Bitcoin Price Analysis: Steady Market Trends as of July 2025

In the world of cryptocurrencies, Bitcoin price analysis takes center stage as traders and investors seek to understand market dynamics and make informed decisions. As of July 14, 2025, the current Bitcoin price stands at an impressive $121,680, contributing to a robust market capitalization of $2.42 trillion. Notably, the Bitcoin trading volume within the last 24 hours reached $56.62 billion, indicating significant activity and interest in the market. Technical analysis has revealed a bullish trend, characterized by consistent price gains and a recent breakout. However, volatility remains, demanding careful attention to Bitcoin price prediction and potential shifts as the market evolves.

Understanding the fluctuations in Bitcoin’s value is crucial for anyone navigating the crypto landscape. Analyzing the Bitcoin market under various lenses, such as its performance metrics or the recent shifts in trading dynamics, reveals key insights. With the crypto landscape experiencing rapid changes, a thorough Bitcoin technical analysis can highlight possible future trends and forecast price movements. Observing the current market capitalization and trading volume provides a broader context for understanding Bitcoin’s recent performance and potential market behavior. As traders assess these factors, the focus on price action becomes paramount for effective decision-making.

Current Bitcoin Price Analysis

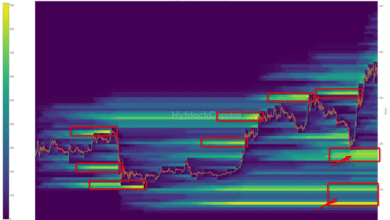

As of July 14, 2025, Bitcoin’s price is an impressive $121,680, reflecting a robust market sentiment among investors. This stability, amidst a fluctuating market landscape, suggests that Bitcoin is currently positioned favorably, having solidified its hold above the critical support levels. Notably, the current Bitcoin price has seen significant gains, climbing approximately 25% from earlier levels of $98,240, which indicates strong buyer interest and market confidence.

Moreover, the support levels now sit in the $110,000 range, a former resistance point that has transformed into a safety net for potential pullbacks. With Bitcoin’s market capitalization now towering at $2.42 trillion, it underscores the cryptocurrency’s strong market position and the increased interest from institutional investors. The sustained trading volume of $56.62 billion signifies active trading, further backing the stability of the current Bitcoin price.

Frequently Asked Questions

What factors influence the current Bitcoin price analysis?

The current Bitcoin price analysis is influenced by several factors, including market demand, trading volume, and overall market capitalization. As of July 14, 2025, Bitcoin’s price stabilized at $121,680 with a market cap of $2.42 trillion. Additionally, technical analysis indicates bullish trends, resistance levels at $123,000, and support around $110,000.

How can I interpret Bitcoin’s trading volume in price analysis?

Bitcoin’s trading volume is a crucial component of price analysis. A strong trade volume of $56.62 billion highlights market interest and can confirm price movements. For instance, recent data shows a notable volume spike during Bitcoin’s rise from $98,240 to a local high of $123,236, suggesting bullish momentum.

What role does Bitcoin technical analysis play in price prediction?

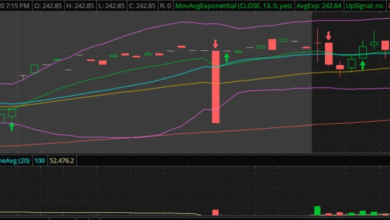

Bitcoin technical analysis is essential for predicting future price movements. Analysts examine charts and indicators such as the RSI, MACD, and moving averages. Currently, mixed signals such as a high RSI and declining momentum suggest potential short-term retracements, while the overall bullish trend points to upward potential.

How does Bitcoin’s market capitalization affect price analysis?

Bitcoin’s market capitalization directly relates to its price stability and overall market health. With a current capitalization of $2.42 trillion, it reflects Bitcoin’s strong position in the market. A high market cap often indicates sustained investor confidence, which could support ongoing bullish price action.

What are the key resistance levels found in Bitcoin price analysis?

In the current Bitcoin price analysis, key resistance is observed at the $123,000 level. This was identified due to previous high trading activity and price congestion. If Bitcoin can breach this level with strong volume, it may signal a continuation of the uptrend towards $125,000–$130,000.

What are the potential outcomes in Bitcoin price prediction based on recent analysis?

Recent Bitcoin price predictions suggest that while the trend remains upward, there are signs of exhaustion which could lead to short-term pullbacks. On one hand, breaking above $123,000 with volume could push towards $125,000; on the other, failure to do so may trigger a retracement to the $110,000–$112,000 support zone.

How do moving averages factor into Bitcoin price analysis?

Moving averages are pivotal in Bitcoin price analysis, providing insight into trend direction and momentum. Currently, all moving averages are signaling bullish trends, indicating that Bitcoin is trading significantly above its long-term baseline. This suggests a strong upward movement, albeit traders should be cautious of potential overextension.

| Key Point | Details |

|---|---|

| Current Price | $121,680 |

| Market Capitalization | $2.42 trillion |

| 24-Hour Trade Volume | $56.62 billion |

| Price Range (24h) | $117,935 to $123,236 |

| Recent Price Action | Bullish cycle with appreciation of approx. 25% |

| Resistance Levels | Around $123,000, support at $110,000 |

| 4-Hour Chart Insights | Structured rally but bearish signals post-high |

| 1-Hour Chart Insights | Parabolic trajectory cooling off with profit-taking |

| Technical Indicators | Mixed signals with overbought conditions noted |

| Moving Averages | All MAs indicate a bullish trend |

Summary

In conclusion, the Bitcoin price analysis indicates a robust and optimistic market sentiment as Bitcoin stabilizes at $121,680. With strong support levels and various indicators supporting a continuation of upward momentum, there remains potential for the price to breach $123,000, opening up possibilities for highs of $125,000 to $130,000. However, traders should remain cautious of recent bearish signals and profit-taking behavior, which could lead to short-term retracements. The overall outlook remains bullish, but vigilance around market movements is essential.