Brian Quintenz CFTC Nomination Surprises Everyone

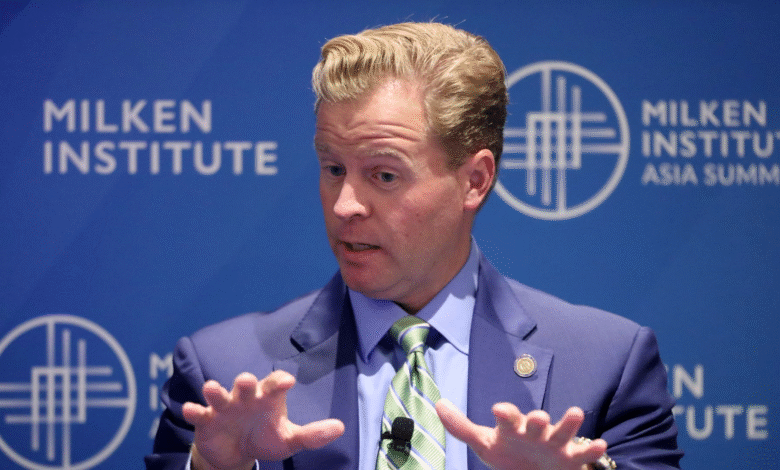

In a surprising twist, Brian Quintenz, who has been a significant figure in the realm of crypto policy and a former commissioner at the U.S. Commodity Futures Trading Commission (CFTC), has been unexpectedly dropped from the CFTC nomination vote roster. This news has sent ripples through the industry as many were anticipating his nomination to lead the commission under President Trump’s administration. With Quintenz’s vast experience and connections at Andreessen Horowitz, his removal raises questions about the future of crypto regulation as we look for the latest crypto policy updates. The implications of this development are further amplified as industry stakeholders closely follow the Brian Quintenz news and its effect on regulatory landscapes. As a former hedge fund manager with deep ties in the financial sector, Quintenz’s CFTC nomination was seen as crucial for shaping the commission’s approach to emerging digital assets.

The recent developments surrounding the CFTC nomination involving Brian Quintenz have caught the attention of crypto enthusiasts and regulatory watchers alike. Known for his role at the Commodity Futures Trading Commission, Quintenz’s sudden removal from the nomination roster has sparked discussions about the implications for future crypto regulations. With a background in hedge fund management and a longstanding involvement in the crypto sector through Andreessen Horowitz, his potential leadership was anticipated to influence many crypto policy initiatives. As the community looks toward the upcoming changes in regulatory frameworks, staying updated on Quintenz’s nomination and its ramifications is essential for investors and stakeholders alike. These unfolding events mark a pivotal moment in the dialogue around digital asset governance and the direction of the CFTC under the Trump administration.

The Political Landscape of Brian Quintenz’s CFTC Nomination

Brian Quintenz’s political journey within the U.S. Commodity Futures Trading Commission (CFTC) has been fraught with uncertainties that illustrate the complexities of federal nominations. Initially nominated by Donald Trump, Quintenz’s tenure and aspirations were marked by fluctuating political tides. His recent removal from the vote roster underscores the volatile nature of political appointments in agencies that oversee critical sectors like cryptocurrency. Differences in political priorities, especially regarding crypto regulation, can significantly influence who holds positions of power, and Quintenz’s standing is no exception.

As the crypto landscape evolves, the importance of CFTC leadership becomes even more pronounced. Quintenz’s previous role as a commissioner and his recent appointment to Andreessen Horowitz positions him as a key player in the intersection of politics, finance, and technology. The industry is closely watching these developments as they could impact future regulatory frameworks and policies. With updates on Brian Quintenz’s nomination likely to resonate throughout the crypto sector, stakeholders must remain vigilant and informed.

Implications of Recent CFTC Nomination News

The surprising decision to remove Brian Quintenz from the CFTC nomination vote raises questions about the implications for U.S. crypto policy. The CFTC plays a crucial role in determining regulatory frameworks for various digital assets, and leadership transitions at the commission can set significant precedents. Investors and innovators in the cryptocurrency sphere worry that without committed leadership, there might be delays in the establishment of clear and supportive regulations. Previous uncertainty surrounding Quintenz’s nominations paints a picture of political maneuvering that could stall critical regulatory decisions.

Furthermore, as a pivotal figure in cryptocurrency policy, Quintenz’s involvement with Andreessen Horowitz indicates a clear connection between venture capital interests and regulatory advocacy. Should his nomination proceed or be re-initiated, it would suggest a strong collaboration between private sector influences and governmental oversight mechanisms. The outcomes of these political developments not only affect the trajectory of U.S. crypto norms but also shape how international markets perceive U.S. regulatory stances.

Quintenz’s Legacy in the CFTC: A Retrospective

Brian Quintenz’s tenure as a commissioner of the CFTC was marked by a commitment to bridging the gap between traditional finance and the burgeoning crypto sector. Appointed during the Obama administration and later nominated by Donald Trump, his dual support across party lines showcases a unique capability to navigate a politically polarized landscape. His role in crafting policies towards digital assets has been crucial for the market’s evolution, as he pushed for regulations that acknowledge the innovative nature of blockchain technology.

Looking back, it’s clear that Quintenz’s insights into technology and finance have benefitted the CFTC in meaningful ways. His focus on fostering innovation while ensuring investor protection has been a delicate balance, informing countless discussions and policy decisions. As the market matures, questions about how his eventual confirmation—or lack thereof—will influence the CFTC’s approach to crypto regulation remain pertinent. Stakeholders are eager to see how his legacy will shape future frameworks in this ever-evolving industry.

Andreessen Horowitz: Impact on Crypto Policies

Andreessen Horowitz has established itself as a formidable player in the venture capital space, particularly within the cryptocurrency sector. The firm’s strategic investments and policies significantly influence the development of new technologies and innovations that leverage blockchain. Brian Quintenz, as the head of policy at the crypto division of Andreessen Horowitz, plays a critical role in shaping the dialogue around regulatory frameworks, ensuring that entrepreneurial pursuits align with existing legal structures.

The intersection of venture capital and regulatory policy not only highlights the importance of leadership like Quintenz’s but also showcases the company’s vested interest in favorable regulations that could promote industry growth. As crypto entrepreneurs seek to innovate, the insights cultivated by Quintenz at Andreessen Horowitz will likely play an indispensable role in steering policy discussions. With regulatory scrutiny increasing, the collaboration between influential firms and policymakers remains key to enabling continued progress in this dynamic sector.

The Future of Crypto Regulation in the U.S.

As we look toward the future, the trajectory of crypto regulation in the U.S. hangs in the balance, shaped by ongoing political developments and leadership appointments like Brian Quintenz’s potential nomination. The evolving nature of the blockchain space demands regulators who are not only knowledgeable but also adaptable to new advancements. The removal of Quintenz from the vote roster may signal a shift that could impact how quickly and effectively new regulations are crafted.

Industry stakeholders express growing concern about regulatory clarity, a critical component for fostering innovation and protecting investors. The outcomes of Quintenz’s nomination will be closely scrutinized, as any delays or changes in leadership could stall critical advancements in establishing a coherent regulatory environment. Moving forward, how the CFTC, under its leadership, embraces the challenges posed by rapid technological advancement will dictate the pace at which the U.S. remains competitive within the global crypto landscape.

Investor Sentiment Amid Nomination Uncertainty

The recent uncertainty surrounding Brian Quintenz’s CFTC nomination has led to a palpable sense of unease among investors in the cryptocurrency market. With fluctuations in asset values, such as Bitcoin and Ethereum, many are left grappling with how potential leadership changes might affect regulatory stances and market dynamics. Quintenz’s experience and proposed policies are seen as integral to ensuring a more stable investment environment, and any disruptions in his nomination process could lead to heightened volatility within the sector.

Investor sentiment is closely tied to regulatory clarity, and Quintenz’s nominal influence has historically contributed to fostering investor confidence. As the CFTC navigates this leadership conundrum, the industry awaits clearer signals to understand how changes in governance might affect policies surrounding crypto assets. In the absence of decisive action, the market may experience increased anxiety, leading to more conservative approaches from potential investors while they await stability in regulation.

Public Perception of CFTC and Crypto Policies

The public perception of the CFTC and its regulatory approach to cryptocurrency has evolved significantly in recent years. With figures like Brian Quintenz at the forefront, the agency has attempted to project a more favorable and understanding stance toward tech innovation, fostering a belief that regulatory frameworks can be both effective and conducive to growth. However, the recent challenges surrounding Quintenz’s nomination signal potential shifts that might reshape public trust in the CFTC’s capabilities to handle emerging issues within the crypto space.

As public interest in crypto policies rises, the actions and decisions made by the CFTC will deeply influence public opinion. Agency leadership is essential in translating complex regulatory language into actionable insights for the average investor and tech enthusiast. With ongoing developments in Quintenz’s nomination process, the CFTC’s ability to reassure the public of its commitment to innovation, safety, and effective governance will determine whether it can maintain its reputation in a rapidly changing financial landscape.

Lessons from Past CFTC Nomination Processes

The history of CFTC nominations is laden with lessons that resonate beyond the political sphere into the realm of finance and technology. Brian Quintenz’s earlier experiences demonstrate how political affiliations, industry pressures, and policy priorities can significantly shape one’s career path. Learning from these past precedents is paramount for understanding how future nominations may be managed. The ability to adapt and navigate the intertwined worlds of politics and finance is crucial for any nominee, particularly within the volatile crypto space.

Moreover, examining previous nomination withdrawals—such as the instances when Trump’s administration shifted its stance on Quintenz—provides insights into how external factors can influence internal agency dynamics. For the industry, this serves as a reminder of the importance of advocating for leadership that not only understands the regulatory landscape but also promotes innovation. As the CFTC looks to the future, these lessons from past nominations will likely inform its strategies to choose leaders who can effectively address the unique challenges presented by the evolving cryptocurrency sector.

What’s Next for Brian Quintenz?

As the dust settles following the unexpected removal of Brian Quintenz from the CFTC nomination vote roster, many are left pondering what the future holds for this influential figure in cryptocurrency regulation. Having previously held a commissioner role and now leading policy in a prominent venture capital firm, Quintenz remains a key player in shaping crypto policies. The convergence of his political experience with his current position at Andreessen Horowitz positions him uniquely to influence both regulatory conversations and blockchain innovations.

Looking ahead, various scenarios could unfold. Quintenz might still find a pathway to reestablish himself within the CFTC, potentially reshaping the regulatory environment for cryptocurrency during a critical time. Alternatively, his role at Andreessen Horowitz could enhance collaboration between the venture capital community and regulators. Regardless of his immediate trajectory, stakeholders in both the political and financial domains will be keenly observing how Quintenz’s next moves may have lasting impacts on the future of crypto legislation.

Frequently Asked Questions

What is the latest news on Brian Quintenz’s CFTC nomination?

Recent reports indicate that Brian Quintenz has been unexpectedly removed from the vote roster for his CFTC nomination. This news comes as a surprise given his previous nomination by President Donald Trump. For more updates on ‘CFTC nomination news’, stay tuned.

Why was Brian Quintenz dropped from the CFTC nomination?

The reasons behind Brian Quintenz being dropped from the CFTC nomination are not officially clear. However, historical patterns suggest that such changes can occur during the nomination process, sometimes triggered by political considerations. For further insights into this story, explore the current ‘crypto policy updates’.

What are Brian Quintenz’s contributions to the CFTC prior to his nomination?

Brian Quintenz served as a CFTC commissioner from 2016 until 2021, where he played a significant role in navigating crypto policy and futures trading regulations. His experience makes him a notable candidate for any future CFTC leadership roles, reflecting his background in both public policy and the financial sector.

How does Andreessen Horowitz fit into Brian Quintenz’s career?

After leaving the CFTC in 2021, Brian Quintenz became the head of policy at Andreessen Horowitz’s crypto branch, a venture capital firm influential in the web3 space. His role at a16z crypto signifies the growing intersection between technology and financial regulations.

Has Brian Quintenz previously faced challenges in his CFTC nominations?

Yes, this isn’t the first time Brian Quintenz’s CFTC nomination faced hurdles. In 2017, President Trump initially withdrew his nomination but later reinstated him. This track record points to the complexities surrounding political nominations, especially within the financial regulatory landscape.

What impact could Brian Quintenz’s withdrawal have on crypto regulations?

Brian Quintenz’s withdrawal from the CFTC nomination may have significant implications for ongoing and future crypto regulations. His extensive background in both the CFTC and as a voice in the crypto community positions him as a key figure in shaping policy discussions moving forward.

What are the implications of the CFTC’s leadership changes for crypto markets?

Leadership changes at the CFTC, including the potential sidelining of candidates like Brian Quintenz, can impact regulatory clarity in the crypto markets. Investors and stakeholders closely monitor such developments as they can influence market confidence and the adoption of new technologies.

What was Brian Quintenz’s role in the CFTC under previous administrations?

Brian Quintenz served as a CFTC commissioner from 2016, initially appointed by President Obama, and later held his position during Trump’s administration until 2021. His tenure involved advocating for innovations in trading and the integration of emerging technologies in regulatory frameworks.

| Key Points |

|---|

| Brian Quintenz was nominated for CFTC chair by President Donald Trump but has been removed from the vote roster, indicating potential issues in the nomination process. |

| He has previously faced nomination withdrawals by Trump, having been appointed as commissioner by Barack Obama in 2016. |

| Quintenz served as a CFTC commissioner until 2021 before joining Andreessen Horowitz as head of policy. |

Summary

Brian Quintenz CFTC nomination has faced an unexpected setback as he has been removed from the vote roster for the position of chair of the Commodity Futures Trading Commission. This situation raises questions regarding the nomination process and highlights past instances where his nomination faced similar challenges. With Quintenz’s extensive experience and prior service as a commissioner, it remains to be seen how this latest development will affect the regulatory landscape in the crypto sector.