Bitcoin Prices Surge Amid Stock and Crypto Market Rally

Bitcoin prices have taken a significant leap recently, soaring past $106K as the stock and cryptocurrency markets show a synchronized rally. This upward movement reflects not only the current Bitcoin price trends but also a growing optimism among investors in the cryptocurrency market. Following the recent surge, Bitcoin trading volume has seen a noticeable increase, suggesting heightened interest in trading this leading digital asset. With a market capitalization now reaching $3.34 trillion, Bitcoin remains a dominant player amidst the broader market fluctuations. The interplay between Bitcoin market trends and external economic indicators underscores its evolving role in the financial ecosystem.

In recent weeks, the digital currency landscape has turned particularly bullish, with Bitcoin showing impressive gains in valuation. This rise captures attention from both seasoned traders and new investors alike, sparking discussions around cryptocurrency investment strategies. The ongoing market dynamics highlight the forward momentum in the blockchain space, often reflecting in the lively Bitcoin trading activities and overall market capitalization. As economic indicators shift and financial institutions adapt, alternative currencies like Bitcoin are positioning themselves as viable assets worth exploring in this investment climate. Many are closely monitoring Bitcoin price movements, eager to capitalize on potential market opportunities.

Current Bitcoin Prices: A Market Overview

Currently, Bitcoin is experiencing a notable surge, with prices reaching up to $106,015.42. This represents a modest increase of approximately 1.47% over the last 24 hours. As investors keep a close eye on market trends, the anticipation for potential price movements is high. Despite the optimistic daily increase, the weekly performance shows a decline of 3.77%, underscoring the volatility inherent in the cryptocurrency market. Traders remain cautious as Bitcoin fluctuates between a range of $104,100.01 and $106,813.58, signaling a volatile atmosphere fueled by mixed market sentiments.

Bitcoin’s price movement is often influenced by broader market trends, and today’s situation reinforces this connection. With the overall cryptocurrency market capitalization climbing to $3.34 trillion, Bitcoin maintains a significant presence with a market share of 64.06%. As the trading volume rises to $47.35 billion, analysts speculate that increased activity may lead to a breakout. Key indicators suggest that market dynamics are shifting, and observers are keenly monitoring these fluctuations for signs of sustained growth.

Bitcoin Market Trends Amid Economic Indicators

The recent upward trend in Bitcoin prices coincides with positive news from the stock market, marking a synergistic relationship between traditional assets and cryptocurrencies. As tech stocks drove gains for indices like the S&P 500, Bitcoin’s price responded positively, illustrating its growing significance in the financial ecosystem. The correlation between Bitcoin and the S&P 500 has notably decreased from about 80% to 54%, which suggests that Bitcoin may be establishing its unique market identity, independent of traditional financial movements. This change embodies a shift in perceptions, particularly among institutional investors.

Alongside market trends, Bitcoin’s trading volume has also shown an encouraging increase, signaling renewed interest among investors. With more traders engaging with BTC, the dynamics in the cryptocurrency market are shifting towards a healthier trading environment. Bitcoin’s resilience features increases in both trading activity and volume, indicating that despite recent setbacks, market participants remain optimistic about a potential rally. This represents a critical juncture as traders evaluate their strategies in anticipation of potential market developments.

The Role of Bitcoin Trading Volume in Market Dynamics

Bitcoin’s trading volume is a crucial parameter that reflects the health and activity within the cryptocurrency market. The recent uptick in Bitcoin trading volume, which has risen by 6.47% to $47.35 billion, highlights increased investor engagement as traders position themselves for possible price movements. High trading volumes often correlate with more significant price movements, as they indicate a larger number of transactions and heightened investor interest. This factor becomes particularly important in assessing potential breakouts or corrective phases in Bitcoin’s price trajectory.

As Bitcoin’s dominance slightly decreases to 64.06%, it faces increasing competition from alternative cryptocurrencies vying for market share. Nevertheless, a consistent trading volume amidst market fluctuations suggests that Bitcoin retains its status as a leading asset, securing a firm foothold in the broader landscape. As conditions oscillate between bullish and bearish sentiments, analyzing trading volumes provides insights into market strength, and can help predict future trends in Bitcoin prices.

Bitcoin Market Capitalization Trends

With a market capitalization that recently climbed to $2.1 trillion, Bitcoin demonstrates its resilience and significance within the cryptocurrency ecosystem. Market capitalization serves as an essential indicator of how investors perceive the asset’s value. Despite experiencing a slight decline in BTC’s overall dominance, its substantial market cap reflects ongoing confidence among traders. The continued influx of capital into Bitcoin, even amidst price volatility, indicates a robust level of trust in its long-term viability.

Moreover, Bitcoin’s growth in market capitalization is indicative of its potential as an investment vehicle. As traditional financial markets demonstrate volatility, investors are increasingly drawn to Bitcoin as a hedge against inflation and economic uncertainty. The recent rise in BTC’s market cap can be attributed to various economic factors, including investor sentiment around monetary policy and the success of Bitcoin in maintaining value during turbulent times. Tracking Bitcoin’s market capitalization closely can provide insights into future trends and highlight its evolving role in global finance.

Bitcoin Prices and Economic Sentiment

The interplay between Bitcoin prices and wider economic indicators presents a compelling narrative for investors. Recent reports of increased job openings in the U.S., which rose to 7.4 million, have contributed to the overall positive economic sentiment, supporting bullish momentum in both traditional and cryptocurrency markets. This resilience showcases Bitcoin’s ability to leverage favorable economic conditions to drive its price upward. As market participants adjust their strategies based on economic data, the link between Bitcoin prices and economic sentiment appears stronger than ever.

Investors are now evaluating Bitcoin not just as a digital asset but also as a component of economic indicators, further integrating it into market strategies. With the current Bitcoin price on the rise, analyzing how such economic factors interact with cryptocurrency performance will be crucial in predicting future movements. As more traditional investors look to Bitcoin for diversification, its role in economic sentiment can potentially recalibrate financial strategies across multiple sectors.

Impact of Stock Market Movements on Bitcoin Prices

The relationship between stock market movements and Bitcoin prices is increasingly becoming a focus for analysts. Recent rallies in tech stocks, which significantly contributed to the S&P 500’s upward trend, have positively impacted Bitcoin’s price as well. The interdependence between these markets highlights the importance of monitoring stock performance when assessing Bitcoin trends. As equities rally, Bitcoin tends to mirror this growth, drawing in traditional investors seeking opportunities within the cryptocurrency space.

Conversely, adverse movements in stock markets can evoke caution among crypto traders, influencing Bitcoin’s price sentiment. This duality underscores the idea that Bitcoin is not merely a speculative asset but rather intricately linked to the broader economic landscape. Therefore, observing the correlations between stock prices and Bitcoin market performance is essential for developing robust trading strategies aimed at capitalizing on emerging trends.

Future Projections: Bitcoin Prices and Market Trends

Looking ahead, the future projections for Bitcoin prices appear optimistic, provided that current market trends continue. Analysts anticipate that if the cryptocurrency remains resilient amidst fluctuating economic conditions and persistent stock rallies, Bitcoin could break key resistance levels. The sentiment within the market leans towards potential bullish trends, especially as trading volumes increase. Investors are keenly observing how external factors will shape price trajectories, which could lead to significant gains in the near future.

However, it is crucial to exercise caution and conduct thorough research when navigating the volatile cryptocurrency terrain. Possibilities for price corrections exist, and with the Bitcoin prices currently within a narrow trading range, strategic planning is essential. Long-term investors may benefit from short-term fluctuations if they leverage their positions wisely. As Bitcoin continues to evolve within the financial landscape, its trajectory remains one of the most scrutinized topics in investment circles.

Understanding Bitcoin’s Market Behavior

Understanding Bitcoin’s market behavior is foundational for traders and investors seeking to navigate the complexities of cryptocurrency trading. The dynamics of Bitcoin’s price are affected by numerous factors, including its trading volume, market capitalization, and external economic indicators. Given its proactive evolution, the cryptocurrency often responds to changes in investor sentiment and broader market trends. For individuals new to the space, grasping these concepts equips them with tools necessary for informed trading decisions.

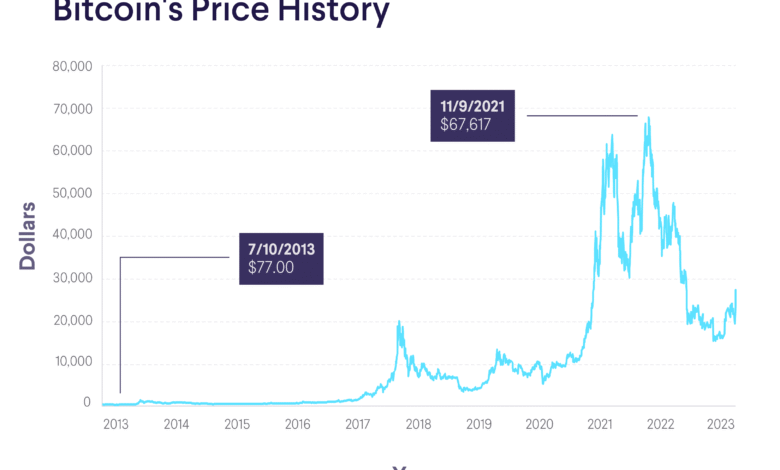

Moreover, the cryptocurrency landscape is characterized by rapid shifts and volatility. Historical price patterns suggest that Bitcoin tends to experience cycles of booms and corrections. Therefore, close monitoring and analysis of Bitcoin movements are vital for traders looking to capitalize on opportunities. Educating oneself about Bitcoin’s market behavior not only enhances trading strategies but also fosters a more profound appreciation for the asset’s potential in the global financial landscape.

The Future of Bitcoin: Market Predictions and Analysis

The future of Bitcoin is a topic of considerable interest among financial analysts and enthusiasts alike. Predictions regarding Bitcoin prices are often tied to developments within both the cryptocurrency space and traditional markets. As Bitcoin continues to gain institutional support and acceptance, market predictions suggest that it might solidify its position as a staple in investment portfolios. With the potential for innovative applications of blockchain technology, Bitcoin’s role within the financial ecosystem could evolve significantly in the coming years.

Analysts remain divided on the exact trajectory of Bitcoin prices, with some forecasting bullish scenarios based on increasing adoption, while others caution against potential volatility. Market predictions indicate that Bitcoin could experience significant price increases if it maintains its momentum and capitalizes on favorable economic conditions. Continuous analysis of market trends, trading volumes, and external factors will be important as investors evaluate Bitcoin’s performance in a rapidly changing financial landscape.

Frequently Asked Questions

What is the current Bitcoin price as of today?

As of now, the current Bitcoin price is $106,015.42. It has seen a modest rebound of 1.47% in the last 24 hours, indicating a movement amidst broader market trends.

How do Bitcoin market trends affect the cryptocurrency market?

Bitcoin market trends often set the tone for the entire cryptocurrency market due to its significant market capitalization of $2.1 trillion. When Bitcoin prices rise, altcoins typically benefit, reflecting an overall bullish sentiment.

What factors contribute to recent Bitcoin price increases?

Recent Bitcoin price increases can be attributed to factors such as a favorable correlation with stock market trends, positive economic data regarding job openings, and increased trading volume which reached $47.35 billion, indicating heightened market activity.

What was the Bitcoin trading volume over the past 24 hours?

The Bitcoin trading volume over the past 24 hours has risen to $47.35 billion, a 6.47% increase, which shows a surge in trading activity in anticipation of potential price movements.

How has Bitcoin’s market capitalization changed in recent days?

Bitcoin’s market capitalization has increased by 1.50% to approximately $2.1 trillion, which highlights its resilience and influence in the current cryptocurrency landscape.

What does the drop in Bitcoin’s dominance indicate?

Bitcoin’s dominance has dropped slightly by 0.26% to 64.06%, suggesting that while Bitcoin remains a leading cryptocurrency, other altcoins may be gaining traction in market share and investor interest.

What are the implications of BTC price fluctuations for traders?

BTC price fluctuations create opportunities for traders to capitalize on market volatility. The recent drop in open BTC derivatives contracts and increased liquidations could signify a market correction or consolidation phase.

How does the performance of Bitcoin impact investor sentiment in the cryptocurrency market?

The performance of Bitcoin directly impacts investor sentiment; a rising Bitcoin price often generates optimism among investors, leading to increased interest and investment in other cryptocurrencies, contributing to a broader cryptocurrency market rally.

| Key Event | Details |

|---|---|

| Bitcoin Price Rise | BTC price climbed to $106,813.58, with a 1.47% increase in the past 24 hours. |

| Market Metrics | Market cap reached $3.34 trillion, with Bitcoin’s market cap at $2.1 trillion. |

| Trading Volume | 24-hour trading volume increased by 6.47% to $47.35 billion. |

| BTC Derivatives Contracts | Total open contracts dropped to $72.01 billion. |

| Market Sentiment | Cautious optimism as Bitcoin’s correlation with S&P 500 decreases to 54%. |

Summary

Bitcoin prices are currently experiencing an upward trend, reaching over $106K amid a rally in both stock and crypto markets. This positive momentum reflects broader market optimism, as traders respond to favorable employment data and other supportive economic indicators. Despite a recent minor pullback in the weekly trend, the overall outlook for Bitcoin prices remains cautiously optimistic, indicating potential for further gains.