Bitcoin Sentiment Meter Drops from Extreme Greed to Neutral

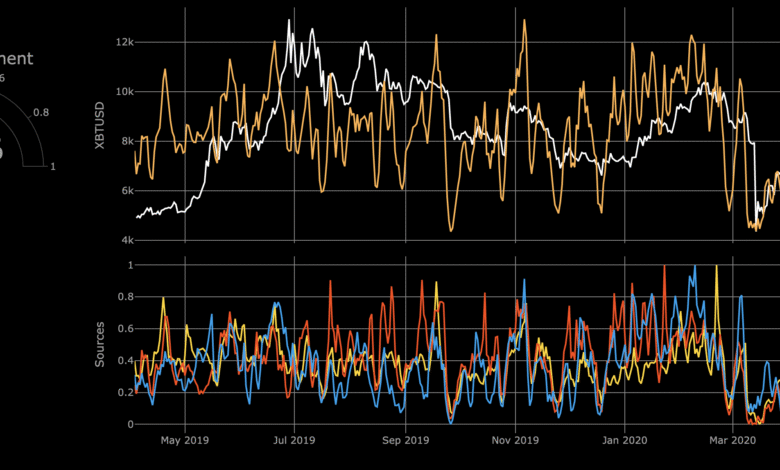

The Bitcoin Sentiment Meter has recently witnessed a dramatic shift, plummeting from ‘extreme greed’ to a more balanced ‘neutral’ stance. This change comes as Bitcoin’s value retraced from an impressive $109,000 to approximately $104,500, reflecting the heightened volatility characteristic of cryptocurrency market trends. Notably, the Crypto Fear and Greed Index, which gauges market sentiment, echoed this transition as it adjusted from a euphoric state to a cautious midpoint. In the wake of Bitcoin’s all-time high earlier this month, sentiment has oscillated significantly, underscoring the intricate relationship between Bitcoin price analysis and trader psychology. As investors navigate these fluctuations, understanding the implications of cryptocurrency sentiment can help them make informed decisions in this ever-evolving financial landscape.

In recent developments within the crypto ecosystem, the Bitcoin Sentiment Meter, which assesses market moods, has exhibited notable fluctuations. Following its peak performance when Bitcoin reached astonishing values, sentiment has now stabilized at a neutral level after a period of intense activity. This situation parallels the shifts seen in the Crypto Fear and Greed Index, which reflects the emotional landscape of cryptocurrency enthusiasts. As traders continue to evaluate Bitcoin’s fluctuations, it becomes increasingly vital to analyze Bitcoin market trends and decipher the intricate relationship both fear and optimism play in price movements. Thus, navigating the complex world of Bitcoin sentiment offers investors critical insight into future market behaviors.

Understanding Bitcoin’s Sentiment Meter

The Bitcoin Sentiment Meter is an essential tool for gauging the emotional state of the cryptocurrency market. This index, along with the Crypto Fear and Greed Index (CFGI), sheds light on the prevailing investor sentiment, ranging from extreme fear to extreme greed. Following a significant drop in Bitcoin’s value—from $109,000 down to $104,500—the sentiment shifted abruptly from a state of extreme greed to a neutral stance. Such shifts indicate not only the current price action but also reflect the collective psychology of investors as they react to market movements.

When Bitcoin hit its all-time high, both the Bitcoin Sentiment Meter and the CFGI surged into the ‘extreme greed’ zone, indicating a bullish outlook among traders. However, this sentiment can be fleeting, as it often changes rapidly in response to price fluctuations. The meter effectively encapsulates the emotional landscape of the cryptocurrency market, where fear and greed often dictate trading behaviors. As investors contemplate buying or selling, understanding where the sentiment lies can offer valuable insights into potential future movements in Bitcoin’s price.

The Impact of the Crypto Fear and Greed Index

The Crypto Fear and Greed Index serves as a barometer for determining market sentiments surrounding Bitcoin and other cryptocurrencies. This index categorizes sentiments, influencing trading decisions and revealing patterns over time. For instance, when the index reflects ‘greed,’ it often signifies a bullish sentiment, potentially leading to increased buying activity. Conversely, when it leans towards ‘fear,’ sellers may dominate the market, driving prices downward. Currently, with Bitcoin stabilizing at $104,500 and the index reading a neutral score, investors find themselves at a pivotal point, uncertain about the next market trend.

Such fluctuations in the Crypto Fear and Greed Index not only represent investor moods but also correlate closely with Bitcoin market trends. A neutral reading often indicates a pause in market momentum, suggesting that traders are cautious and looking for additional signals before committing to buying or selling. Analysis of historical data shows that Bitcoin’s price tends to consolidate during neutral phases before making decisive movements. Thus, the index becomes a crucial tool for anticipating possible Bitcoin price trajectories, especially following significant events like reaching an all-time high.

Analyzing Current Bitcoin Market Trends

As Bitcoin prices linger at $104,500, recent market trends illustrate a degree of uncertainty among investors. Following an explosive rise to over $109,000, the correction to a neutral sentiment indicates that many are reassessing their strategies. This balance between fear and greed often leads to increased volatility, as traders react to external market forces and news that can sway sentiment significantly. Analyzing current market trends requires looking at various indicators, including trading volumes and the longevity of price levels.

Moreover, insights gleaned from price analysis reveal that while there has been some retreat from the all-time highs, Bitcoin’s current price remains impressive, reflecting a notable increase over the last several months. However, potential investors should be cautious, as the shift from bullish sentiment to a more tempered mood may signal a consolidation phase before any new upward movements. This prevailing environment necessitates that traders remain vigilant, utilizing both the Bitcoin Sentiment Meter and historical price trends to inform their trading decisions.

Bitcoin Price Analysis: The Journey Ahead

Bitcoin’s recent price evolution has captured the attention of market analysts and investors alike. Following its peak at $112,000, the drop back to $104,500 raises questions about the future trajectory of this digital asset. Price analysis involves not just observation of numerical values but also understanding the psychological factors that affect traders. The sentiments reflected by the Crypto Fear and Greed Index reveal that while there was excitement leading up to the all-time high, the climate has shifted significantly, necessitating vigilance in the market.

Future price movements for Bitcoin will likely hinge on several factors, including macroeconomic conditions, regulatory news, and technological advancements. Many experts believe that reaching new all-time highs will require a return to a state of increased investor optimism, reflected by a surge in the Crypto Fear and Greed Index towards the ‘greed’ region. Thus, while Bitcoin history suggests that corrections are part and parcel of its growth cycles, how the market navigates through this ‘neutral’ sentiment phase will be crucial for its upcoming trends.

Navigating Market Indecision: Opportunities and Risks

Market indecision in cryptocurrency, particularly Bitcoin, can present both risks and opportunities for savvy investors. In situations where the Crypto Fear and Greed Index hovers around the neutral mark, market participants may be unsure whether to buy, hold, or sell. This uncertainty can lead to price stagnation as traders await further signals. However, for experienced investors, such conditions may offer a chance to capitalize on potential rebounds after sharp corrections, enabling them to enter or accumulate positions in anticipation of future gains.

Furthermore, the volatility observed in Bitcoin often correlates with broader market dynamics, indicating that amid uncertainty lies the potential for significant profits. Strategic investors use tools like the Bitcoin Sentiment Meter to gauge mood shifts and dictate their market timing. Recognizing patterns from past sentiment cycles can empower traders to make informed decisions transitioning through different fear or greed phases, ultimately improving their investment outcomes as the market evolves.

Market Volatility: A Double-Edged Sword

Bitcoin’s price is notoriously volatile, which can be a double-edged sword for investors. On one hand, significant upward swings can yield impressive profits for those who time their trades correctly. Conversely, the same volatility can lead to sudden downturns, as seen when Bitcoin slid from its all-time high to current levels. The Crypto Fear and Greed Index reflects an essential aspect of this volatility—how market sentiment quickly shifts from extreme optimism to caution, influencing trading behaviors dramatically.

Traders must manage risk effectively in a highly volatile environment. Utilizing the Bitcoin Sentiment Meter allows them to gauge how much market enthusiasm or fear is driving prices, making it easier to navigate uncertain waters. Lessons from past volatility incidents teach investors to appreciate the potential for both swift gains and steep losses. As Bitcoin continues its price discovery journey, understanding these dynamics will be vital in navigating the ebb and flow of the market.

The Psychological Factors Influencing Bitcoin Prices

Psychological factors play a significant role in cryptocurrency trading, often dictating market movements more than technical analysis. The recent shift from extreme greed to a neutral sentiment demonstrates how quickly investor moods can pivot, influenced by news and market behavior. The Crypto Fear and Greed Index captures this psychological backdrop, reflecting how emotions—such as fear of losing profits or greed for more gains—impact Bitcoin’s price dynamics. Understanding these elements can provide keen insights into predicting future market trends.

Moreover, recognizing that market sentiment is often catalyzed by external events allows traders to prepare for unforeseen shifts. For instance, positive news about Bitcoin adoption can spur a surge into extreme greed, while negative regulatory news may plunge sentiment into extreme fear. In this way, the Bitcoin Sentiment Meter serves as a critical indicator for understanding not just where investors stand currently, but also how they may react to future developments in the cryptocurrency landscape.

Implications of Bitcoin’s Current Sentiment for Investors

Bitcoin’s current sentiment reading at the midpoint of neutrality presents unique implications for investors. This stage often hints at indecision within the market, potentially leading to range-bound price movements as traders await clearer signals to guide their actions. Investors seeking to enter or exit positions in Bitcoin should approach this current state with a strategic mindset while monitoring the sentiment closely. Possible future signals could trigger either a return to bullish sentiment or further bearish developments.

Understanding the oscillating nature of investment sentiment in the Bitcoin market will empower traders to make more informed choices. Those who recognize the significance of this neutral period may opt to accumulate positions gradually, anticipating potential rebounds as the market processes its emotions. As Bitcoin’s price remains resilient above its previous levels, navigating this balance of sentiment can yield long-term benefits for those willing to remain patient and perceptive in a changing market landscape.

Frequently Asked Questions

What does the Bitcoin Sentiment Meter indicate about current market trends?

The Bitcoin Sentiment Meter reflects current market sentiment, notably showing a shift from ‘extreme greed’ to ‘neutral’ as recently observed. This change suggests that investors are more cautious after the recent price decline—falling from $109,000 to $104,500—highlighting uncertainty in Bitcoin market trends.

How does the Crypto Fear and Greed Index affect Bitcoin price analysis?

The Crypto Fear and Greed Index (CFGI) serves as a critical tool for Bitcoin price analysis by measuring market sentiment. Currently, with the CFGI reading at 50, it indicates ‘neutral’ sentiment, which can imply potential price consolidation as traders await further market direction.

What does a reading of ‘neutral’ in the Bitcoin Sentiment Meter mean for investors?

A ‘neutral’ reading in the Bitcoin Sentiment Meter suggests a balanced market sentiment. This indicates that while traders are not overwhelmingly optimistic or pessimistic, caution prevails among investors as they assess potential movements following Bitcoin’s recent all-time high.

How have fluctuations in the Crypto Fear and Greed Index impacted Bitcoin’s all-time highs?

Fluctuations in the Crypto Fear and Greed Index closely correlate with Bitcoin’s all-time highs. As seen recently, when Bitcoin approached $112,000, the CFGI surged into the ‘extreme greed’ zone, indicating high confidence; however, a subsequent slide to $104,500 caused the sentiment to reset to ‘neutral,’ reflecting market volatility.

Why is the Bitcoin Sentiment Meter important for understanding cryptocurrency sentiment?

The Bitcoin Sentiment Meter is vital for understanding cryptocurrency sentiment as it gauges emotional reactions of investors. By monitoring shifts between fear, greed, and neutrality, traders can better anticipate market trends and make informed decisions regarding their investments in Bitcoin and other cryptocurrencies.

What implications does a transition from ‘greed’ to ‘neutral’ have on Bitcoin market trends?

A transition from ‘greed’ to ‘neutral’ within the Bitcoin Sentiment Meter often signals a cooling off period in the market. This may indicate that investors are reassessing their positions, potentially leading to increased volatility and further price adjustments before a clearer market direction emerges.

How can I utilize the Bitcoin Sentiment Meter for my trading strategy?

To enhance your trading strategy, leverage the Bitcoin Sentiment Meter by integrating its indicators into your analysis. By monitoring shifts in sentiment—such as from greed to neutral—you can identify potential buying or selling opportunities, adjusting your strategy according to market psychology and sentiment trends.

What factors contribute to shifts in the Bitcoin Sentiment Meter readings?

Shifts in the Bitcoin Sentiment Meter readings are influenced by various factors, including market price fluctuations, macroeconomic news, investor sentiment, and global economic events. Events like reaching new all-time highs can surge sentiment into ‘extreme greed’, while price corrections can bring it down to ‘neutral’ or ‘fear’.

How does the Bitcoin Sentiment Meter correlate with Bitcoin’s price movements post-all-time high?

Post-all-time high, the Bitcoin Sentiment Meter often reflects a cooling sentiment, indicated by readings dropping into ‘neutral’ or ‘fear’. This typically happens after new price peaks, as seen with Bitcoin’s recent fall from $109,000, illustrating the psychological impact of profit-taking and investor caution following periods of extreme euphoria.

| Key Point | Details |

|---|---|

| Bitcoin Price Drop | Bitcoin’s price fell from $109,000 to $104,500. |

| Crypto Fear and Greed Index | The CFGI dropped from ‘greed’ to ‘neutral’, currently at 50. |

| Previous ATH | BTC briefly hit a new all-time high around $112,000 before the decline. |

| Market Sentiment Range | The CFGI ranges from 0 (Extreme Fear) to 100 (Extreme Greed). |

| Current Market State | BTC’s neutral sentiment at 50 indicates market indecision amid volatility. |

Summary

The Bitcoin Sentiment Meter has shown a significant shift from ‘Extreme Greed’ to a ‘Neutral’ stance, reflecting the underlying volatility and emotional uncertainty in the market. After reaching a staggering price peak, Bitcoin’s decline to $104,500 coincides with a change in investor sentiment, as illustrated by the Crypto Fear and Greed Index. This neutral position indicates a period of indecision among traders, despite Bitcoin showing a price premium compared to previous levels. As the market seeks clarity, observing the Bitcoin Sentiment Meter will be crucial for forecasting future movements.