Bitcoin Trade Deal Rally Boosts Price Above $105K

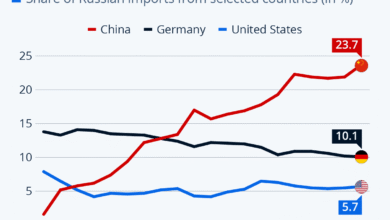

The recent Bitcoin trade deal rally has sparked excitement as financial markets react positively to groundbreaking agreements between the United States and China. U.S. Treasury Secretary Scott Bessent met with China’s Vice Premier He Lifeng, resulting in a crucial trade deal that briefly propelled Bitcoin’s price above $105,000. This surge in BTC’s value came amid optimistic sentiment surrounding the easing of tensions between the two largest economies, providing a necessary boost to investor confidence. As traders speculate on potential future movements in cryptocurrency trends, the implications of the China-US trade deal will likely influence Bitcoin price dynamics significantly. With Bitcoin seemingly bullish, market enthusiasts are keenly watching how these developments unfold amidst shifting financial environments.

The recent surge in Bitcoin’s value, often referred to as the cryptocurrency market’s trade deal rally, has generated significant buzz among investors and analysts alike. This remarkable event follows high-profile negotiations aimed at resolving long-standing economic tensions between the U.S. and China. After the landmark discussions led by Treasury Secretary Scott Bessent and Vice Premier He Lifeng, both nations came to an agreement that seems to have invigorated not just Bitcoin but the broader financial markets. Such developments shed light on underlying currency fluctuations and set the stage for existing and upcoming cryptocurrency trends that could shape the market’s trajectory. With renewed enthusiasm in the air, all eyes now turn to the potential for sustained growth in Bitcoin and other digital assets.

Impact of the China-US Trade Deal on Cryptocurrency Markets

The recent China-US trade deal has significantly impacted global financial markets, creating waves of optimism among investors. With U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng reaching an agreement to soothe trade tensions, stocks surged, and cryptocurrencies, especially Bitcoin, saw a captivating rally. The news about a 90-day reprieve on tariffs not only boosted traditional stock indices like the S&P 500 and Nasdaq but also rejuvenated interest in Bitcoin trading, lifting its value briefly past the $105K mark.

Investors are closely monitoring these developments since the dynamics between the two largest economies influence global trade and investment sentiments. Bitcoin, along with altcoins, has been responding vigorously to news regarding the financial markets, underlining its increasing correlation with traditional assets. As a result, many analysts are predicting that ongoing negotiations and easing of trade tensions could set the stage for a more extended BTC rally, with infused confidence from the current trade deal likely to enhance cryptocurrency adoption further.

Bitcoin Trade Deal Rally: Market Insights and Price Trends

The Bitcoin trade deal rally symbolizes the cryptocurrency’s resilience in the face of geopolitical uncertainties. Following the trade agreement, Bitcoin reached a peak of $105,747.45, impressively navigating towards the $106K threshold. Traders are particularly intrigued by the subsequent market reactions, with Bitcoin maintaining a bullish trend over the week despite slightly cooling off after the initial spike. This indicates a healthy trading environment driven by strategic decisions influenced by macroeconomic factors, making BTC an attractive option once again in volatile markets.

Despite the pullback after the initial surge, Bitcoin’s price remains strong in the context of the broader cryptocurrency trends. With BTC trading volumes increasing by 17.63%, there is a clear indication of robust market engagement. Moreover, the substantial liquidity evident in the derivatives market reflects the sophistication of traders in navigating Bitcoin’s price fluctuations. As the trade deal is put into effect and negotiations continue, the potential for a further rebound is likely, thereby offering favorable long-term implications for Bitcoin and its positioning in the financial markets.

Future Prospects for Bitcoin Amid Ongoing Trade Discussions

As discussions between the U.S. and China evolve, the future prospects for Bitcoin remain a hot topic of debate among investment professionals. The ongoing trade negotiations promise to keep the markets volatile, which can be advantageous for cryptocurrency traders who thrive in such environments. Should the trade deal progress positively and tariffs remain low, there’s potential for increased liquidity in both traditional and crypto markets, perhaps facilitating further rallies for Bitcoin as investors look for safe-haven assets amidst economic uncertainties.

Furthermore, as Bitcoin’s dominance slightly decreases while altcoins gain traction, investors may find opportunities in diversifying portfolios with various cryptocurrencies. This shift can lead to broader adoption of cryptocurrencies, as demonstrated by recent trading patterns. The interplay between Bitcoin’s price movements and the global trade climate will heavily influence investor sentiment moving forward, making it crucial for observers in the financial markets to remain vigilant in tracking these developments.

Understanding Bitcoin Market Volatility After Trade Settlements

Bitcoin’s price volatility frequently draws the attention of traders and investors keen to capitalize on rapid price changes, particularly during significant market events such as trade settlements like the recent China-US agreement. After reaching a high of $105,747.45, BTC experienced a modest retraction, settling at around $102,818.31, signifying typical trading behavior during volatile conditions. The dips often create opportunities for shrewd investors to enter at favorable prices, but they also emphasize the inherent risks present in cryptocurrency trading.

Market participants are analyzing these price movements closely, evaluating the timing for entry and exit strategies. The recent decrease in Bitcoin’s market capitalization coupled with increased trading volume indicates that while some may feel cautious about the recent pullback, others are seizing the moment as an opportunity for further investment. This environment highlights the importance of market insight and risk management for anyone looking to thrive in cryptocurrency trading amid uncertainty in the broader financial markets.

The Correlation Between Trading Volumes and Bitcoin’s Price Actions

Analyzing trading volumes offers significant insight into Bitcoin’s price actions and market sentiment. Following the announcement of the China-US trade deal, Bitcoin’s trading volume surged by over 17.63%, reflecting heightened interest and engagement among both retail and institutional investors. This increase can be directly correlated with the positive sentiment surrounding the trade discussions, highlighting how geopolitical events can influence cryptocurrency markets in real-time.

High trading volumes can often precede price movements, indicating bullish sentiments among traders. However, as volumes rise and prices fluctuate, it becomes imperative for traders to be cautious. The delicate balance between demand and supply often leads to rapid price swings. Therefore, understanding the interlink between trading volumes and price trends is essential for predicting Bitcoin’s trajectory in a landscape that is heavily impacted by both market fundamentals and external events.

Bitcoin’s Resilience in the Face of Global Economic Tensions

Despite facing pressure from fluctuating prices and economic uncertainty, Bitcoin has showcased remarkable resilience as an asset class. The recent trade deal is a testament to the cryptocurrency’s adaptive nature, gaining traction even amid global economic tensions. As traditional markets respond favorably to easing trade tariffs, Bitcoin managed to capture momentum, demonstrating its potential as a hedge against tumultuous financial landscapes. The show of strength from Bitcoin indicates a maturing of the cryptocurrency market, where digital assets can rebound alongside traditional stocks.

Moreover, analysts assert that Bitcoin’s performance during such economic scenarios might attract more institutional investors seeking to diversify their portfolios further. As more money flows into cryptocurrencies, Bitcoin’s narrative strengthens as a credible financial instrument. Its resilience, coupled with strategic responses to international trade discussions, may solidify its status as a cornerstone in the evolving landscape of financial investments.

Analyzing Bitcoin’s Position in a Post-Trade Deal Environment

With the announcement of the China-US trade deal, Bitcoin has found itself at a pivotal moment in the global financial climate. The temporary reduction of tariffs has not only uplifted traditional markets but has also raised questions regarding Bitcoin’s positioning in this new environment. As investors gain confidence in market stability, there is potential for Bitcoin to solidify its role as a key player in the financial sector, attracting more capital flow from traditional assets and increasing its legitimacy.

In this post-trade deal climate, analysts are urging investors to maintain a finger on the pulse of Bitcoin’s movements. The cryptocurrency’s ability to react to macroeconomic changes illustrates its interconnectedness with global markets. With an upward trajectory noted in the week following trade discussions, Bitcoin has positioned itself as a critical asset to watch closely, especially as ongoing negotiations may fuel further interest and market engagement.

The Role of Altcoins in a Flourishing Bitcoin Market

As Bitcoin continues to navigate through its market fluctuations post-trade deal, altcoins have begun to emerge as noteworthy contenders in individual trading spheres. With Bitcoin’s dominance slightly receding, many investors are exploring various altcoins that may present unique opportunities. The surge in interest for alternative cryptocurrencies indicates a growing sensation among traders, as they look to maximize returns across diverse holdings amid promising news in the cryptocurrency market following the trade agreement.

The infusion of fresh capital into altcoins could signify increased market breadth, which may influence Bitcoin’s price positively. Moreover, developments in related technologies such as decentralized finance (DeFi) and non-fungible tokens (NFTs) stand to further support this altcoin rally alongside Bitcoin’s historical strength. Traders are thus encouraged to stay informed about emerging trends, as the flourishing landscape of altcoins could represent fertile ground for investment during periods of Bitcoin momentum.

Predictions for Bitcoin as Trade Winds Shift

As the trade winds shift with new agreements between the U.S. and China, predictions around Bitcoin’s future continue to emerge. Many experts foresee a sustained bullish trend for Bitcoin in the wake of the trade deal, particularly if additional negotiations yield more positive outcomes. The notion that Bitcoin can serve as a barometer for investor confidence in financial markets adds gravity to these predictions, reinforcing the idea that cryptocurrencies remain an integral part of the evolving economic narrative.

With a backdrop of increased global trade cooperation, Bitcoin could benefit from inflows of institutional investment and an enhanced perception as a safe-haven asset. Coupled with rising adoption rates and a growing acceptance of cryptocurrencies as legitimate financial instruments, Bitcoin could potentially reclaim new highs, especially if it maintains robust momentum from this trade deal rally.

Frequently Asked Questions

How did the China-US trade deal impact Bitcoin prices during the rally?

The China-US trade deal significantly boosted Bitcoin prices, causing BTC to rally past $105,000 briefly. This surge was driven by improved market sentiment as stock indices soared in response to the trade agreement, highlighting the interconnectedness between cryptocurrency trends and traditional financial markets.

What were the key outcomes from the recent China-US trade deal that influenced the Bitcoin trade deal rally?

The recent trade deal between China and the US included a 90-day reprieve, reducing tariffs on Chinese goods to 30% and US goods to 10%. This agreement alleviated trade tensions, which turned investor sentiment positive, contributing to the Bitcoin trade deal rally and resulting in a brief price peak above $105,000.

What are the current trends in Bitcoin price following the initial rally spurred by the China-US trade deal?

Following the initial rally from the China-US trade deal, Bitcoin’s price has demonstrated some volatility, dropping to around $102,818.31 after briefly exceeding $105,000. Despite the dip, Bitcoin remains in bullish territory over the past week, suggesting sustained interest in cryptocurrency trends despite short-term fluctuations.

Are Bitcoin and financial markets closely related, as seen in the recent trade deal rally?

Yes, Bitcoin and financial markets are closely linked, as demonstrated by the recent trade deal rally. Positive developments in trade agreements, like the one between China and the US, often lead to heightened investor optimism across both cryptocurrency and traditional financial markets, resulting in increased trading volumes and price movements in Bitcoin.

What should traders consider about the risks of Bitcoin during trade deal rallies?

Traders should consider that while trade deal rallies can lead to significant price increases in Bitcoin, such volatility carries risks; recently, many long positions were liquidated as Bitcoin cooled from its peak. It’s crucial to manage leverage and remain aware of market conditions to mitigate potential losses during rapid price shifts.

| Key Points | Details |

|---|---|

| Trade Deal Impact | Successful negotiations between the U.S. and China led to a temporary reduction in tariffs. |

| Bitcoin Rally | Bitcoin briefly spiked past $105K following the news before settling at around $102K. |

| Stock Market Reaction | Major indices like S&P 500, Nasdaq, and Dow Jones saw significant gains. |

| Market Metrics | Trading volume increased by 17.63%, indicating robust market engagement despite a small dip in prices. |

| Liquidations | Long positions faced significant losses due to sudden market corrections. |

Summary

The recent Bitcoin trade deal rally showcases the compelling influence of trade negotiations on cryptocurrency markets. Following the positive developments in the U.S.-China trade talks, Bitcoin experienced a significant surge, reaching over $105K, though it moderated afterward. This rally highlights the intricate relationship between macroeconomic factors and digital currencies, positioning Bitcoin as a barometer for market sentiment amidst ongoing geopolitical tensions.