Bitcoin Price Prediction: Can It Break Through $110K?

Bitcoin price prediction is at the forefront of discussions in the cryptocurrency community, especially as market dynamics fluctuate. Today, Bitcoin is hovering around $108,220, showcasing significant resilience and a potential breakout towards the elusive $110,000 barrier. With a strong market capitalization and a steady trading volume of $10.41 billion, the current BTC price today reflects a consolidation phase that hints at favorable Bitcoin market trends. Traders and enthusiasts are keenly analyzing Bitcoin price analysis to anticipate future movements, particularly focusing on breakout potential that could lead to new record highs. As we explore the cryptocurrency price forecast, understanding the underlying technical indicators will provide clarity on Bitcoin’s forthcoming trajectory in this volatile landscape.

The future of Bitcoin’s valuation is drawing increased attention as investors seek insights into its potential price movements. This digital currency, known for its volatility, is currently experiencing a critical moment as it tests key resistance levels. With ongoing discussions centered around the cryptocurrency’s growth trajectory, participants in the market are keen to decode Bitcoin’s potential surge or decline. Analysis of market trends, trading volumes, and investor sentiment plays a pivotal role in shaping expectations around BTC’s price movement. As we delve deeper into these factors, the conversation around Bitcoin’s forecast and its impact on the financial market becomes even more pertinent.

Current Bitcoin Market Trends

Bitcoin has emerged as a frontrunner in the cryptocurrency arena, especially with its recent price movement reflecting significant market trends. As of today, Bitcoin is trading around $108,220, indicating a strong position within the cryptocurrency hierarchy. Observing the volatility throughout the day, with fluctuations ranging between $107,138 and $108,320, indicates that traders are actively engaged in buying and selling, thereby contributing to a robust trading volume of $10.41 billion. When examining these market dynamics, it is evident that Bitcoin has managed to maintain its market capitalization of $2.15 trillion, which underscores its resilience even during consolidation phases.

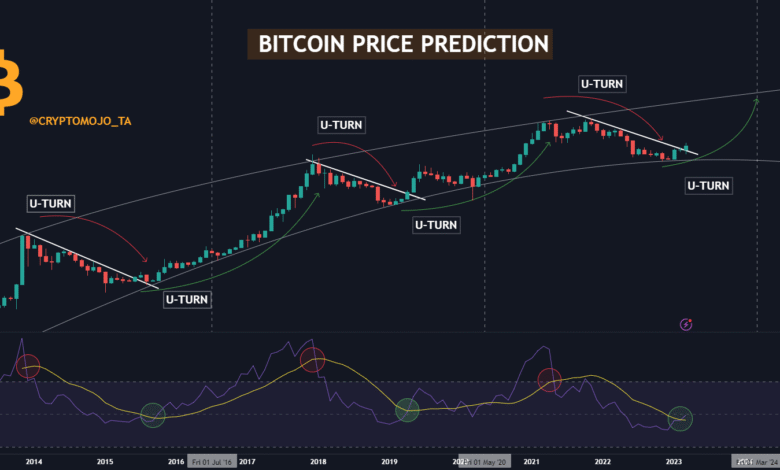

The Bitcoin market trends highlight a bullish sentiment that has been building up over recent weeks. With the price correction from a high of $110,789 to a low of $98,240, traders are paying close attention to the possible breakout above the $110,000 resistance level. Expert analysts suggest that this level, if crossed with high volume, could confirm the beginning of a significant price rally. As we continue to monitor Bitcoin’s movement, key trading indicators such as moving averages and oscillators will play an essential role in determining the potential direction of BTC prices.

Frequently Asked Questions

What is the current Bitcoin price prediction for today?

As of now, Bitcoin’s price prediction indicates that BTC trades around $108,220. Analysts observe a potential breakout above the $110,000 resistance, which could signal a continuation of the bullish trend.

How does Bitcoin price analysis look for the next week?

The Bitcoin price analysis suggests a bullish sentiment this week. With key support levels established at $103,000 and $98,000, a positive breakout above the $110,000 barrier could lead to increased interest and potential price gains.

What are the key Bitcoin market trends influencing the price forecast?

Current Bitcoin market trends show a strong bullish momentum characterized by a recent V-reversal from the lows of $98,240. Increased trading volume and consolidation patterns are indicating a potential upward movement in price.

What factors could lead to a BTC price breakout?

A breakout in BTC price could occur if Bitcoin holds above the consolidation zone, especially if high trading volumes accompany a rise past the $110,000 resistance level. This scenario would indicate strong buyer confidence and possibly lead to new highs.

Can understanding cryptocurrency price forecasts help in trading Bitcoin?

Yes, understanding cryptocurrency price forecasts, including key support and resistance levels, trading volume, and market trends, can significantly aid traders. Analyzing these factors allows for informed decisions and potential entry points for bullish positions.

What levels should traders watch for in Bitcoin’s price prediction?

Traders should closely monitor the levels of $106,800 for short-term support, and $110,000 for potential breakout resistance in Bitcoin’s price prediction. Staying attentive to these levels will help navigate the volatility in the market.

What does the technical analysis reveal about Bitcoin’s price direction?

The technical analysis indicates a bullish outlook for Bitcoin with strong alignment across major moving averages. Indicators like the MACD and momentum support upward movement, while the neutral bias from oscillators suggests caution at overbought conditions.

How significant are volume levels in Bitcoin price prediction?

Volume levels are critical in Bitcoin price prediction as they validate price movements. High trading volumes during breakouts can confirm bullish trends and indicate sustainable upward momentum, while declining volumes may signal potential reversals.

What role do moving averages play in Bitcoin price analysis?

Moving averages are essential in Bitcoin price analysis as they provide clear support and resistance levels. Currently, strong bullish alignment across the 10-day to 200-day moving averages signals a solid uptrend, enhancing the validity of bullish forecasts.

Is it a good time to invest based on Bitcoin’s price trends?

Based on Bitcoin’s current price trends, with the potential for a breakout above $110,000 and solid major moving averages, it may be a favorable time to consider investing, provided that traders manage risk and watch for volume confirmations.

| Key Points | Details |

|---|---|

| Current Price and Market Cap | Bitcoin traded at $108,220 with a market cap of $2.15 trillion and a 24-hour trading volume of $10.41 billion. |

| Price Fluctuations | Intraday trading range: $107,138 – $108,320, indicating consolidation below $108,000. |

| Recent Price Action | Robust V-reversal from the correction; approaching near $110,000 resistance. |

| Key Support Levels | Support at $103,000 and $98,000 based on previous buying activity. |

| Bullish Signals | Breakout above $110,000 with high volume could signify long-term uptrend continuation. |

| Medium-Term Perspective | A bullish flag formation on the 4-hour chart suggests upward potential. |

| Short-Term Momentum | 1-hour chart shows consolidation followed by upward moves; consider entries at $107,700 – $108,000. |

| Oscillator Indicators | RSI at 59 indicates no overbought/oversold; MACD suggests bullish momentum. |

| Moving Averages | Strong bullish alignment across all MAs; support at 10-day EMA ($106,462) and SMA ($105,524). |

| Conclusion | Bullish outlook supports potential for an upward price continuation, but caution remains if key support levels are breached. |

Summary

Bitcoin price prediction indicates a promising trajectory as Bitcoin approaches a key resistance level of $110,000. Recent price actions reflect a strong bullish sentiment, supported by solid moving averages and momentum indicators. However, traders are advised to monitor for potential pullbacks at crucial support levels to ensure optimal entry and exit strategies. If Bitcoin breaks above the $110,000 barrier with substantial volume, it could pave the way for new highs, affirming the prevailing uptrend.