Bitcoin Price Prediction: Global Liquidity Surge Explained

Bitcoin price prediction is a hot topic as the cryptocurrency market braces for a potential surge fueled by unprecedented global liquidity. With the M2 money supply soaring to an astounding range of $95 trillion to $96 trillion, many analysts believe that Bitcoin could see significant gains in the near future. Observations from social media and forums highlight a growing consensus that the influx of liquidity will create a favorable environment for Bitcoin’s growth, suggesting its price could explode by 2025. As discussions around the relationship between Bitcoin and inflation gain traction, enthusiasts are closely examining cryptocurrency market trends. By analyzing Bitcoin price fluctuations through the lens of global economic indicators, investors aim to decode its next move amid these uncertain financial waters.

When exploring forecasts for Bitcoin’s future value, one cannot overlook the intertwined influence of monetary policy and digital currencies. Terms like ‘Bitcoin expectations’ and ‘cryptocurrency growth’ frequently surface in discussions about the evolving landscape of value storage and investment. With the expanding liquidity in global markets, many investors are pondering the possibilities for Bitcoin’s price escalation over the coming years. Cryptocurrency enthusiasts are closely monitoring indicators such as the M2 money supply and inflation rates to anticipate potential shifts in investor sentiment towards assets like Bitcoin. In this rapidly shifting financial environment, understanding these dynamics becomes essential for anyone looking to navigate the cryptocurrency terrain.

Bitcoin Price Prediction: The Role of Global Liquidity

As we look toward 2025, the Bitcoin price prediction has become increasingly optimistic, especially against a backdrop of soaring global liquidity. Having witnessed significant growth in the M2 money supply—with figures hitting between $95 trillion and $96 trillion—many analysts believe this financial influx will favor digital currencies. Historically, large increases in liquidity have correlated with soaring asset prices, and Bitcoin is no exception. By evaluating past trends, we can project that Bitcoin could potentially reach highs of $150,000 as liquidity continues to pour into the financial systems.

The anticipation surrounding Bitcoin is largely tied to its finite supply and the increasing demand for digital assets as part of investment portfolios. With global M2 expected to grow annually by 8% to 10% through 2025, Bitcoin’s role as a store of value becomes even more pronounced. The theory is that as more liquidity enters the market, more investors will turn to Bitcoin as a hedge against inflation, magnifying its price potential. Therefore, incorporating Bitcoin price prediction models into financial strategies is becoming vital for investors aiming to capitalize on this looming liquidity surge.

M2 Money Supply: Catalyst for Bitcoin Price Growth

The recent trends in the M2 money supply highlight its significant influence on financial markets, particularly in the context of cryptocurrency. As central banks around the world, including the U.S. Federal Reserve and the Bank of Japan, aggressively expand their balance sheets, Bitcoin fans are buzzing about how this could escalate its price. M2 encompasses all cash equivalents within the economy, so as it climbs, the availability of money for investment also rises, which could create a perfect storm for Bitcoin price growth. Many cryptocurrency advocates argue that this surge in monetary supply provides both liquidity and momentum, essential ingredients for bullish market behavior.

Furthermore, economic theories reveal that increased liquidity can lead to inflationary pressures, thereby boosting demand for alternative assets like Bitcoin. When more money chases the limited supply of Bitcoin, it is expected to drive prices upwards. Historical correlations between M2 increases and Bitcoin price trends suggest that as M2 rises, investor sentiment typically shifts favorably towards cryptocurrencies, positioning Bitcoin for robust gains. Traders and analysts alike are closely monitoring this correlation, with many citing it as a primary driver of future Bitcoin price analysis.

Navigating Cryptocurrency Market Trends with Bitcoin

Understanding current cryptocurrency market trends is crucial for any investor looking to engage with Bitcoin. With the climate of high global liquidity, cryptocurrencies are increasingly being viewed as attractive investment opportunities. Major trends indicate that as more accessibility to cash manifests through easing monetary policies, Bitcoin’s allure intensifies. Investors are keen to leverage the trend by diversifying their portfolios and seeking high-yield assets, prompting a renewed interest in Bitcoin and other cryptocurrencies.

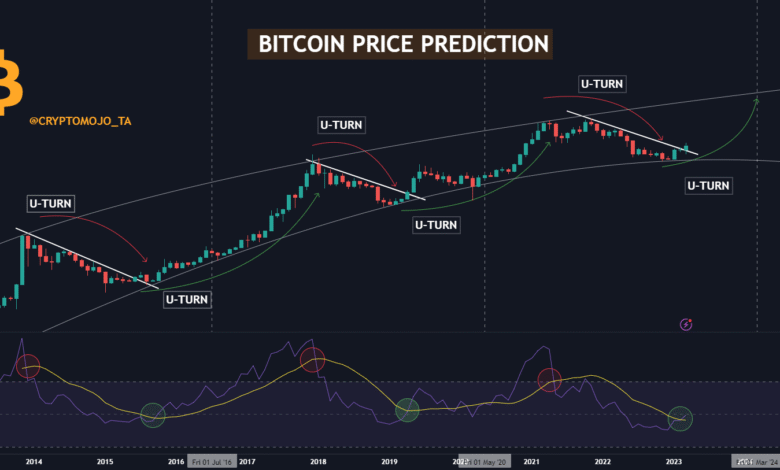

Technical analyses and market behavior suggest that trends indicating a strong correlation between liquidity and Bitcoin prices have consistently led to bullish runs. The overwhelming trend noted amidst the rise of M2 depicts how much liquidity is actively being funneled into riskier assets. Such dynamics are pivotal for predicting how Bitcoin might perform in coming years, as savvy investors will want to capitalize on emerging patterns before they peak. Monitoring these cryptocurrency market trends provides a strategic framework for making informed decisions.

Bitcoin and Inflation: A Hedge for Investors

The relationship between Bitcoin and inflation has been a topic of extensive debate, particularly as the M2 money supply sees unprecedented growth. Traditionally, as inflation rises due to increased liquidity and demand for goods, the value of fiat currency diminishes, making alternative assets like Bitcoin increasingly appealing. Investors are recognizing that holding Bitcoin can reduce exposure to inflation risks by providing a hedge against the declining purchasing power of traditional currencies.

Moreover, Bitcoin’s capped supply of 21 million coins positions it uniquely in an inflationary environment. As fiat money continues to be printed at alarming rates, Bitcoin can serve as a counterbalance, making it an attractive option for those concerned about economic instability. This dynamic has led to a surge in discussions regarding the role of Bitcoin as a hedge against inflation, supporting not only its price growth but also its adoption among institutional investors who seek stability in turbulent times.

Impact of Central Bank Policies on Bitcoin Valuation

The monetary policies enacted by central banks across the globe directly influence cryptocurrency valuations, including Bitcoin. With central banks implementing measures such as quantitative easing—aiming to inject liquidity into the economy—investor behavior tends to shift favorably towards Bitcoin and other digital currencies. Lower interest rates tend to spur borrowing and spending, creating a propensity for investors to seek higher returns in alternative assets, thus driving demand for Bitcoin.

Furthermore, statements and actions from influential figures, such as those in the Trump administration advocating for Fed rate cuts, signal heightened volatility and uncertainty in traditional markets. Such an environment presents favorable conditions for Bitcoin, which is increasingly viewed as a secure store of value amidst economic instability. Consequently, Bitcoin’s valuation is intricately linked to central bank policies, making monitoring these developments essential for predicting its price movements and future potential.

Emerging Patterns in Bitcoin Trading During Liquidity Influx

Recent analysis of Bitcoin trading patterns during periods of increased liquidity reveals a marked tendency for price escalation. Historical data points to notable buying surges following governmental stimulus announcements, demonstrating how the influx of new money tends to correlate with increasing cryptocurrency purchases. During the last major liquidity influx between 2020 and 2021, Bitcoin’s price skyrocketed, illustrating the significant effect that these economic factors can exert on trading dynamics.

Additionally, the patterns resulting from heightened liquidity show that the cryptocurrency market often operates on sentiment and speculation, particularly influenced by social media trends. Investors actively monitoring liquidity flows have adjusted their strategies, capitalizing on the speculative nature that accompanies rising M2 levels. Consequently, emerging patterns in Bitcoin trading have become increasingly relevant, with traders benefiting from understanding these fluctuations to maximize their trading potential.

The Future of Bitcoin Amidst a Financial Landscape of Easing

Looking ahead, the future of Bitcoin in an era dominated by financial easing remains an area of great promise. As stimulus measures and the expansion of the M2 money supply continue, Bitcoin enthusiasts anticipate a strong bullish trend that could catapult prices to new heights. This perspective hinges on the belief that cryptocurrencies will become more integrated into mainstream finance, capitalizing on the available liquidity in the market.

Simultaneously, as more individuals and institutional investors shift their focus toward Bitcoin as a long-term investment strategy, this could solidify its status as a primary asset class. The convergence of economic policies favoring liquidity and Bitcoin’s unique characteristics could lead to a future where the digital currency not only flourishes but significantly transforms conventional financial landscapes.

Global Trade Dynamics and Bitcoin’s Positioning

The interplay between global trade dynamics and Bitcoin’s positioning within the economic arena is becoming increasingly significant as monetary policies evolve. As China’s heightened monetary expansion attracts attention, it affects global liquidity flows, creating ripples across cryptocurrency markets. Bitcoin’s valuation is thus linked intricately to international trade relationships and the corresponding liquidity that these connections create, making it an essential element in global economic discussions.

With China’s M2 exceeding $44 trillion and influencing market trends through trade policies, Bitcoin could emerge as a central player in the future of international finance. Stakeholders in global markets are beginning to recognize that Bitcoin can provide a means to hedge against traditional economic fluctuations, thereby reinforcing its position as a leading cryptocurrency in a world characterized by unpredictable trade dynamics. The future of Bitcoin within this context appears promising, especially as it gains traction among global investors seeking stability.

Frequently Asked Questions

How does global liquidity impact Bitcoin price prediction?

Global liquidity plays a crucial role in Bitcoin price prediction. As the M2 money supply reaches historic highs, it indicates increased economic liquidity, which often leads to higher demand for assets like Bitcoin. When liquidity floods into the market, Bitcoin prices are likely to surge due to its scarcity, allowing it to capture a larger share of this liquidity.

What is the relationship between M2 money supply and Bitcoin price analysis?

M2 money supply is a key indicator in Bitcoin price analysis. Historical data suggests that as M2 expands, Bitcoin tends to see price increases, often leading price movements by several weeks. This correlation highlights that a growing money supply can enhance investment interest in Bitcoin, driving its price upward as investors seek assets with limited supply.

What cryptocurrency market trends are influenced by Bitcoin and inflation?

Cryptocurrency market trends are significantly influenced by the interplay of Bitcoin and inflation. As inflation rises, the appeal of Bitcoin as a hedge increases, which can lead to higher demand and prices. Given its capped supply of 21 million coins, Bitcoin is often viewed as a protection against the devaluation of fiat currencies during inflationary periods.

How does M2 growth affect Bitcoin price predictions for 2025?

M2 growth is expected to heavily influence Bitcoin price predictions for 2025. Current forecasts suggest that as M2 continues to rise by 8% to 10% annually, Bitcoin could experience substantial price increases, potentially reaching values as high as $150,000. The influx of liquidity typically leads to higher valuations for Bitcoin as investors seek assets that retain value amid increasing fiat supply.

Why is Bitcoin price prediction becoming more optimistic with global M2?

Bitcoin price prediction is becoming more optimistic due to the unprecedented growth of global M2. This increase signifies heightened liquidity, which historically correlates with rising prices in assets like Bitcoin. Analysts believe that with more capital available for investment, Bitcoin’s price is primed for substantial growth as it stands out as a scarce investment option.

| Key Points | Details |

|---|---|

| Global M2 Surge | The global M2 money supply has reached $95 trillion to $96 trillion, setting a stage for potential Bitcoin price increases. |

| Bitcoin Trading Price | Bitcoin is currently trading between $117,800 and $118,102. |

| Link to Economic Liquidity | M2 measures various liquid assets, providing clarity on economic liquidity and potential inflation risks. |

| Impact of Central Banks | Central banks, notably the U.S. Federal Reserve and others, are managing M2 to influence monetary policies and liquidity availability. |

| China’s Contribution | China’s M2 exceeds $44 trillion, important for global liquidity due to its significant economic policies. |

| Correlation with Asset Prices | Historically, high M2 aligns with rising asset prices, including Bitcoin, linked by correlations of 0.65 to 0.89. |

| Bitcoin Price Predictions | Up to $150,000 is projected for Bitcoin with upcoming liquidity surges, driven by M2 increases. |

| Long-Term Outlook | With global M2 expected to grow by 8% to 10% annually through 2025, significant opportunities for Bitcoin price increases are anticipated. |

Summary

Bitcoin price prediction is optimistic due to the unprecedented surge in global M2 money supply, which is expected to enhance liquidity across various financial markets. As central banks continue to address economic challenges with expansive monetary policies, Bitcoin stands out as a prime asset that could benefit significantly from this influx of liquidity. The current trading price of Bitcoin combined with historical trends suggests that it could soar to new heights, potentially reaching $150,000 as more capital seeks scarce assets amid rising inflation concerns. Therefore, investors should closely monitor these economic indicators as they could shape the future of Bitcoin.