Bitcoin Mining Giant Mara Completes $950M BTC Acquisition

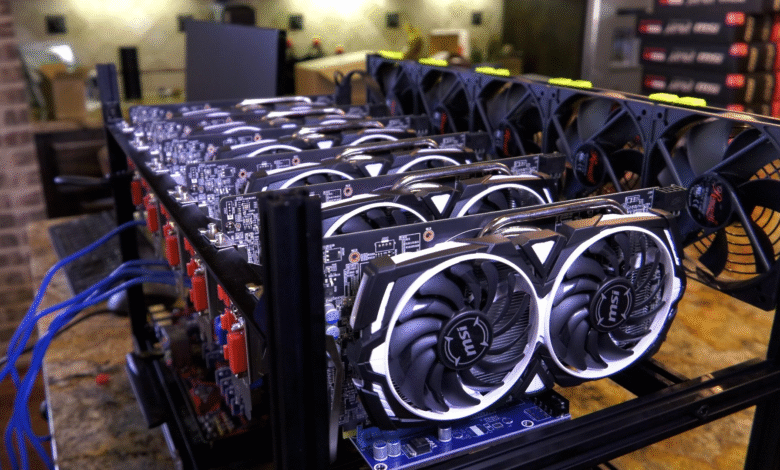

Bitcoin mining is reshaping the digital economy, acting as the backbone of the cryptocurrency revolution. As the largest bitcoin miner globally, Mara recently completed an impressive $950 million acquisition, using interest-free senior convertible notes as a unique financing approach. This maneuver not only bolsters Mara’s holdings but also underscores its dominance in the market, fueling interest in crypto lending and the emerging paradigm of a bitcoin shadow bank. With a market capitalization nearing $6 billion, the company is set to challenge its competitors, especially as it aims to increase its reserves of this valuable digital asset. The growing scale of operations, coupled with strategic financial moves like the Bitcoin convertible notes, positions Mara at the forefront of innovation in bitcoin mining and cryptocurrency investments.

The process of generating and validating new bitcoins, often referred to as cryptocurrency mining, is gaining traction as a vital element of the blockchain ecosystem. Companies such as Mara have harnessed innovative financial strategies to enhance their bitcoin portfolios, reflecting a significant trend in digital asset management. By employing various financing mechanisms, including the issuing of convertible notes, these miners can secure capital to expand their operations and bolster their cryptocurrency reserves. This shift is not just about mining; it signifies a transformation in the cryptocurrency landscape, potentially leading some firms to resemble traditional banking institutions, albeit focused exclusively on digital currencies. As the largest bitcoin miner, Mara’s ventures into new financial avenues may redefine how bitcoin is perceived and utilized across the globe.

Mara Bitcoin Acquisition: A Strategic Move in Cryptocurrency

Mara’s recent acquisition of $950 million through interest-free senior convertible notes marks a pivotal moment in its strategy as the largest bitcoin miner. This capital influx not only positions Mara to enhance its bitcoin holdings but also underscores its ambition to close the gap with leading players in the industry, such as Strategy. By leveraging these funds effectively, Mara could accelerate its acquisition of additional bitcoin, boosting its already substantial cryptocurrency portfolio. This acquisition is significant as it allows the company to fortify its market presence and maintain its competitive edge in the ever-evolving landscape of digital currencies.

In the competitive world of cryptocurrency, where players constantly vie for dominance, Mara’s move reflects a broader trend among bitcoin miners to consolidate resources and expand their influence. The issuance of convertible notes not only serves as a valid financial strategy but also indicates a shift in how major mining operations perceive their role within the broader financial system. As Mara pursues its acquisition goals, the implications for the market may be profound, further solidifying its position as a primary actor in the crypto sector.

The Role of Bitcoin Mining in Crypto Lending

Bitcoin mining has increasingly intersected with crypto lending as companies like Mara look for innovative ways to generate additional revenue streams. By utilizing its substantial bitcoin reserves as collateral, Mara can engage in lending operations that provide liquidity while maintaining exposure to the cryptocurrency market. This approach exemplifies the transformative potential of bitcoin mining, where companies are not merely miners but are evolving into comprehensive financial entities—often referred to as ‘shadow banks.’ Through lending operations, miners can capitalize on their holdings while reducing the pressure to sell their assets during market downturns, thereby stabilizing their operations.

The shift towards a bitcoin-backed lending model is indicative of the broader changes occurring within the cryptocurrency ecosystem. As firms like Mara embrace these new business models, the lines blur between traditional financial practices and innovative crypto-centric approaches. The ability of bitcoin miners to operate in dual capacities—mining and lending—could redefine their role within the market, increasing their overall profitability while contributing to the burgeoning crypto lending space. This trend not only benefits individual miners but also enhances the liquidity and usability of bitcoin in the financial landscape.

Mara: The Largest Bitcoin Miner and Its Competitive Strategy

As the world’s largest publicly traded bitcoin miner, Mara’s competitive strategy hinges on its ability to adapt to the rapidly changing dynamics of the cryptocurrency market. With a market capitalization of $5.98 billion and a remarkable holding of 50,000 BTC, the company stands as a formidable player among bitcoin miners. These impressive metrics not only highlight Mara’s operational capacity but also reflect its resilience and strategic foresight in an industry often characterized by volatility. By continuously optimizing its mining processes and expanding its bitcoin treasury, Mara is positioning itself to outpace competitors and potentially seize market share from larger holders like Strategy.

The position of the largest bitcoin miner also allows Mara to influence market trends significantly. As it scales its operations, it brings a heightened level of market security and trust among investors who are increasingly turning to cryptocurrency assets. Furthermore, its innovative use of bitcoin convertible notes to raise capital showcases a strategic financial maneuver that aligns with the evolving interests of investors looking for exposure to bitcoin without direct ownership. As the narrative unfolds, Mara’s dual role as both miner and lender may solidify its reputation as a vital player in the future of cryptocurrency.

Understanding Bitcoin Convertible Notes and Their Impact on Mining Companies

Bitcoin convertible notes have emerged as a popular financing method among leading companies like Mara. By issuing these interest-free financial instruments, Mara can attract qualified investors who are eager to gain exposure to the booming bitcoin market. Convertible notes offer the advantage of minimal immediate financial burden while providing a potential to convert into equity, thus aligning the interests of the company with those of investors. This strategic financial maneuver not only raises essential capital for operational growth and bitcoin acquisition but also reinforces the company’s commitment to its stakeholders.

The implications of utilizing bitcoin convertible notes extend beyond immediate financial benefits. By integrating this financial instrument into its strategy, Mara signifies a shift towards more sophisticated forms of funding that cater specifically to crypto-related environments. This adaptation reflects a deeper understanding of investor dynamics and market trends, ultimately allowing Mara to navigate challenges that may arise in a volatile cryptocurrency landscape. As more mining companies adopt similar strategies, the overall financial health of the mining sector may improve, potentially leading to greater market stability.

Exploring the Concept of a Bitcoin Shadow Bank

The concept of a bitcoin shadow bank has surfaced as innovative companies like Mara forge new paths in the financial landscape. Shadow banks are entities that perform banking functions but operate outside of traditional regulatory frameworks. By leveraging their bitcoin holdings for lending purposes, companies like Mara serve as decentralized financial institutions, offering liquidity in the crypto market and generating returns without being classified strictly as banks. This evolution exemplifies how traditional banking principles can be blended with blockchain technology to create novel financial solutions for investors.

As Mara continues to amass its wealth of bitcoin, speculation surrounding its role as a shadow bank is gaining traction. The potential for mining operations to double as financial facilitators presents significant opportunities for both companies and investors alike. By cultivating a shadow banking model, Mara not only takes advantage of its bitcoin reserves but also taps into an underserved market of cryptocurrency lending. This innovative approach allows the company to enhance its profitability while providing necessary financial services within the crypto ecosystem, possibly redefining the discussions around mining firms and their contributions to the economy.

The Future of Bitcoin Miners and Their Financial Strategies

As the cryptocurrency landscape continues to evolve, the future of bitcoin miners like Mara will hinge on their ability to adapt and innovate. The financial strategies they employ will be crucial in navigating market fluctuations and meeting the needs of investors. With rising interest in bitcoin conversion to more conventional financial instruments—such as convertible notes—mining firms are at the forefront of shaping a new paradigm in finance that blends traditional approaches with the cutting-edge features of blockchain technology.

Furthermore, as miners explore alternative revenue streams, the potential for growth in areas such as crypto lending will likely expand. Bitcoin miners are no longer seen just as entity operations; they are becoming multifaceted players that can engage in lending, trading, and investment. By diversifying revenue sources, these companies can enhance their resilience against market changes and build a more sustainable business model that capitalizes on the myriad opportunities inherent in the growing cryptocurrency market.

Investing in Bitcoin: Benefits and Risks

Investing in bitcoin presents both enticing benefits and inherent risks. On one hand, the volatility of bitcoin prices can lead to substantial gains for investors who buy at opportune times. Its decentralized nature and limited supply contribute to its appeal, as many view bitcoin as a hedge against inflation and a new form of digital gold. Furthermore, significant investments from mining companies like Mara signal growing confidence in the cryptocurrency, potentially paving the way for increased mainstream adoption.

On the flip side, the risks associated with bitcoin investment cannot be overlooked. Price fluctuations can be dramatic, resulting in significant losses for investors unaware of market dynamics. Additionally, the regulatory landscape surrounding cryptocurrency continues to evolve, with potential legal implications for holders that could impact future prices. As miners like Mara continue to navigate these complexities, prospective investors must weigh the potential returns against the risks, creating a balanced approach to cryptocurrency investment.

Mara’s Impact on the Global Bitcoin Market

Mara’s position as the largest publicly traded bitcoin miner renders it a crucial player in the global bitcoin market. The company’s activities, particularly its substantial acquisitions, can create ripple effects throughout the cryptocurrency ecosystem, influencing market perceptions and investor behavior. With its reported ownership of 50,000 BTC, Mara stands as a robust counterbalance to larger players like Strategy who dominate the market. The presence of such a significant whale in the market may act as a stabilizing force, helping to manage price volatility resulting from speculative behaviors.

Moreover, as Mara continues to adapt and innovate within the mining sector, its strategies could serve as a benchmark for other miners and investors. The company’s foray into lending and the establishment of a shadow bank may inspire a new wave of financial models within the crypto industry. As more entities observe Mara’s trajectory, the potential for transformative practices across the crypto landscape increases, ensuring that the influence of leading miners extends beyond simple bitcoin production to encompass significant financial implications for the market at large.

Frequently Asked Questions

What impact does the Mara bitcoin acquisition have on the bitcoin mining industry?

The Mara bitcoin acquisition is significant as it positions Mara as the largest bitcoin miner with a strong financial backing of $950 million to acquire more BTC. This move not only strengthens their market position but also sets a precedent for other bitcoin mining firms to seek similar funding opportunities to grow their operations and BTC holdings.

How are bitcoin convertible notes used in the context of bitcoin mining?

Bitcoin convertible notes are a financing option that allows mining companies like Mara to raise capital without immediate equity dilution. Mara’s issuance of interest-free convertible notes enabled them to secure $950 million, which will be used to purchase additional bitcoin and support corporate growth, enhancing their mining activities.

Who is the largest bitcoin miner and how does it affect the bitcoin market?

Mara, formerly Marathon Digital Holdings, holds the title of the largest bitcoin miner in the world, with a market capitalization of $5.98 billion. As the largest bitcoin miner, Mara’s activities significantly influence the supply dynamics in the bitcoin market, impacting prices and liquidity through their substantial BTC holdings.

What is the concept of a bitcoin shadow bank and how does it relate to bitcoin mining?

A bitcoin shadow bank refers to entities like Mara that leverage their bitcoin holdings for lending to generate returns without being traditional financial institutions. In the case of Mara, their substantial BTC reserves allow them to lend out bitcoin and contribute to their revenue streams, providing additional financial flexibility in the competitive bitcoin mining landscape.

How does crypto lending relate to bitcoin mining companies like Mara?

Crypto lending is a service where companies lend their cryptocurrency holdings to others for a fee. For bitcoin mining companies like Mara, engaging in crypto lending with their significant bitcoin reserves can create an additional revenue stream, further facilitating their operations and providing capital for growth initiatives.

What are the future prospects for bitcoin miners following Mara’s recent fundraising?

Mara’s successful fundraising through the issuance of convertible notes signals a positive outlook for bitcoin miners. It suggests that mining firms can tap into innovative financial instruments to boost their capabilities. As more miners follow suit, we can expect heightened competition and advancements in bitcoin acquisition strategies, impacting the overall market.

| Key Point | Details |

|---|---|

| Mara’s Fundraising | Mara raised $950 million through interest-free senior convertible notes. |

| Market Position | Mara is the largest bitcoin mining company globally with a market cap of $5.98 billion. |

| Bitcoin Holdings | Mara holds 50,000 BTC, making it the second-largest bitcoin holder among publicly listed firms. |

| Comparative Holdings | Mara is far behind Strategy, which holds 607,770 BTC. |

| Use of Funds | The funds will be used for purchasing more BTC and general corporate needs. |

| Bitcoin ‘Shadow Bank’ Speculation | Mara is speculated to operate like a bitcoin ‘shadow bank’ by lending out BTC for a fee. |

Summary

Bitcoin mining has become a pivotal part of the cryptocurrency landscape, and Mara’s recent $950 million fundraising showcases its ambition to increase its Bitcoin holdings. With innovative funding strategies and a strong market presence, Mara positions itself as a significant player in the industry, potentially redefining its role as more than a mining entity but as a financial powerhouse leveraging its substantial BTC assets.