CATL Battery Technology: Innovations and Market Strategies

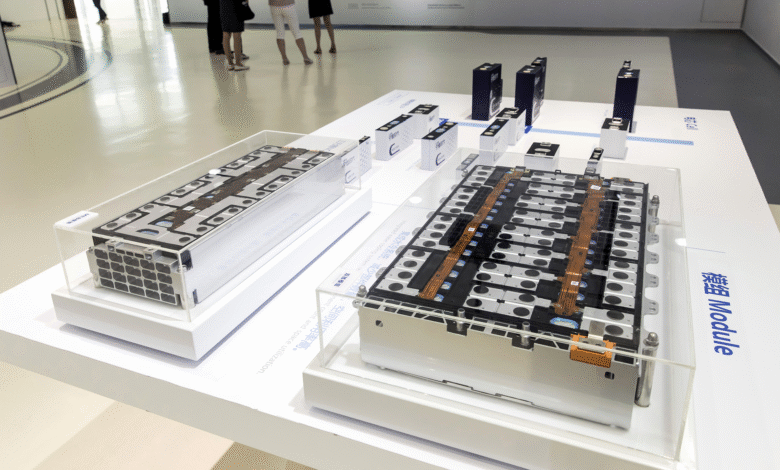

CATL battery technology is at the forefront of innovation in electric vehicle batteries, redefining expectations for energy solutions globally. Contemporary Amperex Technology Co., Limited, a prominent supplier to Tesla, is not just a hardware manufacturer; it’s evolving into a comprehensive platform that integrates advanced software ecosystems and artificial intelligence for battery monitoring systems. Analysts from Morgan Stanley have recently projected a bullish outlook on CATL share price, raising their target to 445 Hong Kong dollars, a clear indication of the company’s growing market influence. This surge follows significant partnerships, such as the one with Ford, which bolsters CATL’s revenue potential through lucrative licensing agreements. As CATL embarks on ambitious IPO expansion plans and European operations, its technology is set to play a pivotal role in the future of the electric vehicle landscape.

The drive for cutting-edge battery solutions is exemplified by the advancements in CATL’s energy storage technologies, focusing on electric vehicle power sources. CATL, widely recognized as a key player in the battery manufacturing domain, is broadening its reach by integrating software capabilities aimed at enhancing safety and efficiency in battery management. Recent financial projections highlight the rising CATL share price, which mirrors the industry’s confidence in innovative partnerships like the Ford collaboration. The company’s strategic initiatives, including IPO expansion into new markets, are paving the way for a robust presence in the electric vehicle sector. Furthermore, the integration of smart battery monitoring systems positions CATL as a leader in delivering next-generation energy solutions.

The Evolution of CATL: More Than Just a Battery Supplier

Contemporary Amperex Technology Co. Ltd. (CATL) is charting a new course in the electric vehicle industry that extends far beyond its role as a battery pack supplier. Analysts from Morgan Stanley, led by Jack Lu, highlight that CATL is evolving into a comprehensive provider of not only hardware but also a sophisticated software ecosystem. This transformation is led by the integration of artificial intelligence technology aimed at enhancing battery monitoring systems, ensuring improved safety and efficiency in electric vehicles. The company’s innovative approach places it at the forefront of what could be a paradigm shift in how battery technologies are managed and optimized in real-time.

By transitioning from solely a hardware focus to a full-fledged service model, CATL is positioning itself to capture significant value in the burgeoning electric vehicle market. As the industry continues to grow, such advancements in CATL’s battery technology could be pivotal for manufacturers looking for competitive advantages. With its ambitions set high, CATL’s forward-thinking strategy not only enhances the appeal of its products but also aligns well with the broader trend of automakers seeking integrated solutions that combine both hardware and software.

CATL’s Strategic Partnerships: Fueling Growth and Innovation

In recent developments, CATL’s strategic partnership with Ford stands out as a significant milestone in its expansion strategy. This collaboration is poised to benefit CATL through lucrative licensing agreements expected to generate substantial revenue from Ford’s BlueOval Battery Park in Michigan. With an anticipated yield of 1.3 billion yuan (approximately $181 million) annually by 2027, this partnership illustrates the potential financial impact of aligning with major automotive suppliers. Such collaborations not only strengthen CATL’s financial position but also enhance its market presence as electric vehicle adoption accelerates.

However, the partnership comes with challenges, especially as CATL faces increased scrutiny in the United States, being included on the Pentagon’s list of companies facing restrictions starting in 2026. Despite these geopolitical concerns, analysts remain optimistic about CATL’s future, indicating that risks are already priced into their stock value. Such a positive outlook is reinforced by Bank of America’s ‘Buy’ rating on CATL, underscoring confidence in its growth trajectory, which is bolstered by alliances with leading automakers like Ford.

Analyzing CATL’s IPO and Europe Expansion Plans

The successful execution of CATL’s initial public offering (IPO) has garnered attention for its strategic implications and funding opportunities to facilitate global expansion, particularly in Europe. With plans for a new factory in Hungary nearing completion and a staggering $6 billion investment earmarked for a nickel mining and battery production project in Indonesia, CATL is setting the groundwork for enhanced production capabilities. This expansion is crucial as the demand for high-performance electric vehicle batteries continues its upward trajectory. By diversifying its production base, CATL can mitigate risks associated with supply chain disruptions and position itself favorably within the European market.

Indeed, CATL’s expansion strategy exemplifies its commitment to becoming a global leader in battery manufacturing. As the EU pushes towards sustainable energy and transportation solutions, CATL’s focus on European operations aligns perfectly with this overarching initiative. Furthermore, such a move is expected to bolster CATL’s share price, supported by increasing demand for electric vehicle batteries in European markets, where numerous manufacturers are integrating CATL technology into their vehicles to stay competitive.

The Impact of AI on CATL’s Battery Monitoring Systems

Artificial intelligence (AI) is revolutionizing numerous industries, and CATL is leveraging this technology to enhance its battery monitoring systems. With the integration of AI, CATL is not only improving the battery lifecycle management but also enhancing the safety protocols associated with battery usage. This innovation is critical as electric vehicles rely heavily on robust battery performance for efficiency and longevity. By optimizing battery health through predictive analytics, CATL is establishing itself as a leader in ensuring that electric vehicle batteries maintain optimal function over time.

The implications of these advancements in battery monitoring extend beyond performance metrics; they also contribute to consumer trust in electric vehicles. As awareness of battery technology grows, consumers will desire assurances about safety and durability. CATL’s proactive approach in adopting AI to oversee battery health ensures that electric vehicles equipped with their batteries can provide the reliability that buyers expect, thereby influencing purchasing decisions and driving increased adoption in the marketplace.

Geopolitical Challenges: CATL’s Strategic Risk Management

CATL’s growth has not been without its hurdles, particularly concerning geopolitical challenges that could affect its operations outside of China. Being included on the Pentagon’s list has raised concerns regarding future restrictions, which is critical given the increasing tension between the U.S. and China. However, analysts believe that CATL’s share price already reflects these risks, indicating market confidence in CATL’s strategic planning and risk management capacities. The ability to adapt and navigate these challenges will be essential for CATL as it continues to extend its global reach.

In this context, CATL’s focus on diversifying its production facilities and establishing partnerships abroad, such as with Ford, demonstrates a practical approach to mitigating the potential impact of political risks. With the prospect of expanded access to new markets and safer revenue streams, CATL is enhancing its resilience in the face of fluctuating global dynamics. This strategic foresight will be pivotal in sustaining its market leadership while also protecting shareholder value amidst uncertainty.

Collaborating with Zeekr: Advancements in Hybrid Vehicles

Another noteworthy initiative for CATL is its collaboration with automotive companies like Zeekr to innovate in the hybrid vehicle sector. By combining CATL’s advanced battery technology with Zeekr’s commitment to developing high-performance hybrids, the partnership aims to carve out a significant share in this rapidly growing market. As hybrid vehicles become increasingly popular due to their balance of efficiency and performance, CATL’s involvement positions it advantageously to cater to evolving consumer demands.

This collaboration is not just about expanding product offerings; it reflects a broader trend where traditional automotive manufacturers recognize the need for advanced battery technology to meet stringent environmental regulations. As automakers strive to optimize their fleets for better fuel efficiency and reduced emissions, CATL’s hybrid solutions can play a crucial role in enhancing vehicle performance while minimizing environmental impact. The innovation stemming from such partnerships will bolster CATL’s reputation as a key player in sustainable automotive solutions.

Forecasting the Future: CATL’s Continued Market Dominance

As CATL continues to grow and innovate, industry analysts are optimistic about its potential to maintain market dominance in the battery technology sector. With the company focusing on both hardware and software advancements, coupled with strategic alliances, CATL is well-positioned to capitalize on the increasing global demand for electric vehicle batteries. The projected growth in electric vehicle adoption and the need for reliable power sources translate directly to opportunities for CATL to enhance its market share significantly.

Looking ahead, analysts believe that CATL’s ability to navigate geopolitical uncertainties while concurrently innovating its battery technologies will play a critical role in its sustained success. As traditional automotive giants increasingly adopt electric and hybrid technologies, CATL’s key role in supplying cutting-edge battery systems will further solidify its standing as a market leader. Investors and industry stakeholders alike will be closely monitoring CATL’s developments, as its trajectory will likely have a significant impact on the broader electric vehicle ecosystem.

Understanding CATL’s Financial Performance and Share Price Trends

CATL’s financial performance has garnered significant attention, particularly following investments and predictions regarding its share price trajectory. Analysts recently raised CATL’s price target to 445 Hong Kong dollars ($56.69), reflecting a 14% increase from previous valuations. This surge is attributed to the company’s impressive growth strategy and its ability to capitalize on emerging market opportunities in electric vehicle batteries. Such positivity surrounding its share price is indicative of investor confidence in CATL’s long-term viability and market strategy.

However, it is crucial to note that share price fluctuations can be influenced by external factors, including regulatory changes and market competition. As CATL expands its operations in key regions and solidifies partnerships, such fluctuations will need to be navigated carefully. Investors are likely to keep a close eye on CATL’s strategic moves, including any shifts in its collaborations or technological advancements, as these will provide critical insights into future financial performance and market positioning.

The Future Landscape of Electric Vehicle Batteries: CATL’s Role

The electric vehicle battery market is at a pivotal moment, and CATL’s ongoing innovations are set to redefine its landscape. As automakers continuously seek improvements in battery technology for better performance, CATL is at the forefront with its advanced battery systems that cater to a variety of vehicle types. The transition to electric vehicles is expected to drive demand for efficient and sustainable battery solutions, pushing manufacturers to rely on leading providers like CATL to meet these needs.

In this context, CATL’s ongoing investments in research and development, as well as strategic partnerships, will likely play a significant role in shaping the future of electric vehicle batteries. Furthermore, as the world pivots towards greener energy solutions, CATL’s focus on sustainability and technology innovation positions it as not just a supplier but a pivotal player in driving the entire electric vehicle industry forward.

Frequently Asked Questions

What are the advantages of CATL battery technology for electric vehicles?

CATL battery technology offers numerous advantages for electric vehicles, including high energy density, longer lifespan, and improved safety features. As a leading supplier, CATL is focused on enhancing battery performance through innovative battery monitoring systems and artificial intelligence, ensuring efficient energy management and safety for electric vehicle manufacturers.

How does CATL’s partnership with Ford affect the future of battery technology?

The partnership between CATL and Ford, particularly through the BlueOval Battery Park, signifies a transformative step in battery technology for electric vehicles. This collaboration is anticipated to generate substantial licensing fees for CATL and drive advancements in battery development, benefiting both companies as they enhance production capabilities and market reach.

What is the significance of CATL’s IPO expansion on battery production in Europe?

The recent CATL IPO expansion plays a pivotal role in scaling up battery production in Europe. With significant investments, including a new factory in Hungary, CATL aims to meet the growing demand for electric vehicle batteries and strengthen its market presence, ensuring a competitive edge in the evolving automotive sector.

How does CATL ensure battery safety through monitoring systems?

CATL prioritizes battery safety by implementing advanced battery monitoring systems that utilize artificial intelligence. These systems continuously analyze battery performance, detect anomalies, and optimize charging practices to enhance security and longevity, positioning CATL as a leader in reliable battery technology for electric vehicles.

What impact does the Morgan Stanley price target increase have on CATL share price?

Morgan Stanley’s increased price target for CATL share price reflects favorable market sentiment regarding CATL’s innovative battery technology and growth prospects. The revised target of 445 HKD signifies confidence in CATL’s strategies, including licensing agreements and international expansion, potentially attracting more investors.

What are CATL’s strategies for overcoming geopolitical risks?

To address geopolitical risks, CATL is diversifying its market strategies and focusing on expanding its operations globally. By leveraging its recent IPO funds and establishing partnerships, such as with Ford, CATL aims to mitigate potential restrictions while solidifying its leadership in the electric vehicle battery market.

What future developments can we expect from CATL in the electric vehicle battery industry?

Future developments from CATL in the electric vehicle battery industry include advancing their battery technology through innovative collaborations, like with Zeekr for hybrid vehicles, and expanding production facilities globally to meet burgeoning demand. These efforts are expected to enhance CATL’s capabilities and market share across various regions.

| Key Points | Details |

|---|---|

| CATL’s Ambitions | CATL aims to become not just a manufacturer of battery packs, but also a provider of a software ecosystem for battery management. |

| Analyst Insights | Morgan Stanley analysts have raised CATL’s stock price target to 445 HKD, a 14% increase due to positive growth expectations. |

| Partnerships and Revenue Generation | A new partnership with Ford could yield substantial licensing revenues for CATL, expected to reach 1.3 billion yuan ($181 million) annually. |

| Geopolitical Concerns | CATL faces scrutiny from the U.S. due to restrictions but analysts believe the risks are reflected in current stock prices. |

| Expansion Plans | CATL is using funds from its IPO to expand operations in Europe, including a factory in Hungary and a $6 billion project in Indonesia. |

| Market Diversification | Collaborations, like with Zeekr for hybrid vehicles, are diversifying CATL’s offerings, potentially increasing market share in China. |

Summary

CATL battery technology represents a significant advancement in the electric vehicle market, as the company not only seeks to provide quality battery packs but also embraces innovative software solutions for battery management. This dual approach is expected to enhance the reliability, safety, and overall performance of electric vehicles, thus solidifying CATL’s position as a leading supplier to major automotive manufacturers. Their strategic partnerships and expansion efforts are likely to further bolster their market presence, making CATL a key player in the future of green technology.