Bitcoin Price: Downtrend Persists Amid Mixed Signals

The Bitcoin price recently hovered around $103,891, indicating a persistent downtrend that has dominated market activity. As traders analyze cryptocurrency trends, the bear market has been further complicated by mixed technical signals. A deeper look into Bitcoin market analysis reveals potential trading strategies to navigate the current volatility, especially given the rejection at the critical $112,000 level. Observations show that a close below the $100,000 support could signal significant bearish momentum, emphasizing the importance of robust BTC trading strategies. Therefore, staying updated on Bitcoin price fluctuations and potential breakouts is essential for both investors and enthusiasts alike.

When discussing the current value of the leading cryptocurrency, one cannot ignore the ongoing bearish momentum engulfing the market. Recent fluctuations in the cryptocurrency ecosystem reflect broader economic sentiments and investor sentiments surrounding digital assets, especially Bitcoin. Analyzing price action can uncover vital trading strategies, shedding light on the nuances of market behavior in these turbulent times. This situation calls for a keen understanding of technical analysis for Bitcoin, informed by emerging trends and historical patterns. In this context, understanding the cryptocurrency landscape is crucial as prices revitalize or retreat.

Understanding the Current Bitcoin Price Trends

The Bitcoin price has recently been under significant pressure, trading around $103,891 while testing crucial support and resistance levels. Following a noteworthy rejection from the $112,000 mark, the market has been displaying a bearish bias, characterized by a series of lower highs and lower lows. Technical indicators suggest that if Bitcoin fails to hold the current support level between $100,000 and $102,000, it may trigger a more pronounced downtrend. This scenario is compounded by a consistent increase in selling volume, reflecting bearish sentiment among traders and investors.

Market analysis indicates that Bitcoin is currently experiencing a consolidation phase, with price action confined within a narrow intraday range. This stagnation is reflected in the oscillators, such as the RSI and stochastic indicators, which are signaling neutral conditions. As traders analyze the market, attention is focused on whether Bitcoin can reclaim the resistance levels around $108,000 to $110,000, which could provide a spark for upward momentum amidst ongoing market uncertainty.

Technical Analysis: Bitcoin’s Downtrend Signals

In recent technical analysis, the formation of a double-top pattern near the previous high has raised concerns for Bitcoin bulls, as it indicates a potential continuation of the downtrend. On the daily chart, the price action depicts strong resistance zones, suggesting that sellers are firmly controlling the market. The current bearish momentum is further supported by a close examination of moving averages, where short-term indicators are aligned bearishly against the price, indicating a prevailing trend favoring downward price movement.

Furthermore, the 4-hour chart reflects a descending pattern following another failed attempt to break above the $108,990 level. The presence of temporary support at $102,309 acts as a critical decision point for traders. If this level holds, it could lead to a short-term bounce, but sustained downward pressure may overpower bulls, pushing the price towards lower support levels. This conflicting environment underscores the importance of cautious trading strategies amidst mixed signals from various technical indicators.

Strategies for Trading Bitcoin in a Bearish Market

Given the current market conditions, traders should adapt their strategies to navigate the ongoing Bitcoin downtrend effectively. One crucial approach is to utilize short-term trading strategies, including scalping opportunities on price dips. During a bear market, identifying resistance levels, such as those around $106,000, is essential for executing profitable trades. Traders can consider opening short positions or using derivatives to capitalize on anticipated downward movements, particularly if strong volume accompanies price breaks beneath support.

Additionally, it is vital for traders to maintain a disciplined risk management strategy during these turbulent times. Setting stop-loss orders at strategic levels can protect positions from unexpected volatility while allowing traders to capture potential bounces without incurring substantial losses. By honing in on key support and resistance levels, along with employing appropriate trading tools, traders can position themselves strategically within the Bitcoin market, maximizing potential returns while minimizing risks during this prevailing downtrend.

Analyzing Bitcoin Market Sentiment and Its Impact on Price

Market sentiment plays a crucial role in shaping Bitcoin’s price movements, and current indicators suggest a cautious atmosphere among traders. With Bitcoin oscillating within a tight range and a lack of strong conviction in either direction, sentiment appears mixed, influencing trading behaviors significantly. Reports of increasing selling pressure amplify this cautious sentiment, prompting investors to adopt a more defensive posture as they await clearer signals.

The overall bearish market sentiment is also evident in the declining trading volume, indicating that many traders are hesitant to enter the market amid uncertainty. With the oscillators and moving averages mostly showing bearish signals, coupled with a neutral RSI, the market appears fraught with indecision. Nevertheless, as traders monitor Bitcoin price trends closely, shifts in sentiment, driven by external market news or broader economic factors, could lead to sudden volatility—underscoring the need for vigilance and adaptability.

Long-term Outlook for Bitcoin Amid Volatility

While the immediate outlook for Bitcoin indicates a predominance of bearish tendencies, it is essential for traders and investors to also consider the long-term potential of the cryptocurrency. Historical trends have shown that Bitcoin often undergoes periods of significant corrections followed by bullish recoveries. Analysts predict that if Bitcoin can stabilize above critical support levels and begin affirming its strength above $106,000, it may pave the way for a new bullish phase, attracting additional investment and driving prices back up.

However, the market remains sensitive to external factors, including regulatory developments and macroeconomic conditions, which could influence long-term trends. As more institutional players enter the cryptocurrency market, the dynamics of Bitcoin’s price movement may evolve, potentially leading to increased resilience against downturns. For now, a balanced perspective that appreciates both the bearish signals in the short term and the long-term upward potential is paramount for navigating the complex cryptocurrency landscape.

BTC Trading Strategies to Consider During a Downtrend

Amidst the current downtrend in Bitcoin prices, traders are encouraged to refine their BTC trading strategies to adapt to the bearish market environment. With short-term price declines anticipated, implementing a combination of stop-loss orders and profit-taking strategies can be effective. This allows traders to protect their investments and maximize profit potentials during upward corrections. Buying on dips can also be a viable approach; identifying critical support levels could provide lucrative entry points.

Moreover, using advanced technical analysis methods, such as Fibonacci retracements or moving average crossovers, can offer additional insights into potential price actions. These strategies facilitate better decision-making by providing clarity on potential resistance points, which could signal optimal times to exit positions. Engaging in educated trading backed by solid research and a responsive strategy allows BTC traders to capitalize on short-term opportunities while managing the inherent risks associated with trading in a downtrend.

Key Resistance and Support Levels to Monitor

In the context of Bitcoin’s ongoing downtrend, identifying key resistance and support levels is crucial for effective trading. As mentioned earlier, immediate support appears strong in the $100,000 to $102,000 range. A substantial breach below this threshold could result in a major downtrend, prompting increased selling pressure. Conversely, resistance levels are dominantly noted between $108,000 and $110,000. Until the price breaks and sustains above these resistance barriers, Bitcoin’s movement may continue to reflect bearish sentiments.

Understanding these levels enables traders to prepare for either scenario effectively. A break and close above resistance levels could signal a market recovery, enticing buyers and potentially reversing the downtrend. Conversely, consistent rejections at these levels could reinforce bearish strategies, leading to heightened selling activity. Keeping a keen eye on these technical levels is vital for traders aiming to navigate the fluctuating landscape of Bitcoin effectively.

The Role of Volume in Bitcoin’s Price Action

Volume is a critical factor in understanding the underlying strength of any price movement in financial markets, including Bitcoin. Analyzing trading volume alongside price action provides essential insights, especially during a downtrend. The current low trading volume coupled with price fluctuations indicates that traders are uncertain, making the potential for further declines plausible. High-volume selling days typically signify fear and panic among investors, underscoring the importance of volume analysis in gauging market depth.

Moreover, volume trends can reveal potential reversals or continuations of existing trends. For instance, if Bitcoin manages to rally past its resistance levels on increasing volume, this could signify renewed bullish sentiment and attract traders back into the market. Conversely, if price increases occur on declining volume, this may indicate a lack of conviction, suggesting the possibility of a downward reversal. Therefore, monitoring Bitcoin’s trading volume is vital for traders to make informed decisions about entries and exits, enhancing their overall market strategies.

Cautious Optimism Amidst Bitcoin Market Fluctuations

Despite the current bearish outlook for Bitcoin, there remains cautious optimism in the community. Investors are still focused on the potential long-term benefits of holding Bitcoin, as historical performance has shown that patience often pays off. Many experts believe that the conditions for an eventual price recovery are still intact, especially as institutional interest in cryptocurrencies continues to grow. With Bitcoin’s finite supply and increasing adoption, many investors maintain a bullish perspective over the long run despite short-term volatility.

This optimism tends to reinforce a solid psychological basis among Bitcoin supporters, who view price corrections as opportunities to accumulate more assets at lower prices. The general consensus indicates that once Bitcoin secures a firm base within established support levels, the market could transition into a bullish phase, rekindling enthusiasm among traders and investors. Thus, while the downtrend persists, maintaining a diversified portfolio and a long-term view can be prudent strategies for navigating this volatile market environment.

Frequently Asked Questions

What factors are currently affecting the Bitcoin price movements?

The recent Bitcoin price movements are heavily influenced by market analysis indicating a sustained downtrend following a rejection from $112,000. Key factors include bearish technical signals, dominant selling volume, and the formation of a double-top pattern. Support levels are crucial, especially around the $100,000 to $102,000 range, while resistance is anticipated at $108,000 to $110,000. Traders should consider these levels in their BTC trading strategies.

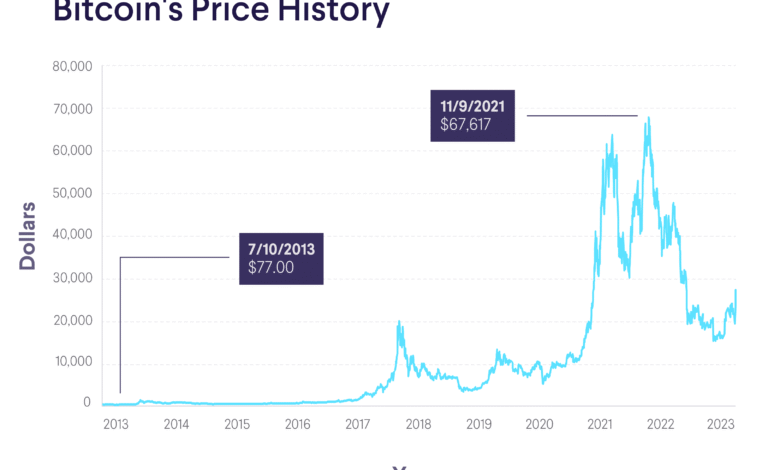

How does the current Bitcoin downtrend compare to previous trends?

The current Bitcoin downtrend, characterized by lower highs and lower lows, mirrors past bearish cycles where significant rejections from key resistance levels caused price declines. Technical analysis highlights this pattern and suggests that if the price closes below the $102,000 threshold, a deeper correction could unfold, marking a distinct phase in Bitcoin’s price history compared to previous trends.

What technical analysis tools can help predict Bitcoin price movements?

To analyze Bitcoin price movements effectively, traders often utilize various technical analysis tools such as moving averages, oscillators like the Relative Strength Index (RSI) and Stochastic indicators, and chart patterns. Currently, the bearish signals from short-term moving averages and neutral indicators like the RSI provide insights into potential price action, guiding cryptocurrency trading strategies.

Can we expect a recovery in Bitcoin price soon amid current conditions?

Although Bitcoin is currently facing a downtrend, there is potential for recovery if the price can sustainably surpass $106,000 with strong volume. The market remains in a transitional phase, and any bullish momentum will hinge on overcoming immediate resistance levels amidst the existing bearish sentiment.

How do volume trends affect Bitcoin price analysis?

Volume trends play a crucial role in Bitcoin price analysis. Spikes in volume during sell-offs indicate capitulation events, which can signal potential reversals or continuation of the trend. Currently, lower trading volumes alongside a downtrend suggest indecision in the market, impacting BTC trading strategies as traders seek clearer signals for potential price movements.

What should traders look for in BTC trading strategies during a downtrend?

During a downtrend, traders should focus on identifying key support levels, such as the $100,000 to $102,000 range, and resistance levels around $108,000 to $110,000. Scalping and shorting strategies may offer opportunities if they align with technical signals, including price bouncing within the $102,500–$103,000 range targeting exits around $104,000–$105,000, while being cautious of bullish reversals.

What does the Bitcoin market analysis suggest about future price predictions?

Current Bitcoin market analysis suggests a cautious outlook for future price predictions, with the potential for continued downtrend if pressure below the $102,000 mark is maintained. However, any bullish pushes supported by trading volume above key resistance levels could signal a shift that traders should monitor closely.

| Key Point | Details |

|---|---|

| Current Bitcoin Price | $103,891 |

| Market Capitalization | $2.065 trillion |

| 24-hour Trading Volume | $28.02 billion |

| Price Range (Intraday) | $102,624 to $106,087 |

| Support Level | $100,000 to $102,000 |

| Resistance Level | $108,000 to $110,000 |

| Market Sentiment | Bearish with potential for caution |

| Oscillator Signals | Mixed outlook; RSI at 46, Stochastic at 23 |

Summary

The current Bitcoin price is under keen observation as it continues to display bearish trends amid conflicting technical signals. Currently trading around $103,891, it has shown resilience in resisting breaks below support levels but remains under pressure as various indicators signal indecisiveness in market momentum. Investors should keep an eye on critical resistance and support levels as they navigate through the current consolidation phase.