BitMine Ethereum Treasury Strategy Aims High After 700% Soar

BitMine Ethereum Treasury is making waves in the investment community, leveraging a daring strategy to accumulate $250 million in Ethereum assets. Following the appointment of Wall Street visionary Tom Lee as Chairman, the company’s stock has seen an astonishing 700% surge, capturing the attention of market watchers and crypto enthusiasts alike. As BitMine positions itself as a potential leader in the ETH investment arena, many are comparing it to the well-known MicroStrategy model that transformed corporate treasury strategies. This ambitious move into Ethereum signals a new direction, potentially redefining how companies perceive digital assets in their financial portfolios. With the rise of BitMine stock and its bold Ethereum strategy, the market eagerly anticipates how this venture will unfold in the coming months.

The BitMine Ethereum Treasury initiative is being touted as a transformative approach within the cryptocurrency sector, setting the stage for an innovative accumulation of Ether. As the company, previously focused on Bitcoin, makes a strategic pivot towards establishing a significant Ethereum holding, investment analysts are buzzing with excitement about its potential. Tom Lee, a respected figure in financial circles, brings considerable clout to this venture, raising expectations for positive outcomes akin to those achieved by major players like MicroStrategy. By positioning itself at the forefront of ETH investment trends, BitMine is not merely adapting; it is forging a new path that could influence how companies structure their corporate reserves in the digital age. This shift represents a broader movement in the industry, where traditional financial strategies are being revisited in light of blockchain technology.

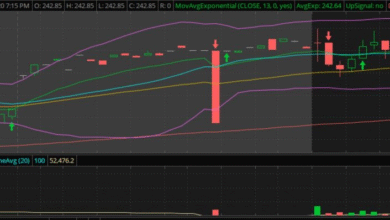

The Meteoric Rise of BitMine Stock

BitMine’s recent surge of over 700% can be attributed to several strategic moves that have caught the attention of investors and analysts alike. Chief among these is the appointment of Tom Lee, a prominent figure in financial strategy, as the Chairman of the Board. Lee’s credibility in the markets has reignited interest in BitMine stock, making it a key player within the cryptocurrency mining space and elevating its profile among institutional investors. The market response reflects a broader cultural shift towards crypto assets, further fueled by the recent discussions surrounding Ethereum’s potential as a treasury asset.

Furthermore, this meteoric rise signals a transformation of BitMine from a traditional mining operation to a forward-thinking player in the blockchain ecosystem. The infusion of a $250 million investment for their Ethereum treasury strategy suggests a calculated risk that could yield substantial returns. As investors search for viable opportunities in crypto, BitMine’s bold approach could position it to replicate the success seen by firms like MicroStrategy, which set a precedent by adopting Bitcoin as a key asset in their financial strategy.

Exploring BitMine’s Ethereum Treasury Strategy

The Ethereum treasury strategy is central to BitMine’s vision as it aims to become the largest publicly traded holder of Ether. This ambitious goal reflects a growing recognition of Ethereum’s potential beyond just a cryptocurrency; it is becoming a vital player in the infrastructure of blockchain finance. By accumulating substantial ETH reserves, BitMine is positioning itself to benefit from Ethereum’s expanding fee revenue, which could explode tenfold if adoption rates continue to climb. This strategy not only represents a pivot towards Ethereum but underscores BitMine’s commitment to evolving with market trends.

In terms of execution, BitMine’s $250 million private placement attracted significant backing from reputable investment funds, showcasing strong investor confidence in its strategy. As institutional interest in Ethereum rises, particularly with companies like Circle achieving IPO milestones, BitMine could capture a slice of this growing market. If successful, its treasury approach may set a new standard within the corporate sphere, possibly inspiring other firms to adopt similar ETH investment strategies. This could ultimately lead to a seismic shift in corporate treasury management toward Ethereum-centric models.

Tom Lee’s Influence on BitMine’s Strategy

Tom Lee’s role as Chairman marks a pivotal moment for BitMine, given his stature as a seasoned Wall Street strategist. His expertise not only lends credibility to BitMine but also aligns with the company’s ambition to innovate within the cryptocurrency space. Lee’s strategic insights are likely to help BitMine navigate the complexities of the evolving financial landscape, potentially shaping its approach to Ethereum investments and treasury strategies. His active involvement and public advocacy could galvanize both retail and institutional investors, leveraging his influence to promote BitMine as a forward-thinking option in crypto.

Moreover, Lee’s track record with other tech-forward investments positions him as an invaluable asset in marketing the potential upside of BitMine stock. His perception of Ethereum’s future as a treasury asset aligns seamlessly with BitMine’s vision, making the company a compelling choice for investors looking for high-growth opportunities within the crypto markets. If BitMine can deliver on its ambitious strategic goals, it may not only reward its stockholders but also enhance Lee’s reputation as an influential strategist in the blockchain domain.

The Growing Importance of Ethereum in Corporate Treasuries

As Ethereum continues to gain traction among leading corporations, it raises pertinent questions about the future of treasury management in the corporate world. Companies are increasingly exploring digital assets, and Ethereum stands out as a strong candidate for treasury reserves. BitMine’s determination to amass a considerable ETH reserve reflects this trend, suggesting a broader shift towards recognizing cryptocurrencies as viable options for corporate assets.

The implications of such a shift are profound; if Ethereum becomes a staple in corporate treasuries, it could legitimize cryptocurrency further and encourage more companies to adopt similar strategies. As firms like BitMine lead the charge, the ripple effect could inspire a new wave of corporate investment in digital currencies, helping to stabilize and innovate treasury management practices. This paradigm shift may ultimately reshape how companies view assets, liabilities, and investments in the context of a digital economy.

Lessons from MicroStrategy for BitMine

MicroStrategy’s groundbreaking investment in Bitcoin serves as a pivotal case study for BitMine as it embarks on its own journey to establish an Ethereum treasury. By adopting Bitcoin as a core asset, MicroStrategy experienced accelerated growth, heightened investor interest, and a significant increase in market valuation. The fundamental lesson here for BitMine is the effectiveness of articulating a clear, bold strategy that transcends traditional investment paradigms.

BitMine’s potential to mirror MicroStrategy’s success hinges on its ability to effectively communicate its Ethereum strategy to investors. Clarity of vision, sustainability of the business model, and the potential for substantial returns are factors that can attract both retail and institutional investors. If executed correctly, BitMine’s approach to establishing an Ethereum treasury not only has the chance to elevate its status in the cryptocurrency realm but could also position it as a definitive leader in corporate treasury innovation.

Market Reactions to the BitMine News

The announcement regarding BitMine’s impressive stock surge and $250 million ETH treasury strategy has not gone unnoticed by the market. Investor sentiment fluctuates significantly in response to new developments, and BitMine has become a focal point of discussions among financial analysts and industry experts. With such dramatic price movements, it is essential to understand the market psychology that underpins BitMine’s stock trajectory, which often mirrors the broader sentiments surrounding cryptocurrency investments.

As speculative interest rises, BitMine’s rapid stock price escalation serves as both an opportunity and a cautionary tale. While some investors may view this as a chance for quick gains, others remain wary of the inherent volatility associated with cryptocurrency stocks. Therefore, the news surrounding BitMine not only drives immediate interest but also fosters deeper conversations about risk management and investment strategies within the cryptocurrency domain.

Analyzing BitMine’s Financial Outlook

BitMine’s recent financial report reveals intriguing insights into its current position and future prospects. The company has demonstrated impressive revenue growth, particularly driven by its leasing business. The robust increase from $1.22 million to $2.05 million in quarterly revenue within a year indicates strong operational momentum and effective business scaling—critical when considering the company’s transition towards Ethereum as a core reserve asset.

However, the thin margin from self-mining illustrates the challenges BitMine faces in optimizing its operational efficiencies. As the company pivots strategically toward Ether, reviewing these financial results provides a roadmap for future growth and sustainability. Effective management of costs, coupled with the successful execution of its Ethereum treasury, will be pivotal in determining BitMine’s long-term success amidst evolving market dynamics.

Potential Risks and Challenges Ahead for BitMine

While BitMine’s stock has experienced significant gains and its Ethereum treasury strategy appears promising, the inherent risks cannot be overlooked. The rapid changes in the cryptocurrency landscape, combined with market volatility, pose potential challenges for BitMine’s strategic ambitions. For instance, if Ethereum fails to maintain its adoption rates or if regulatory environments shift unfavorably, BitMine’s plans could be jeopardized, potentially impacting investor confidence.

Moreover, competition within the cryptocurrency space continues to intensify. As seen with Bit Digital’s pivot to Ethereum, other players may quickly adopt similar strategies, diluting BitMine’s market advantage. As the company forges ahead with its ambitious goals, managing public perception, operational efficiency, and investor expectations will be crucial in mitigating risks and capitalizing on opportunities in an ever-evolving market.

Future Prospects of BitMine in the Crypto Space

The future of BitMine hinges on its ability to effectively implement its Ethereum treasury strategy while navigating the complexities of the cryptocurrency landscape. Given the current momentum, there is a growing belief that BitMine could play a pivotal role in shaping how digital assets are perceived within corporate treasury management. As Ethereum’s utility expands, BitMine’s position may solidify, potentially leading to long-term growth and stability.

If successful, BitMine could pave the way for further institutional investments in Ethereum, creating a ripple effect throughout the industry. The emerging narrative around Ethereum as a treasury asset could redefine investment strategies and financial management practices. Consequently, under the leadership of Tom Lee and with its ambitious plans for ETH accumulation, BitMine stands at a crossroads of potential, reflecting both the opportunities and challenges that lie ahead as it seeks to establish itself as a key player in the crypto ecosystem.

Frequently Asked Questions

What is the BitMine Ethereum treasury strategy all about?

The BitMine Ethereum treasury strategy is focused on raising $250 million to accumulate Ether (ETH) with the goal of becoming the largest publicly traded holder of Ethereum. This strategic shift emphasizes Ether as a key reserve asset for the company, positioning BitMine as a potential leader in the corporate adoption of Ethereum treasury assets.

How has BitMine stock performed recently?

BitMine stock ($BMNR) has experienced an astonishing surge, skyrocketing over 700% within 24 hours after the announcement of Tom Lee from Fundstrat as Chairman. This dramatic rise reflects investor enthusiasm around BitMine’s strategic pivot towards an Ethereum treasury strategy.

Who is Tom Lee and what is his involvement with BitMine?

Tom Lee is a prominent Wall Street strategist known for his insights in the cryptocurrency market. He was recently appointed as Chairman of BitMine, which has contributed to the significant increase in BitMine’s stock price and bolstered investor confidence in its Ethereum treasury strategy.

Could BitMine become the MicroStrategy of Ethereum?

Many investors are speculating whether BitMine could replicate the success of MicroStrategy in terms of corporate treasury strategies focused on ETH. The company’s aggressive accumulation plan for Ethereum may position it at the forefront of institutional investment in cryptocurrencies.

What makes the BitMine Ethereum treasury strategy unique?

The uniqueness of BitMine’s Ethereum treasury strategy lies in its intention to utilize Ethereum not just as a speculative asset but as a core reserve for corporate treasury functions. The company aims to leverage its growing ETH holdings to capitalize on the expanding revenue potential from Ethereum staking and transaction fees.

What can we expect from BitMine’s future developments?

Given BitMine’s ambitious plans to cultivate a substantial Ethereum treasury, future developments may include increased ETH acquisition, strategic partnerships within the DeFi space, and potentially significant shifts in the perception of cryptocurrencies as reserve assets among corporations.

What factors are driving investment in BitMine’s Ethereum strategy?

Investors are being driven by the prospect of Ethereum becoming a mainstream corporate treasury asset, along with the backing of substantial funds for BitMine’s $250 million private placement. The growing adoption of ETH for financial infrastructure, along with trends in corporate treasury management, are likely contributing to this investment interest.

| Key Point | Details |

|---|---|

| BitMine Stock Surge | BitMine’s stock soared by over 700% after the appointment of Tom Lee as Chairman. |

| Ethereum Treasury Strategy | BitMine is raising $250 million to accumulate Ether and become the largest public holder. |

| Shift from Bitcoin | While pivoting to Ethereum, BitMine will not abandon its Bitcoin mining operations. |

| Financial Growth | Q2 FY2025 revenue doubled to $2.05 million, with leasing as a major revenue driver. |

| Investor Confidence | A strong lineup of funds supported the $250 million private placement for Ethereum strategy. |

| Market Perception | Investors are interested in BitMine’s potential rather than its current mining capabilities. |

| Conclusion Point | The success of BitMine’s strategy could position it as a leader in corporate Ethereum treasury strategies. |

Summary

BitMine Ethereum Treasury strategy represents a significant shift in corporate finance, aiming to become the largest publicly traded holder of Ether. With the stock gaining 700% and ambitious plans to implement a $250 million Ethereum treasury, BitMine could mirror MicroStrategy’s successful strategy with Bitcoin. As Ethereum adoption accelerates, BitMine’s approach could redefine how companies manage digital currencies, making it a crucial player in this financial evolution.