Bitcoin Price Analysis: Bulls vs Bears at $110K

Bitcoin price analysis is crucial for navigating the ever-changing landscape of the cryptocurrency market. As Bitcoin currently trades around $107,338, traders and investors are closely monitoring price movements and market support levels to make informed decisions. Understanding Bitcoin price prediction models and employing effective Bitcoin trading strategies can significantly enhance trading success. In-depth Bitcoin technical analysis reveals key resistance areas, particularly the crucial $108,500 and $110,700 thresholds, which, if broken, may lead to substantial upward trends. Keeping a keen eye on cryptocurrency market trends and technical indicators will empower traders to maximize their returns in this volatile environment.

Examining the current state of Bitcoin and its price dynamics offers invaluable insights into the broader digital currency marketplace. The ongoing fluctuations around $107,338 illustrate the volatile nature of this leading cryptocurrency and highlight the importance of implementing sound trading strategies. Effective forecasting methods and a thorough understanding of support and resistance levels are essential for navigating potential market shifts. A detailed technical assessment of Bitcoin prices not only helps in recognizing future trends but also in aligning with the latest developments within the cryptocurrency ecosystem. As market participants strategize their next moves, nuanced interpretations of price behavior will play a pivotal role in achieving favorable outcomes.

Understanding Bitcoin Price Analysis

Bitcoin price analysis is crucial for traders looking to navigate the highly volatile cryptocurrency market effectively. Currently trading at $107,338, Bitcoin’s price has fluctuated between $106,556 and $107,572, indicating a period of consolidation. During this phase, technical indicators play a vital role in forecasting potential price movements. For instance, the recent bounce from the $98,240 support level signifies that there is substantial buyer interest at lower prices, which can offer opportunities for traders to enter at favorable levels.

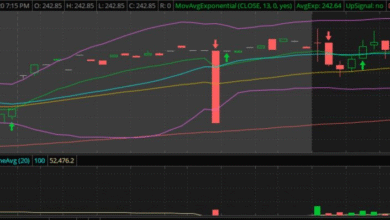

Analyzing Bitcoin’s price action through daily and 4-hour charts reveals critical resistance levels that traders aim to break. Immediate resistance is noted at $108,500, with a stronger barrier around $110,700. These levels are pivotal as they determine the market’s trajectory; a successful breach can signal continuation toward higher price ranges. Consequently, traders often employ techniques such as Fibonacci retracements and moving average analysis to identify strategic entry and exit points, aiding in better trade execution around these key price zones.

Market Support Levels and Their Significance

Market support levels, like the current $106,000 zone for Bitcoin, are essential for determining potential price reversals. Investors often view these levels as areas of high demand, where buying interest may outweigh selling pressure. Recent trading activity has shown that Bitcoin’s resilience above this support suggests bullish sentiment in the market. A sustained price above $106,000 may compel more traders to enter long positions, contributing to upward momentum and potentially pushing the price toward previously established resistance levels.

Additionally, understanding the dynamics of market support levels helps in developing effective trading strategies. For instance, if Bitcoin approaches the $106,000 support but shows weakening buying volume, traders might consider this a warning sign and evaluate their positions carefully. Technical indicators, such as relative strength index (RSI) readings, can also provide insights into whether a price bounce is likely. By closely monitoring these support levels, traders can manage their risk more effectively while capitalizing on price movements.

Cryptocurrency Market Trends Affecting Bitcoin

The cryptocurrency market is characterized by rapidly changing trends that are crucial for Bitcoin traders to understand. Currently, Bitcoin operates within a broader bullish framework, buoyed by positive market sentiment and robust demand post-recovery from earlier lows. Tracking movements in market capitalization, which stands at $2.13 trillion, can reveal underlying trends that impact Bitcoin’s price performance. With fluctuations in trading volume reaching $18.47 billion, such metrics indicate that investor interest remains strong, further propelling the price action.

Furthermore, analyzing the overall trend in the cryptocurrency sector shows a growing inclination towards institutional adoption and mainstream acceptance. As companies integrate Bitcoin into their balance sheets and investors diversify portfolios with digital assets, significant upward pressure could build. This macro trend creates an ideal environment for Bitcoin to push beyond critical resistance levels and achieve new milestones in valuation, supported by growing investor confidence.

Bitcoin Trading Strategies to Consider

Successful Bitcoin trading requires a well-defined strategy that capitalizes on market volatility and aligns with individual risk tolerance. With Bitcoin currently showing signs of upward momentum, traders might consider adopting a trend-following strategy that seeks to ride bullish waves while managing pullbacks. By employing techniques such as stop-loss orders and position sizing, traders can maximize profits while protecting their capital during price corrections.

Moreover, utilizing various technical analysis tools can also enhance effectiveness in trading Bitcoin. For instance, combining moving averages with oscillators like the MACD or RSI can provide critical insights into market conditions. As current forecasts suggest potential continuation toward the $110,700 resistance level, employing a mixed strategy of trend analysis and oscillators could optimize entry and exit points, ensuring that traders are appropriately positioned to benefit from price movements.

Technical Analysis: A Key to Bitcoin Trading

Technical analysis forms the backbone of informed Bitcoin trading decisions, allowing traders to assess market dynamics based on historical price movements and chart patterns. By examining the daily and 4-hour charts, it becomes evident that Bitcoin has established a robust bullish trend, which underscores the importance of monitoring key technical indicators. The current uptrend and potential for breakout above resistance levels like $108,500 present traders with strategic opportunities to enter the market or adjust their existing positions.

Moreover, understanding the implications of moving average convergence-divergence (MACD) and other oscillators enhances traders’ ability to make informed decisions. As the MACD maintains a bullish stance while other indicators show neutral readings, it indicates that Bitcoin’s upward momentum remains intact. This creates an environment where traders can optimize their moves based on real-time analysis, aligning their strategies with market sentiments and potential price fluctuations.

Bullish and Bearish Views on Bitcoin

Adopting a dual perspective on market conditions is crucial for Bitcoin traders as it prepares them for both bullish and bearish scenarios. The current bullish sentiment hinges on Bitcoin maintaining support above $106,000, with traders anticipating that a breakout past $108,500 could activate further upward momentum. If Bitcoin successfully pushes toward the $110,700 level, it may reinforce bullish sentiment and attract new entrants into the market. These conditions offer a favorable outlook for those employing momentum-based trading strategies.

On the other hand, traders must remain vigilant about bearish signals as well. Should Bitcoin fail to uphold the $106,000 support and continue to lack upward momentum, it could prompt a retracement toward the $103,000–$104,000 region. This potential downside emphasizes the importance of risk management strategies in trading, as detecting early signs of trend reversals can significantly mitigate losses. Ultimately, a balanced approach allows Bitcoin traders to navigate the market fluctuations more adeptly.

The Role of Market Volume in Bitcoin Price Movement

Market volume is a critical factor influencing Bitcoin price movement, providing insights into the strength of current trends. Current trading volumes hovering around $18.47 billion suggest a high level of engagement in Bitcoin trading, which may support price increases if maintained. When significant volume accompanies price movements, it often confirms the validity of the trend, whether bullish or bearish. Thus, monitoring volume trends alongside price action can be an essential strategy for traders looking to capitalize on Bitcoin’s volatility.

Conversely, diminishing volume can indicate indecision in the market, as observed in the current low-volatility environment. For example, the recent price compression between $106,350 and $107,794 highlights a lack of consensus among traders that may precede a breakout decision. In this context, traders should remain cautious and seek confirmation through a volume spike coupled with price movement to minimize the risks associated with false breakouts or reversals.

Leveraging Support and Resistance in Bitcoin Trading

In the world of Bitcoin trading, understanding support and resistance is essential for making well-informed decisions. The current analysis reveals significant support at $106,000 and resistance between $108,500 and $110,700. Traders often look for price action at these levels to identify potential buy or sell opportunities. By observing how Bitcoin reacts near these price thresholds, one can gauge market sentiment and adjust trading strategies accordingly.

Utilizing specified support and resistance areas can improve trading success rates. For instance, if Bitcoin bounces off the $106,000 support level with increased volume, it could be an indication for traders to enter long positions ahead of a potential rally. Conversely, rejection at resistance levels might prompt traders to exit positions or implement protective measures. This approach complements broader strategy frameworks, such as trend following or swing trading, and aids in developing a robust trading plan.

The Future of Bitcoin: Predictions and Possibilities

Looking ahead, Bitcoin’s future remains a topic of significant interest among traders and investors alike. Current price predictions suggest potential growth, especially if the cryptocurrency maintains its bullish trend and successfully clears resistance barriers like $110,700. As institutional interest continues to rise and more investors explore Bitcoin as a viable asset class, its price is likely to experience upward pressure, enhancing long-term price forecasts.

However, Bitcoin’s future is not without risks. Market volatility, regulatory changes, and geopolitical factors can all influence price behavior significantly. Traders must remain informed about the broader cryptocurrency landscape and utilize sound trading strategies to navigate these uncertainties. By focusing on technical analysis, market sentiment, and emerging trends, Bitcoin traders can position themselves to capitalize on future price movements effectively.

Frequently Asked Questions

What are the current trends in Bitcoin price analysis?

The latest Bitcoin price analysis highlights a consolidation phase around $107,338, with key resistance at $108,500 and support at $106,000. Observing the cryptocurrency market trends shows a bullish sentiment if the price overcomes the $108,500 mark. Traders should monitor trading strategies around these price points for optimal entry and exit.

How does Bitcoin price prediction inform trading strategies?

Bitcoin price prediction is essential for formulating effective trading strategies. Utilizing technical analysis, traders can identify pivotal support and resistance levels. Currently, with immediate resistance at $108,500 and support around $106,000, anticipating Bitcoin’s movement can guide decisions on when to enter or exit trades.

What are market support levels in Bitcoin price analysis right now?

In the current Bitcoin price analysis, the market support level is established at $106,000, reinforced by a strong bullish trend following a bounce from $98,240. Traders should consider this support level for potential re-entry points if prices pull back from their recent highs.

How significant are technical indicators in Bitcoin price analysis?

Technical indicators play a crucial role in Bitcoin price analysis by providing insights into market sentiment and potential trend movements. For instance, the presence of bullish candles and increased volume can signal ongoing strength, while oscillators indicate a neutral to bullish position, urging traders to watch for breakout opportunities around critical price levels.

What should traders look for in Bitcoin technical analysis?

Traders should focus on Bitcoin technical analysis by monitoring key price levels and volume trends. Currently, the $106,000–$108,500 range acts as a critical zone, with a potential bullish continuation if prices break past resistance. Observing oscillators and moving averages can also enhance understanding of market dynamics.

What factors contribute to Bitcoin price fluctuations in the analysis?

Factors influencing Bitcoin price fluctuations include market sentiment often indicated by technical indicators, trading volume behavior, and general cryptocurrency market trends. Recent price actions suggest a deliberation phase, which may lead to breakout scenarios as traders react to support and resistance levels.

How can traders use bullish divergence in Bitcoin price analysis?

Traders can apply bullish divergence in Bitcoin price analysis to identify potential reversal points. If the relative strength index (RSI) shows divergence while prices consolidate, especially near the $106,500 area, it may indicate a buying opportunity, suggesting an imminent upward movement.

What role do moving averages play in Bitcoin price analysis?

Moving averages are vital in Bitcoin price analysis as they help identify trends and support levels. Currently, all moving averages from 10 to 200 periods indicate a bullish scenario, with prices above these averages reinforcing the strength of potential upward movements in the market.

What are the implications of Bitcoin’s consolidation phase in price analysis?

The current consolidation phase in Bitcoin price analysis indicates potential indecision in the market, which can precede significant movements. This phase, reflected in the price range of $106,000 to $108,500, requires close monitoring for breakout signals that could shift the market trend.

How should traders react to resistance levels in Bitcoin price analysis?

Traders should approach resistance levels in Bitcoin price analysis with caution. Should Bitcoin break above the $108,500 resistance with supportive volume, it could signal a buy opportunity. Conversely, rejection near this level may indicate buyer fatigue, prompting traders to reassess their positions.

| Key Points | Details |

|---|---|

| Current Price | $107,338 (Market Cap: $2.13 trillion) |

| 24-Hour Volume | $18.47 billion |

| Key Support Level | $98,240 (acting as a demand zone) |

| Immediate Resistance | $108,500, followed by $110,700 |

| Potential Re-entry Zone | $103,000 to $104,000 (with reversal confirmations) |

| Key Price Range | $106,000 to $108,500 (sideways consolidation) |

| Price Action Insights | Low volatility; ideal for scalping near $106,500 |

| Momentum Indicators | Mixed; MACD bullish, RSI neutral |

| Bullish Conditions | Maintain above $106,000 and break $108,500 with volume |

| Bearish Risks | Fall below $106,000; potential retracement to $103,000–$104,000 |

Summary

Bitcoin price analysis indicates that while the cryptocurrency is currently trading near $107,338, it faces critical resistance and support levels that could shape its near-term trajectory. The market exhibits a bullish outlook if the price can break above $108,500 with volume, suggesting potential movement toward $110,700. However, if the price cannot maintain support at $106,000 and shows signs of weakness, we could see a downward correction toward the $103,000–$104,000 region. Therefore, keeping an eye on these key levels is essential for traders looking to capitalize on Bitcoin’s price movements.