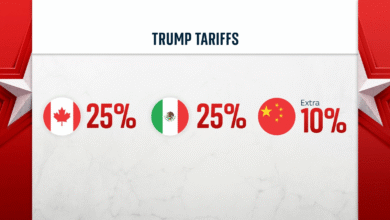

Tariff Price Increases Impacting Companies and Consumers

Tariff price increases are reshaping the landscape of consumer goods and services, as companies respond to the financial pressures imposed by recent trade policies. New data indicates a significant shift in pricing strategies, with many businesses passing costs directly onto consumers, sparking concerns over the impending impact on overall prices. This phenomenon is further fueled by the backdrop of President Trump’s tariffs, which have ignited discussions among executives about adapting to a new economic reality. As companies grapple with elevated expenses, we are witnessing a concerning trend of consumer price hikes that may tighten household budgets. This swift adaptation by businesses is more than just a response to tariffs; it reflects a broader recalibration of the market influenced by evolving US trade policy.

Price adjustments stemming from tariff policies are causing ripples throughout the economy, prompting businesses to reevaluate their pricing structures. Recent insights reveal that a considerable number of enterprises are opting to transfer increased costs onto their clientele, a decision driven by the challenges posed by elevated tariff rates. The discourse surrounding this dilemma highlights the complexities of corporate responses to financial pressures, particularly in the context of recent US trade negotiations. With many firms experiencing significant input cost increases, the pressure to sustain profitability is leading to inevitable shifts in retail pricing strategies. As businesses navigate these turbulent waters, the delicate balance between maintaining customer loyalty and ensuring financial viability will be critical.

The Impact of Tariff Price Increases on Consumers

Recent data reveals a significant impact on consumers as tariffs increase the overall cost of goods and services. The majority of companies have decided to pass on the costs associated with tariff price hikes directly to their customers. This means that everyday consumers can expect to see higher prices in stores, affecting budgets across the country. As companies continue to raise prices, the question remains about consumer resilience and how long they can absorb these additional costs without changing spending habits.

In May, surveys conducted by the New York Federal Reserve highlighted a troubling trend where 77% of service companies and 75% of manufacturers felt compelled to pass on the tariff-induced cost increases to consumers. More alarmingly, over 30% of manufacturers admitted to transferring the entire increase in costs to their clients. This escalation of costs not only strains family budgets but raises critical questions about the broader implications of U.S. trade policy.

Companies Raising Prices Amidst Trade Policy Changes

As U.S. trade policy evolves, many companies find themselves in a difficult position regarding pricing strategies. With the looming threat of tariffs, business leaders are adjusting their rates to maintain profit margins. A remarkable 90% of CEOs surveyed indicated either current price increases or intentions to do so in the near future. This behavior underscores the urgency that companies feel in adapting to changing economic conditions, often leading to swift action, as evidenced by manufacturers and service providers raising prices shortly after experiencing tariff-related cost hikes.

Even with pressure from figures like President Trump, who encourages businesses to absorb costs, many executives have made it clear that this is not a viable option. The reality of increased production costs due to tariffs forces companies to rethink pricing structures. Executives acknowledge that the immediate need to maintain financial stability outweighs potential backlash from consumers, indicating a likely trend towards increased consumer price hikes as tariffs continue to shape the economic landscape.

Understanding the Connection Between Tariffs and Consumer Prices

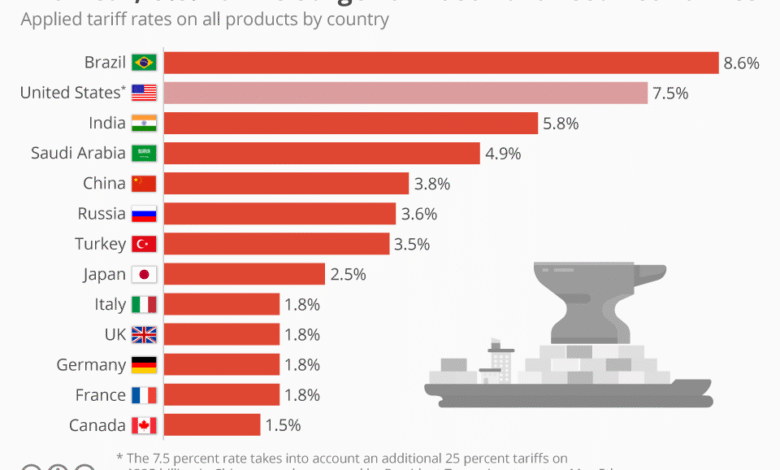

The relationship between tariffs and consumer prices is complex yet undeniable. As tariffs are implemented, the cost of imported goods rises, inherently leading to higher consumer prices. The reality faced by both manufacturers and service providers highlights a cycle where increased production costs translate into increased prices for consumers. Experts warn that sustained tariff pressures from the administration, particularly impactful due to President Trump’s approach, may lead to an ongoing cycle of price hikes.

Moreover, consumer prices are not only influenced by the tariffs themselves but are also shaped by the general market response to inflationary pressures triggered by these tariffs. Many companies, anticipating long-term costs, are now calculating their pricing strategies with tariffs as a primary factor. This proactive approach means consumers need to be prepared for a shift in pricing dynamics, where increased costs become a standard rather than a temporary measure.

The Role of U.S. Trade Policy in Price Adjustments

U.S. trade policy has a direct correlation with how companies set their prices. With the Trump administration’s assertive tariff imposition, businesses are reevaluating cost structures and pricing methodologies in response to the new landscape. The uncertainty created by constantly shifting trade agreements complicates the planning processes for many businesses, forcing them to adopt a reactive stance when it comes to pricing adjustments.

There’s a growing awareness among businesses that trade policy decisions are not isolated events; they have a cascading effect throughout the economy. For instance, firms are increasingly hesitant to commit to long-range pricing strategies, opting instead for short-term adjustments. This volatile environment lends itself to increased consumer price hikes as companies opt to pass along any uncertainties and costs directly to their customers.

Responses from Corporate Executives on Tariff Challenges

Corporate executives are increasingly vocal about the challenges posed by tariffs in their operations. Many have expressed concern regarding the difficulties in forecasting costs and planning for future expenses. In recent surveys, comments from executives reveal a clear frustration with how tariffs disrupt supply chains and complicate pricing strategies. ‘Chaos does not bode well for anyone, especially when it impacts pricing,’ remarked one industry leader, emphasizing the often unseen ramifications tariffs can have on operational stability.

While many leaders recognize the necessity of price adjustments in light of tariff pressures, they also understand the potential backlash from consumers. Companies find themselves in a precarious situation of needing to manage both profit margins and customer satisfaction concurrently. As such, executives are adopting cautious approaches, focusing on contingency planning while managing the inherent unpredictability of tariffs, which complicates their strategic objectives.

The Speed of Price Hikes Following Tariff Announcements

The speed at which companies implement price hikes following tariff announcements is remarkable. Surveys indicate that nearly 35% of manufacturers raised prices within a week of incurring additional costs due to tariffs. This rapid response highlights the urgency companies feel to adjust to the new financial realities instigated by U.S. trade policy. With a significant portion of companies reacting quickly, it illustrates how entrenched the effects of tariffs have become in shaping corporate strategies.

Such swift price adjustments may continue as further tariffs loom, illustrating a fundamental shift in how industries respond to market pressures. Executives must balance the need for immediate changes with the long-term impacts these price hikes could have on customer loyalty and purchasing behavior. With impending deadlines for upcoming tariff escalations, many anticipate continued volatility in consumer prices if companies remain pressured to keep margins intact.

Uncertainty in the Future of U.S. Tariffs and Prices

The uncertainty surrounding the future of U.S. tariffs continues to cast a shadow over consumer pricing strategies. As companies await policy changes or confirmations regarding tariffs, planning becomes challenging. Executives voice concerns regarding how sustained tariff levels will affect long-term pricing stability. Overall, this unpredictability is forcing businesses to adopt flexible pricing models, as they must remain agile in responding to potential changes in tariffs.

This environment of uncertainty creates a heightened sense of caution among both businesses and consumers. Many companies are deferring significant purchases or investments until there is clearer guidance on trade policy. This caution can inadvertently lead to higher prices as companies opt to hedge against risks associated with unpredictability in tariffs. As the trade landscape evolves, this trend may exacerbate consumer price volatility in the coming months.

Contingency Planning Amid Tariff Pressures

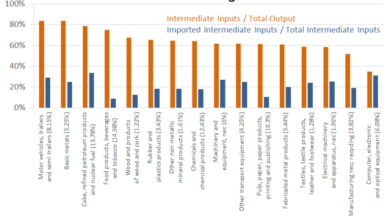

In response to ongoing tariff pressures, many companies are undertaking extensive contingency planning. Business leaders across various industries acknowledge that the current state of tariffs requires them to be proactive about potential cost fluctuations. This approach is seen as critical in minimizing the risks associated with volatile pricing caused by tariffs, particularly as many firms have already observed supply chain disruptions.

However, this level of preparation can be taxing for organizations. Executives have expressed that focusing on contingency plans is diverting attention from core strategic initiatives, negatively impacting overall business growth. Many companies are forced to balance essential operational decisions with the unpredictable nature of tariffs, which can lead to a loss in focus and increases in final cost burdens passed down to consumers.

Strategies to Mitigate the Impact of Tariffs on Consumer Prices

To counteract the rising trend of consumer pricing due to tariffs, companies are exploring various strategies to mitigate their impact. These could include optimizing supply chains, negotiating better terms with suppliers, or diversifying sourcing to reduce dependency on tariff-impacted goods. By taking such measures, businesses aim to minimize additional costs and potentially shield consumers from direct price increases.

Moreover, educational campaigns targeted at consumers may also play a role in alleviating some backlash against price hikes. Companies are starting to communicate more transparently about the reasons behind price changes, highlighting external factors such as tariffs. This kind of transparency can help foster consumer understanding and patience during times of uncertainty, allowing businesses to adjust prices while preserving their customer relationships.

Frequently Asked Questions

How are tariff price increases affecting consumer prices?

Tariff price increases are leading to significant consumer price hikes as companies pass on additional costs. Data from the New York Federal Reserve indicates that approximately 77% of service firms and 75% of manufacturers have already raised their prices due to tariffs imposed under President Trump’s trade policies.

Are companies raising prices due to President Trump’s tariffs?

Yes, many companies are raising prices in response to President Trump’s tariffs. A survey revealed that nearly 90% of CEOs either have raised prices or plan to soon, with a focus on increasing them by at least 2.5% to cope with higher operating costs driven by tariffs.

What is the impact of US trade policy on company pricing strategies?

US trade policy, particularly under President Trump’s administration, has led to increased tariffs that significantly impact pricing strategies. Many companies are forced to pass these tariff costs onto consumers, resulting in overall price increases across various sectors.

What percentage of firms reported passing tariff impact on prices to customers?

According to a survey from the New York Fed, about 77% of service firms and around 75% of manufacturers have passed at least some of the tariff-related cost increases onto their customers, highlighting the widespread impact of tariffs on consumer prices.

What challenges do companies face with the ongoing tariff hikes?

Companies face challenges including supply chain disruptions and uncertainty around US trade policy as tariffs continue to fluctuate. Executives are concerned about the impact of these issues on pricing and strategic planning, leading to a cautious approach in decision-making.

When did companies start to raise prices following tariff announcements?

Companies began raising prices very quickly after the announcement of tariff increases by President Trump. Surveys show that over 35% of manufacturers and nearly 40% of service firms raised their prices within a week of experiencing tariff-related cost increases.

How do tariffs influence consumer behavior and purchasing decisions?

Tariffs influence consumer behavior by causing price hikes, leading some consumers to delay purchases or seek alternative products. The uncertainty surrounding tariffs causes consumers to be more cautious with their spending, which can further impact overall consumer demand.

Are there any plans to roll back tariff increases?

While there have been discussions regarding trade agreements and potential rollbacks of certain tariffs, the overall landscape remains uncertain. Companies are preparing for a potential return of previously suspended tariffs and continue to adapt their pricing strategies accordingly.

| Key Point | Details |

|---|---|

| Price Increases | A majority of companies are raising prices due to tariffs, with 77% of service firms and 75% of manufacturers passing increased costs to customers. |

| Rapid Response | Over 35% of manufacturers and nearly 40% of service firms increased prices within a week of tariff-related cost hikes. |

| Corporate CEOs’ Reactions | Approximately 90% of surveyed CEOs indicated they are raising prices or planning to do so, with many anticipating increases of at least 2.5%. |

| Uncertainty in Trade Policy | Businesses are struggling with confusion over trade policy as a deadline for resuming tariffs approaches. |

| Impact on Supply Chains | Executives reported that tariffs have created disruptions in supply chains similar to those caused by Covid-19, and they are focused on contingency planning. |

Summary

Tariff price increases are significantly impacting consumer prices, as evidenced by the rising costs passed on by various companies. Recent data reveals that a substantial number of service firms and manufacturers are raising their prices due to the economic pressures brought on by tariffs. With the impending July deadline for previously suspended tariffs, companies are in a state of uncertainty regarding future costs, resulting in strategic shifts and contingency planning. The corporate landscape is facing challenges that stem from both pricing pressures and the unpredictability of trade agreements, making it essential for businesses to adapt swiftly to changing economic conditions.