Bitcoin Price Forecast: $120K As Stocks Tumble

As the cryptocurrency market evolves, the Bitcoin price forecast is capturing the attention of investors and analysts alike. Recent fluctuations in the financial landscape, particularly the significant decline in stock prices, have contributed to Bitcoin’s remarkable surge, positioning it as a potential safe haven asset. With Bitcoin recently testing the $119K mark, the ongoing analysis of cryptocurrency trends suggests that BTC price predictions are becoming increasingly optimistic. Market participants are keenly observing how Bitcoin navigates these turbulent times, particularly following financial market news that links external pressures to its performance. As Bitcoin’s influence grows, its trajectory presents both exciting opportunities and complex challenges for investors.

Exploring the realm of digital currencies, the Bitcoin market analysis reveals intriguing dynamics influencing its price movements. Recent shifts in global economic conditions have resulted in staggering gains, pushing Bitcoin to new heights. Investors and traders alike are looking closely at BTC forecasts, adjusting their strategies according to emerging data and cryptocurrency patterns. With the digital landscape constantly changing, understanding the nuanced factors that stimulate Bitcoin’s ascent is crucial for those engaged in this evolving financial ecosystem. In this context, the conversation around cryptocurrency tends to focus not only on Bitcoin but also on the broader implications for altcoins and the entire market.

Bitcoin Price Forecast: What Lies Ahead?

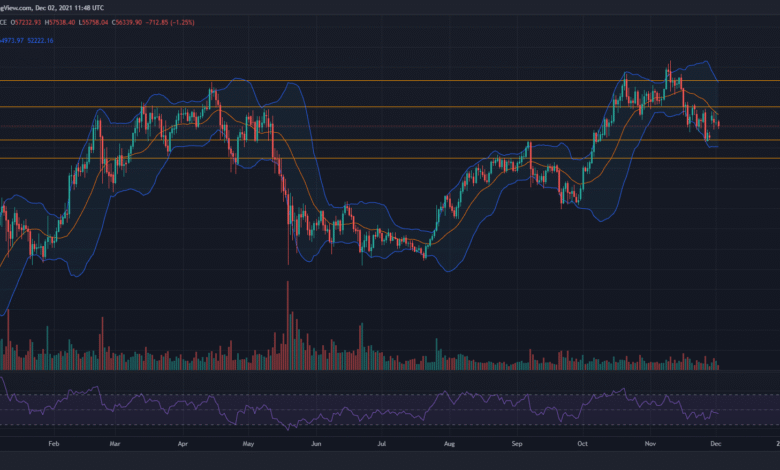

As Bitcoin continues its upward trajectory, many analysts are speculating about its future price movements. The recent surge towards the $120K mark raises questions about possible resistance levels and the broader implications for the cryptocurrency market. Investors are closely monitoring Bitcoin price forecasts, particularly amidst the volatility in traditional financial markets. Given recent trends, it’s essential to analyze how macroeconomic factors, such as inflation rates and monetary policies, might impact Bitcoin’s performance in the coming months.

Furthermore, the popularity of Bitcoin is not just defined by its price but also by its increasing adoption across various sectors. As Bitcoin solidifies its status as a store of value akin to digital gold, many forecasts suggest it could challenge traditional financial instruments. Key indications from the Bitcoin market analysis show that institutional demand remains robust, and as retail interest grows, projections for Bitcoin could see it breaking through new barriers, fostering a bullish sentiment among investors.

Impact of Stock Market Declines on Bitcoin

The declining performance of stock markets, specifically following President Trump’s recent trade announcements, showcases a divergent path for Bitcoin. While equities struggled, Bitcoin not only maintained its value but surged, indicating its potential as a safe-haven asset during turbulent financial times. The contrasting trajectories of Bitcoin and traditional stocks underscore a growing trend where investors look to cryptocurrencies for stability in an increasingly volatile economic landscape.

Market observers note that such stock market dips often prompt investors to reconsider their portfolios, possibly leading them towards Bitcoin as an alternative investment option. As financial market news unfolds, the narrative around Bitcoin as a hedge against economic instability continues to gain traction, suggesting that further stock volatility could open doors for new all-time highs in BTC prices. The current dynamic emphasizes the need for ongoing market analysis and a clear understanding of cryptocurrency trends.

Understanding Bitcoin Market Dynamics

The dynamics of the Bitcoin market are complex, influenced by a myriad of factors ranging from regulatory news to market sentiment. Recently, the Bitcoin market has been reacting strongly to geopolitical tensions and economic shifts, reflecting an environment ripe for rapid price changes. Analysts are diving deep into Bitcoin market analysis to identify patterns that can predict future movements, emphasizing the importance of staying informed amidst such volatility.

In addition to external economic factors, the behavior of traders plays a crucial role in shaping market dynamics. High liquidation rates, particularly among short sellers, highlight the risks inherent in betting against Bitcoin during bullish phases. The intertwining of trader psychology and market movements suggests that keeping an eye on psychology as part of the broader market strategy is vital for anticipating BTC price predictions, especially as the market continues to evolve.

Recent Bitcoin Surges: Key Highlights

Recent surges in Bitcoin prices have been closely linked to major developments within the cryptocurrency sphere. The inception of Bitcoin exchange-traded funds (ETFs) has attracted significant capital inflows, pushing Bitcoin to new highs. The notable rise in investment interest, particularly from institutional players, is seen as a catalyst for the current bullish momentum, drawing attention back to Bitcoin amidst the turmoil in traditional financial markets.

Additionally, Bitcoin’s ability to reach significant price levels, such as the recent peak of nearly $119K, signals a strong demand in the marketplace. This trend is further underscored by the growing sentiment surrounding Bitcoin as a digital asset, leading to heightened interest from new investors seeking exposure to cryptocurrency trends. As these surges continue, understanding the underlying factors driving this demand will be crucial for investors eyeing future opportunities.

Financial Market News Impact on BTC Prices

The intersection of financial market news with Bitcoin prices is an ever-evolving narrative that investors must navigate. Instabilities in fiat markets often correlate with increased interest in Bitcoin, recognized as a decentralized and borderless asset. As stock markets react negatively to geopolitical tensions and policy shifts, Bitcoin often finds itself in a favorable position, appealing to those seeking financial security outside traditional systems.

Moreover, the impact of real-time financial news can lead to volatile price swings for Bitcoin as investors react to developments promptly. Keeping abreast of financial market news helps investors anticipate potential price movements and adjust their strategies accordingly. Such awareness becomes particularly beneficial for those looking to capitalize on cryptocurrency trends, ensuring they are well-positioned to respond to market changes swiftly.

Bitcoin Dominance and Altcoin Performance

Surprisingly, while Bitcoin’s value has surged towards noted thresholds, its dominance in the market has slightly declined. This shift suggests that altcoins are gaining traction and potentially outperforming Bitcoin in certain segments of the cryptocurrency market. Increased performance in altcoins can indicate changes in investor sentiment, as traders diversify their portfolios beyond BTC, presenting new opportunities for growth in cryptocurrencies beyond the leading coin.

In light of these developments, market analysts are keen to explore the implications of Bitcoin’s declining dominance. This could represent a healthy shift toward a more balanced crypto market, where multiple assets gain recognition and value. Understanding these dynamics can empower investors to make informed decisions regarding their investments in both Bitcoin and altcoins, keeping an eye on future BTC price predictions in relation to the overall market landscape.

The Role of Trade Policies in Bitcoin Valuation

Trade policies possess a profound influence on Bitcoin’s valuation, especially amid rising geopolitical tensions. Recent tariffs imposed by the U.S. government have stirred concerns in the stock market, while Bitcoin appears less impacted, showcasing its resilience. This phenomenon prompts speculation on Bitcoin as an alternative asset in times of trade-related uncertainty, drawing investors looking to diversify their exposure to fluctuations in traditional markets.

Furthermore, the ongoing discussions about potential trade wars and economic sanctions can create an environment where Bitcoin thrives as a borderless currency. Such scenarios elevate Bitcoin’s utility as a medium of exchange in contrast to regulated fiat currencies, suggesting it may gain more traction among investors seeking stability during economic unrest. Observing how trade policies evolve will be crucial for understanding future BTC price predictions and market trends.

Future Influences on Bitcoin Price Movements

Looking forward, numerous influences could shape Bitcoin’s future price movements, including technological advancements, cryptographic improvements, and broader acceptance in global markets. The announcement of new developments in blockchain technology or significant partnerships could serve as catalysts for price rallies. Keeping an eye on industry changes will be vital for investors looking to navigate the market effectively.

Moreover, societal perceptions around Bitcoin are shifting, as more institutions adopt cryptocurrency into their operational practices. As a result, this broader acceptance could provide substantial upward momentum for prices, steering BTC towards new milestones in the approaching months. Investors must stay attuned to these evolving trends within the cryptocurrency sector, ensuring they’re primed to make strategic moves as fresh market opportunities emerge.

Investor Strategies Amidst Bitcoin Volatility

In the face of recent Bitcoin volatility, investors are reassessing their strategies to maximize opportunities within this dynamic market. Emphasizing a diversified investment approach that includes both Bitcoin and altcoins can mitigate risks while capitalizing on potential gains. With the correlation of Bitcoin price fluctuations to broader financial events, having a well-thought-out strategy can help investors navigate uncertain market conditions effectively.

Additionally, utilizing technical analysis and market sentiment indicators can empower investors to make informed decisions on entry and exit points. Given the high liquidity and trading volumes observed in the Bitcoin market, employing proper risk management tactics stands paramount for successfully capitalizing on sudden price movements. Overall, a proactive and informed strategy will be essential for success in the ever-evolving landscape of Bitcoin investing.

Analyzing Bitcoin’s Market Cap Growth

Bitcoin’s market capitalization reflects the overall confidence and investment in the digital asset space. As observed, Bitcoin’s market cap reached approximately $2.33 trillion, fueled by increasing demand from both institutional and retail investors. Such growth underscores the potential for Bitcoin as a primary catalyst within the cryptocurrency landscape, often serving as a bellwether for market trends and investor behavior.

The sustained growth in Bitcoin’s market cap is indicative of a larger acceptance of cryptocurrency as a legitimate asset class. This has been buoyed by positive sentiment driven by Bitcoin’s resilience against traditional economic fluctuations. As new players enter the market and the ecosystem evolves, tracking Bitcoin’s cap will offer insights into future price trajectories and the overall health of the cryptocurrency market.

Frequently Asked Questions

What is the current Bitcoin price forecast amid recent market trends?

The current Bitcoin price forecast is optimistic as BTC surged close to $120K recently, driven by unprecedented market activity and strong performances in spot bitcoin ETFs. Recent trading has shown BTC reaching highs of $118,856.47 with a stable increase in trading volume.

How do cryptocurrency trends influence Bitcoin price predictions?

Cryptocurrency trends have a significant impact on Bitcoin price predictions. Recent trends, such as strong market capitalization growth and increasing investor interest in Bitcoin ETFs, suggest a bullish sentiment, making analysts optimistic about BTC hitting new highs.

What factors could trigger Bitcoin surges in the upcoming months?

Several factors could trigger Bitcoin surges, including ongoing regulatory developments, market news regarding global financial stability, and increased adoption of Bitcoin as a hedge against inflation. The recent decline in the US Dollar Index also supports potential BTC uptrends.

Why did Bitcoin’s dominance decrease while its price surged?

Bitcoin’s dominance decreased despite its price surge due to several altcoins performing better, capturing a portion of BTC’s market share. This shift indicates a trend where investors may diversify into other cryptocurrencies while still holding Bitcoin as a core asset.

What does the financial market news suggest about the Bitcoin market analysis?

Financial market news suggests that the Bitcoin market is resilient even in the face of traditional market volatility. The recent rally reflects investor confidence in Bitcoin as an alternative asset class, especially amidst poor performance in the stock markets due to geo-political tensions.

Why is the Bitcoin price forecast reaching towards $120K important for investors?

Reaching a Bitcoin price forecast of $120K is pivotal for investors because it signals a potential new benchmark for BTC, likely attracting new capital inflows and encouraging bullish further investment in the cryptocurrency market.

What can investors expect from Bitcoin price predictions over the next few weeks?

Investors can expect Bitcoin price predictions to remain bullish over the next few weeks. Factors like increased trading volume, market interest in crypto ETFs, and possible macroeconomic shifts may support continued upward momentum in BTC prices.

| Key Point | Details |

|---|---|

| Bitcoin Price Movement | Bitcoin peaked at $118,856.47 before adjusting to $117K. |

| Impact of U.S. Politics | Trump’s tariffs on Canada caused stock market declines, while Bitcoin remained resilient. |

| Market Metrics | BTC trading volume increased by 86.52%, market cap around $2.33 trillion. |

| XRP Analysis | Some analysts forecast XRP price could reach between $4 to $6 with potential breakout signals. |

| Overall Trends | Bitcoin’s recent surge linked to strong ETF performance and weakening U.S. Dollar. |

Summary

The Bitcoin price forecast indicates that the cryptocurrency is heading towards $120K as it continues to gain support despite external market pressures. With recent movements demonstrating Bitcoin’s resilience against stock market volatility spurred by political events, many analysts remain bullish on its potential. The increased trading volume and market capitalization further highlight the growing interest and investment in Bitcoin as it solidifies its place in financial markets.