BP Takeover Speculation: ADNOC Joins the Race for Assets

BP takeover speculation is gaining momentum as the UAE’s oil powerhouse, ADNOC, positions itself as a leading contender for some of BP’s prime liquefied natural gas (LNG) assets. Recent reports indicate that ADNOC is evaluating a potential acquisition, sparking discussions throughout the oil industry about possible mergers and acquisitions that could reshape the market dynamics. With BP’s struggles in recent years, many industry insiders believe that a divestment strategy could lead to significant energy company divestment opportunities, particularly for firms eyeing BP’s hydrocarbon investments. As ADNOC aims to strengthen its portfolio, this unfolding scenario involving BP LNG assets could set the stage for a seismic shift within the energy sector. Analysts are closely monitoring these developments, as the outcome may redefine strategies for major players in the oil industry.

Speculation surrounding a BP acquisition is heating up, especially with ADNOC actively considering its options to secure valuable gas assets from the struggling energy giant. The Abu Dhabi National Oil Company has emerged as a key player in this potential market reshuffle, raising questions about forthcoming mergers in the oil sector. As discussions unfold regarding BP’s financial strategy, many are pondering the implications of such a significant absorbance, especially in light of the ongoing pressure on BP to optimize its hydrocarbon investments. The possibility of a transformative alliance between these two energy titans could signal a new era in the industry’s landscape, as firms seek to navigate through uncertain economic climates. With ADNOC’s vested interest in BP’s assets, it is crucial to understand the broader ramifications that may unfold within the energy market.

Understanding the BP Takeover Speculation

The BP takeover speculation has gained momentum in recent weeks, particularly with the arrival of ADNOC as a serious contender for possible acquisitions. As the oil giant faces a challenging financial landscape, the interest from ADNOC signals a critical juncture for BP’s future. Analysts are examining the implications of this potential takeover, given that ADNOC is a key player in the energy sector with significant financial resources. With BP’s consistent underperformance relative to competitors, the prospect of a merger becomes more plausible, raising questions about the direction of both companies in the evolving energy landscape.

One key focus of the speculation revolves around BP’s liquefied natural gas (LNG) assets, which ADNOC has shown particular interest in. Analysts suggest that a divestment of these high-value assets could be a strategic move for BP. This scenario not only benefits ADNOC in enhancing its portfolio with vital energy resources but also allows BP to make focused adjustments towards its core operations. As the oil industry experiences numerous mergers, the outcome of this speculation could reshape market dynamics, potentially positioning ADNOC as a leading energy company globally.

ADNOC Acquisition Strategy: A Focus on LNG Assets

ADNOC’s strategic focus on acquiring BP’s LNG assets aligns with its broader corporate goals. By enhancing its portfolio with these assets, ADNOC will be better positioned in the competitive landscape of global natural gas markets. Given that the demand for cleaner energy sources is rising, investments in LNG are seen as critical for securing future growth. Moreover, ADNOC has expressed its commitment to reinforcing Abu Dhabi’s status as a global leader in energy and chemicals, and acquiring BP’s LNG holdings can facilitate that ambition.

However, the negotiation might not be as straightforward. Market observers note that ADNOC’s approach will likely be cautious and calculated. The oil giant understands the significance of BP’s LNG assets and may leverage PB’s current financial pressures to secure favorable terms. By maintaining a strategic partnership while simultaneously pursuing acquisitions, ADNOC could bolster its operations while fostering a collaborative relationship that enhances both companies’ standings in the energy sector.

Implications of BP’s Strategic Reset

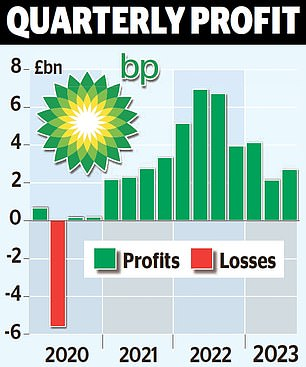

BP’s recent strategic reset highlights its commitment to transitioning towards a focus on traditional fossil fuels, despite pressure from activist investors for a more aggressive shift to renewables. The company’s decision to increase oil and gas investments indicates a reaction to the ongoing speculation regarding potential takeovers. By stabilizing its finances, BP is trying to garner investor confidence and fend off unwanted acquisitions, including those potentially posed by ADNOC.

This shift in strategy not only impacts BP’s operational direction but also shapes the competitive landscape within the oil industry. Firms like ADNOC, which are actively seeking to expand through strategic acquisitions, may view BP’s restructuring as a prime opportunity. As BP aims to divest up to $20 billion in assets, it may inadvertently facilitate ADNOC’s acquisition ambitions, allowing it to strengthen its position in the hydrocarbon investment arena.

The Role of XRG in Energy Company Divestment

XRG, ADNOC’s international investment division, plays a pivotal role in the company’s pursuit of BP’s assets. Launched with the goal of stimulating investments in gas and chemicals, XRG is strategically positioned to capitalize on BP’s ongoing divestments. The division’s approach to acquisitions aligns well with ADNOC’s vision of enhancing its global footprint in the energy sector, making it a key player in the discussions surrounding BP’s strategic decisions.

As XRG seeks to achieve an enterprise value of $80 billion, its focus on strategic asset acquisition becomes even more relevant. The potential partnerships with firms like BP could aid significantly in reaching those financial milestones. Moreover, the proactive stance of XRG may prompt other public oil companies to reconsider their strategies concerning BP, thus intensifying the competition for valuable oil and gas assets. The outcome of these dynamics will ultimately influence the future sustainability and profitability of both ADNOC and BP.

Merging Interests: BP and ADNOC’s Long-standing Relationship

The relationship between BP and ADNOC is rooted in years of cooperation across various energy projects. This long-standing partnership has included ventures in both hydrocarbons and renewable energy, creating a foundation of trust that can influence current merger discussions. As the oil industry navigates changing dynamics, including the shift towards more sustainable practices, such relationships could provide significant advantages during acquisition negotiations.

Furthermore, the historical collaboration between the two companies positions them uniquely to merge operations harmoniously, should a takeover occur. The mutual interests in enhancing technological advancements in energy extraction, coupled with ADNOC’s financial clout, could pave the way for a fruitful merger. It will be crucial for both entities to evaluate strategic synergies that would arise from such a partnership, potentially reshaping the future energy landscape.

Market Reactions to BP’s Potential Acquisition by ADNOC

Market reactions to the speculation of an ADNOC acquisition of BP’s assets have been a mixed bag. On one hand, BP’s stock has exhibited volatility amidst these rumors, reinforcing concerns about investor confidence and the company’s future direction. Potential buyers, including ADNOC, are seen as influential players in determining BP’s stock performance in the near term, with many investors eager to understand how these discussions may unfold.

On the other hand, the oil industry is witnessing a growing trend towards consolidation, and the potential merger could be interpreted as a strong signal of confidence in BP’s traditionally valuable assets. If successfully negotiated, such a deal may catalyze further mergers within the industry, prompting other companies to reevaluate their strategies regarding asset management and acquisition possibilities. The continued discourse around ADNOC’s interest undoubtedly fuels speculation and excitement in the oil sector.

Energy Company Divestment Strategies in Context

The ongoing speculation surrounding ADNOC’s interest in acquiring BP’s LNG assets brings to light broader trends in energy company divestment strategies. Companies like BP are increasingly pressured to streamline their operations and manage debt effectively. This strategic divesture mirrors a wider industry trend where firms reassess their holdings to focus on more lucrative sector segments, particularly in the face of mounting pressures for energy transition.

As oil companies navigate these market changes, strategic divestment becomes a necessary tool to enhance operational efficiency and ensure long-term sustainability. BP’s decision to cut down on renewable energy investments while bolstering its fossil fuel commitments exemplifies this trend. Such mechanisms afford significant opportunities for firms like ADNOC, allowing them to acquire valuable resources while positioning themselves at the forefront of the energy market.

Future Prospects: Will There Be a BP Breakup?

The prospect of a BP breakup has become a topic of speculation among investors, particularly as the company navigates financial difficulties and market pressures. While some analysts argue that a full breakup may not align with shareholders’ interests, the ongoing strategic reset coupled with asset divestment lays the groundwork for potential regional or segment-specific sales. This environment could pique the interest of companies like ADNOC, who may be seeking specific assets rather than a complete acquisition.

Moreover, the changing landscape in the oil industry suggests that BP’s operational structure may need reevaluation to withstand competitive pressures effectively. If ADNOC does acquire BP assets, it could indicate the start of broader realignment across the oil industry, potentially leading other firms to adopt similar strategies. As this situation develops, stakeholders will closely monitor BP’s actions to assess the likelihood of a profound restructuring in the turbulent energy market landscape.

Frequently Asked Questions

What is the current state of BP takeover speculation involving ADNOC?

The current BP takeover speculation centers on the UAE oil giant ADNOC, which is reportedly considering acquiring BP’s liquefied natural gas (LNG) assets. This follows BP’s struggles in the oil industry, making it a prime acquisition target amidst talks of asset divestment and mergers.

How does ADNOC’s interest in acquiring BP LNG assets impact the energy market?

ADNOC’s interest in BP LNG assets could signify a shift in the energy market, potentially consolidating power among major players. This speculation surrounding BP takeover deals reflects broader trends in oil industry mergers and the strategic maneuvering of energy companies amidst fluctuating market dynamics.

What are the implications of potential oil industry mergers involving BP and ADNOC?

Potential oil industry mergers involving BP and ADNOC could reshape the competitive landscape, enhance market share for ADNOC in natural gas, and possibly lead to strategic partnerships in hydrocarbons. Such moves create implications for future energy company divestment and investment strategies.

Are there possible risks associated with BP’s divestment strategy amid takeover speculation?

Yes, BP’s divestment strategy amid takeover speculation poses risks, including potential loss of core assets that could affect its long-term viability. While the company aims to regain investor confidence through strategic resets, it must carefully balance divestitures with maintaining operational effectiveness.

What role does BP’s strategic reset play in the takeover speculation by ADNOC?

BP’s strategic reset, which includes shifting focus to fossil fuels and increasing hydrocarbon investments, directly contributes to takeover speculation by making BP’s assets more appealing to companies like ADNOC looking to enhance their portfolios, especially in LNG and chemicals.

Why might ADNOC not pursue a complete acquisition of BP?

ADNOC might not pursue a complete acquisition of BP due to a lack of strategic interest in BP’s oil assets. Instead, ADNOC’s focus appears to be on acquiring specific segments, like LNG assets, which align more closely with its growth strategy in the energy sector.

How are analysts viewing the possibility of BP being acquired by ADNOC or others?

Analysts view BP as a leading acquisition candidate given its recent performance struggles. With ADNOC expressing interest in specific BP assets, experts anticipate intense competition from other oil giants like Shell and Exxon Mobil, indicating a robust interest in potential takeovers.

What could be the future for BP amid rising takeover threats from firms like ADNOC?

The future for BP amid rising takeover threats looks complex as it attempts to execute its strategic reset and focus on hydrocarbons. The company will need to manage investor expectations and navigate potential mergers carefully to maintain its market position and financial stability.

| Key Points | Details |

|---|---|

| ADNOC’s Interest in BP | ADNOC is reportedly considering acquiring certain LNG assets from BP, amid rising takeover speculation. |

| Potential Full Acquisition | There are indications that ADNOC may contemplate a complete acquisition, though it seems unlikely due to a lack of interest in BP’s oil assets. |

| BP’s Strategic Reset | BP is realigning its focus towards fossil fuels and plans to increase oil and gas investments while cutting renewable energy projects. |

| Market Response | BP’s share price has stabilized but shows a decline year-to-date, indicating investor concerns amidst takeover rumors. |

| Advisory Insights | Experts suggest BP must improve cash flow and reduce debt, creating a time-sensitive scenario that could influence negotiations. |

Summary

BP takeover speculation is heating up as ADNOC, the UAE oil giant, expresses interest in acquiring certain gas assets from BP. This potential acquisition comes amid BP’s strategic shift towards fossil fuels and asset divestments, making it a key point of discussion in the energy sector. Analysts continue to monitor the evolving landscape as ADNOC seeks to position itself advantageously in this competitive market.