Bitcoin Recovery: Analysts Forecast New All-Time High

Bitcoin recovery has become the focal point of discussions among crypto enthusiasts as the digital asset shows signs of resilience following recent volatility. After experiencing a brief dip spurred by the geopolitical tensions between Israel and Iran, BTC has managed to bounce back, reaffirming its strength in the crypto market. Analysts are now anticipating a potential BTC all-time high, particularly with recent Bitcoin price forecasts pointing to a bullish trend. Market sentiment is increasingly positive, as crypto market analysis indicates that investors are regaining confidence in digital assets performance. The latest recovery not only highlights Bitcoin’s volatility but also reinforces its position as a pivotal player in the broader crypto economy.

The resurgence of Bitcoin has captivated the attention of digital currency traders and investors alike as they look at the implications of current market movements. Following recent geopolitical events, the flagship digital asset has showcased its ability to rebound sharply after experiencing significant fluctuations in value. Observers are keenly studying the Bitcoin trend, with many hopeful that this momentum may lead to new highs in the near future. As the landscape of virtual currencies evolves, ongoing crypto market assessments are critical to understanding the performance dynamics of Bitcoin and other digital assets. With various factors at play, including macroeconomic indicators and investor sentiment, the stage is set for an intriguing chapter in the ongoing saga of cryptocurrency.

Bitcoin Recovery: A Resilient Comeback after the Conflict Dip

Last week, Bitcoin (BTC) demonstrated remarkable resilience, quickly bouncing back from a significant dip triggered by geopolitical tensions. The conflict-related market fluctuations momentarily pushed Bitcoin’s price below $100,000, alarming many investors and analysts alike. However, Bitcoin’s recovery was swift, with the digital asset reclaiming its status by peaking at $110,307. This comeback not only restored investor confidence but also ignited discussions around potential market trends, fueling forecasts of a new all-time high. The factors contributing to this resurgence are multifaceted, encompassing market reactions to economic policies and external geopolitical events.

Analysts have pointed out that Bitcoin often behaves like a volatile asset during crises, reflecting its perceived role as a safe haven in uncertain times. The recent surge above $110,000 signals a renewed interest in Bitcoin, aligning with various technical indicators suggesting a bullish trend ahead. Furthermore, as other digital assets also show marginal gains, Bitcoin’s strong recovery underscores its foundational dominance in the crypto market, making it a focal point for both new and seasoned investors looking to capitalize on evolving market conditions.

BTC on Cusp of a New All-Time High: Market Predictions

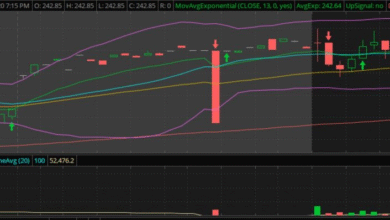

The cryptocurrency market is abuzz with speculation as Bitcoin edges closer to a potential new all-time high, a sentiment echoed by many market analysts. After a turbulent week, marked by significant price movements, Bitcoin’s current trajectory seems promising. Data from market analysis platforms indicates that not only is BTC asserting itself above critical price levels, but its overall trading volume and market capitalization are also on the rise. This bolstered performance hints at a robust bullish trend that may lead Bitcoin to surpass previous records. With the digital asset currently sitting at impressive levels, the stage is set for an exciting market phase.

Market sentiment plays a pivotal role in cryptocurrency valuation, and Bitcoin is no exception. The new all-time high forecast is underpinned by a combination of optimistic predictions and historical performance trends. Notably, analysts emphasize the importance of monitoring Bitcoin’s price movements concerning key psychological levels like $110,000, alongside broader technical indicators. This blend of forecasting and trend analysis suggests that if BTC maintains its upward momentum, it could soon achieve unprecedented heights in its pricing history. Investors are watching closely—this market wave could redefine Bitcoin’s place in the digital asset space.

Analyzing Digital Assets Performance: What’s Next for BTC?

As Bitcoin continues its rally, a deeper analysis of digital assets performance reveals intriguing insights into market dynamics. The recent uptick in Bitcoin’s price, alongside the performances of other cryptocurrencies like HYPE and TRX, points to a flourishing crypto ecosystem. HYPE’s impressive rise, driven by growth in decentralized finance (DeFi) applications, casts a positive light on Bitcoin, suggesting that investor confidence might be returning to the cryptocurrency space. Enhanced performance across the board demonstrates that Bitcoin remains inextricably linked to the overall health of the digital asset market.

Amidst this optimistic environment, factors such as regulatory developments, technological advancements, and market sentiment will likely play crucial roles in shaping future outcomes for Bitcoin and its peers. Understanding the current landscape requires continuous crypto market analysis to gauge how external influences might affect Bitcoin’s price trajectory. Ultimately, the coming weeks will be pivotal as Bitcoin eyes potential new highs, and all eyes remain locked on its performance metrics alongside macroeconomic trends.

Bitcoin Price Forecast: Insights and Projections

As investors navigate the tumultuous waters of the crypto market, accurate Bitcoin price forecasts are more crucial than ever. Analysts are employing a mix of technical analysis and fundamental assessment to predict BTC’s future price movements. With Bitcoin recently bouncing back from a temporary low, many are forecasting a surge that could lead to a new all-time high. By examining key resistance levels and overall market sentiment, they are trying to identify the optimal conditions for this anticipated rally. Each shift in price brings with it new insights, as the crypto market dynamic is ever-evolving.

The implications of these findings suggest that Bitcoin could once again attract intense speculative interest, eventually pushing its price into uncharted territories. However, potential investors are advised to remain cautious, understanding that the crypto market is notoriously volatile. Monitoring market trends and price forecasts becomes essential for anyone looking to capitalize on BTC’s performance. With Bitcoin’s strong historical performance and adaptability, its future remains a topic of debate among analysts and enthusiasts alike.

Understanding Crypto Market Analysis: The Role of Bitcoin

Effective crypto market analysis hinges on an understanding of Bitcoin’s unique position as the flagship cryptocurrency. Market analysts stress the importance of BTC’s influence on the rest of the digital assets landscape, as its price movements often dictate the trends of altcoins and other cryptocurrencies. This interdependency calls for comprehensive analytical strategies that encompass Bitcoin’s price behavior, market capitalization changes, and investor sentiment. Understanding these dynamics provides clearer insights into potential future movements in the crypto economy.

Furthermore, the volatility and rapid fluctuations seen in Bitcoin serve as a yardstick for market conditions. Recent market trends—such as high trading volumes and surges in demand for digital assets—mirror Bitcoin’s performance and indicate overall investor sentiment in the crypto world. As analysts continue to monitor these developments, the results yield valuable data that can inform trading strategies and investment decisions. In essence, a robust crypto market analysis framework must keep Bitcoin’s performance at its core to navigate the complexities of the digital asset space.

Evaluating Bitcoin Trends: Short-term vs. Long-term Perspectives

Evaluating Bitcoin trends requires a nuanced approach that distinguishes between short-term fluctuations and long-term performance. The recent volatility surrounding geopolitical events serves as a reminder of Bitcoin’s capacity for dramatic shifts, often influenced by macroeconomic factors. Observing these trends helps analysts and investors identify key entry and exit points within the market. For short-term traders, recognizing momentum shifts can provide profitable opportunities, while long-term investors might focus on the overall trajectory of Bitcoin’s adoption and integration into mainstream finance.

In the long-term perspective, Bitcoin’s finite supply and increasing institutional adoption suggest a bullish outlook. Many believe that as digital assets become a staple in investment portfolios, Bitcoin will experience sustained demand that outpaces its supply limitations. Consequently, understanding both short-term and long-term trends is essential for forming a well-rounded investment strategy in the dynamic world of cryptocurrencies. By analyzing these trends through varied lenses, investors can better position themselves for success in the evolving crypto market.

Implications of Recent Market Dynamics on Bitcoin’s Future

Recent market dynamics have substantial implications for Bitcoin’s future, especially as it recovers from those temporary dips triggered by global uncertainties. Bitcoin’s resilience in the face of adversity strengthens its reputation as a reliable digital asset, attracting new investors. The broader implications suggest that as Bitcoin stabilizes and heads toward potential new highs, those previously cautious may reconsider their stance on cryptocurrency investments. Market analysts are increasingly optimistic about BTC’s performance, reinforcing expectations of a sustained bullish trend.

Moreover, the interconnectedness of the crypto market highlights how fluctuations in Bitcoin directly affect the price patterns of other digital assets. Notably, the rise of altcoins like HYPE and TRX, amid Bitcoin’s growth, indicates a renewed investor interest across the digital asset spectrum. These developments could sway overall crypto market valuation, catalyzing further price appreciation for Bitcoin as well. As more investors turn to digital currencies for diversification, Bitcoin’s carefully monitored price trajectory will remain a focal point for understanding the broader market landscape.

Recent Major Players in the Crypto Market: Bitcoin Leads the Way

In the ever-evolving world of cryptocurrency, Bitcoin continues to lead the charge as the most influential player among digital assets. The recent market performance of Bitcoin, including its recovery and brief surges above essential price benchmarks, sets the tone for the rest of the market. With other notable gainers catching up, BTC’s leadership manifests through its historical role and the lion’s share of market capitalization. Observations of recent trends confirm that as Bitcoin goes, so too does the broader crypto market.

Highlighting Bitcoin’s influence also includes recognizing how emerging players like HYPE and TRX are defining their spaces within the industry. Their gains offer a glimpse into market dynamics, often responding to Bitcoin’s fluctuations. This interconnectedness emphasizes the importance of monitoring Bitcoin as a key indicator, providing insights into potential market directions for new investors exploring the digital asset landscape. Consequently, Bitcoin’s position as a market leader profoundly impacts confidence and investment decisions across various digital asset categories.

Navigating Future Challenges: Bitcoin’s Path Ahead

Navigating future challenges in the cryptocurrency landscape requires a strategic focus on Bitcoin’s performance and adaptability. As the digital asset continues to recover from recent dips, market participants are looking at how Bitcoin will respond to forthcoming challenges such as regulatory changes and severe market corrections. These looming factors necessitate a cautious outlook, as price volatility remains a constant in the realm of cryptocurrencies. Adapting to these realities will be key for investors aiming to ride the wave of Bitcoin’s potential recovery and growth.

Furthermore, the broader adoption of digital currencies into financial systems adds layers of complexity and opportunity for Bitcoin’s future. Institutions and retail investors alike are navigating an environment marked by rapidly changing perceptions of cryptocurrencies. As Bitcoin attempts to solidify its place as a mainstream financial asset, overcoming these market challenges will be pivotal. Continuous assessment of Bitcoin’s resilience will guide stakeholders in making informed decisions as they look toward a promising, albeit unpredictable, crypto future.

Frequently Asked Questions

What are the key factors influencing Bitcoin recovery following the recent market dip?

Several factors are influencing Bitcoin recovery, particularly after its recent plunge related to geopolitical tensions. Notably, Bitcoin’s ability to rebound above the $100,000 mark signifies strong support from investors, who are reacting positively to market developments like legislation passage and broader economic trends. Analysts are closely monitoring Bitcoin price forecasts and market dynamics as they predict a possible new all-time high with sustained interest in digital assets.

How does the recent Bitcoin price forecast impact recovery strategies?

The recent Bitcoin price forecast suggests potential growth after recovery from volatility, which can affect recovery strategies for investors. With analysts predicting Bitcoin to reach new heights, it’s crucial for investors to reassess their positions and strategies, focusing on timing market entries and exits based on Bitcoin trends and emerging patterns within the crypto market analysis.

How can I recover lost Bitcoin after market crashes?

To recover lost Bitcoin after market crashes, consider strategies like dollar-cost averaging, where you gradually reinvest in Bitcoin over time, balancing out any losses. Additionally, monitoring Bitcoin trends can provide insight into optimal buying opportunities as the market stabilizes. Stay informed on crypto market analysis to make data-driven decisions that enhance your recovery efforts.

What role does Bitcoin’s all-time high play in current recovery sentiment?

Bitcoin’s all-time high plays a crucial role in current recovery sentiment, as it serves as a psychological benchmark and a target for traders. As Bitcoin approaches these historical values, it often sparks renewed investor interest and optimism, leading to increased market activities which facilitate recovery. Analysts’ assessments of Bitcoin’s trajectory reflect this sentiment, indicating a rally could bring BTC back to its all-time highs.

What indicators should I watch for a successful Bitcoin recovery?

Key indicators for a successful Bitcoin recovery include volume spikes, resistance and support levels, and the overall sentiment of the crypto market. Observing Bitcoin trend patterns and how BTC behaves around significant price levels helps gauge potential rebounds. Additionally, following crypto market analysis from reputable sources can provide insights into anticipated movements, enhancing your decision-making process during recovery phases.

What are the risks associated with Bitcoin recovery investments?

Investing during Bitcoin recovery involves risks such as market volatility, regulatory changes, and geopolitical events that can abruptly shift prices. It’s essential to analyze Bitcoin trends thoroughly and utilize sound risk management strategies. Diversification of digital assets and regular updates through reliable crypto market analysis can help mitigate some of these risks while capitalizing on recovery opportunities.

Can Bitcoin recovery be sustained in the current economic climate?

Sustained Bitcoin recovery in the current economic climate relies on broader market conditions, investor sentiment, and regulatory environments. Analysts are optimistic, suggesting that if Bitcoin can maintain momentum and navigate through current challenges, it is likely to experience sustained growth. Close attention to Bitcoin price forecasts and market catalysts can provide a clearer picture of its potential trajectory.

| Key Point | Details |

|---|---|

| Market Overview | The crypto market had a volatile week with Bitcoin fluctuating around $110,000 and ending with a 0.4% gain. |

| BTC Recovery | BTC’s recovery began after dropping during the Israel-Iran conflict, hitting a peak of $110,307. |

| Analyst Predictions | Analysts predict BTC could reach new all-time highs in the coming weeks. |

| Outstanding Performers | HYPE and TRX led gains at 3.6% and 3.4%, respectively, along with a significant surge in the stablecoin market. |

| Notable Gainers and Losers | SUI gained 2.7%, ETH rose 2%, while SOL dropped 3.9% to around $146. |

| SOL Analysis | An analyst suggests SOL may experience a breakout despite its recent downward movement. |

| Other Movers | LINK, AVAX, BCH, and DOGE all saw slight declines. |

Summary

Bitcoin recovery is on the horizon as the leading cryptocurrency markets have shown resilience following volatility. After a significant dip amid geopolitical tension, Bitcoin has once again captured the $110,000 mark, igniting hopes for new all-time highs. Analysts are bullish on BTC’s potential, aligning it with broader positive movements in the crypto market.