Central Banks Gold Buying Accelerates Amid De-Dollarization

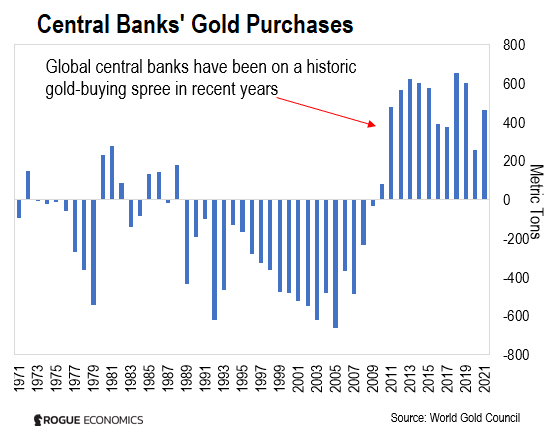

Central banks are ramping up their gold buying as concerns about economic uncertainty and the U.S. dollar decline take center stage in global finance. With de-dollarization gaining momentum, these institutions view gold reserves as a secure alternative to U.S. dollar-denominated assets. The latest reports indicate a projected purchase of 1,000 metric tons of gold by central banks in 2025, reflecting an enduring commitment to enhancing their gold stockpiles amid fluctuating markets. This shift is fueled by a weakening faith in the fiscal stability of the United States, as geopolitical tensions and financial instability mount. As central bank demand for gold rises, the allure of this precious metal as a safe haven continues to grow markedly in an increasingly uncertain world.

As central banks pivot toward precious metals, the trend of increasing gold accumulation emerges prominently in discussions around financial resilience. These monetary authorities, seeking to bolster their assets against the backdrop of fluctuating currencies and unstable economic conditions, are focused on enhancing their strategic reserves. The ongoing push for de-dollarization encapsulates a broader movement away from traditional reliance on the U.S. dollar, as nations seek to mitigate risks associated with dollar depreciation. In light of rising geopolitical challenges, central banks are recognizing gold’s unique position as a politically neutral reserve that can safeguard their financial interests. This evolving landscape highlights the critical role of gold within the parameters of modern monetary policy and economic strategy.

The Surge in Central Banks Gold Buying Amid Economic Uncertainty

In the face of economic uncertainty and geopolitical instability, central banks are significantly increasing their gold reserves. This strategic move is driven by the growing belief that gold serves as a reliable hedge against fluctuations in fiat currencies, particularly the U.S. dollar. In 2025, central banks are expected to acquire 1,000 metric tons of gold, marks the fourth year of robust official sector buying. This commitment reveals not only a desire to diversify away from dollar assets but also a proactive stance against potential economic downturns.

As institutions rediscover the value of gold amid escalating tensions and depreciation of the dollar, the long-term outlook for gold remains bullish. Despite a projected decrease in purchases compared to 2024, the sustained demand signifies a robust commitment to gold as a safe haven. Metals consultancy, Metals Focus, has reiterated that investments in gold are bolstered by fears regarding the U.S. fiscal outlook, showcasing how central banks are navigating these challenging financial waters.

De-Dollarization and its Impact on Global Gold Demand

The ongoing trend of de-dollarization has emerged as a crucial factor compelling central banks to increase gold buying. Countries are increasingly wary of their reliance on the U.S. dollar, influenced by political instability and evolving geopolitical dynamics. As a consequence, many central banks are stockpiling gold as a means to reduce their exposure to dollar-dominated assets, which have shown volatility amid U.S. economic challenges. This strategic shift represents a significant pivot in monetary policy aimed at fostering resilience against global market shifts.

The implications of de-dollarization extend beyond individual nations, influencing the global economic landscape. Countries within alliances such as BRICS and the Shanghai Cooperation Organisation are systematically promoting trade in national currencies, further emphasizing the importance of gold as a stabilizing asset. As central banks respond to the dollar’s fluctuations by enhancing their gold reserves, we can anticipate a ripple effect that may reshape the dynamics of international trade and financial stability.

The Ongoing Strategy of Central Banks: Gold Reserves vs. U.S. Dollar Assets

In light of increasing geopolitical tensions and economic uncertainties, central banks are recalibrating their asset allocations, with a notable shift towards gold reserves. Historically viewed as a haven in turbulent economic climates, gold presents a politically neutral option for countries seeking to minimize their dependency on U.S. dollar assets. The strategic accumulation of gold is indicative of a larger trend where nations are reinvesting to safeguard their economies against potential U.S. monetary policy shifts that may induce market instability.

As the U.S. dollar faces challenges related to fiscal stability and international confidence, central banks are embracing gold to counterbalance these risks. The forecast for gold prices suggests an upward trajectory, with metals experts predicting significant increases that align with broader central bank buying trends. This dual strategy not only reinforces the appeal of gold but also presents an opportunity for nations to assert their financial sovereignty in a shifting global currency landscape.

Geopolitical Factors Influencing Central Bank Gold Buying

Geopolitical tensions have historically played a pivotal role in shaping central banks’ strategies regarding asset purchases. The emergence of conflicts and shifts in political rapport among nations have led to a growing consensus on the need for reserve diversification. As countries face potential sanctions or economic fallout from U.S. policies, their shift towards accumulating gold is increasingly viewed not only as prudent but necessary. By diversifying their holdings, nations aim to fortify their economies against external pressures, ensuring more resilient financial stability.

Furthermore, this geopolitical landscape creates a favorable environment for gold to thrive as a safe-haven asset. Countries historically reliant on U.S. Treasury bonds are now paying closer attention to gold reserves, acknowledging them as a non-liability alternative that safeguards value during periods of instability. As the global narrative shifts, we may witness an intensified competition among nations to secure gold, enhancing its value and significance on the international stage.

The Future of Gold Prices Amid Central Bank Purchases

As central banks ramp up their gold purchases, the implications for gold prices are becoming increasingly pronounced. Analysts have projected that the average gold price could increase by 35% in 2025, reflecting both increased demand from official sectors and heightened economic uncertainty. The climbing prices signify not only a reaction to the current climate but also an ongoing belief in gold’s long-term viability as a store of value. Given these projections, investors may view gold as one of the most reliable assets amidst fluctuating market conditions.

The anticipated rise in gold prices can also be attributed to the declining influence of the U.S. dollar in international trade, particularly as countries diversify their reserves. As central bank demand for gold continues to rise, the potential for elevated prices creates new dynamics in the commodities market. In a financial world focused on risk assessment, the current scenario proposes a win-win situation for gold: an increase in demand along with an upward price trajectory, possibly redefining the asset’s outlook in the years ahead.

The Role of Central Banks in Global Economic Stability

Central banks play a crucial role in maintaining global economic stability, particularly through their asset management strategies. As central banks globally continue to bolster their gold reserves, they position themselves as key players in shaping financial responses to economic uncertainty. This proactive approach not only reflects a commitment to safeguarding national wealth but also serves to support broader economic resilience in the face of unpredictability. The consistent accumulation of gold is signaling a shift towards long-term strategic planning in lieu of short-term gains.

In essence, the decisions made by central banks today will have lasting implications for global financial stability. By enhancing their gold reserves, central banks are not just reacting to immediate threats but are also preparing for potential future instabilities that can arise from geopolitical shifts or economic downturns. The strategic management of assets reflects an understanding that stability can often be found in the intrinsic value of tangible assets like gold, reinforcing its role as an essential hedge in uncertain times.

Central Bank Demand: A Forecast for the Future of Gold

Central bank demand for gold is set to play a significant role in shaping the market in the foreseeable future. The anticipated acquisition of 1,000 metric tons in 2025 underlines a robust trend of sustained buying activity following several years of growth. This forecast, while showing a slight reduction from previous years, emphasizes that central bank demand remains historically high, signaling faith in gold’s reliability as a reserve asset amid fluctuating global market dynamics.

Looking ahead, the implications of this demand extend beyond immediate financial metrics. Should central bank purchases continue on this upward trajectory, we might experience a tightening of gold supplies, leading to further price increases. As central banks across various nations solidify gold’s position within their reserves, they highlight its significance as a strategic asset capable of providing stability in the face of U.S. dollar decline and economic uncertainty. This not only reshapes investment strategies but also solidifies gold’s status as an enduring store of value.

Gold as a Strategic Asset in the Age of De-Dollarization

In an era where de-dollarization is becoming a focal point for many economies, gold stands out as a strategic asset. The movement away from U.S. dollar dependency is gaining traction as countries recalibrate their economic policies and trade relationships. Within this context, gold serves not only as a hedge against inflation but also as a means for countries to control their monetary sovereignty. As nations increasingly prioritize their economic independence, the demand for gold is likely to intensify.

The pursuit of gold as a strategic asset reflects broader economic philosophies that challenge the status quo of global finance. Nations opting for gold as their reserve of choice underscore a shift in narrative toward valuing tangible assets that possess inherent worth, detached from political whims. This creates a more diversified and resilient economic pathway for countries navigating the complexities of international relations. As de-dollarization continues to gain momentum, the role of gold will only become more pivotal in shaping global economic policies.

The Influence of Futuristic Technologies on Gold Market Dynamics

The integration of advanced technologies within the gold market is altering traditional practices and introducing new avenues for investment. As digital platforms and blockchain technologies emerge, they are enhancing transparency and accessibility within the gold sector. This digital transformation empowers investors with real-time access to market data, enabling them to react swiftly to trends impacting the price of gold. Central banks leveraging technology for gold transactions can also streamline their operations, potentially increasing the pace of gold acquisitions.

Furthermore, as countries experiment with digital currencies, the relationship between traditional assets like gold and these new financial instruments could evolve. Gold may see renewed appreciation as a stabilizing asset in a world transitioning towards digital finance, especially as governments look for safe-haven investments amidst rising inflation and currency fluctuations. Such innovations suggest that the gold market is on the cusp of transformation, reflecting a blend of tradition with modern technology that could redefine its role in the global economy.

Frequently Asked Questions

Why are central banks increasing gold buying in response to de-dollarization?

Central banks are increasing gold buying as a strategic measure to reduce dependence on U.S. dollar-denominated assets amid rising global distrust in U.S. fiscal stability. This shift towards gold reserves reflects a desire to secure a more stable and politically neutral form of wealth in light of economic uncertainty and geopolitical tensions.

How does central bank demand for gold reflect concerns about the U.S. dollar decline?

The growing central bank demand for gold highlights concerns about the U.S. dollar’s declining global dominance. As central banks react to inflation, a volatile fiscal outlook, and geopolitical instability, they view gold as a safer reserve asset, thus fostering a trend of de-dollarization and a significant increase in gold reserves.

What impact does economic uncertainty have on central bank gold buying strategies?

Economic uncertainty significantly influences central bank gold buying strategies. With fears over the stability of traditional safe-haven assets like U.S. Treasuries, central banks are investing in gold to safeguard their reserves and maintain financial security, as it is regarded as a politically neutral and stable asset.

Which countries are leading in gold purchases among central banks as part of de-dollarization efforts?

Countries like Poland, Azerbaijan, and China are among the leading purchasers of gold as central banks seek to enhance their gold reserves. This aligns with their strategy to move away from reliance on the U.S. dollar and reinforces the trend of de-dollarization.

What role does central bank gold buying play in the future of global currencies?

Central bank gold buying plays a critical role in reshaping the future of global currencies. As these institutions strengthen their gold reserves, it underscores a trend toward diversifying away from the U.S. dollar, potentially leading to the emergence of alternative currencies and increased use of national currencies in international trade, especially among BRICS and SCO countries.

| Key Points | Details |

|---|---|

| Central Banks Increase Gold Reserves | In 2025, central banks are expected to purchase 1,000 metric tons of gold. |

| De-Dollarization Trend | The shift away from the U.S. dollar is driving significant gold purchases for four consecutive years. |

| Factors Influencing Gold Demand | Global distrust in U.S. fiscal stability, political instability, and high geopolitical tensions are key drivers. |

| Projected Gold Prices | Gold price is expected to rise 35% in 2025, reaching approximately $3,210 per ounce. |

| Notable Buyers | Countries like Poland, Azerbaijan, and China are leading gold purchases, along with continued purchases from Iran. |

Summary

Central banks’ gold buying is accelerating due to rising global tensions and skepticism around the stability of the U.S. dollar. In response to political and fiscal issues in the United States, central banks are increasingly viewing gold as a strategic reserve asset, continuing a trend of significant acquisitions over the past few years. The projected increase in gold prices and ongoing geopolitical factors suggest that this gold buying trend will likely persist, revealing the growing preference for gold as a secure asset amidst economic uncertainty.