Bitcoin Price Forecast: Will July Bring a Volatile Surge?

As the cryptocurrency market evolves, the Bitcoin price forecast is more crucial than ever for investors and traders alike. With Bitcoin currently trading at around $106,537, understanding its future price trajectory through effective Bitcoin price prediction becomes essential for informed cryptocurrency analysis. The current BTC market trends suggest a volatility that could shape trading strategies in the upcoming months. Observers are keen on Bitcoin’s movement, especially looking ahead to the noted volatility in July 2025, making it imperative for traders to adapt their Bitcoin trading strategies accordingly. Keeping an eye on the latest market shifts will enable participants to navigate the unpredictable waters of Bitcoin volatility and capitalize on emerging opportunities.

In today’s rapidly changing digital finance world, insights into Bitcoin’s potential price movements are paramount for savvy investors. The future performance of this leading cryptocurrency hinges on a variety of market forces, including trading patterns and fluctuations in investor sentiment. As market analysts delve into Bitcoin forecasting, they emphasize the need for thorough cryptocurrency evaluations to decipher upcoming trends. This analytical approach also aids in preparing effective trading tactics and anticipating the possibility of significant fluctuations in the Bitcoin market by mid-2025. Understanding these dynamics is crucial for anyone looking to optimize their investment decisions in this volatile environment.

Understanding Bitcoin Price Forecasts for July 2025

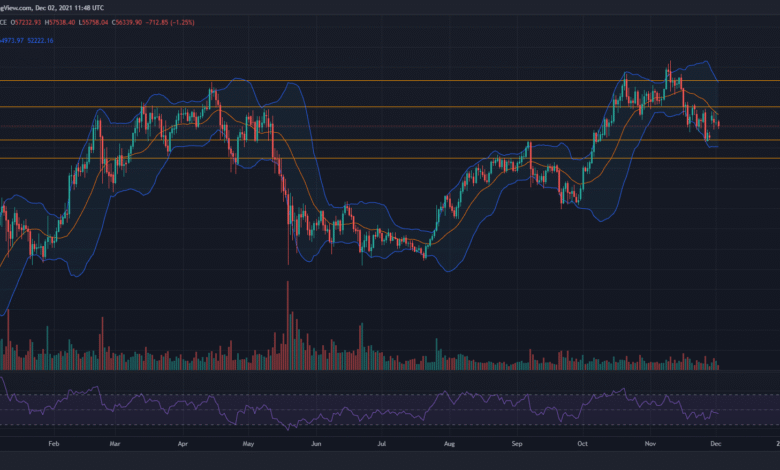

As we analyze the Bitcoin price forecast for July 2025, it’s crucial to consider the current market dynamics and historical trends that can influence price movements. Currently trading around $106,537, Bitcoin presents a mixed outlook where bearish sentiments have arisen from recent price fluctuations. Traders are closely monitoring key support levels, particularly the $106,000 mark, which, if breached, could lead to further downward pressure towards the $100,000 range. Technical indicators suggest a cautious approach, as the market exhibits signs of indecision and potential volatility.

Additionally, potential Bitcoin trading strategies are essential to navigate this uncertain landscape. Utilizing tools such as Fibonacci retracements and moving averages can help traders identify possible entry and exit points. For example, the 10-period SMA suggests a buy signal, which may encourage long-term investors to maintain their positions despite the short-term pressures. Moreover, since historical data reveals that July can often bring volatility in BTC market trends, informed predictions and meticulous analysis are vital for making educated investment decisions.

Key BTC Market Trends Impacting Price Movements

Recent BTC market trends reveal a pattern of volatility that has traders both cautious and opportunistic. Bitcoin’s failure to maintain breakout levels above $108,800 has created a scenario where market participants are keenly watching for signs of stability or further decline. Intraday trades are characterized by weak bounces around $107,500 to $108,000, signaling potential short entry points for day traders. These fluctuations are indicative of a market grappling with bearish pressure, and traders must adapt to the sentiment shifts that can occur rapidly.

Moreover, the analysis of Bitcoin volatility, particularly throughout July 2025, shows how external factors such as regulatory news, geopolitical events, and macroeconomic indicators can contribute to price fluctuations. The Cryptocurrency analysis suggests that keeping abreast of news cycles is integral to predicting moves within the market. With indicators showing a bearish engulfing pattern forming near $108,000, preparation for downward momentum may provide traders with lucrative shorting opportunities, provided they are equipped with effective trading strategies.

Crafting Effective Bitcoin Trading Strategies

Developing effective Bitcoin trading strategies is paramount in a market characterized by rapid price movements and uncertainty. Traders are currently facing decisions on whether to adopt a long or short position based on Bitcoin’s current support levels and resistance zones. The recent analysis indicates that maintaining positions near the $102,000-$103,000 range may offer a strategic setup for those looking to capitalize on potential rebounds. Furthermore, observing trading volumes can provide insights, as increased volume often precedes significant price changes.

Additionally, implementing risk management techniques such as stop-loss orders can shield traders from substantial losses amidst volatility. It is also advisable to utilize technical indicators such as the RSI and MACD alongside charts to find confluences that support trade decisions. By blending technical analysis with market sentiment, traders can create a more robust Bitcoin trading strategy, thus enhancing their potential for profitability in diverse market conditions.

Analyzing the Bear and Bull Verdicts for Bitcoin

The ongoing battle between bearish and bullish sentiments in the Bitcoin market is especially pronounced as of July 2025. A bullish outlook hinges on the ability of Bitcoin to hold the crucial $106,000 support level. If buyers re-enter the market around the $102,000-$103,000 zone, we could witness a resurgence in upward momentum, potentially pushing the price towards $110,000 and beyond. This scenario is reinforced by the bullish structure indicated by moving averages, which still signal strength despite recent pullbacks.

Conversely, if the support at $106,000 fails to hold, the bearish case becomes stronger, suggesting a decline into the $103,000-$100,000 range. Observations of oscillator readings and intraday trading patterns further validate this bear verdict, indicating a possible swift acceleration downward, especially if the price dips below $98,000. Adapting trading strategies to align with these scenarios can be vital for traders looking to manage their portfolios effectively amid the prevailing volatility.

Technical Indicators: Gauging Bitcoin’s Market Sentiment

Understanding and interpreting technical indicators is essential for gauging Bitcoin’s market sentiment. Currently, the relative strength index (RSI) at 52 suggests an equilibrium between buyers and sellers, reflecting indecision in the market. Meanwhile, the stochastic indicator indicates overbought conditions, prompting a sell signal that may lead to short-term corrections. These indicators can offer traders clues about potential entry points, highlighting the importance of combining them with market analysis for a comprehensive view.

The moving averages further emphasize the market’s mixed signals, with short-term averages triggering sell signals while longer-period averages indicate continued bullish sentiment. This divergence necessitates a flexible trading approach, allowing traders to navigate the intricacies of Bitcoin price movements effectively. By continuously monitoring these indicators and updating strategies accordingly, traders can aspire to make informed decisions that respond to rapid market changes.

Long-Term Perspectives on Bitcoin’s Price Dynamics

Adopting a long-term perspective on Bitcoin’s price dynamics is vital for investors looking to ride out volatility. The overarching trend remains bullish, supported by long-term moving averages that continue to issue buy signals, showcasing the resilience of Bitcoin in the larger scheme. While short-term fluctuations can lead to panic selling, those with a longer investment horizon may find value in the current price range as a potential accumulation phase.

Moreover, understanding macroeconomic factors and cryptocurrency adoption rates can provide insights into future price trajectories. As institutional investments and positive regulatory news catalyze greater mainstream acceptance, the long-term outlook for Bitcoin remains promising. Investors should leverage comprehensive market analyses and adopt strategies that align with this bullish potential, capitalizing on dips and maintaining positions through market fluctuations.

Navigating Bitcoin’s Intraday Trading Opportunities

With Bitcoin’s market experiencing notable volatility in July 2025, identifying intraday trading opportunities has become a pivotal strategy for engaged traders. The capability to capitalize on short-term price fluctuations can determine profit margins, especially in uncertain market conditions. Recent trading patterns have shown that Bitcoin’s prices fluctuate within specific ranges, allowing traders to leverage these movements through well-timed trades.

Intraday traders should focus on crucial support and resistance levels, employing techniques like scalping and day trading to maximize their returns. Close monitoring of volume trends, combined with oscillators like the RSI and stochastic indicators, can further refine trading strategies. By employing a disciplined approach and adhering to established trading plans, investors can effectively navigate the rapidly changing landscape of Bitcoin’s pricing.

The Future of Bitcoin: What Lies Ahead

Looking to the future, Bitcoin’s journey remains fraught with both opportunities and challenges. As various economic and technological factors converge, understanding potential scenarios that could unfold is essential for predicting price movements. The cryptocurrency market tends to respond sharply to news events, regulatory changes, and macroeconomic shifts, all of which could significantly impact Bitcoin’s trajectory. Traders need to stay informed and adaptable to capitalize on these evolving circumstances.

Additionally, with technological advancements driving cryptocurrency utility and further integration into financial systems, the future of Bitcoin could witness enhanced demand dynamics. A potential mainstream shift towards digital currencies might solidify Bitcoin’s stature, driving its price higher in the long term. Awareness of upcoming trends and a solid grasp of the market’s driving forces can empower traders to make strategic decisions that align with Bitcoin’s evolving landscape.

Frequently Asked Questions

What is the current Bitcoin price forecast for July 2025?

As of July 1, 2025, the Bitcoin price forecast is approximately $106,537, reflecting its trading conditions and overall market capitalization of $2.11 trillion. Analysts are monitoring for potential fluctuations as Bitcoin may encounter volatility in the coming weeks.

How does Bitcoin volatility affect price predictions?

Bitcoin volatility plays a significant role in price predictions as it can lead to rapid price movements. Currently, the Bitcoin price forecast suggests a cautious approach, particularly with recent fluctuations between $106,000 and $108,000. Traders should be aware of these dynamics when planning their crypto strategies.

What are the key indicators influencing Bitcoin price predictions this July?

Key indicators influencing Bitcoin price predictions this July include the Relative Strength Index (RSI), which is currently at 52, indicating equilibrium, and the stochastic %K reading suggesting overbought conditions. Additionally, the support at $106,000 is crucial for determining potential price movements.

What Bitcoin trading strategies should be considered given the current market trends?

Given the current market trends, traders should consider short-term strategies, such as monitoring entry points around $106,000–$107,500 while setting profit-taking targets near the $108,000 resistance. Observing the timing of market breakouts and managing stops is essential for navigating Bitcoin’s price volatility.

Are there any bearish signals to watch for in Bitcoin’s price forecast?

Yes, there are several bearish signals in Bitcoin’s price forecast. The bearish engulfing pattern on the daily chart, coupled with the risk of declining below the $106,000 support could lead to further price drops towards the $100,000 range. Traders should remain vigilant as these signals may indicate increased selling pressure.

What potential does the Bitcoin price forecast hold for a bullish reversal?

The Bitcoin price forecast may show potential for a bullish reversal if the price holds above the $106,000 support and buyers re-enter around the $102,000–$103,000 zone. This could signal a resumption of the longer-term uptrend if resistance at $108,000 is subsequently breached.

What market trends should investors monitor for Bitcoin price prediction accuracy?

Investors should monitor several market trends for accurate Bitcoin price predictions, including overall market sentiment, trading volumes, and technical indicators like moving averages. Current trends depict a mixed environment, indicating potential opportunities for both bullish and bearish strategies.

How do Bitcoin trading strategies adapt to market volatility?

Bitcoin trading strategies must adapt to market volatility through careful analysis of price levels and technical indicators. Strategies such as scalping near established support levels and employing stop-loss orders can help mitigate risks associated with sudden price swings in Bitcoin’s trading activity.

What are the implications of the 10-period moving average on Bitcoin’s price forecast?

The 10-period moving average indicates a sell signal at $106,607, while other longer-period moving averages suggest a buy. This divergence highlights the necessity for traders to consider both short- and long-term market conditions when evaluating the Bitcoin price forecast.

| Key Metrics | Details |

|---|---|

| Current Price | $106,537 |

| Market Capitalization | $2.11 trillion |

| 24-Hour Trading Volume | $21.87 billion |

| Price Range (Intraday) | $106,544 – $107,938 |

| Short-term Support Level | $106,000 |

| Resistance Level | $108,000 |

| Long-term Support Levels | $102,000 – $103,000 |

| Bearish Signal | Break below $106,000 could lead to $100,000 |

Summary

The Bitcoin price forecast indicates a complex trading scenario as we head into July 2025. Despite its current valuation of $106,537, market indicators suggest both cautious bullish and bearish sentiments. The critical support at $106,000 is a focal point for traders; a breach could trigger further declines towards the $100,000 range. Conversely, if Bitcoin can hold this level and push through resistance at $108,000, there’s potential for a rally towards $110,000 and beyond. Investors should remain vigilant and adaptable to market movements.