Bitcoin Surge Predictions Amid Market Volatility and Trump Tariffs

Bitcoin surge predictions have been electrifying the minds of investors and enthusiasts alike, especially in light of recent developments in the crypto market. As we observe fluctuations influenced by external factors, such as President Trump’s tariff threats, the volatility within the cryptocurrency landscape becomes evident. Despite this week’s price shifts, with Bitcoin ending just above $108,000, analysts continue to push forward optimistic Bitcoin price predictions, forecasting potential highs of up to $140,000 by July. These bullish forecasts suggest that while market conditions are uncertain, there is a robust belief in the resilience of Bitcoin against the backdrop of global economic turbulence. Keeping an eye on cryptocurrency trends, investors are strategizing to navigate potential gains amidst the ongoing analysis of these shifts in momentum and external influences.

In the evolving realm of digital currencies, predictions regarding Bitcoin’s skyward momentum have captivated both traders and analysts. The recent discourse surrounding the cryptocurrency market not only addresses Bitcoin’s potential but also examines influential events, like tariff announcements, that disrupt typical trading patterns. With market analysts providing their insights into Bitcoin’s performance—heralding it as a pivotal player in the digital asset space—attention is drawn towards fluctuations and expected growth trajectories. As experts assess the broader implications of these economic indicators, discussions emerge about the future trajectory of not just Bitcoin, but the entire cryptocurrency ecosystem. The ongoing analysis underscores the importance of staying informed about these significant economic events and their corresponding impact on cryptocurrency valuations.

Bitcoin Surge Predictions Amid Market Volatility

The cryptocurrency market is notorious for its volatility, and recent events have underscored this reality. Bitcoin’s surge predictions remain a hot topic among analysts and investors alike, especially after witnessing its recent fluctuations influenced by geopolitical events. With President Trump’s tariff threats against the EU creating ripples in the financial markets, we see a classic example of how external factors can significantly affect cryptocurrency prices. Despite this, some analysts are optimistic, projecting that Bitcoin could soar to unprecedented heights, potentially reaching $140,000 by July.

In analyzing the Bitcoin price prediction landscape, it becomes clear that many investors are focusing on macroeconomic indicators, such as the global money supply. As Raoul Pal suggests, these factors could play a pivotal role in Bitcoin’s potential to gain nearly 30% in just a few months. However, traders should remain cautious as volatility can lead to swift price corrections. Understanding these dynamics is essential for anyone looking to navigate the challenges of the crypto market effectively.

Impact of Trump’s Tariff Threat on Cryptocurrency Trends

The unexpected announcement regarding tariffs from Donald Trump prompted immediate reactions within the cryptocurrency market. Many investors had anticipated bullish trends for Bitcoin, which had seen a week marked by significant gains before this news broke. This series of tariff threats understandably rattled traders, resulting in a temporary sell-off that affected Bitcoin’s price. The correlation between geopolitical events and trade policies illustrates the sensitivity of the crypto market to external influences, reinforcing the importance of constant market analysis.

As we assess the impact of these developments, it is evident that not only Bitcoin but also other cryptocurrencies experienced similar fluctuations. While Bitcoin’s dominant position often dictates market trends, other assets like WLD and HYPE have shown resilience amidst these disturbances, attracting significant investor interest. This diverse behavior across cryptocurrencies signals that investors are increasingly looking at innovative tokens as they navigate through periods of turbulence within the broader crypto landscape.

Market Overview: Current Values and Predictions

Tracking the latest market values provides insight into where Bitcoin and its counterparts currently stand amid fluctuating trends. As Bitcoin registers a price around $108,923.00, it’s crucial for investors to analyze market capitalization figures alongside BTC’s dominance, which remains robust at over 65%. This dominance is indicative of Bitcoin’s influential role as a market leader, even as other altcoins like Ethereum and Solana try to carve out their niches in this highly competitive space.

Moving forward, investors should maintain a close watch on the market cap trends and Bitcoin’s evolution as predictions suggest a possible surge to extraordinary heights. The cryptosphere is deeply intertwined with global economic shifts, making it vital for traders to stay updated on the latest insights. Whether one is focused on Bitcoin price prediction or observing shifts across altcoins, understanding these market dynamics can significantly improve strategic investment decisions.

The Role of Market Analysts in Cryptocurrency Investments

Market analysts play a crucial role in guiding investors through the complexities of the cryptocurrency landscape. Their predictions and analyses, like those of Raoul Pal, are highly sought after as they provide much-needed context in a market marked by uncertainty and rapid changes. Investors rely on these insights to gauge the potential trajectories of Bitcoin and other cryptocurrencies. Analysts utilize historical data and current events, crafting a narrative that helps to form educated guesses about future movements in the market.

Moreover, the influence of analysts extends beyond Bitcoin, substantially impacting how investors view emerging cryptocurrencies such as WLD and HYPE. The success of these tokens highlights the importance of staying informed about market trends and capitalizing on opportunities that analysts forecast. With their ability to interpret market signals and deliver timely insights, analysts help demystify the often chaotic world of cryptocurrency, allowing investors to make informed decisions.

The Future Outlook for Bitcoin and Market Cap Dynamics

The outlook for Bitcoin as we progress into the summer months appears cautiously optimistic. With analysts suggesting a potential surge towards $140,000, the enthusiasm among Bitcoin supporters remains palpable. The dynamics of market capitalizations will play a pivotal role in shaping the future trajectory of Bitcoin and the entire crypto ecosystem. Monitoring changes in dominance is vital for gauging Bitcoin’s influence and potentially predicting other coins’ performance as the market evolves.

Equally important is the future of alternative cryptocurrencies, which can often overshadow Bitcoin’s narrative. Tokens like WLD and HYPE are examples of how diverse trends can reshape market views, creating a spectrum of investment opportunities. Investors should be vigilant in following these developments, as shifts in market cap and investor sentiment can significantly dictate future price actions across the board. As the crypto market matures, understanding these nuances will be critical to smart investing.

Cryptocurrency Market Trends: A Deep Dive

Analyzing cryptocurrency market trends is essential for anyone looking to invest wisely. As Bitcoin experiences fluctuations due to factors like the Trump tariff threats, it’s evident that these markets are highly sensitive to news and shifts in investor sentiment. Observing the interplay between Bitcoin and other cryptocurrencies helps identify trends that may not be immediately apparent. For investors, staying aware of these trends can yield substantial rewards, especially if one capitalizes on predictive analyses.

Additionally, emerging tokens are gaining traction, showcasing the ever-evolving landscape of cryptocurrency. Established tokens like Bitcoin and Ethereum may dominate headlines, but newcomers are beginning to offer competitive investment opportunities. By closely following both established and emerging trends, investors can ascertain which cryptocurrencies are likely to define the future of the market. A comprehensive understanding of these trends will facilitate more strategic investment decisions.

Understanding Cryptocurrency Volatility and Its Drivers

Cryptocurrency volatility has become a defining characteristic of the market, often posing challenges and opportunities for investors. Multiple factors contribute to this instability, including regulatory news, market sentiment, and technological advancements. The recent turmoil brought on by tariff threats is a prime example of how external events can send shockwaves through the market, leading to rapid price swings. Understanding these drivers of volatility is crucial for anyone aiming to invest in cryptocurrencies like Bitcoin.

Investors must recognize that volatility can also be an indicator of potential gains. Quick shifts in market dynamics can present buying opportunities for those who pay attention to trends and act strategically. While the inherent risks are significant, the potential for profit draws many to the crypto space. Aspiring investors should familiarize themselves with the factors affecting volatility, ensuring they remain well-prepared to make informed investment decisions.

The Role of Innovation in Cryptocurrency Growth

Innovation remains a pivotal force behind the growth of the cryptocurrency sector. As developers introduce new technologies and concepts, these innovations often lead to the creation of new currencies, platforms, and investment opportunities. Bitcoin has been a trailblazer in this regard, but it is crucial for investors to keep an eye on how newer projects like WLD and HYPE may reshape the market landscape. The fusion of innovation with market dynamics will undoubtedly influence future trends.

As the cryptocurrency ecosystem matures, the integration of advanced technologies such as smart contracts, decentralized finance (DeFi), and blockchain interoperability will challenge traditional models, paving the way for a more versatile financial landscape. Understanding these innovations is crucial for investors looking to stay ahead in a rapidly evolving market. By embracing change and recognizing the potential of these advancements, investors can position themselves favorably for the future.

Navigating Challenges in the Crypto Market

The crypto market is not without its challenges, from regulatory scrutiny to prevailing market sentiments. As seen with the recent tariff threats affecting Bitcoin and other cryptocurrencies, understanding how to navigate these challenges effectively is vital for success. Investors must adopt a proactive approach to deal with potential pitfalls, primarily focusing on informed decision-making and sound trading strategies.

Investors should also consider diversifying their portfolios to mitigate risks associated with market volatility. By including a mix of established cryptocurrencies like Bitcoin and promising newcomers, traders can better weather the storm during turbulent times. Staying informed about global economic conditions and market signals will empower investors to respond adeptly to the ever-changing landscape of the cryptocurrency market.

Frequently Asked Questions

What are the latest Bitcoin price predictions amidst recent market volatility?

Recent Bitcoin price predictions suggest a potential peak of over $140,000 by July, despite recent market volatility caused by political events such as Trump’s tariff threat against the EU. Analysts like Raoul Pal have pointed out that the global money supply metrics favor a continued upward trend for Bitcoin in the near future.

How does market volatility affect Bitcoin surge predictions?

Market volatility can significantly impact Bitcoin surge predictions, as demonstrated by the recent reaction to Trump’s tariff threat. Such political events can cause sudden sell-offs and fluctuation in prices. However, experts believe that the underlying fundamentals, including the global money supply, will still push Bitcoin towards new highs.

What factors are influencing Bitcoin analysis and surge predictions lately?

Recent factors influencing Bitcoin analysis and surge predictions include global economic trends, significant political statements like Trump’s tariffs, and the overall sentiment in the cryptocurrency market. Analysts look at these elements to evaluate Bitcoin’s potential trajectory.

What expert insights are available on Bitcoin surge predictions?

Experts like Raoul Pal suggest that Bitcoin could surge past $140,000 by July based on broad economic indicators and market behavior. This prediction considers the historical patterns of Bitcoin price movements and current market dynamics.

What are the implications of Trump’s tariff impact on Bitcoin and the broader crypto market?

Trump’s tariff impact has introduced volatility into the crypto market, momentarily stalling Bitcoin’s recent surge. Such geopolitical events can cause panic selling; however, they also present potential buying opportunities for long-term investors expecting Bitcoin to rebound strong.

What are the current trends affecting Bitcoin prices and surge predictions?

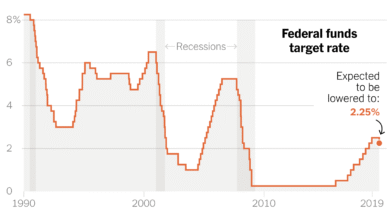

Current trends affecting Bitcoin prices include macroeconomic indicators, interest rates, and political developments. These trends are critical to Bitcoin surge predictions as they shape investor sentiment and market dynamics within the crypto landscape.

How do cryptocurrency trends affect Bitcoin’s upward potential?

Cryptocurrency trends, such as increasing institutional adoption and innovative blockchain technologies, positively impact Bitcoin’s upward potential. As the market matures and more investors enter, Bitcoin’s price predictions reflect growing confidence in its viability as a digital asset.

Are there any recent Bitcoin price predictions after the surge stalled?

Yes, despite the recent stall, experts maintain bullish Bitcoin price predictions, with a target of around $140,000 by July. This forecast is based on historical price analyses and the expected recovery from current market volatility.

| Key Point | Details |

|---|---|

| Bitcoin Price Movement | Bitcoin ended the week at $108,923, up 5% despite market volatility. |

| Trump’s Tariff Threat | The announcement caused a temporary sell-off, dropping BTC to $107,217. |

| Analyst Prediction | Raoul Pal predicts Bitcoin could reach $140,000 by July, a potential 30% gain. |

| WLD and HYPE Performance | WLD surged nearly 50% after major investments, and HYPE experienced a strong rally. |

| Market Overview | Total cryptocurrency market cap is $3.54T, with BTC dominance at 65.30%. |

Summary

Bitcoin surge predictions indicate a bullish sentiment in the crypto market despite recent disruptions. Analysts foresee a potential rise to $140,000 by July, supported by underlying market dynamics. This comes paired with fluctuations in other cryptocurrencies like WLD and HYPE, which also demonstrated significant gains amidst the broader market volatility. As traders adjust to ongoing economic developments, Bitcoin’s resilience and investment potential remain at the forefront of discussions.