Chainlink CCIP Launches on Solana for Cross-Chain Assets

Chainlink’s CCIP is transforming the landscape of decentralized finance by enabling seamless cross-chain interoperability, and its recent launch on Solana is a groundbreaking step forward. This integration is significant as it connects over $19 billion in Solana assets with networks such as Ethereum and BNB Chain, paving the way for secure, efficient transactions across multiple platforms. With the CCIP launch, projects like Maple Finance and Shiba Inu can now bring their tokenized assets into Solana’s thriving ecosystem, enhancing liquidity and institutional investment opportunities. Moreover, the v1.6 upgrade not only reduces transaction costs but also boosts scalability, making it easier for developers to leverage Chainlink Solana’s capabilities. As a result, Chainlink’s robust infrastructure is set to bolster Solana’s capability in the DeFi space and facilitate bigger cross-chain collaboration than ever before.

The debut of Chainlink’s Cross-Chain Interoperability Protocol brings a new era of connection between various blockchains, and especially enhances the Solana network. This move showcases innovative capabilities that allow for effective data and asset transfers across diverse ecosystems, bridging the gap between decentralized platforms. As Chainlink facilitates the linking of assets worth billions, it opens doors for many projects to flourish, especially within the realm of decentralized finance. With improvements like reduced transaction fees and a streamlined structure, this technology is pivotal for the evolution of blockchain interoperability. Altogether, the CCIP launch signals a noteworthy expansion in the cross-chain ecosystem, ensuring that Solana stays competitive and responsive to the needs of developers and users alike.

Understanding Chainlink’s Cross-Chain Interoperability Protocol (CCIP)

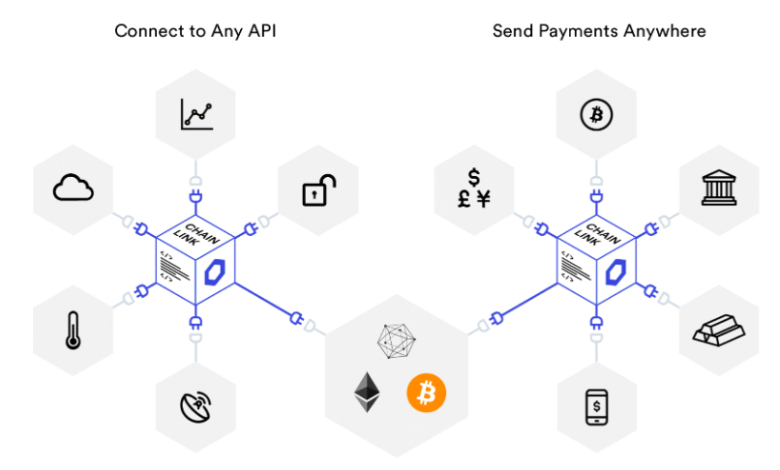

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a groundbreaking solution in the realm of blockchain technology, enabling seamless interaction and movement of assets across different blockchain networks. With the recent launch on Solana, Chainlink is paving the way for enhanced cross-chain interoperability, allowing developers to build complex decentralized applications (DApps) that can interact not just with the Ethereum blockchain but also with Solana and others that use differing architectures. This capability is crucial for decentralized finance (DeFi) as it opens the door for a much wider audience to utilize and benefit from various blockchain assets.

The CCIP deployment on Solana is a notable achievement, especially considering that Solana offers unique benefits like high throughput and low transaction costs. This launch is part of a broader vision to link disparate blockchain networks, facilitating the transfer of data and assets with unprecedented ease. As institutions begin to recognize the value of cross-chain connectivity, projects like Maple Finance and Shiba Inu are expected to thrive in this interconnected financial ecosystem, driving significant growth in the market.

The Impact of CCIP Launch on Solana’s Ecosystem

Chainlink’s CCIP launch is set to significantly impact Solana’s ecosystem by enhancing accessibility and liquidity for Solana assets. By allowing over $19 billion in tokenized assets to be transferred securely between Solana and other blockchain networks, this integration is projected to attract a broader range of institutional investors. The seamless transfer capabilities will not only improve liquidity for existing assets but also inspire the creation of new financial products, thus expanding Solana’s footprint within the decentralized finance sector.

Furthermore, with projects such as Maple Finance utilizing CCIP to bridge their syrupUSD stablecoin to Solana, we can expect to see an increase in decentralized lending and liquidity solutions tailored for Solana users. This move emphasizes the significance of cross-chain interoperability in modern DeFi applications, aligning perfectly with current trends where users demand more options and better access to their assets. The streamlined architecture and reduced transaction costs further assure developers that building on Solana is not just feasible but also profitable.

Advantages of Cross-Chain Interoperability for Decentralized Finance

Cross-chain interoperability represents a paradigm shift in the decentralized finance landscape. It allows users to access and manipulate assets across different blockchain networks without being confined to a single platform. This flexibility minimizes barriers to entry, allowing a more extensive range of users to participate in DeFi activities. For instance, a user on Solana can now interact with Ethereum-based DeFi applications, leveraging opportunities that were previously inaccessible due to the limitations of isolated blockchain environments.

Moreover, the ability to transfer assets across chains increases the liquidity pool available in DeFi markets. As more users bring their assets from different ecosystems, the overall volume and variety of transactions increase, which can lead to better pricing, reduced slippage, and ultimately more successful trading experiences. The CCIP’s efficient architecture is key to this transition, as it can handle hundreds of blockchain interactions, setting a new standard for how decentralized applications will operate in the future.

Chainlink’s Role in Bridging Multiple Blockchains

Chainlink is emerging as a critical player in the blockchain space, especially with its Cross-Chain Interoperability Protocol enabling the integration of multiple blockchains like Solana, Ethereum, and BNB Chain. This ability to bridge disparate blockchain ecosystems not only facilitates the growth of decentralized applications but also enhances the overall resilience of the crypto network. By providing a reliable method for data and asset transfers across chains, Chainlink is effectively knitting together various blockchain protocols into a cohesive financial ecosystem.

As Chainlink’s CCIP continues to expand its capabilities, it helps foster an environment where innovations in DeFi can flourish. The connections made possible by this protocol are likely to lead to more collaborative projects among developers and institutions, driving the adoption of blockchain technology beyond current limits. By securing billions in total value locked (TVL) across various DeFi platforms, Chainlink not only highlights its role as an integral service provider but also underscores the growing demand for efficient cross-chain solutions.

The Future of Cross-Chain Solutions in Web3

The recent advancements in cross-chain solutions like Chainlink’s CCIP portend an exciting future for the Web3 ecosystem. As blockchain technology continues to evolve, the need for interoperability will rise significantly. Users and developers will demand the ability to navigate effortlessly between different networks, enhancing usability and expanding the scope of decentralized applications. The CCIP is at the forefront of this evolution, enabling more robust interactions among various blockchain technologies.

In the coming years, we can expect to see accelerated developments in cross-chain solutions, opening avenues for new financial products and services. As the boundaries between blockchains diminish, users will benefit from increased flexibility and access to diverse assets. Additionally, as institutions recognize the opportunity to participate in cross-chain markets, more capital is expected to flow into the DeFi sector, creating a sustainable growth trajectory that benefits all participants in the ecosystem.

How Chainlink Enhances Security in Cross-Chain Transactions

Security is paramount in any financial transaction, particularly in decentralized environments where assets are moved across various blockchain platforms. Chainlink’s architecture is designed to enhance security in cross-chain transactions, utilizing decentralized oracle networks that aggregate data from multiple sources to ensure accuracy and reliability. This approach minimizes the risks associated with fraud and manipulation, fostering trust in the cross-chain operations that CCIP facilitates.

Moreover, the integration of security protocols within CCIP not only protects the integrity of transactions but also bolsters user confidence in decentralized finance. As projects commence their integration with Chainlink’s CCIP, they inherit the robust security measures in place, ensuring that both developers and users can transact with peace of mind. This security-centric approach is vital in attracting institutions and individual investors alike, as confidence in blockchain technology continues to grow.

Leveraging Chainlink’s CCIP for Institutional Investments

With the rollout of Chainlink’s CCIP on Solana, the pathway is being paved for increased institutional investment in decentralized finance. Institutions are typically cautious, requiring clear frameworks and secure environments to invest their capital. Chainlink’s proven track record in securing smart contracts and its infrastructure designed for cross-chain transfers creates a compelling case for institutional players looking to diversify their investments in blockchain technology.

By facilitating seamless transfers between Solana and other blockchains, CCIP offers institutions access to a broader array of assets and investment opportunities. This integration not only enhances liquidity but also allows traditional financial institutions to engage with tokenized real-world assets in a way that aligns with their risk management frameworks. As this trend continues, we will likely see a significant uptick in legitimate institutional participation within the DeFi space.

Exploring the Market Value of Tokenized Assets on Solana

The launch of Chainlink’s CCIP on Solana has the potential to reshape the market value of tokenized assets significantly. With an estimated $19 billion in assets now able to move between Solana and other blockchains, the liquidity and accessibility of these assets are bound to deepen. This shift not only uplifts the value of existing assets but also encourages the creation of new types of tokenized resources that cater to the evolving needs of users in the DeFi space.

As Solana’s infrastructure supports swift and cost-efficient transactions, tokenized assets are likely to gain traction among investors seeking profitable opportunities. Enhanced interoperability through Chainlink allows various tokens to communicate seamlessly with one another, providing users with the ability to diversify their portfolios across different platforms. This interplay creates a dynamic market environment, driving innovation that could redefine how assets are perceived and utilized in the blockchain sphere.

The Mechanisms Behind CCIP and Its Benefits

Understanding the mechanisms behind Chainlink’s CCIP provides insight into its profound impact on the blockchain ecosystem. At its core, CCIP enables protocols and applications to share information and assets across multiple blockchains seamlessly, utilizing smart contracts and decentralized oracles to ensure secure data transmission. This decentralized approach helps prevent a single point of failure, offering enhanced security and resilience compared to traditional cross-chain solutions.

The benefits of implementing CCIP extend to developers, users, and the broader DeFi landscape. By adopting this technology, developers can create more versatile applications that tap into the strengths of various blockchain networks. Users, on the other hand, enjoy improved access to a broader range of services and assets, leading to a more inclusive financial environment. Overall, CCIP represents a significant advancement toward achieving full interoperability within the blockchain space, driving innovation and adoption for years to come.

Frequently Asked Questions

What is Chainlink CCIP and how does it enhance cross-chain interoperability?

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) facilitates seamless cross-chain asset and data transfers across multiple blockchain networks, including Solana. By enabling interoperability among ecosystems like Ethereum and BNB Chain, CCIP enhances decentralized finance (DeFi) by allowing projects to access a broader market and utilize shared liquidity.

How does Chainlink CCIP benefit Solana assets?

With the launch of Chainlink CCIP on Solana, assets valued at over $19 billion can be tokenized and integrated into Solana’s ecosystem. This allows projects to reduce transaction fees and benefit from the high-speed capabilities of Solana, significantly expanding the use cases for Solana assets in DeFi.

What are the implications of the CCIP launch for decentralized finance?

The CCIP launch on Solana marks a significant advancement in decentralized finance by linking diverse ecosystems. This integration supports the scaling of DeFi applications, attracts institutional investors, and enhances liquidity for tokenized real-world assets (RWAs), ultimately leading to a more interconnected financial landscape.

Which projects are leveraging Chainlink CCIP on Solana?

Notable projects utilizing Chainlink CCIP on Solana include Maple Finance and Shiba Inu. These platforms are utilizing the Cross-Chain Token (CCT) standard to expand their tokenized assets into Solana, thereby capitalizing on its unique features and growing market potential.

What advantages does Chainlink’s CCIP v1.6 upgrade offer?

The CCIP v1.6 upgrade provides significant advantages, including reduced transaction costs and a streamlined architecture for scaling across numerous blockchains. This upgrade enhances the efficiency of cross-chain transactions, allowing for quicker and more cost-effective movement of assets between Solana and other chains.

How is Chainlink CCIP expected to influence institutional participation in Solana?

Chainlink CCIP is anticipated to attract institutional capital to Solana by enhancing the network’s ability to facilitate cross-chain transactions and provide access to decentralized finance solutions. This positioning allows Solana to deepen liquidity and broaden participation in the tokenization of real-world assets.

What role does Chainlink already play in the Solana ecosystem?

Chainlink already supports multiple protocols within the Solana ecosystem by offering essential services such as price feeds and data streams. This foundational infrastructure lays the groundwork for expanded applications, particularly with the introduction of CCIP, enabling broader interoperability and utility.

Are there other networks benefiting from Chainlink CCIP aside from Solana?

Yes, Chainlink CCIP is designed to work with multiple blockchain networks, including Ethereum, BNB Chain, and Arbitrum. The protocol’s capabilities are consistently expanding, enabling various ecosystems to enjoy the benefits of cross-chain interoperability and enhanced decentralization.

| Key Point | Details |

|---|---|

| CCIP Deployment | Chainlink’s CCIP is operational on Solana, marking its first deployment on a non-EVM blockchain. |

| Asset Value | Over $19 billion in tokenized assets are linked through CCIP. |

| Supported Projects | Projects like Maple Finance, Shiba Inu, and Backed Finance can expand into Solana’s ecosystem. |

| Cost Efficiency | The v1.6 upgrade reduces transaction costs and streamlines architecture for scaling. |

| DeFi Impact | Chainlink secures billions in DeFi total value locked (TVL), enhancing Solana’s liquidity. |

| Future Developments | Further integration with non-EVM blockchains is expected, enhancing cross-chain capabilities. |

Summary

Chainlink CCIP’s recent launch on Solana represents a significant milestone in the realm of cross-chain interoperability. With the capability to link over $19 billion in tokenized assets, CCIP enhances the Solana ecosystem by allowing seamless transfers between major networks like Ethereum and BNB Chain. The integration positions Solana to attract institutional investments and bolster the liquidity of real-world tokenized assets. As further developments emerge, Chainlink CCIP is set to redefine cross-chain transactions, making it a pivotal player in decentralized finance.