Chicago Fed Inflation Outlook: A Cautious Approach Ahead

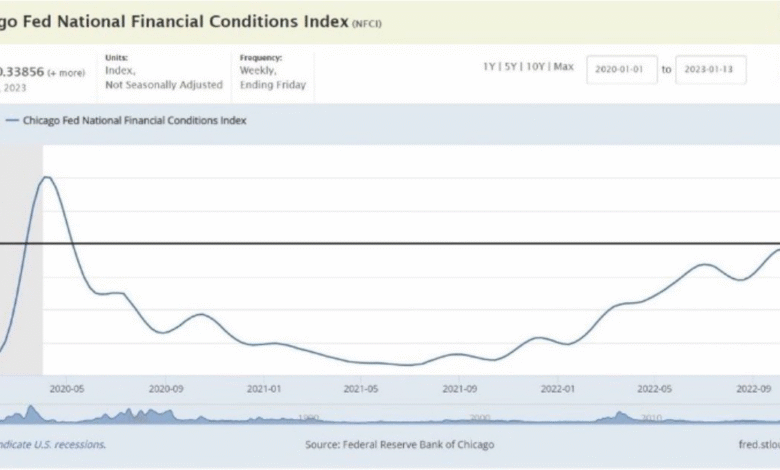

The Chicago Fed inflation outlook reveals a nuanced perspective as president Austan Goolsbee navigates the complexities of the current economic landscape. During a recent visit to a local business, he voiced concerns about the tangible impact of tariffs on ingredient costs, underlining the interconnectedness of global trade and local economic health. With recent spikes in wholesale prices and consumer inflation hovering at 2.7%, Goolsbee is advocating for a careful evaluation of incoming data before considering any interest rate cuts. This approach aims to balance the demands for lower financing costs against the reality of rising costs, reflecting the broader sentiment of caution among Fed officials. As the Fed prepares for its upcoming meeting on September 17, Goolsbee’s insights will be crucial in shaping monetary policy decisions that affect countless businesses and consumers alike.

In assessing the economic landscape, the Chicago Fed’s perspective on inflation serves as a critical touchpoint for understanding financial stability. With Austan Goolsbee at the helm, the focus shifts to the implications of tariffs on local businesses and the ripple effects on prices seen by consumers. Amid concerns over rising wholesale costs and job market fluctuations, the call for a data-driven approach echoes a desire for clarity before executing any changes to interest rates. This careful deliberation demonstrates the Fed’s commitment to maintaining equilibrium between consumer needs and economic indicators, ensuring robust strategies are in place as they gather insights. As they approach key meetings, this scrutiny reflects the Fed’s goal of safeguarding long-term economic resilience.

The Importance of Understanding Inflation Trends

The current inflation trends have become a focal point for policymakers and business owners alike. Chicago Fed president Austan Goolsbee aptly pointed out that obtaining a few months of reliable data is crucial for assessing the ongoing economic health. With inflation metrics recently showing elevated levels—such as the consumer inflation rate hovering around 2.7%—it is essential to dissect these numbers for their implications on broader economic conditions. Such insights will guide the Federal Reserve in making informed decisions regarding monetary policy and interest rates.

Moreover, understanding inflation trends is not just about numerical observations; it involves analyzing underlying factors such as tariff impacts on supply chains and commodity prices. For instance, the increases in tariff costs faced by local businesses like Mel-O-Cream Donuts exemplify how external economic pressures can exacerbate inflation fears. As the Fed considers possible interest rate cuts, the data gathered over the next few months will play a pivotal role in shaping a clear vision for sustainable economic adjustment.

Chicago Fed Inflation Outlook: What’s Next?

The Chicago Fed inflation outlook has raised questions around future monetary policy decisions, especially as president Austan Goolsbee emphasizes the need for more data before making any significant adjustments to interest rates. The current economic landscape reflects a delicate balancing act; while some sectors are calling for immediate relief through interest rate cuts, ongoing complexities such as rising wholesale prices and labor shortages suggest caution. Goolsbee’s focus on waiting for more indicators before proceeding illustrates the Fed’s commitment to a data-driven approach.

This approach is particularly relevant given the recent unexpected rise in wholesale prices, which has prompted speculation about the Fed’s next moves. Goolsbee acknowledged the political pressures that exist for rate cuts, yet he reiterated that decisions should twist and turn solely on economic data. The Chicago Fed’s inflation outlook thus not only aims to stabilize prices but also to maintain maximum employment, ensuring that the economy does not veer into instability amid ongoing challenges.

The Role of Interest Rate Cuts in Economic Recovery

Interest rate cuts have traditionally been a tool used by the Fed to stimulate economic growth during sluggish periods. As president Austan Goolsbee weighs the potential for lowering rates, he is acutely aware that such actions must be synchronized with the current economic climate. For example, businesses are pushing for lower financing costs to cope with inflated ingredient prices due to tariffs, prompting a discussion on whether interest rates should be reduced to address these challenges.

However, Goolsbee’s sentiment hints at a more nuanced path ahead. He recognizes the ongoing labor shortages and inflationary pressures which complicate the simple act of cutting rates. The delicate interplay between managing employment levels and inflation creates a complex backdrop for any potential monetary easing. As the Fed moves forward, the implications of interest rate cuts will depend heavily on real-time economic assessments and feedback from both businesses and consumers.

Tariff Impact on Local Businesses and Inflation

The impact of tariffs on local businesses cannot be overstated, as highlighted by Austan Goolsbee during his visit to Mel-O-Cream Donuts. The sharp rise in shipment costs, from $2,100 to $4,200, exemplifies how tariffs can strain a business’s operational viability. These heightened costs ultimately trickle down to consumers, contributing to the persistent inflation rates that pose challenges for the Fed as it assesses economic stability.

In this context, Goolsbee emphasizes that the Fed must consider such external pressures when formulating monetary policy. Tariffs not only inflate production costs but also hinder business growth by strangling profit margins. As the Fed contemplates its next monetary policy adjustments, understanding the relationship between tariffs and inflation will be critical in framing effective responses that support both economic growth and price stability.

Key Economic Indicators Influencing Policy Decisions

Numerous economic indicators play a vital role in shaping the Federal Reserve’s policy decisions, particularly concerning interest rates and inflation outlook. Among these, wholesale prices, labor market trends, and consumer inflation rates are of utmost importance. According to Goolsbee, the recent uptick in wholesale prices signals a potential shift in economic dynamics, which necessitates careful monitoring before implementing key monetary changes.

Additionally, labor market conditions will also factor significantly into policy considerations. With certain sectors facing ongoing shortages, Goolsbee signifies that job market health offers nuanced signals about the economy’s trajectory. Ultimately, the integration of these economic indicators into the Fed’s decision-making process will ensure that policies are aligned with the broader goal of sustaining economic momentum while curbing inflation.

Business Sentiment Amid Economic Transitions

During times of economic transition, understanding business sentiment becomes crucial for analyzing potential monetary policy impacts. As Goolsbee pointed out, many businesses have expressed concerns about rising costs associated with tariffs, which has bred a sense of uncertainty regarding future investment and operational decisions. Such sentiments reveal a broader narrative about how external factors, like international trade policies, influence local markets and price stability.

This apprehensiveness is reflected in calls for interest rate cuts from businesses seeking relief amidst fluctuating costs. The Fed’s role, therefore, shifts toward ensuring that these sentiments are addressed adequately by maintaining an environment conducive to growth and investment while monitoring inflationary pressures. Continually gauging business sentiment will help the Fed navigate its path through unpredictable economic waters.

Navigating Labor Market Challenges in Policy

Navigating the challenges presented by the labor market is another crucial aspect of policy-making for the Federal Reserve. As president Goolsbee noted, parts of the job market are still grappling with significant labor shortages, which complicates the Fed’s policy landscape. Addressing these challenges is vital not only for scoring maximum employment but also for controlling inflation, thereby enabling smoother economic operations.

The Fed’s ability to adjust interest rates effectively hinges on understanding how labor market dynamics impact inflation and economic growth. This becomes increasingly complex in light of the ongoing transitional phase in the economy. Goolsbee’s insights provide a valuable backbone for how the Fed will navigate these dual objectives, balancing the responses necessary to foster job growth while simultaneously ensuring price stability.

The Intersection of Politics and Economic Policy

While the Federal Reserve operates independently, political factors inevitably influence economic policy decision-making. Austan Goolsbee has pointed out that although the futures market suggests a 0.25% rate cut, it is vital that such decisions remain rooted in economic data rather than political pressures. This distinction is essential to ensure that monetary policy remains effective and suited to the actual economic climate.

This interplay between politics and economics highlights the need for a deliberate approach to policy formulation. By focusing on factors such as inflation rates and labor market conditions, the Fed can better navigate the complexities that arise at the intersection of these two spheres. Goolsbee’s cautious yet pragmatic stance exemplifies how economic indicators should primarily dictate the Fed’s actions, ensuring stability irrespective of political sentiment.

Moving Forward: The Need for Caution and Data-Driven Decisions

As the Chicago Fed gears up for its next meeting, the emphasis on caution and the need for thorough data collection stands out. Goolsbee has stressed that navigating the current economic landscape requires more than just quantitative measures; it demands an understanding of the qualitative factors influencing inflation, tariffs, and interest rates. Gathering extensive data over the forthcoming months will be a critical component in aligning monetary policy with the realities of the economy.

Economists and stakeholders alike are watching closely to see how the Fed adapts its policies based on incoming data. With inflation rates above the Fed’s target and mixed signals from sectors like the job market, a careful approach to decision-making will ensure that any steps taken are in the best interest of maintaining economic health. Ultimately, the Chicago Fed’s dedication to a prudent, informed path will serve as a stabilizing force amidst ongoing economic volatility.

Frequently Asked Questions

What is the Chicago Fed inflation outlook according to Austan Goolsbee?

The Chicago Fed inflation outlook, as articulated by President Austan Goolsbee, is currently cautious. He indicates that before making any decisions about interest rate cuts, the Fed needs to analyze data over a few months to assess the economy’s health and inflation trends.

How do tariff impacts affect the Chicago Fed inflation outlook?

Tariff impacts are significant in the Chicago Fed inflation outlook, as noted by Austan Goolsbee during a recent visit to a local business. He highlighted how tariffs on imported ingredients, like palm oil, have risen sharply, contributing to higher costs and influencing inflation pressures in the economy.

How might interest rate cuts relate to the Chicago Fed inflation outlook?

Interest rate cuts are closely tied to the Chicago Fed inflation outlook. President Goolsbee has pointed out that while there may be market expectations for interest rate cuts due to elevated inflation and rising wholesale prices, a careful evaluation of economic data is needed before implementing any changes.

What recent economic indicators have influenced the Chicago Fed inflation outlook?

Recent economic indicators, such as a surprising rise in wholesale prices and a consumer inflation rate of 2.7%, have influenced the Chicago Fed inflation outlook. These factors indicate that inflation remains above the Fed’s target, prompting a cautious stance from officials, including Austan Goolsbee.

What is Austan Goolsbee’s stance on interest rate adjustments in the context of the Chicago Fed inflation outlook?

Austan Goolsbee’s stance on interest rate adjustments, in relation to the Chicago Fed inflation outlook, emphasizes a data-driven approach. He suggests that any decisions regarding interest rate cuts should be based on comprehensive economic data rather than external pressures, as the Fed navigates a transitional economic phase.

How does the Chicago Fed inflation outlook reflect the current job market conditions?

The Chicago Fed inflation outlook reflects complexities within the job market, as noted by Austan Goolsbee. Despite some sectors facing labor shortages, which can complicate policy decisions, the Fed aims to ensure both employment and price stability in its economic strategies.

What challenges does the Chicago Fed face regarding the inflation outlook and interest rates?

The Chicago Fed faces challenges in balancing the inflation outlook with interest rates, particularly as Austan Goolsbee highlights the need for careful consideration of economic data, rising costs from tariffs, and labor market conditions before making policy decisions.

Why is the Chicago Fed inflation outlook important for businesses?

The Chicago Fed inflation outlook is crucial for businesses as it affects interest rates and financing costs. With ongoing concerns about inflation and potential rate cuts, businesses seek clarity on economic health to make informed decisions about investments and pricing.

| Key Points |

|---|

| Chicago Fed President Austan Goolsbee is cautious about the economy’s health. |

| Goolsbee discussed the impact of tariffs on ingredient costs for local businesses, particularly in the food sector. |

| The business he visited, Mel-O-Cream Donuts, has seen shipment tariff costs rise from $2,100 to $4,200. |

| Despite local production, reliance on imports makes businesses vulnerable to international trade policies. |

| Goolsbee is awaiting more inflation data before the Fed’s meeting on September 17 regarding interest rate decisions. |

| Recent data shows consumer inflation at 2.7%, higher than the Fed’s target of 2%. |

| Market expectations suggest a possible interest rate cut due to requests from businesses for lower financing costs. |

| Some labor shortages still exist in the job market, affecting Fed policy decisions. |

| Goolsbee stressed the importance of using economic data, not political pressure, to guide decisions on interest rates. |

| Fed officials share a cautious stance, advocating for data-driven policy rather than hasty rate adjustments. |

| Balancing maximum employment and price stability remains a key challenge for the Fed amidst ongoing economic fluctuations. |

Summary

The Chicago Fed inflation outlook emphasizes the critical need for careful analysis of inflation data to assess the economy’s trajectory. President Austan Goolsbee highlights significant pressures from tariffs affecting local businesses, despite the resilience shown in some sectors. With consumer inflation still above target and labor market dynamics in play, the Fed must proceed cautiously, prioritizing data over external influences in its decision-making process for future interest rates.