Bitcoin Price Surges: Bulls Eye Target of $108K

The Bitcoin price has recently shown intriguing volatility, trading between $105,971 and $106,032 with a robust market capitalization of $2.10 trillion. As cryptocurrency trading heats up, investors keenly analyze Bitcoin price predictions and market dynamics to strategize their next moves. Over the past 24 hours, Bitcoin’s fluctuating price between $104,004 and $106,450 highlights a critical period of indecision among traders, influenced by various technical indicators. Many analysts are observing a potentially bullish trend as momentum builds in lower timeframes, backed by increasing trading volumes. With the Bitcoin technical indicators suggesting careful observation and strategic entries, traders remain optimistic about approaching price targets like $108,000 in this evolving market.

In recent days, the value of Bitcoin has experienced a landscape of fluctuating figures, characterized by significant trading activity and market capitalizing at over two trillion dollars. Observations around Bitcoin valuation and future forecasts have been pivotal for many investors navigating the dynamic cryptocurrency sector. Recent trends show the price oscillating between noteworthy thresholds, reflecting a state of mixed trading sentiment. As bullish momentum potentially brews beneath the surface, the analysis of price behavior could indicate fresh opportunities amid cautious speculation. With various technical tools indicating trends and reversals, traders are encouraged to stay alert for breakout signals that might lead to strategic investments.

Understanding Bitcoin’s Current Price Dynamics

As of the latest market data, Bitcoin’s price is fluctuating between $105,971 and $106,032, showcasing significant trading activity. This range demonstrates Bitcoin’s resilience amid a bustling trading environment, with a total market capitalization reaching around $2.10 trillion. Such a robust market cap indicates sustained investor interest, even as price movements reflect a narrow intraday variance. Traders closely monitor this dynamic, aware that periods of tight price action often precede volatile breakouts or corrections.

The recent price range indicates not only technical indecision but also a potential buildup of bullish momentum, as evidenced by the trading volume of $21.88 billion over the past 24 hours. With Bitcoin’s price hitting highs and lows within a relatively narrow band, market participants are paying attention to key technical indicators that could suggest future movements. Traders aiming to capitalize on Bitcoin’s price trends should remain vigilant about market signals that may imply a breakout beyond current resistance levels.

Bitcoin Price Prediction: Near-Term Outlook

Recent analysis of the Bitcoin charts has revealed a short-term bullish breakout following the establishment of a double bottom pattern at $103,957. After this critical threshold was crossed, momentum surged, aided by increased volume indicating renewed buying interest. In these circumstances, Bitcoin’s price prediction centers around the $106,000 mark, with immediate resistance established at $106,521. Successfully breaking this resistance level could spur bulls to aim for even higher targets, such as the psychological level of $108,000.

However, traders should also prepare for potential retracement scenarios. A pullback towards $105,500 could present another ideal entry point for short-term traders looking to position themselves optimally in the market. Careful monitoring of technical indicators across lower timeframes will provide insights into whether this bullish momentum can be sustained or if traders should brace for potential reversals. It’s critical to align these predictions with broader market shifts and sentiment surrounding cryptocurrency trading.

Analyzing Bitcoin’s Mid-Term Technical Indicators

Examining the 4-hour Bitcoin chart unveils a complex mix of signals indicating a weak recovery from previous price dips. Despite a recent drop to $103,388, the upward momentum observed suggests growing buying strength in the $105,500 to $106,000 range. Key technical indicators, including volume profiles, are showing increased interest, indicating potential accumulation phases. Traders should note how this could reflect a shift in Bitcoin’s market dynamics and sentiment in the mid-term.

Should Bitcoin convincingly break past $106,500, it may signify the beginning of a more robust bullish phase as more buyers enter the market. The rounded bottom structure visible on the charts suggests that the momentum could continue, flipping the narrative and providing traders with fresh opportunities. Analyzing these mid-term indicators can greatly assist traders in formulating effective cryptocurrency trading strategies as they navigate Bitcoin’s price landscape.

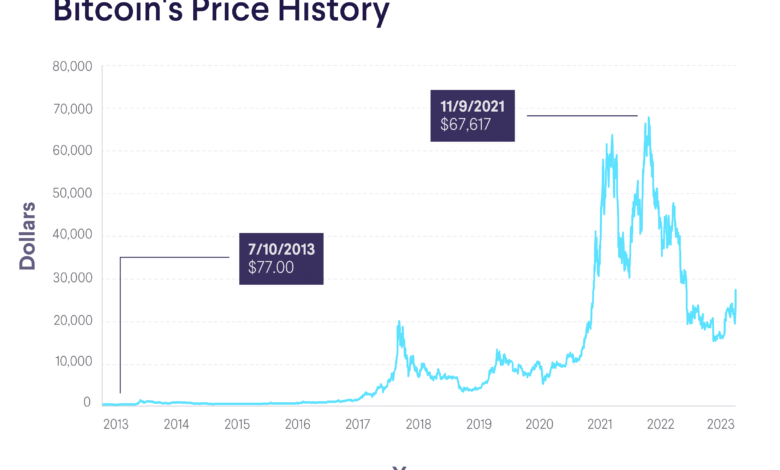

Long-Term Trends and Bitcoin’s Market Direction

When inspecting the daily BTC/USD chart, long-term trends provide a more nuanced understanding of Bitcoin’s price journey. Currently, Bitcoin shares a slightly bearish tilt, particularly after price rejection in the $112,000 zone and subsequent pullbacks towards lower support levels. Notably, the failure to maintain firmness above the $105,000 mark contributes to a bearish flag pattern emerging. Long-term traders need to be cautious, as waning volume should inform their strategic positioning.

A daily close above critical levels, such as $107,500, will be essential for bullish traders. Without this confirmation, the risk of consolidation remains prevalent, potentially pushing the price back towards the range of $100,426 to $103,000. Understanding these long-term trends can help traders set realistic expectations and prepare for possible scenarios in the increasingly complex cryptocurrency market.

Deciphering Mixed Signals in Bitcoin’s Technical Analysis

Technical indicators can often be contradictory, and the current analysis of Bitcoin reveals a landscape of mixed signals. While some oscillators display neutral readings, the overall sentiment leans positive according to momentum oscillators. The divergence among indicators such as the RSI, ADX, and MACD highlights the ambivalent nature of Bitcoin’s current price trend. This complexity adds layers to technical analysis, necessitating a careful approach from traders.

Nonetheless, the alignment of short- to long-term moving averages suggests an underlying bullishness. Nonetheless, the dissenting signal from the 30-day simple moving average brings a note of caution. Traders need to critically evaluate these mixed signals while crafting their positions and risk management strategies in the fast-paced environment of cryptocurrency trading, where swift market changes can lead to quick gains or losses.

Short-Term Trading Strategies for Bitcoin

In light of the recent bullish trends on intraday charts, traders can explore various short-term trading strategies to maximize earnings. By focusing on precise entry and exit points derived from technical indicators, traders can capitalize on upward momentum. Key levels, such as the $106,000 mark, represent critical thresholds: breaching this could signal stronger bullish activity, while a rejection might lead to quick profit-taking among speculative traders.

Moreover, maintaining strict risk controls is paramount in this volatile environment. Traders should look to implement stop-loss orders strategically, especially around significant resistance levels where reversals could occur. By adopting a disciplined approach, traders can optimize their chances of benefiting from short-term price movements while using technical indicators to navigate the complexities of Bitcoin’s price action.

Risks Associated with Bitcoin Trading

Despite appealing prospects, Bitcoin trading comes with inherent risks that savvy traders must navigate. The cryptocurrency market is notorious for its volatility, and price movements can change rapidly within hours. For instance, a sudden failure to break resistance levels like $107,500 could prompt a sharp decline, resulting in significant losses for unprepared traders. Understanding these risks is vital when developing a robust trading strategy.

Traders should remain informed about external market influences that can dramatically affect Bitcoin’s price, such as regulatory news or shifts in investor sentiment. By acknowledging these factors, one can anticipate potential pivots in market trends and adjust trading strategies accordingly. Success in cryptocurrency trading hinges on an ability to manage risks effectively while seeking opportunities for gains, thus transforming awareness into informed trading choices.

Evaluating Bitcoin’s Market Sentiment

Market sentiment plays a crucial role in influencing Bitcoin’s price trajectory. In recent weeks, the prevailing sentiment has fluctuated between bullish optimism and cautious skepticism, shaped significantly by ongoing market analysis and trading volume trends. Understanding the nuances behind this sentiment can provide traders with insights into potential future price movements and trading opportunities.

Sentiment shifts often correlate with price action, as traders react to technical indicators and news developments. Bullish signals can often generate positive sentiment, leading to increased buying pressure. Conversely, negative developments can create fear and suggest a bearish shift. By consistently gauging market sentiment, traders can position themselves advantageously in the dynamic and often unpredictable world of cryptocurrency trading.

Future of Bitcoin: What Lies Ahead?

Looking ahead, Bitcoin’s future price trajectory remains a subject of intense speculation among traders and analysts alike. With the ongoing bullish momentum observed in shorter timeframes, many are optimistic about reaching milestones like $108,000. The historical performance of Bitcoin, coupled with emerging bullish patterns and supportive technical indicators, provides a foundation for these predictions.

However, traders should remain grounded in reality and consider the broader market conditions that can influence these predictions. External factors such as regulatory developments, macroeconomic trends, and shifts in investor sentiment may dramatically alter Bitcoin’s prospects. As the market continues to evolve, those engaged in cryptocurrency trading must stay informed and flexible, adapting their strategies to contend with the changing landscape.

Frequently Asked Questions

What can we expect for Bitcoin price predictions in the upcoming weeks?

Bitcoin price predictions in the upcoming weeks are cautiously optimistic as recent technical indicators show a bullish trend. If Bitcoin can maintain its position above $106,000 and break the resistance at $106,521, we could see targets around $108,000 to $109,000 for short-term trades. However, resistance near $107,500 remains a key level to watch.

How does current Bitcoin market analysis influence cryptocurrency trading decisions?

Current Bitcoin market analysis indicates a mixed sentiment with both bullish and bearish signals. Traders should consider the technical indicators, such as the formation of bullish patterns on shorter timeframes. Observing the price movements around $106,000 will be crucial, as breakout opportunities could lead to profitable cryptocurrency trading decisions.

What are the key technical indicators to watch for Bitcoin price movements?

Key technical indicators for analyzing Bitcoin price movements include the moving averages, RSI, and MACD. Currently, the moving averages align with bullish signals, while the RSI and MACD show mixed readings. A decisive break above $106,521 coupled with strong volume could signal further bullish momentum.

Are there signs of a Bitcoin bullish trend based on recent price action?

Yes, recent price action suggests the potential for a Bitcoin bullish trend, especially after forming a double bottom pattern around $103,957. If Bitcoin sustains trading above $106,000 and breaks higher, this could confirm a bullish trend, targeting prices of $108,000 and beyond.

What influences the fluctuation of the Bitcoin price in the short-term?

The fluctuation of Bitcoin price in the short-term is influenced by several factors, including market sentiment, volume changes, and the presence of technical patterns. Recent moves above $106,000 indicate a shift in momentum, but caution is warranted if the price fails to reclaim levels above $107,500 due to potential bearish signals.

| Point | Details |

|---|---|

| Current Bitcoin Price Range | $105,971 to $106,032 in the last hour. |

| Market Capitalization | $2.10 trillion |

| 24-Hour Trading Volume | $21.88 billion |

| Short-Term Analysis | Bullish breakout above $106,000; resistance at $106,521. |

| Mid-Term Indicators | Weak recovery indicated, strong buying in the $105,500–$106,000 range. |

| Long-Term Trends | Sideways movement with bearish risks; needs to reclaim above $110,000. |

| Mixed Signals | Neutral indicators show ambivalence; MACD shows bearish momentum. |

| Bull Verdict | Target $108K–$109K if momentum above $106,521 is sustained. |

| Bear Verdict | Potential pullback to $103,000–$100,426 if below $107,500. |

Summary

The Bitcoin price is currently experiencing a critical phase as it hovers between $105,971 and $106,032. As traders closely monitor the 1-hour, 4-hour, and daily charts, there are indications of potential bullish setups as well as significant bearish risks. With immediate targets set at $108,000 for bullish traders, caution is recommended given the mixed signals from various technical indicators. Ultimately, successful trading strategies should focus on maintaining risk controls and responding to momentum shifts, especially around key levels like $106,000 and $107,500.