Bitcoin Mining Hardware: American Bitcoin’s 25 EH/s Aspirations

Bitcoin mining hardware is at the forefront of the cryptocurrency revolution, driving the immense computational power required to validate transactions and secure the network. As companies like American Bitcoin Corp (ABTC) emerge from established players such as Hut 8, the importance of sophisticated hardware is becoming increasingly evident. ABTC aims to scale its operations to a remarkable 25 EH/s, relying heavily on advanced mining technologies from manufacturers like Bitmain and MicroBT. However, the expansion of such ventures stands at risk due to potential geopolitical hurdles, particularly regarding the import of Chinese hardware. As U.S. tariffs could impact costs and availability, understanding the dynamics of Bitcoin mining hardware is crucial for industry participants and investors alike.

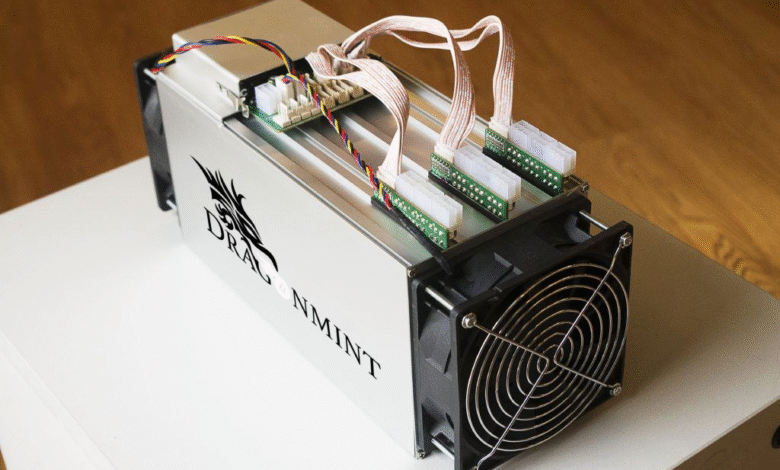

In the rapidly evolving landscape of cryptocurrency, mining equipment plays a pivotal role in supporting the integrity and efficiency of blockchain transactions. This essential technology, often referred to in industry jargon as mining rigs or ASIC miners, is vital for participants looking to harness the power of Bitcoin. Recent developments, such as those involving American Bitcoin Corp (ABTC) and its strategic alignment with established firms like Hut 8, showcase how advanced machinery from global suppliers can influence production capacity significantly. The heavy reliance on imported mining devices, especially from Chinese manufacturers, raises critical questions about supply chain stability and potential trade issues. Understanding the implications of these dynamics is essential for stakeholders invested in the burgeoning field of digital currency mining.

The Rise of American Bitcoin Corp (ABTC)

American Bitcoin Corp (ABTC) has emerged as a notable player in the rapidly evolving landscape of cryptocurrency mining, particularly with its roots in Hut 8. As it embarks on its journey towards becoming a publicly traded entity, ABTC aims to harness its affiliation with high-profile figures like Eric Trump and Donald Trump Jr. The strategic move to file an S-4 registration statement underscores ABTC’s commitment to transparency regarding its financial health and operational strategy. Positioned to scale its capacity to an impressive 25 EH/s, ABTC’s ambitions reflect a confident approach to leveraging its heritage while addressing current industry dynamics.

Key to ABTC’s growth strategy is its existing relationship with Hut 8 and their collaborative efforts in enhancing mining infrastructure. The detailed insights into ABTC’s mining operations reveal that this venture is not merely a statistical gamble; it is grounded in solid mining principles. Given the firm’s ability to mine approximately 135 BTC in its inaugural quarter since the launch, there are optimistic expectations for future performance as ABTC ramps up operations, signaling a competitive edge in the sector.

The Importance of Bitcoin Mining Hardware

One of the primary factors that will determine the success of any mining venture, including ABTC, is the quality and efficiency of the Bitcoin mining hardware utilized. Currently, ABTC capitalizes on a combination of Bitmain’s S21 series and MicroBT’s advanced M5X and M6X series miners. These state-of-the-art machines are integral to achieving the desired hashrate and, in turn, profit margins. The selection of specific brands influences not only operational efficiency but also overall cost-effectiveness, essential for competing in the crowded market of Bitcoin miners.

Moreover, as ABTC plans to expand its mining capacity through a significant agreement with Bitmain, its access to top-tier mining hardware underpins its ambitious thrust towards 25 EH/s. With the U3S21EXPH systems promising an output of 860 PH/s each, ABTC’s strategic acquisition of these units could position it as a frontrunner in the public mining sector. However, the reliance on cutting-edge Bitcoin mining hardware highlights a crucial dependency on suppliers, which may be impacted by geopolitical factors and tariffs on Chinese imports.

Navigating Geopolitical Challenges in Bitcoin Mining

As ABTC establishes its foothold in the competitive mining landscape, it faces significant geopolitical challenges that may influence its operational framework. The recent S-4 filing pointed out that the company’s dependency on Chinese sourcing for Bitcoin mining hardware may complicate their future. U.S. trade policies, particularly potential tariffs on imported mining equipment, raise crucial questions regarding ABTC’s cost management and scalability as it strives to enhance its mining operations.

Navigating through these complexities will require strategic agility on ABTC’s part. While tariffs could lead to elevated costs of mining hardware and disrupt supply chains, strategic partnerships with manufacturers and suppliers outside of China might mitigate risks. This scenario underscores the importance of assessing both current and future geopolitical landscapes, suggesting that ABTC must evolve quickly to maintain its growth trajectory amid changing international trade environments.

ABTC’s Financial Health and Mining Strategy

The financial blueprint laid out in ABTC’s S-4 registration statement provides a glimpse into the underlying financial mechanics of the budding mining operation. With a reported production cost of approximately $86,303 per BTC, the figures indicate a sizeable financial outlay, possibly hinting at the high power and maintenance costs relative to competitors. This data offers insights into the operational pressures faced by ABTC as it transitions from Hut 8’s proprietary mining narrative to a more industrialized, hosting-oriented platform.

As Hut 8 pivots towards bolstering its data center and power infrastructure, the potential for recurring revenue streams from ABTC emerges as a strategic advantage. By fostering a collaborative mining framework, ABTC could streamline cost structures and enhance overall profitability, proving critical in a sector that continuously wrestles with fluctuating crypto market dynamics. The careful balance between expenditure and revenue generation will be pivotal as ABTC crafts its identity in the evolving Bitcoin mining sphere.

The Future of Bitcoin Mining: ABTC’s Vision

Reflecting on ABTC’s burgeoning vision, it’s important to recognize the ambitious nature of its growth trajectory. With a firm commitment to achieving 25 EH/s, ABTC not only aims for numerical success but also to position itself among the elite publicly traded Bitcoin miners. As the company assesses its operational pathways, addressing both the technological demands and market volatility will be critical. Moreover, their reliance on advanced hardware like Bitmain’s products underscores the pivotal role that equipment plays in the success narrative.

ABTC’s vision for the future of Bitcoin mining transcends mere production capabilities; it seeks to embed itself as a leader with sustainable practices. Engaging in transparent operations and developing innovative strategies to counteract market challenges could pave the way for a new standard in response to competition and regulatory landscapes. By safeguarding its interests while navigating the complexities of the industry, ABTC is set to harness every opportunity that shapes its potential in the Bitcoin mining landscape.

Leveraging Hut 8’s Infrastructure and Expertise

The collaboration between American Bitcoin Corp (ABTC) and Hut 8 presents unique synergies that both firms can leverage to enhance their operational capabilities. Hut 8’s already established infrastructure allows ABTC to ramp up its mining operations efficiently, utilizing existing power resources and data centers. This integration serves not only to minimize initial capital outlays for ABTC but also accelerates the implementation timeline for reaching operational milestones like 25 EH/s.

Hut 8’s expertise in managing large-scale mining operations is an invaluable asset for ABTC, especially in navigating complex industry challenges. Through sharing knowledge on operational optimization and risk management, ABTC can fortify its mining strategy while ensuring that its production remains competitive. This relationship exemplifies a trend in the Bitcoin mining sector, where collaborations can create win-win scenarios for established players and new entrants alike.

Understanding the Hashrate Landscape and its Implications

In the world of Bitcoin mining, hashrate is a critical metric that determines a miner’s competitiveness and profitability. ABTC currently boasts a production capacity of 10.17 EH/s but targets a more ambitious level with the deployment of Bitmain’s cutting-edge miners. Understanding the implications of hashrate is pivotal; in essence, the higher the hashrate, the greater the chances of successful mining and revenue generation in a volatile market.

However, achieving and maintaining a high hashrate also incurs significant operational costs, further complicated by the dynamics of energy prices and maintenance expenses. ABTC’s strategic objectives revolve around optimizing these elements to ensure sustainable growth. By carefully analyzing the hashrate landscape and its correlations with market trends, ABTC can better position itself to capitalize on profitable mining opportunities, solidifying its place in the Bitcoin ecosystem.

The Role of Tariffs on Mining Hardware Acquisition

The intricate dynamics of international trade and tariffs play a crucial role in the acquisition of Bitcoin mining hardware. As highlighted in the S-4 filing, the potential for rising U.S. tariffs on Chinese-manufactured mining equipment presents a challenge for American Bitcoin Corp (ABTC). Depending on how these tariff policies evolve, ABTC may face increased costs, impacting its bottom line and strategic plans for scaling operations.

Moreover, the uncertainty surrounding tariffs necessitates that ABTC explore alternative supply chains or collaborate with hardware manufacturers beyond Chinese borders. This strategic pivot could not only mitigate risk but also diversify its mining operations more broadly. Understanding this landscape will be critical as the company integrates lessons learned from trade policies into their long-term growth strategies.

ABTC’s Competitive Positioning in the Bitcoin Mining Market

As ABTC prepares for a competitive entry into the public realm of Bitcoin mining, it must establish a clear positioning strategy within the crowded market. Key to this is not only achieving the targeted hashrate of 25 EH/s but also differentiating itself through technological innovation and operational efficiency. The strategic partnerships with leading hardware manufacturers, notably Bitmain, will provide a backbone for ABTC’s operations as it competes against established miners.

ABTC’s positioning will also hinge on its ability to adapt to market fluctuations and regulatory changes. As the Bitcoin mining ecosystem evolves, staying attuned to emerging trends and technological advancements will be vital. Successful positioning as a competitive mining operation will require ABTC to balance cutting-edge technology with strategic foresight, ensuring its relevance in an ever-changing industry.

Frequently Asked Questions

What Bitcoin mining hardware is used by American Bitcoin Corp (ABTC)?

ABTC utilizes a combination of Bitmain’s S21 series and MicroBT’s M5X and M6X series Bitcoin mining hardware to achieve a hashrate capacity of 10.17 EH/s at Hut 8’s facilities.

How does ABTC plan to increase its Bitcoin mining capacity?

ABTC aims to scale up to 25 EH/s primarily through a hosting agreement with Bitmain for the U3S21EXPH systems, which can deliver up to 860 PH/s each. This strategic partnership is key to ABTC’s growth plans.

What are the implications of relying on Chinese hardware for Bitcoin mining?

ABTC’s reliance on imported Bitcoin mining hardware from Chinese manufacturers raises concerns about potential U.S. tariffs, which could affect the cost-effectiveness of their mining operations and overall profitability.

Is ABTC affected by trade policies related to Bitcoin mining hardware?

Yes, the recent changes in U.S. trade policy and the possibility of increased tariffs on Chinese-made Bitcoin mining hardware could impact ABTC’s ability to import necessary equipment at affordable prices.

What are the financials of ABTC’s Bitcoin production in Q1 2025?

In Q1 2025, ABTC mined 135 BTC at a direct production cost of $11.65 million, which translates to approximately $86,303 per BTC, indicating significant operational costs associated with their Bitcoin mining approach.

Why did Hut 8 halt the publication of Bitcoin production updates?

Hut 8 halted its Bitcoin production updates as part of the strategic divestment of its self-mining operations to focus on hosting and infrastructure, leading to the formation of American Bitcoin Corp (ABTC).

What is the significance of ABTC’s merger with Gryphon Digital?

The merger with Gryphon Digital allows ABTC to prepare for going public, showcasing its financial strategies and growth plans in the Bitcoin mining sector, crucial for attracting investment.

How does the cost of the U3S21EXPH units compare to other Bitcoin mining hardware?

The maximum purchase price for 17,280 U3S21EXPH units is estimated at around $320 million, suggesting a cost of approximately $21/TH/s, which is competitive given the current market for Bitcoin mining hardware.

What production strategy is ABTC pursuing after its spin-off from Hut 8?

ABTC is focusing on a hosting strategy, moving away from proprietary mining operations to enhance infrastructure and support greater Bitcoin mining capacities through strategic partnerships.

What potential challenges does ABTC face in its Bitcoin mining operations?

ABTC may face geopolitical challenges stemming from its reliance on Chinese hardware manufacturers, including the risk of increased tariffs and potential delays in equipment imports.

| Key Point | Details |

|---|---|

| Company Overview | American Bitcoin Corp (ABTC), a spin-off from Hut 8, aims to go public and has filed an S-4 registration statement. |

| Hashrate Capacity | ABTC currently has a hashrate capacity of 10.17 EH/s and plans to reach 25 EH/s. |

| Mining Strategy | Relies on Chinese-manufactured hardware, particularly Bitmain’s S21 series and MicroBT’s M5X & M6X miners. |

| Financial Insights | In Q1 2025, ABTC mined 135 BTC at a production cost of $86,303 per BTC. |

| Growth Challenges | Potential U.S. tariffs on imported mining equipment could impact costs and operations. |

| Future Outlook | Completion of infrastructure for additional Bitmain miners could position ABTC among top miners. |

Summary

Bitcoin mining hardware plays a crucial role in the operations of companies like American Bitcoin Corp (ABTC). As ABTC maneuvers through its growth plans and geopolitical challenges, the reliance on Chinese-manufactured mining equipment becomes evident. With its ambitious target of reaching 25 EH/s in capacity, ABTC’s strategy underscores the importance of sourcing efficient and cost-effective Bitcoin mining hardware amid looming tariff threats.