BNB Acquisition: Nano Labs Buys $50 Million in Tokens

BNB acquisition is making headlines as Nano Labs Ltd pushes the boundaries of their digital asset strategy, recently investing $50 million in 74,315 BNB tokens. This significant purchase raises their digital asset reserves to an impressive $160 million, showcasing their commitment to strengthening their BNB treasury strategy. By integrating cryptocurrency investment into their business model, Nano Labs is poised to navigate the evolving web3 infrastructure landscape more effectively. This move signals a strategic belief in the long-term value of BNB as a vital asset among digital currencies. With ambitions to expand their holdings significantly, Nano Labs is setting an influential precedent for fellow investors in the digital economy.

The recent surge in Nano Labs’ cryptocurrency purchases highlights a pivotal moment in the realm of digital currency strategy, particularly through their BNB acquisition. As a leading provider in web3 systems, Nano Labs seeks to enhance its digital asset portfolio, reflecting an adaptive approach to market dynamics. By investing in BNB and other digital currencies, the company is not only bolstering its asset reserves but also reiterating the importance of strategic cryptocurrency investments. Furthermore, this calculated initiative is part of a broader treasury management plan that anticipates scaling holdings considerably in the near future. Overall, this development underscores a transformative shift towards integrating digital assets as fundamental components of modern financial infrastructure.

Understanding Nano Labs’ $50 Million BNB Acquisition

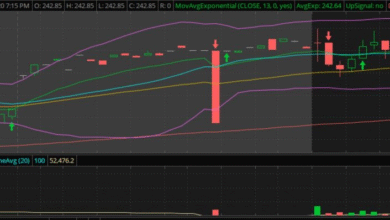

In a significant move for the cryptocurrency landscape, Nano Labs has successfully acquired 74,315 BNB tokens, totaling an investment of $50 million. This strategic decision elevates the company’s digital asset reserves to approximately $160 million, primarily composed of various cryptocurrencies. The calculated purchase price of $672.45 per BNB token reflects not only Nano Labs’ financial commitment but also its growing belief in the sustainable value of BNB as part of its treasury strategy. As a central player in the web3 infrastructure space, Nano Labs is aligning its investment strategy towards cryptocurrencies that show long-term potential.

This acquisition is more than just a financial transaction; it highlights the company’s ambition to solidify its position in the competitive web3 ecosystem. With the intent to scale its BNB holdings to $1 billion, Nano Labs is strategically positioned to leverage the price movements and investor interest in BNB. By accumulating a significant share of BNB’s circulating supply, the company not only enhances its cryptocurrency portfolio but also establishes itself as a formidable player in the cryptocurrency investment arena, focusing on building a robust foundation for future growth.

Nano Labs’ Strategic BNB Treasury Strategy and Its Implications

The strategic BNB treasury strategy developed by Nano Labs aims to deepen the company’s involvement in the cryptocurrency markets while maximizing its holdings. A critical component of this strategy is the plan to hold between 5% and 10% of BNB’s total circulating supply. Such an aggressive accumulation plan signals to market participants that Nano Labs is not just a passive investor, but a proactive entity eager to capitalize on potential market advantages. This approach exemplifies how companies are now viewing cryptocurrencies as traditional investment assets, seeking to diversify their reserves by integrating digital currencies like BNB into their portfolio.

Furthermore, this BNB treasury strategy reflects a broader trend of digital asset reserves in corporate finance. As companies like Nano Labs embark on significant cryptocurrency investments, they contribute to the legitimization of digital assets within institutional finance. By strategically utilizing convertible notes and private placements to fund future acquisitions, Nano Labs aims to enhance its financial flexibility. This commitment to integrating web3 technologies indicates a shift in investor confidence and underlines the increasing importance of digital assets as reliable vehicles for growth in the rapidly evolving financial landscape.

The Rise of BNB in Nano Labs’ Future Financial Planning

As the cryptocurrency market continues to evolve, BNB is increasingly regarded as a cornerstone asset in Nano Labs’ future financial planning and strategies. The company’s decision to accumulate BNB tokens as part of its digital asset reserves highlights a proactive approach to navigating the complexities of the digital asset landscape. By recognizing BNB’s innovative capabilities and its essential role within the Binance ecosystem, Nano Labs forecasts a positive trajectory for the token, further solidifying its hold in the competitive web3 infrastructure sector.

This surge in BNB acquisitions not only reflects confidence in its market performance but also signals a strategic alignment with the underlying technologies and services it supports. Nano Labs’ foresight in integrating BNB into its treasury strategy demonstrates a commitment to capturing market share in the burgeoning space of decentralized finance, as well as incorporating best practices in cryptocurrency investment. Such strategic insights will likely pay dividends as the demand for web3 applications and infrastructure continues to grow, enabling Nano Labs to exploit emerging opportunities within this dynamic sector.

Market Confidence Boosted by Nano Labs’ BNB Purchase

The recent $50 million investment in BNB by Nano Labs is expected to have ripple effects throughout the cryptocurrency markets, boosting overall market confidence. As one of the more significant acquisitions in recent times, this transaction serves as a barometer for other institutional investors considering entry into the rapidly expanding domain of digital assets. The bold move made by Nano Labs underscores the increasing trend of corporates integrating cryptocurrencies into their financial strategies, further normalizing digital assets in traditional investment frameworks.

As institutional players like Nano Labs make substantial investments in cryptocurrencies, they help mitigate volatility and provide a level of assurance that draws in additional investors. This acquisition not only reinforces BNB’s perceived stability and utility but helps lift sentiment across the cryptocurrency landscape. By enhancing its digital reserve with such high-value assets, Nano Labs signals the maturity of the cryptocurrency investment market, paving the way for greater institutional involvement in web3 initiatives, and consequently fostering a more secure environment for digital asset innovation.

Exploring Digital Asset Reserves and Their Importance

Digital asset reserves have emerged as a key component for companies operating within the increasingly digital economy. For Nano Labs, cultivating a diverse range of digital assets, including Bitcoin and BNB, not only strengthens its balance sheet but also shields it against market fluctuations. By strategically increasing its BNB holdings, Nano Labs is investing in a cryptocurrency that’s closely tied to the Binance ecosystem, which is known for its innovative and robust technological offerings.

Furthermore, having a healthy digital asset reserve enables companies to engage more effectively in emerging trends in the web3 space and to capitalize on the growing appeal of decentralized finance. Digital assets like BNB represent forward-thinking strategies that reflect a broader acceptance of cryptocurrencies within corporate finance. As businesses like Nano Labs continue to adapt and expand their digital asset reserves, they position themselves to take full advantage of future market developments, ensuring they remain agile and competitive in a landscape marked by rapid change.

Long-term Vision: Scaling BNB Holdings to $1 Billion

Nano Labs has announced an ambitious plan to scale its BNB holdings to a staggering $1 billion, illustrating a long-term vision that places significant emphasis on the growth potential of digital currencies. This target not only envisions substantial financial returns but also indicates a strategic positioning within the larger cryptocurrency ecosystem. By setting such high goals for its treasury strategy, Nano Labs is projecting confidence in BNB’s future trajectory, viewing it as a key asset in its overarching financial framework.

To achieve this ambitious target, Nano Labs will need to intensify its acquisition efforts and explore innovative funding methods, such as convertible notes and strategic partnerships. This proactive approach reflects the growing recognition of BNB as a valuable digital asset, which is essential for companies that aim to integrate cryptocurrency more deeply into their operational strategies. The successful execution of this long-term vision could significantly enhance Nano Labs’ competitive edge in the web3 infrastructure market, while setting a precedent for future corporate cryptocurrency investment strategies.

Nano Labs: A Leader in Web3 Infrastructure and Investment

As a prominent player in the web3 infrastructure space, Nano Labs is leveraging its position to integrate cryptocurrency investments into its broader operational strategy. By acquiring $50 million worth of BNB, the company is not only enhancing its financial reserves but also asserting itself as a leader in the digital asset ecosystem. With a clear focus on strategic assets like BNB, Nano Labs is setting a precedent for the rest of the industry, driving forward the conversation on how web3 technologies can create lasting value.

Moreover, Nano Labs’ investment approach highlights the increasing recognition of cryptocurrencies as legitimate avenues for corporate growth. With the potential for significant returns on investments in digital assets, businesses operating in the web3 sector are now focusing on long-term strategies that incorporate cryptocurrency into their frameworks. Through its commitment to expanding its BNB holdings, Nano Labs is positioning itself as an innovative and forward-thinking entity in the modern financial landscape of web3, which could inspire other companies to follow suit.

Evaluating the Security and Utility of BNB Investment

As Nano Labs embarks on its BNB acquisition journey, it’s crucial to evaluate the security and utility of this digital asset. A significant aspect of BNB’s value proposition lies in its underlying technology and the reputation of the Binance ecosystem, which has demonstrated strong resilience and adaptability in the face of market challenges. This factor plays a vital role in assuring investors like Nano Labs about the potential stability and growth of their investments.

Additionally, the security methods employed in managing BNB holdings are pivotal in safeguarding against potential risks common within the cryptocurrency domain. By focusing on such risk management protocols, Nano Labs can effectively build trust within its investor base while enhancing its digital reserve strategy. As companies increasingly consider cryptocurrencies as part of their asset allocation, understanding the nuances of security and utility becomes indispensable.

The Future of Cryptocurrency Investment Through BNB Accumulation

The future of cryptocurrency investment is being reshaped by companies like Nano Labs that are actively accumulating assets like BNB. Investing in digital currencies is no longer a niche market; it is becoming an important strategy for corporate finance and growth. Nano Labs’ substantial investment signifies a shift towards broader acceptance of cryptocurrencies as legitimate investment vehicles that can contribute to long-term financial stability. Their proactive stance in accumulating BNB tokens, suggests a belief in the currency’s continued relevance and potential for appreciation.

As more companies recognize the benefits of holding digital assets, the dialogue surrounding cryptocurrency investment will likely expand. The trend set by Nano Labs may encourage more institutional players to explore similar strategies, thereby deepening liquidity and enhancing the overall market for cryptocurrencies like BNB. This evolution not only fosters investor confidence but also promotes innovation in the web3 infrastructure, paving the way for new solutions and opportunities in the burgeoning digital economy.

Frequently Asked Questions

What is the significance of Nano Labs’ recent BNB acquisition?

Nano Labs’ acquisition of 74,315 BNB tokens for $50 million is significant as it strengthens their digital asset reserves to approximately $160 million. This move is a part of their BNB treasury strategy, signaling confidence in BNB’s potential as a strategic asset in the web3 infrastructure sector.

How does Nano Labs plan to implement its BNB treasury strategy?

Nano Labs aims to implement its BNB treasury strategy by scaling its BNB holdings to potentially $1 billion during its accumulation phase. The strategy includes maximizing the efficiency of their digital asset reserves, which will consist of 5% to 10% of BNB’s circulating supply, indicating a long-term commitment to BNB investment.

What role does BNB play in Nano Labs’ digital asset reserves?

BNB plays a crucial role in Nano Labs’ digital asset reserves, currently valued at approximately $160 million. The recent purchase highlights BNB’s importance within their portfolio and showcases the company’s strategy to enhance its investments in cryptocurrency as part of its web3 infrastructure development.

Why is Nano Labs focusing on BNB as part of its cryptocurrency investment strategy?

Nano Labs is focusing on BNB due to its strategic significance in the rapidly evolving web3 market. By acquiring BNB, the company aims to establish a robust cryptocurrency investment strategy that aligns with their ambition to be a key player in web3 finance and infrastructure.

What are the future plans for BNB acquisitions by Nano Labs?

Moving forward, Nano Labs plans to pursue further BNB acquisitions through channels such as convertible notes and private placements. The company is dedicated to reinforcing its BNB treasury strategy, which may contribute to significantly increasing its BNB holdings in the coming years.

How does Nano Labs view the security and utility of BNB?

Nano Labs evaluates the security and utility of BNB as part of its decision-making process for further acquisitions. The company’s investments reflect a growing understanding of BNB’s role in the cryptocurrency landscape and its potential to enhance their digital asset reserves.

| Details | |

|---|---|

| Company | Nano Labs Ltd (Nasdaq: NA) |

| Investment Amount | $50 million |

| BNB Acquired | 74,315 BNB |

| Average Price per BNB | $672.45 |

| Total Digital Asset Reserves | Approximately $160 million |

| Future Plans | Expand BNB holdings to $1 billion |

| Long-term Strategy | Aim to hold 5-10% of BNB’s total circulating supply |

Summary

BNB acquisition has been markedly emphasized by Nano Labs’ recent investment strategy, highlighting their confidence in the potential of the token. By acquiring 74,315 BNB for $50 million, Nano Labs has not only boosted its digital asset reserves but has also set ambitious plans to expand its holdings significantly. This acquisition indicates a notable shift towards BNB as a strategic investment in the landscape of web3 finance and infrastructure. With plans to reach up to $1 billion in BNB holdings, Nano Labs is poised to play a significant role in the future of digital assets.