Bitcoin Treasuries: Transforming Corporate Finance Models

Bitcoin treasuries are becoming a focal point in the conversation about modern corporate finance, as companies explore innovative capital allocation strategies. The growing trend of accumulating BTC as a reserve asset signifies a shift in bitcoin adoption among corporate treasuries, prompting businesses to reevaluate their financial frameworks. Advocates like Pierre Rochard suggest that these bitcoin accumulation strategies could have profound deflationary effects on the broader economy by reducing production costs. This approach challenges traditional norms of reinvesting profits into operations, instead favoring the potential benefits of holding digital assets. As organizations pivot toward adopting a BTC strategy, the implications for corporate finance models could be revolutionary, influencing how capital is structured and utilized in the years to come.

As corporations increasingly delve into digital currencies, the concept often referred to as bitcoin holdings within corporate treasuries emerges as a game changer in the landscape of business finance. This growing movement may drive shifts in capital deployment and strategic financial planning, as firms look to leverage bitcoin not just as an investment but as a cornerstone of their fiscal policies. By embracing this cryptocurrency into their financial reserves, businesses might realize unique advantages over their competitors, capitalizing on the benefits of a deflationary economic model. Furthermore, these treasury strategies could usher in broader acceptance of digital currencies in the corporate world, ultimately transforming the way value is stored and enhanced in business operations. As such, the integration of bitcoin into corporate finance stands to not only reshape individual company strategies but also redefine the financial ecosystem as a whole.

The Rise of Bitcoin Treasuries in Corporate Finance

Bitcoin treasuries are emerging as a transformative force within corporate finance, with companies increasingly viewing Bitcoin (BTC) not just as a technology but as an integral part of their financial strategy. As organizations shift their focus towards BTC acquisition, we witness a profound reshaping of capital allocation. This transition marks a departure from traditional financial models that prioritize immediate reinvestment in operations, leading to a re-evaluation of profitability metrics based on alternative asset holdings. The inclination to hold BTC as an asset class suggests a strategic pivot towards long-term financial sustainability.

Adopting bitcoin as a treasury asset can prompt significant shifts in how firms assess their financial health and operational efficiency. As businesses begin to prioritize BTC accumulation, the competitive landscape changes, fostering a new emphasis on deflationary buying power. With a capped supply of Bitcoin, companies that hold BTC might experience less volatility in input costs over time, positioning themselves competitively in an evolving economic framework where traditional currency-based evaluations become dated.

Capital Allocation Strategies: Prioritizing BTC

The evolving landscape of corporate finance demands a reevaluation of capital allocation strategies, especially in light of Bitcoin’s unique characteristics. Companies that prioritize BTC firsthand are increasingly recognizing its potential to yield greater returns than traditional investments. This admirable shift showcases not just a reaction to market trends but a proactive strategic alignment, where firms are opting for a reserve that complements their operational frameworks while simultaneously safeguarding against inflationary pressures.

As discussed by Pierre Rochard, the scenario where firms shift from operational reinvestment to Bitcoin acquisition does not merely disrupt traditional finance but also heralds a new era for corporate treasury management. The attraction to BTC is fueled by its deflationary effects; as more companies join the bitcoin treasury movement, the input costs for goods and services begin to decrease—a phenomenon that could enhance overall production profitability. This competitive edge might compel more corporations to consider incorporating BTC into their financial structures, signaling a widespread shift in capital allocation priorities.

Deflationary Effects of Bitcoin Adoption

The introduction of bitcoin into corporate finance not only redefines asset management but also triggers notable deflationary effects that can reshape entire market paradigms. By replacing or augmenting traditional cash reserves with BTC, companies are likely to experience a decrease in the cost of goods and services over time. This deflationary trend arises from the fixed supply nature of Bitcoin, which contrasts sharply with conventional currency that can be subjected to inflation through increased money supply.

As businesses transition to bitcoin treasuries, the cascading effect of decreased input costs fosters an environment where pricing strategies can be revisited. Companies can afford to either lower prices, gain a competitive edge, or improve profit margins—all while utilizing an asset that is increasingly appreciated for its scarcity and reliability. Understanding these deflationary effects is crucial for businesses to navigate this financial evolution while reorienting their corporate finance strategies.

BTC Strategy for Long-Term Financial Health

Implementing a BTC strategy as a part of long-term financial planning can provide corporations with unparalleled financial resilience. With Bitcoin’s inflation-resistant characteristics, treasuries holding significant BTC reserves could insulate firms from the unpredictable fluctuations of traditional markets. This unique position not only secures profits but also allows organizations to strategically plan for future investments without the immediate pressure to reinvest in their operations.

Moreover, a robust BTC strategy involves a thoughtful approach to capital allocation, wherein companies weigh the benefits of holding bitcoin against operational reinvestment opportunities. As noted by Rochard, the journey from simply accumulating BTC to potentially exiting traditional operations reflects a changing mindset in corporate finance, one that curates long-term benefits over short-term gains. Companies willing to adopt this forward-thinking strategy might emerge as industry leaders, demonstrating a commitment to innovative financial practices.

Microstrategy’s BTC Journey and Its Implications

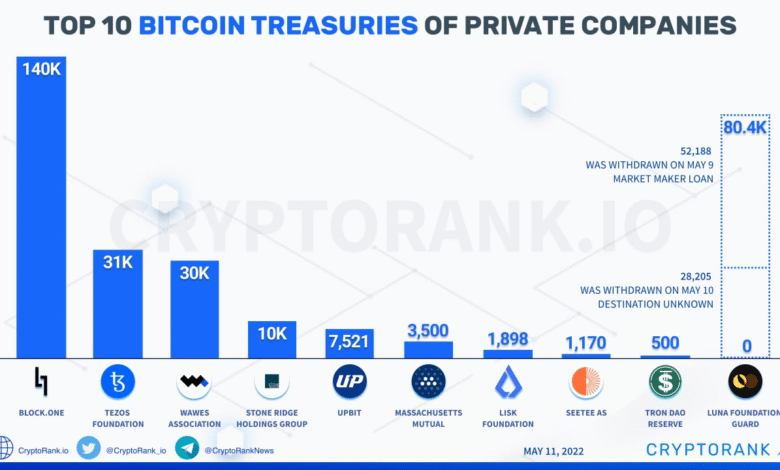

Microstrategy serves as a quintessential case study of BTC strategy in action, having significantly altered its corporate strategy to focus on substantial bitcoin accumulation. Through a combination of direct purchases and strategic debt financing to acquire BTC, the firm has showcased the viability of adopting a bitcoin treasure model in lieu of traditional asset management approaches. This move not only positioned Microstrategy as a pioneer but also set a precedent for other corporations to consider similar models.

The implications of Microstrategy’s journey illustrate that the successful transition towards bitcoin treasury management can inspire a broader acceptance among corporations wary of BTC’s volatility. Advocates argue that the benefits associated with Bitcoin, including its deflationary effects, fixed supply, and increasing acceptance, can ultimately outweigh the risks of its price fluctuations. As more firms set a precedent for BTC accumulation, they contribute to a financial landscape marked by innovation and adaptation.

Corporate Strategy Redefined with Bitcoin

The integration of Bitcoin into corporate strategy necessitates a fundamental shift in operational thinking. Companies are beginning to recognize that accumulating BTC may offer them a strategic advantage, redefining what it means to be agile in today’s volatile economic climate. The idea that corporate finance can move beyond mere profit reinvestment into multifaceted strategies involving cryptocurrencies emphasizes the need for updated governance frameworks and risk assessment methodologies.

This fundamental shift implies that corporate leaders must now consider Bitcoin not just as a speculative investment but as an operational asset that plays a significant role in corporate sustainability. By adopting Bitcoin as a treasury asset, organizations signal a commitment to innovation, resilience, and a readiness to adapt to the ever-changing demands of a digital economy. As businesses continue to embrace these strategies, this could usher in a new standard for financial management that intertwines traditional and digital assets.

Bitcoin’s Role in Shaping Future Corporations

As Bitcoin adoption becomes more mainstream, its role in shaping the future of corporations cannot be overstated. Companies that prioritize BTC as part of their financial strategies are likely to foster environments conducive to innovation and operational efficiency. The adoption of bitcoin treasury strategies is more than just a financial pivot; it symbolizes an ideology that embraces technological innovation while challenging the status quo of corporate finance.

In this evolving landscape, the ramifications of holding Bitcoin extend well beyond the balance sheet. Corporations that integrate BTC into their operations will have a unique opportunity to influence market dynamics, productivity, and consumer behavior. By participating in the bitcoin economy, firms can potentially redefine their paths to profitability, leading to a future where Bitcoin is an integral component of corporate finance.

Navigating the Risks of Bitcoin Strategy

One of the critical elements that firms must consider when adopting a bitcoin strategy is the associated volatility risks. Alfred to as a disruptive innovation, Bitcoin’s market can fluctuate dramatically, leading some analysts and executives to view BTC as a double-edged sword in corporate treasury management. Understanding these risks is essential for organizations that aim to implement a robust BTC holding strategy without jeopardizing their financial security.

Developing risk management frameworks that accommodate BTC’s volatility will be crucial for businesses looking to leverage its potential benefits. Companies must also consider the regulatory landscape surrounding Bitcoin and its implications for traditional financial operations. Establishing clear guidelines for managing this asset class can pose challenges, but it is a necessary step towards regional and global adoption that aligns with evolving corporate strategies.

Future Insights on Bitcoin and Corporate Finance

Looking toward the future, the relationship between Bitcoin and corporate finance appears poised for continued evolution. As more corporations champion bitcoin treasuries, it is essential to understand the long-term implications of this trend on global markets and economic structures. The implications of widespread Bitcoin adoption extend beyond financial metrics, potentially redefining corporate cultures and employee engagement strategies.

Future insights indicate that with increased bitcoin adoption among corporate treasuries, a new financial paradigm might emerge that prioritizes long-term stability over short-term profits. As organizations learn from peers and industry leaders like Microstrategy, an increasing number of firms may shift their strategies to include BTC as a fundamental component of their financial outlook. This evolution could ultimately lead to an economic landscape characterized by innovation, resilience, and a distinct departure from conventional finance.

Frequently Asked Questions

What are Bitcoin treasuries and how do they impact corporate finance?

Bitcoin treasuries refer to the practice of companies accumulating Bitcoin (BTC) as a key part of their capital allocation strategy. This shift in corporate finance can disrupt traditional models by prioritizing Bitcoin holdings over conventional investments, potentially enhancing profitability and enabling companies to benefit from Bitcoin’s deflationary effects.

How does Bitcoin accumulation affect capital allocation strategies in businesses?

Accumulating Bitcoin as part of a treasury strategy influences capital allocation by encouraging companies to divert funds from operational reinvestment toward Bitcoin investments. This change can create a feedback loop where reduced input costs lead to increased production profitability, driving overall economic changes.

What role does Bitcoin adoption play in reshaping corporate risk management strategies?

Widespread Bitcoin adoption can transform corporate risk management strategies by introducing BTC as a unique and volatile asset class. Companies that adopt Bitcoin treasuries may find new ways to hedge against inflation while managing traditional financial risks, making their capital allocation strategies more resilient.

Can Bitcoin treasuries lead to deflationary effects in the economy?

Yes, Bitcoin treasuries have the potential to lead to deflationary effects. As companies opt to hold BTC instead of reinvesting in operations, it could lower production costs, consequently making goods and services more affordable and influencing market dynamics toward deflation.

What is the potential future of corporate finance with the rise of Bitcoin treasuries?

The future of corporate finance may see a significant evolution with the rise of Bitcoin treasuries. Companies may adopt innovative BTC strategies that prioritize Bitcoin holdings, affecting their investment decisions, operational models, and overall impact on capital markets and economic performance.

How have firms like Microstrategy influenced the emergence of Bitcoin treasuries?

Firms like Microstrategy have set a precedent for Bitcoin treasuries by actively accumulating BTC through direct purchases and debt financing, showcasing how corporate treasuries can strategically leverage Bitcoin as a reserve asset. Their approach has inspired other companies to consider a similar BTC strategy despite the associated volatility.

What challenges do companies face when implementing Bitcoin treasury strategies?

Companies implementing Bitcoin treasury strategies face several challenges, including Bitcoin’s price volatility, regulatory uncertainties, and the need for robust risk management frameworks. Balancing these factors while pursuing capital allocation in Bitcoin can prove complex for corporate finance professionals.

Is Bitcoin a viable long-term reserve asset for corporate treasuries?

Many experts argue that Bitcoin is a viable long-term reserve asset due to its fixed supply and deflationary characteristics. As businesses increasingly recognize Bitcoin’s potential, its role in corporate treasuries could solidify, appealing to companies seeking to preserve capital against inflation.

| Key Point | Details |

|---|---|

| Potential Economic Revolution | Bitcoin accumulation strategies could reshape corporate capital allocation and profitability. |

| Advice from Pierre Rochard | Companies prioritizing BTC over reinvestment may trigger a feedback loop affecting overall economic profitability. |

| Progression of Corporate Strategy | A theoretical progression where companies start saving in BTC, then use it instead of reinvestment, leading to the creation of bitcoin treasury companies. |

| Microstrategy Example | Microstrategy exemplifies this strategy by accumulating BTC through purchases and debt, showcasing a successful bitcoin treasury model. |

| Volatility Considerations | Some analysts view BTC accumulation as risky due to volatility, yet advocates cite fixed supply as a protection against inflation. |

Summary

Bitcoin treasuries represent a transformative approach to corporate finance, suggesting that as more companies adopt bitcoin accumulation strategies, the conventional models of capital allocation could evolve significantly. The insights shared by bitcoin advocate Pierre Rochard indicate that prioritizing bitcoin may not only enhance profitability for businesses but could also lead to broader economic changes by lowering production costs. As this trend develops, we may witness a notable shift in how companies perceive their reserves, ultimately championing the role of bitcoin in corporate treasury strategies.