PayPal Pay With Crypto: Revolutionizing Merchant Payments

PayPal Pay With Crypto is set to revolutionize the way businesses engage with the evolving cryptocurrency market. By introducing this innovative feature, PayPal enables users to make crypto payments seamlessly, directly connecting merchants with over 650 million digital wallet holders. This bold move significantly enhances PayPal’s crypto adoption strategy while drastically reducing transaction fees by up to 90%, thus attracting more merchants to consider cryptocurrency as a viable payment option. With access to more than 100 cryptocurrencies and instant conversion between digital assets and stablecoins, the platform positions itself at the forefront of mainstream commerce. As businesses increasingly seek to tap into the $3 trillion crypto economy, PayPal’s efforts signal a pivotal moment for merchant adoption of cryptocurrency.

PayPal’s new initiative, known as Pay With Crypto, is a groundbreaking service that allows businesses to harness the potential of digital currencies for everyday transactions. This service simplifies the process of accepting a wide array of cryptocurrencies and streamlines conversions into fiat or stablecoins, creating a better experience for both merchants and consumers. As the global acceptance of electronic payment systems grows, the integration of crypto payments will play a critical role in enhancing revenue channels and improving customer access for merchants. Furthermore, PayPal’s commitment to reducing transaction costs and facilitating cross-border payments unlocks immense opportunities within the digital economy. With an impressive outreach to a broad audience of cryptocurrency users, this initiative is poised to set new standards in payment processing and drive further interest in solutions that bridge traditional finance and digital assets.

The Future of Payments: PayPal Pay With Crypto

PayPal’s recent launch of Pay With Crypto signals a monumental shift in the way consumers approach digital payments. By enabling instant transactions with over 100 cryptocurrencies, PayPal is set to bridge the gap between the traditional financial system and the burgeoning cryptocurrency market. The ability to conduct crypto payments will appeal to a massive base of users who already engage with digital wallets, providing a seamless integration into everyday transactions.

Moreover, with the growing acceptance of cryptocurrencies, PayPal’s initiative is an essential step towards mainstream adoption. The recent enhancements not only lower transaction costs by up to 90% but also expand access to a market comprising over 650 million crypto users. This empowers merchants to tap into new revenue streams while accommodating customers who prefer to transact in digital currencies.

Frequently Asked Questions

What is PayPal Pay With Crypto and how does it facilitate crypto payments?

PayPal Pay With Crypto is a service that allows U.S. merchants to accept over 100 cryptocurrencies as payment through digital wallets. This innovative platform simplifies cross-border transactions by enabling instant conversion of crypto to stablecoin or fiat, significantly reducing transaction fees by up to 90%.

How does PayPal support merchant adoption of cryptocurrency through Pay With Crypto?

PayPal enhances merchant adoption of cryptocurrency with its Pay With Crypto service by connecting merchants to a vast market of over 650 million crypto users. This service enables merchants to accept a broad range of digital assets, unlocking new revenue opportunities within the multi-trillion-dollar crypto market.

What currencies and wallets are supported under PayPal’s Pay With Crypto service?

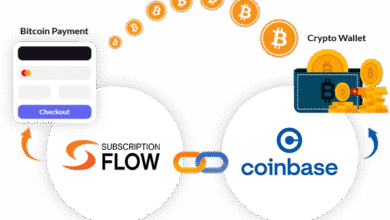

PayPal’s Pay With Crypto supports transactions across 100+ cryptocurrencies, including major currencies like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). It also integrates with popular digital wallets such as Coinbase, Metamask, Binance, and Kraken, facilitating easy access for both merchants and customers.

What are the benefits of using PayPal Pay With Crypto for businesses?

Businesses utilizing PayPal Pay With Crypto benefit from lower transaction costs, which can be reduced by up to 90%. The service provides instant conversion of digital assets, increased customer reach to the growing cryptocurrency market, and the potential for significant revenue growth through the acceptance of various cryptocurrencies.

Are there any risks associated with using PayPal Pay With Crypto?

While PayPal Pay With Crypto offers many benefits, there are inherent risks, including regulatory uncertainties and the lack of FDIC or SIPC insurance. Merchants should evaluate these factors when considering the adoption of cryptocurrency payments.

How can merchants access the rewards system through PayPal Pay With Crypto?

Merchants can earn rewards of up to 4% on funds stored as PayPal’s U.S. dollar-backed stablecoin (PYUSD). This rewards program incentivizes businesses to engage more deeply with the Pay With Crypto platform and maximize their crypto payment potential.

What impact does PayPal Pay With Crypto have on the cryptocurrency market?

PayPal Pay With Crypto has a significant impact on the cryptocurrency market by driving mainstream adoption. By making crypto payments accessible to millions of users and merchants, it fosters a broader acceptance of digital currencies and stimulates growth within the $3 trillion crypto economy.

Is PayPal’s Pay With Crypto service available globally?

Currently, PayPal Pay With Crypto is available only to U.S. merchants. However, the company has plans for expansion, potentially allowing more international merchants to access this service in the future.

| Feature | Description |

|---|---|

| PayPal Pay With Crypto | A new service launched by PayPal allowing U.S. merchants to accept over 100 cryptocurrencies. |

| Instant Crypto Payments | Offers instant conversion of cryptocurrencies to stablecoins or fiat currency, enhancing transaction efficiency. |

| Transaction Fee Reduction | Lowers transaction costs for merchants by up to 90% compared to traditional payment methods. |

| Market Reach | Connects merchants to a global market with over 650 million cryptocurrency users. |

| Rewards Program | Merchants can earn up to 4% in rewards on funds held as PYUSD, PayPal’s stablecoin. |

| Compatibility | Supports integration with popular wallets like Coinbase, Metamask, and more, expanding payment options. |

| Regulatory Hurdles | Faced with unresolved regulatory challenges; lacks FDIC or SIPC insurance for crypto transactions. |

| Mainstream Adoption | Marks a significant step in making crypto payments mainstream despite existing risks. |

Summary

PayPal Pay With Crypto is transforming the digital payment landscape by enabling U.S. merchants to embrace cryptocurrencies seamlessly. With this innovative service, PayPal is not only simplifying cross-border commerce but also significantly cutting down transaction fees, thereby enhancing merchants’ revenue potential. As the service connects to a rapidly expanding market of over 650 million crypto users and supports more than 100 digital assets, it effectively positions PayPal at the forefront of the crypto payment revolution, promoting broader acceptance and usage of cryptocurrencies as a viable payment solution.