Bitcoin Price Volatility Sparks $1B Liquidation Frenzy

Bitcoin price volatility has become a topic of great interest among investors and analysts alike, especially given its dramatic impacts on the broader crypto market trends. Over the past week, Bitcoin soared to a new all-time high of $124,517, only to plummet swiftly after key inflation data was released, resulting in over $1 billion in liquidations. Such fluctuations not only showcase Bitcoin’s nature as a volatile cryptocurrency but also highlight the intricate relationship it shares with external economic factors like inflation. As Bitcoin’s price analysis continues to develop, it reveals indicators that suggest how inflation impacts on crypto can lead to sharp market corrections. Understanding these dynamics is crucial for traders aiming to navigate the unpredictable waters of digital assets, including Ethereum price movement and other altcoins.

The unpredictable nature of Bitcoin’s price dynamics is not merely a financial curiosity but serves as a microcosm of the entire cryptocurrency landscape. This infamous volatility often leads to moments of significant excitement and trepidation within the crypto space, especially when coupled with shifts in economic conditions. As traders and investors monitor crypto market movements, they must be mindful of how factors such as inflation can ripple through various currencies, including Bitcoin and Ethereum. Observers of the market frequently analyze these trends, aiming to uncover insights that could inform their strategies amidst the whirlwind of price changes. Ultimately, staying attuned to these evolving patterns is essential for anyone wishing to effectively participate in the volatile cryptocurrency arena.

Bitcoin Price Volatility Amid Inflation Concerns

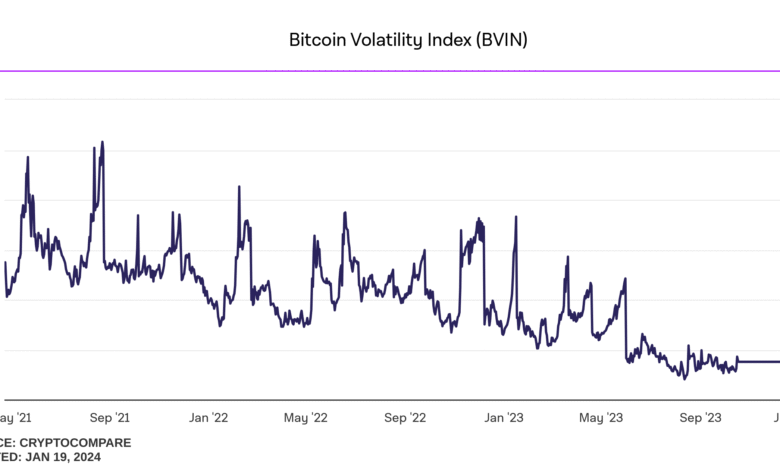

Bitcoin’s price volatility has become a defining characteristic of its market behavior, often responding dramatically to macroeconomic announcements. This week, the crypto market experienced an intense level of fluctuation as Bitcoin surged to an all-time high of $124,517, only to plummet shortly after due to the release of the U.S. Producer Price Index (PPI). Such rapid price swings highlight not only Bitcoin’s inherent volatility but also its sensitivity to inflationary pressures. Investors reacted swiftly to the PPI data, which suggested higher inflation rates, leading to a frenzy of liquidations that exceeded $1 billion, all within a day.

The wild oscillations in Bitcoin’s price illustrate the challenges many investors face in a volatile cryptocurrency market. Despite reaching highs this week, the sudden downturn underlines the fact that external economic factors, such as U.S. monetary policy and inflation expectations, can exert a powerful influence on digital asset prices. As Bitcoin continues to navigate through this turbulent landscape, market participants may need to adjust their strategies, considering the possibility of significant corrections in response to inflation data and other economic indicators.

Impact of Inflation on Crypto Market Trends

Inflation has increasingly been positioning itself as a pivotal aspect influencing crypto market trends. With the inflation rate hitting alarming highs, the crypto market’s behavior appears more poised to react. This week was a prime example, where the unexpected surge in the PPI not only triggered a massive sell-off but also reignited debates among investors about the long-term value of cryptocurrencies as inflation hedges. As traditional investment avenues struggle under inflationary pressures, many are exploring the role of Bitcoin and other cryptocurrencies in preserving value.

The potential relationship between inflation and cryptocurrency prices remains complex. On one hand, Bitcoin is frequently touted as “digital gold,” with proponents claiming it could serve as a hedge against rising inflation. On the other hand, the recent volatility indicates that the market still reacts sharply to macroeconomic news. As inflation continues to strain global economies, understanding how these dynamics impact expectations around Bitcoin price analysis and crypto market trends will be pivotal for investors seeking to navigate this challenging landscape.

Ethereum Price Movement and Market Recovery

Ethereum also experienced considerable price movement this week, particularly as it approached its all-time high, reaching $4,791. This surge was indicative of investor confidence in Ethereum, owing largely to its expanding role in DeFi and the NFT markets. However, the subsequent dip following the release of inflation data saw ETH dropping below $4,500, reflecting the overall market downturn triggered by the PPI report. Such volatility in Ethereum’s price movement exemplifies the broader trends affecting many altcoins in the current economic climate.

Despite these fluctuations, Ethereum managed to end the week with a 4.4% gain, indicating a resilience amidst the market turmoil. This enduring upward movement can be attributed to the strengthening fundamentals behind its ecosystem, especially as developers continue to innovate and enhance capabilities. For investors looking towards Ethereum’s future, understanding these macroeconomic influences combined with developments within the Ethereum network can provide insights into potential longer-term price trajectories.

The Role of Leveraged Positions in Crypto Liquidations

The events of this past week also highlighted the risks associated with leveraged trading in the cryptocurrency space. With the rapid rise and fall of Bitcoin and Ethereum prices, over $1 billion in leveraged positions were liquidated almost instantaneously. This significant liquidation reflects the fragility present in the crypto market, where traders often employ high levels of leverage to amplify their gains, only to find themselves vulnerable during periods of volatility. Such events not only impact individual traders but can also have broader repercussions on market sentiment and stability.

As the crypto market grapples with ongoing volatility, the role of leveraged trading will remain a point of discussion. Educated trading strategies and risk management practices are crucial for those participating in the market. Understanding the mechanics behind leveraged positions is vital, as they can lead to sudden, dramatic market shifts when a significant number of traders are forced to liquidate their positions, further exacerbating price declines and creating a cycle of asset sell-offs.

Market Sentiment and Crypto Investment Strategies

Market sentiment is arguably one of the most influential factors in driving cryptocurrency prices. Following significant price shifts, as observed this week with Bitcoin and Ethereum, investor psychology plays an essential role in shaping market dynamics. The intense fluctuations have generally steered sentiments towards caution, with many investors pausing to reassess their strategies in light of the volatility. Building a solid understanding of market sentiment can help investors navigate through turbulent periods more effectively.

For those involved in crypto trading, developing a robust investment strategy that accommodates for sentiment shifts can be beneficial. As market conditions tighten and inflation looms, traders may need to focus more on long-term trends, rather than short-term gains that can be compromised by economic announcements. By factoring in sentiment and the potential for regulatory changes, investors can align their strategies to better manage volatility and enhance the likelihood of sustainable returns, particularly in an unpredictable market.

The Interconnection of Assets in a Volatile Market

In a mixed-market environment where Bitcoin and Ethereum experience significant price movements, the interconnection between various crypto assets becomes apparent. This week’s swift movement in the crypto economy underscores how fluctuations in Bitcoin’s price can dictate market trends, affecting the performance of major altcoins like SOL and DOGE as well. The interconnectedness means that an event impacting one cryptocurrency could inadvertently lead to a cascading effect across others, illustrating the importance of a holistic view when analyzing market conditions.

Moreover, as cryptocurrencies grow in adoption and the market expands, the behavior of these assets in relation to each other will become a focal point for traders seeking to optimize their positions. By understanding correlations, investors can better position themselves to mitigate risks that arise during periods of heightened volatility, ensuring a more informed approach to crypto investments. Monitoring shifts not only within individual cryptocurrencies but across the broader spectrum can aid in developing a comprehensive portfolio strategy.

Future Outlook: Navigating Crypto Volatility

The future of cryptocurrencies will invariably involve navigating the challenges posed by volatility, particularly as macroeconomic factors like inflation continue to impact market dynamics. This week’s rollercoaster ride for Bitcoin and Ethereum serves as a reminder of the importance of resilience and strategic planning in a volatile landscape. It’s critical for investors to stay tuned to economic indicators and global events that can sway market directions. The lessons gleaned from such volatility can shape future trading strategies and potential investment timelines.

As we move forward, education remains vital within the cryptocurrency space, particularly with regards to understanding market vulnerabilities. Investors who equip themselves with knowledge on inflation, price analysis, and market sentiment can weather the storms of volatility more effectively. By proactively strategizing and remaining informed, traders can position themselves to seize opportunities amid volatility, ultimately fostering a deeper integration of cryptocurrencies within the global market and investment portfolios.

Analyzing High-Cap Altcoins’ Performance

As the leading assets in the cryptocurrency market, high-cap altcoins such as XRP, SOL, and DOGE experienced a variety of outcomes this week. While some managed to ride the upward momentum alongside Bitcoin and Ethereum, others fell victim to market corrections. XRP, for example, started the week hovering just above $3.30 but closed around $3.12, marking a notable decline amidst fluctuating investor interest. As these high-cap players maneuver through the turbulence, their performance serves as a bellwether for broader market trends.

Understanding the performance of these high-cap altcoins is essential for gauging overall market health. Their price movements often resonate with public sentiment and can indicate potential shifts in investment patterns. For investors and analysts alike, tracking these patterns can provide insight into how smaller cryptocurrencies might respond in times of volatility. This week’s performance highlights the importance of monitoring not just Bitcoin or Ethereum but also how surrounding altcoins respond as markets evolve.

Crypto Market Predictions and Analyst Projections

Market predictions and analyst projections play a crucial role in shaping investor expectations in the cryptocurrency landscape. As Bitcoin approached unprecedented highs and subsequently experienced a sharp decline, many analysts have revisited their forecasts for the coming weeks. Positive sentiment remains prevalent among some traders who believe that Bitcoin can successfully breach the $124,000 barrier again if macroeconomic conditions stabilize and inflation fears subside. Similarly, Ethereum’s potential to reach new highs remains a subject of intrigue for market observers.

However, it’s also important to keep a balanced perspective. Analysts caution that ongoing economic uncertainty, particularly surrounding inflation and interest rates, may temper bullish sentiments. As such, predictions should be approached with caution, acknowledging that the volatile cryptocurrency market can shift rapidly. Investors should remain vigilant and informed while revisiting market analyses to help refine their investment strategies amid continual changes.

Frequently Asked Questions

What factors contribute to Bitcoin price volatility?

Bitcoin price volatility is influenced by several factors, including market sentiment, regulatory news, and macroeconomic indicators such as inflation data. Events like the release of U.S. PPI data often trigger significant price fluctuations as traders react to economic signals, leading to rapid price changes.

How can I analyze Bitcoin price volatility effectively?

Effective Bitcoin price analysis involves studying historical price movements, market trends, and trading volumes. You can utilize tools like technical analysis, which includes studying price charts and indicators, to better understand market behavior and anticipate potential volatility.

What role does inflation play in Bitcoin price volatility?

Inflation can greatly impact Bitcoin price volatility as it affects investor confidence. Higher inflation often leads to increased demand for cryptocurrencies as a hedge against fiat currency debasement, which can result in sharp price swings in the crypto market.

Why is Bitcoin considered a volatile cryptocurrency?

Bitcoin is categorized as a volatile cryptocurrency due to its susceptibility to rapid price changes driven by speculation, market dynamics, and external economic factors. This volatility presents both risks and opportunities for investors and traders in the crypto space.

How do crypto market trends affect Bitcoin price volatility?

Crypto market trends significantly influence Bitcoin price volatility. Bullish market conditions can lead to higher prices as investor sentiment shifts positively, while bearish conditions may result in sharp declines, reflecting the overall mood and behavior of market participants.

What impact does ETH’s price movement have on Bitcoin price volatility?

ETH’s price movement can closely correlate with Bitcoin price volatility. As major cryptocurrencies often share investor sentiment, significant price changes in Ethereum can lead to similar reactions in Bitcoin, creating a ripple effect across the broader crypto market.

Can Bitcoin’s price volatility create profitable trading opportunities?

Yes, Bitcoin’s price volatility can create profitable trading opportunities for seasoned investors. By leveraging market analysis and employing strategies like day trading or swing trading, traders can capitalize on price fluctuations for potential gains.

How do global events impact Bitcoin price volatility?

Global events, such as geopolitical tensions, regulatory changes, or economic reports, can cause sudden shifts in Bitcoin price volatility. Investors tend to react quickly to such events, resulting in significant price movements in short periods.

What trends can we expect in Bitcoin price volatility in the current market?

In the current market, investors should expect fluctuating levels of Bitcoin price volatility, particularly in response to economic indicators like inflation rates and Federal Reserve policies. Traders should remain vigilant and prepared for both upward and downward price movements.

| Key Points | Details |

|---|---|

| Crypto Market Performance | The crypto economy increased from $3.97 trillion to $4.04 trillion, highlighting a week of significant volatility. |

| Bitcoin’s Price Surge | BTC hit an all-time high of $124,517 before experiencing a sharp decline after inflation data release. |

| Ethereum’s Climb | ETH surged to $4,791, nearing its all-time high from 2021 before dropping. |

| Impact of U.S. PPI Data | Hotter-than-expected inflation data resulted in over $1 billion in liquidations across crypto markets. |

| Market Recovery | BTC recovered to $119,000 but closed the week at around $118,800, a modest 0.2% increase. |

| Altcoin Performance | Most major altcoins showed marginal gains, with XRP experiencing a significant decline of 6.7%. |

Summary

Bitcoin price volatility remains a focal point in the cryptocurrency landscape, highlighted by its sharp price movements this past week. After achieving an all-time high, Bitcoin faced drastic fluctuations following inflation news, illustrating how market sentiment can shift unexpectedly. Despite some recovery, the overall performance underscores the inherent risks and dynamics that define Bitcoin’s price movements. Investors must remain vigilant as the crypto market is susceptible to external economic factors, emphasizing the unpredictability that accompanies Bitcoin price volatility.