Bitcoin Price Prediction: Kiyosaki Sees $90K Dip This Month

With the uncertain landscape of cryptocurrency, Bitcoin price prediction has become a hot topic among investors and market analysts alike. This August, renowned financial educator Robert Kiyosaki believes that the so-called “Bitcoin August Curse” could see prices plummet to $90,000, presenting what he views as a golden opportunity for strategic investing in Bitcoin. As Kiyosaki prepares to double his BTC investments during this potentially tumultuous period, many are reflecting on their Bitcoin investment strategies in light of possible volatility. In 2023, the fear of a Bitcoin price drop could dissuade newcomers to the crypto market, yet seasoned investors may see this as a chance to buy the dip. Understanding the implications of Kiyosaki’s forecast may be crucial for anyone considering strong positions in digital assets.

The impending fluctuations in Bitcoin’s market value have many discerning investors on alert, leading to renewed discussions about the future of this digital currency. As authors and financial commentators analyze trends in cryptocurrency, terms like “cryptocurrency market volatility” and “digital asset investment opportunities” frequently surface, paralleling prominent figures in the space such as Robert Kiyosaki. His commentary on the looming threats of financial instability pushes individuals to reassess their asset allocations, particularly concerning Bitcoin’s potential as a safe haven. Alternative phrases such as “cryptocurrency predictions” and “BTC market trends” further enhance the discourse, tapping into the insights of seasoned investors seeking clarity during uncertain times.

The Bitcoin August Curse: What It Means for Investors

The notion of the ‘Bitcoin August Curse’ has circulated within the crypto community, particularly as the month of August historically sees a downturn in Bitcoin prices. Robert Kiyosaki attributes the potential drop to $90K to this phenomenon, emphasizing that investors might face a period of uncertainty. He encourages potential investors to view this as a strategic opportunity. His perspective is rooted in the belief that such market fluctuations are typical in the volatile world of cryptocurrency, and thus, savvy investors must be prepared to capitalize on these dips.

Kiyosaki’s analysis suggests that understanding market cycles creates an informed investment strategy. For those considering investing in Bitcoin, seeing these price corrections not as obstructions but as opportunities can lead to valuable long-term gains. As skeptical thoughts about the cryptocurrency sector rise, embracing the nature of these downturns could strengthen an investor’s resolve to increase their holdings, particularly when prices are favorable.

Robert Kiyosaki’s Insights on Bitcoin Investment Strategy

Kiyosaki’s compelling arguments about Bitcoin extend beyond mere predictions; they delve into effective Bitcoin investment strategies. By doubling his investment during what he considers an opportune moment, Kiyosaki illustrates a proactive and aggressive approach to wealth-building in cryptocurrency. He believes that holding Bitcoin long-term, especially during moments when prices fluctuate, can yield remarkable returns, emphasizing that his initial investment has grown significantly without intricate management.

The strategic perspective Kiyosaki promotes entails holding Bitcoin as a hedge against economic instability, as highlighted in his critiques of traditional investments. His stance encourages investors to diversify by integrating Bitcoin alongside tangible assets like gold and silver. By taking calculated risks and viewing Bitcoin’s volatility as a buying opportunity, investors can optimize their investment strategy, especially as uncertain economic factors loom over traditional markets.

What Does a $90K Bitcoin Price Drop Mean for Future Prospects?

A potential price drop to $90K raises questions about the sustainability of Bitcoin’s growth trajectory. Kiyosaki believes that such a decline might shock some investors but could ultimately lead to a fresh wave of interest in cryptocurrency as a robust investment avenue. This reflection on Bitcoin’s price volatility is essential for anyone considering entering the market—understanding that lows can often precede significant highs.

Market sentiment plays a crucial role in Bitcoin’s performance. By framing Bitcoin as a resilient asset, Kiyosaki posits that dips may attract more investors, thus stabilizing the cryptocurrency ecosystem in the face of adversity. For trend-watchers, the price dynamics surrounding a $90K threshold could either serve as a warning or a green light; the real challenge lies in how investors will react and adapt their strategies to these fluctuations.

Historical Performance: Learning from Bitcoin Price Drops

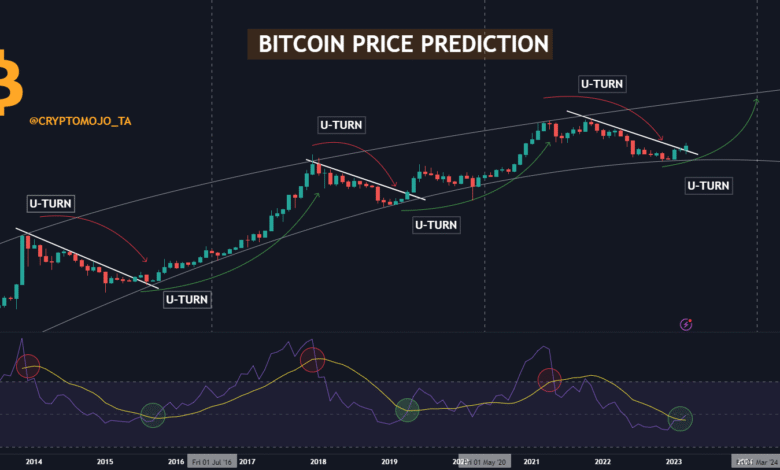

Historically, Bitcoin has undergone numerous price corrections that reflect its volatile nature. Investors have witnessed significant downturns followed by rapid recoveries, highlighting the asset’s character as a double-edged sword. Kiyosaki’s appeal to consider the ‘Bitcoin August Curse’ reflects this historical trend, where past performance may provide a window into future fluctuations. Therefore, understanding historical data can inform whether to hold or invest during upcoming declines.

Lessons from previous Bitcoin price drops underscore the importance of timing and mental fortitude when it comes to investing in volatile markets. Investors are reminded that a calculated approach, leveraging both historical trends and current market conditions, can yield rewards in the long term. Engaging with these lessons may empower more seasoned and new investors alike to navigate the complexities of Bitcoin investments.

Bitcoin Price Prediction: What Kiyosaki Foresees for the Future

Robert Kiyosaki’s prediction of Bitcoin potentially dropping to $90K is a reflection of his deep engagement with market trends and economic indicators. However, beyond predicting a decrease, he anticipates an eventual recovery fueled by investor adaptation and market resilience. His predictions resonate not only with keen followers of cryptocurrency but also serve as a wake-up call for those uncharted in the crypto landscape.

While price predictions can often lead to speculation, Kiyosaki’s insights emphasize the importance of having a long-term view toward Bitcoin investments. Instead of succumbing to fear during price dips, investors are encouraged to formulate a strategy rooted in both historical precedent and current market dynamics. This dual lens can lead to more informed decisions and ultimately a more prosperous journey in the world of cryptocurrency.

Emerging Economic Trends: Implications for Bitcoin Investors

As economic dynamics shift towards instability, Kiyosaki’s warnings about traditional assets spur intrigue among potential Bitcoin investors. The rising debts and economic concerns present a dual narrative—on one end, financial planners promote the safety of conventional investments such as bonds, while on the other, Kiyosaki argues that such assertions lack grounding in reality. These contradictions make Bitcoin an appealing alternative for investors looking to shield themselves from economic downturns.

Emerging trends suggest that investors are increasingly considering Bitcoin as a viable hedge against inflation and economic collapse. Kiyosaki’s insights position Bitcoin not just as a speculative asset but as a strategic part of a diversified portfolio aimed at long-term wealth accumulation. By addressing impending economic realities and shifting investment practices, Bitcoin stands to transform not only individual portfolios but the broader financial landscape.

The Role of Education in Bitcoin Investment Success

Education plays a pivotal role in the success of any investment strategy, especially when navigating the complexities of Bitcoin and the broader cryptocurrency market. Kiyosaki’s emphasis on understanding what underpinning forces affect Bitcoin prices—like seasonal trends and market sentiments—highlights how informed investors can better prepare for the unknown. Embracing education can thus demystify cryptographic assets and instill confidence in making significant financial decisions.

Moreover, as Bitcoin becomes more mainstream, the need for comprehensive educational resources becomes paramount. Investors who actively seek information, whether through books, online resources, or community engagement, are better equipped to adapt in the fast-paced crypto environment. By prioritizing ongoing education, investors can camouflage themselves against market volatility and enhance their overall investment strategy.

The Psychology Behind Bitcoin Investment Decisions

The psychology of investing significantly influences decision-making processes, particularly in volatile markets like cryptocurrencies. Kiyosaki’s observations underscore how fear and greed can drive irrational behaviors among investors, especially during downturns. The challenge for many is to maintain a level-headed approach amidst the chaos, analyzing market conditions instead of making impulsive decisions based purely on emotion.

Understanding one’s psychological triggers can facilitate more rational investment choices. Kiyosaki encourages a mindset shift—viewing downturns as potential opportunities for investment rather than obstacles. This perspective can empower investors to hold on to their Bitcoin or consider adding to their positions during market declines, ultimately positioning themselves for success in the long run.

Navigating Market Volatility: Strategies for Bitcoin Investors

Market volatility is an inherent characteristic of Bitcoin, and Kiyosaki’s approach suggests that successful investing in this arena requires adaptable strategies. Investors are urged to remain aware of trends such as the ‘Bitcoin August Curse’ and to develop strategies that account for potential price drops. These strategies can include setting purchase limits during downturns or diversifying investments to mitigate risk.

Navigating the turbulent waters of cryptocurrency investment involves a mix of patience, research, and a solid strategy. Kiyosaki advocates for a focus on long-term objectives rather than short-term gains, arguing that a well-thought-out investment strategy can withstand market fluctuations. Sifting through the noise of daily price changes and focusing on the wealth-building potential can yield remarkable benefits for long-term Bitcoin investors.

Frequently Asked Questions

What is the Bitcoin August Curse and how does it affect Bitcoin price prediction?

The Bitcoin August Curse is a trend observed where Bitcoin’s price tends to decline during the month of August. According to Robert Kiyosaki, this pattern could potentially lead BTC’s price to drop to $90K. Investors are often advised to monitor this trend closely as it may present buying opportunities in anticipation of future price recovery.

How does Robert Kiyosaki’s Bitcoin price prediction influence investing in Bitcoin?

Robert Kiyosaki’s Bitcoin price prediction suggests that Bitcoin could face a significant dip, possibly down to $90K. His perspective encourages investors to view price drops as chances to increase their holdings, emphasizing that strategic investing in Bitcoin can lead to substantial long-term profits, despite short-term volatility.

What should investors consider regarding Bitcoin’s price drop in 2023?

Investors should be aware that forecasts, like Robert Kiyosaki’s prediction of a Bitcoin price drop to $90K, highlight the inherent risks and volatility of cryptocurrency. This emphasizes the importance of having a solid Bitcoin investment strategy, which might include dollar-cost averaging during price drops to mitigate overall investment risk.

Can the historical trend of Bitcoin’s August decline impact long-term price forecasts?

Yes, the historical trend called the Bitcoin August Curse can significantly impact long-term price forecasts. If Bitcoin consistently underperforms in August, as claimed by Kiyosaki, this may affect investor sentiment and strategies, potentially leading to a lower price point, such as $90K, that investors should be prepared for.

What investment strategies can mitigate the risks of Bitcoin price volatility?

To mitigate the risks associated with Bitcoin’s price volatility, investors can adopt strategies such as dollar-cost averaging, diversifying their cryptocurrency portfolio, and setting clear investment goals. Following insights from investors like Robert Kiyosaki, being prepared to capitalize on price dips—like during the anticipated August decline—can also enhance investment outcomes.

Why is Robert Kiyosaki optimistic about accumulating Bitcoin despite potential price drops?

Robert Kiyosaki remains optimistic about accumulating Bitcoin even if its price drops to $90K because he sees these dips as opportunities for wealth-building. His belief is that, despite short-term fluctuations, investing in Bitcoin can lead to significant long-term gains, especially as he views Bitcoin as a uniquely designed asset that is advantageous for investors.

What role does economic uncertainty play in Bitcoin price predictions?

Economic uncertainty plays a crucial role in Bitcoin price predictions. Influential figures like Robert Kiyosaki assert that the current financial landscape, marked by substantial debt and market volatility, can drive Bitcoin prices down, potentially presenting buying opportunities. Understanding these economic factors is essential for formulating an effective Bitcoin investment strategy.

| Key Point | Details |

|---|---|

| Kiyosaki’s Prediction | Robert Kiyosaki predicts Bitcoin could drop to $90K in August. |

| Bitcoin August Curse | A historical trend where Bitcoin often underperforms in August. |

| Investment Strategy | Kiyosaki plans to double his Bitcoin investment if prices drop. |

| Critique of Traditional Investments | Kiyosaki warns against relying on bonds and highlights market instability. |

| Long-term Wealth Building | He emphasizes Bitcoin’s potential for making millionaires. |

| Support for Bitcoin in Retirement Accounts | Recent policies allowing retirement accounts to invest in Bitcoin are seen as significant. |

Summary

Bitcoin price prediction indicates that there is a possibility of a significant decline, with expert Robert Kiyosaki forecasting a drop to as low as $90K this month. Kiyosaki’s insights on the historical ‘Bitcoin August Curse’ suggest that the market may suffer due to seasonal trends, which he views not as a threat, but rather as an opportunity to increase his investments. His confidence in Bitcoin and its potential to generate wealth reflects a growing sentiment among investors who see it as a hedge against traditional economic downturns. As Kiyosaki continues to champion Bitcoin, alongside precious metals, he encourages investors to reassess their approaches, especially in light of recent policy changes supporting Bitcoin investments in retirement accounts.