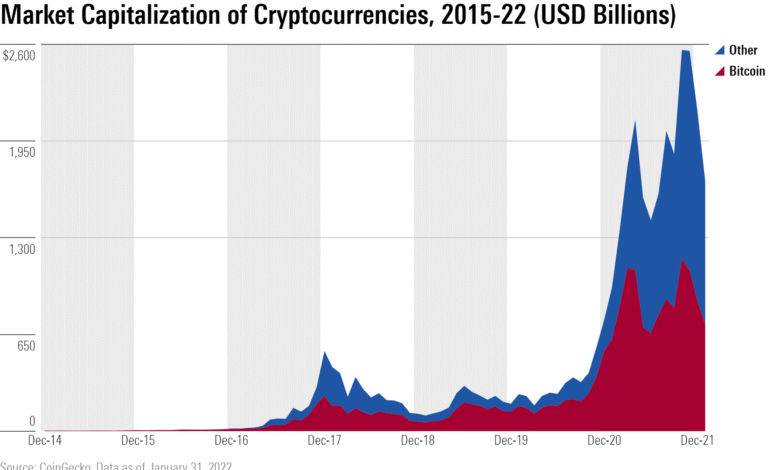

The recent decline in Bitcoin’s price can also be attributed to the heightened volatility reflected in parameters such as trading volume and market capitalization. While Bitcoin’s trading volume increased by 8.61% to $44.44 billion, its market cap fell by 1.48% to $2.1 trillion. This divergence highlights a scenario where increased trading activity does not equate to rising prices, perhaps suggesting investors are consolidating or preparing for further market changes. Observers must keep an eye on how these Bitcoin market trends unravel, especially as they relate to movements in the stock market.

In the face of these market fluctuations, it’s vital for investors to stay informed on Bitcoin’s price changes and its interrelationship with traditional financial indicators. The recent downturn was exacerbated by significant individual stock movements, particularly Tesla’s sharp decline triggered by political commentary. Investors might need to reconsider their strategies, as Bitcoin’s current performance seems predominantly influenced by external market pressures, including the performance of the S&P 500. This paints a complex picture where Bitcoin is not operating in isolation, but rather being swayed by the forces acting upon the broader financial landscape.

Furthermore, with the varying dynamics between Bitcoin and the stock market, speculative interest remains vital. Increased liquidations, primarily from long positions, reveal a nervous sentiment among traders, casting doubt on a swift recovery for Bitcoin. As Bitcoin navigates these turbulent waters, understanding the driving forces behind its price drops, correlated with broader market behavior, will be crucial for investors looking to make informed decisions.

The Impact of Stock Market Performance on Bitcoin’s Future

The relationship between stock market trends and Bitcoin’s performance cannot be underestimated, particularly during periods of volatility. Recent events have showcased how the decline in major equities is paralleled by Bitcoin’s price drop. For instance, as the S&P 500 struggled, so did Bitcoin, which emphasizes the sensitivity of cryptocurrencies to traditional market fluctuations. Investors are now looking for signs of stability or potential rebound, especially as Bitcoin demonstrates a tendency to mirror movements in the stock arena.

As the stock market continues to face challenges, analysts are left contemplating the long-term implications for Bitcoin. One notable aspect is the trading volume associated with Bitcoin, which saw a significant increase even amidst price declines. This rise in trading volume might indicate a strategic repositioning by investors, who may be capitalizing on perceived opportunities for future growth. As Bitcoin’s value changes, it is essential to track how shifts in investor confidence reflect upon trading volumes and, by extension, future market trends.

Further complicating Bitcoin’s outlook is the sentiment expressed by major players in the stock market and potential regulation conversations that might influence trading patterns. The interplay of political narratives and market performance—as demonstrated by events surrounding influential figures—can greatly sway investor behavior in both sectors. Investors should stay attuned to these developments, as they will serve to shape the continuity of Bitcoin trends, especially during challenging market conditions.

Ultimately, the forward trajectory of Bitcoin is likely to be significantly impacted by stock market performance. Thus, for investors, a solid strategy entails not only keeping track of Bitcoin price drops but also understanding broader economic indicators that drive market sentiment. This intersection of cryptocurrency and traditional finance could create both challenges and opportunities as the markets evolve.

Frequently Asked Questions

What factors are causing the recent Bitcoin price drop related to stock market impact?

The recent Bitcoin price drop has been influenced by a cooling stock market after reaching all-time highs. Both the S&P 500 and Nasdaq experienced declines, prompting a correlated dip in Bitcoin’s value. As traditional markets face challenges, cryptocurrency trends often reflect these shifts, leading to decreased trading volumes and investor sentiment.

How do cryptocurrency trends affect Bitcoin trading volume today?

Cryptocurrency trends indicate a direct relationship between Bitcoin and stock market performance, impacting trading volume. With Bitcoin’s price slipping by 1.50% amidst a stock market slide, trading volume saw an 8.61% increase, despite the overall market cap fall. This suggests that traders are responding to market volatility by increasing their activity in anticipation of potential rebounds.

What is the relationship between Bitcoin’s recent performance and S&P 500 performance?

The S&P 500 performance has a significant influence on Bitcoin’s market trends. As the S&P 500 dropped, Bitcoin’s price followed suit, reflecting how investor sentiment can sway across asset classes. When stocks decline, investors may turn to Bitcoin, yet the recent slip in Bitcoin suggests that caution remains prevalent amid macroeconomic concerns.

How has Bitcoin’s market capitalization changed during the recent stock market drop?

During the stock market’s decline, Bitcoin’s market capitalization dipped by 1.48%, showcasing its sensitivity to broader market trends. Despite this, Bitcoin’s dominance increased slightly, suggesting that within the cryptocurrency space, Bitcoin is still viewed as a safer asset compared to altcoins, indicating resilience amid overall market fluctuations.

What are the implications of Bitcoin trading volume rising while the price drops?

An increase in Bitcoin trading volume alongside a price drop can signal heightened market activity and interest from traders. This could be indicative of traders speculating on price recovery or liquidating positions as volatility rises. It reflects a dynamic market environment where participants react to changes in cryptocurrency trends heavily influenced by stock market performance.

| Key Points | Details |

|---|---|

| Stock Market Downturn | S&P 500 and Nasdaq fell by 0.36% and 1.10%, respectively. |

| Bitcoin Price Movement | Bitcoin dipped 1.50% to $106,002.05 amidst stock market declines. |

| Tesla’s Impact | Tesla shares dropped 5.15% following criticism from President Trump. |

| Market Metrics | Trading volume rose 8.61% to $44.44 billion; market cap dipped 1.48% to $2.1 trillion. |

| Open Futures Contracts | Value decreased by 2.78%, suggesting lower speculative interest. |

Summary

Bitcoin market trends are currently reflecting a shared downturn with the stock markets, as demonstrated by the recent decline in Bitcoin’s price amidst falling stock values. With Bitcoin slipping 1.50% to $106,002.05, market pressure is evident, especially after significant stocks like Tesla faced heavy losses due to external criticisms. The increase in trading volume and Bitcoin dominance ratio amidst a broader market decline indicates a complex landscape for cryptocurrency investors, suggesting that while Bitcoin may face short-term fluctuations, it remains a central player in the financial ecosystem.