China Deflation: Economic Risks and Export Challenges Ahead

China is currently grappling with deflation, a situation that poses significant risks to its economy. As the Chinese government encourages exporters to redirect their goods from international markets like the U.S. back to domestic consumers, it faces the challenge of weak consumption and oversupply. The ongoing trade tensions and tariffs have compounded these issues, leaving many analysts concerned about the future of the China economy. According to Goldman Sachs, China’s retail inflation is expected to fall to zero in 2025, raising alarms over deflation risks in China. With Chinese exports being redirected, the potential for economic slowdown in China looms, casting doubt on the country’s inflation forecast and overall economic stability.

The current situation in China can be described as a struggle against falling prices, significantly affecting the local economy. As domestic goods flow back from stagnating export markets, the reliance on internal consumption becomes increasingly vital. Tariffs and trade disputes with the U.S. have led to a notable reduction in export demand, prompting a shift in focus towards sustaining the Chinese market. Economists warn that if the trend continues, it could lead to deeper economic challenges, reinforcing the concerns regarding deflationary pressures. Ultimately, the strategic pivot aims to stabilize local businesses while navigating an uncertain global landscape.

Understanding China Deflation and Its Economic Implications

China is at a critical juncture as it faces increasing deflationary pressures largely driven by a shift in export strategy. As tariffs imposed by the U.S. stifle international demand, Chinese exporters are being urged to redirect their focus to domestic markets. This response may seem pragmatic, yet it risks intensifying deflation in a landscape where weak consumption and overcapacity already prevail. Analysts are concerned that without proactive measures, the deflation risks in China could undermine economic growth, challenging Beijing’s aggressive growth targets for 2025.

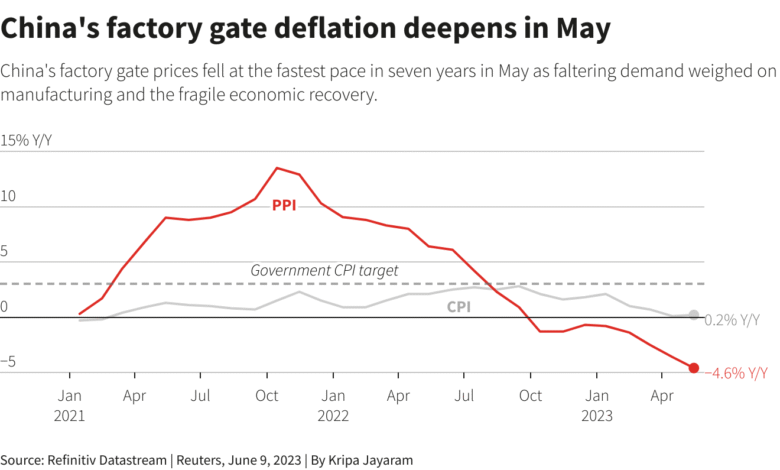

The anticipated retail inflation forecast for China paints a troubling picture, projecting a drop to zero percent in 2025, while the producer price index is expected to fall sharply. These figures cast doubt on the effectiveness of potential stimulus measures by the Chinese government, as many economists predict that clarity on economic recovery must first emerge before decisive action is taken. The implications of ongoing deflation are profound, affecting everything from consumer spending to business profitability.

China’s Economic Slowdown and Export Dependencies

The economic slowdown in China cannot be overlooked, particularly as local realities clash with ambitious growth targets. The reliance on exports as a traditional economic driver has significantly influenced China’s policies. Moreover, with the ongoing trade conflict leading to a drastic increase in tariffs—up to 145%—the compulsion for exporters to pivot to domestic sales is growing. Local governments and businesses are rallying to support this shift, but the reality is sobering; among the challenges posed is the risk of diminished profit margins and the potential for a protracted price war.

This environment creates a precarious situation for companies once focused on international markets. As they battle to maintain sales amid falling prices and rising costs, the fallout on employment in export-heavy regions becomes evident. With estimates suggesting that 16 million jobs are tied to goods destined for U.S. markets, the repercussions of the decelerating export sector could lead to increased job losses, feeding into the already dampened consumer sentiment and spending.

Impact of Tariffs on Chinese Exports and Domestic Consumption

Trade tariffs have severely impeded Chinese exports, prompting a shift in focus towards the domestic market, but not without a host of challenges. As the economic landscape evolves, companies are faced with lowered demand for their products abroad and heightened competition within China. Major e-commerce platforms are pivoting to capitalize on this direction, but their success hinges on whether domestic consumers will respond positively to these redirected exports. The trade war has not only diminished export orders but also raised complex issues, leading to a decline in profit margins and rising instances of returned goods.

Moreover, while the realignment towards domestic sales may momentarily stabilize businesses, it does not guarantee profitability. The aggressive discounting of goods aimed to attract consumers could further compress margins, leading to a scenario where survival becomes complex for smaller firms. Therefore, understanding the intricate relationship between tariffs, export shifts, and domestic consumption patterns is vital for grasping the broader implications of China’s response to its deflationary pressures.

The Role of E-commerce in Stabilizing China’s Economy

In the wake of deflation risks and an economic slowdown, the role of e-commerce giants like JD.com and Tencent becomes increasingly critical. These platforms are not only facilitating the sales of redirected exports but also implementing aggressive promotional strategies to incentivize domestic consumption. For instance, JD.com has pledged substantial financial resources to support exporters and create new market segments aimed specifically at Chinese consumers. This e-commerce pivot reflects a broader trend where digital channels become crucial lifelines for businesses adapting to sudden market changes.

However, the sustainability of such strategies remains in question. While promoting discounted goods could drive temporary sales, the long-term viability hinges on consumer confidence and spending willingness. As prices fall and competition intensifies, understanding consumer behavior will be pivotal. The e-commerce sector’s ability to adapt to these economic realities will significantly influence both its health and the wider recovery of the Chinese economy.

Consumer Sentiment Amidst China’s Economic Transition

In an economy grappling with deflationary pressures, understanding consumer sentiment becomes paramount. Recent dips in the consumer price index highlight growing concerns among the populace about income stability and employment opportunities. This cautious sentiment inevitably reflects in spending habits, contributing to a cycle where reduced consumption exacerbates overall economic challenges. Ultimately, consumers are responding to their economic environment by tightening their belts, which compounds issues for businesses trying to stimulate demand in a struggling domestic market.

The precarious situation is further complicated by external factors, including tariffs and international market dynamics. As job security wanes in export-reliant regions, the sense of uncertainty looms large over consumer behavior. Enhancing confidence in the consumer market will be vital for China as it seeks to re-establish a robust economic footing. Efforts to stimulate consumption must navigate these challenges delicately, ensuring that support measures resonate with the realities of a wary consumer base.

Job Market Challenges Amid Deflation in China

The intertwined nature of the job market and deflation in China presents specific contemporary challenges. As companies pivot to domestic markets amid falling prices and decreasing profit margins, job security appears increasingly tenuous. The projection that 16 million jobs are tied to exports—not just manufacturing but also those reliant on broader economic dynamics—underscores the stakes involved. As firms adapt their strategies, concerns mount about potential job losses and long-term economic stability.

Moreover, the structural shifts in the economy signal a need for robust retraining and reskilling initiatives. Policymakers must recognize the urgency of preparing the labor force for changing demands as traditional sectors face significant transformations. Fostering job creation in emerging industries and supporting workers during transitions will be essential components of navigating these challenges and mitigating the adverse effects of deflation on the economy.

Economic Forecasts: Addressing Deflation in China

While predictions for China’s economic outlook remain cautious, the focus on addressing deflation is increasingly urgent. Goldman Sachs forecasts a real GDP increase of only 4.0% this year, suggesting that economic momentum is notably stalling. With the potential for retail inflation falling significantly, understanding the broader implications of these trends becomes essential for businesses and policymakers alike. As the economy heads into uncharted waters, strategic interventions will be vital to combat inflationary and deflationary pressures.

Addressing these economic challenges will require a multi-faceted approach, balancing short-term necessities with long-term stability. Policymakers must remain vigilant and responsive to economic indicators, exploring innovative measures to support consumption and boost investor confidence. Only through careful navigation of these delicate dynamics can China hope to stabilize its economy and guard against further deflation threats.

Local Government Initiatives: Supporting China’s Economic Adaptation

In response to the economic challenges, local governments are stepping up efforts to support exporters and boost domestic consumption. Initiatives to foster collaboration among local authorities and businesses reflect a shared understanding of the urgent need to stabilize the economy. As the domestic market becomes even more critical, local programs are being designed to encourage spending and mitigate the adverse impacts of rising tariffs on exporters.

However, the success of these initiatives hinges on their design and implementation. Policymakers must ensure that support translates into tangible benefits for both businesses and consumers while simultaneously maintaining a focus on long-term economic sustainability. As local governments become instrumental in navigating this transition, their ability to adapt to changing circumstances will play a crucial role in guiding China’s economy through this period of uncertainty.

The Path Forward: Navigating China’s Economic Landscape

Looking ahead, the path forward for China involves navigating a complex economic landscape shaped by deflation, trade tensions, and changing consumption patterns. The interplay of external pressures and domestic adaptation will determine how effectively the economy responds to these challenges. Proactive measures to stimulate both exports and domestic demand will be critical in mitigating the adverse effects of low inflation and ensuring economic resilience.

Moreover, fostering an environment conducive to innovation and competitiveness will be essential in securing China’s economic future. By addressing the root causes of deflation and maintaining a focus on sustainable growth, the government can better equip the economy to tackle the multifaceted challenges it faces. The ongoing transformation of China’s economic model will ultimately depend on successfully balancing these factors to thrive in a rapidly evolving global market.

Frequently Asked Questions

What are the current deflation risks in China?

China is currently experiencing significant deflation risks, exacerbated by weak domestic consumption and excess capacity. As exporters divert goods from international markets to the domestic sphere due to U.S. tariffs, this shift is contributing to further price declines throughout the economy.

How is the economic slowdown in China affecting deflation?

The economic slowdown in China is impacting deflation rates, with falling consumer demand leading to negative readings on the consumer price index. This ongoing decline in economic activity, coupled with a decrease in export orders, contributes to persistent deflationary pressures across various sectors.

What is the China inflation forecast for the upcoming year?

According to Goldman Sachs, the China inflation forecast indicates that retail inflation could drop to 0% in 2025, compared to a minor increase in 2024. Meanwhile, wholesale prices are expected to decline further, suggesting a challenging economic environment characterized by deflation.

How is China addressing deflation risks in its economy?

To counter deflation risks, China is encouraging businesses to shift exports towards the domestic market. Major companies, supported by local governments, are promoting consumption through discounts and special offers to bolster sales amidst a deflationary backdrop.

What role do Chinese exports play in the deflationary trends?

Chinese exports have a crucial role in the deflationary trends as the trade war and tariffs reduce overseas demand. This results in an influx of goods into the domestic market that drives prices down, leading to heightened competition and price wars among companies, which further exacerbates deflation.

What impact does weak consumer demand have on deflation in China?

Weak consumer demand in China is a primary driver of deflation, causing prices to fall as businesses struggle to sell their goods. This decline in the consumer price index reflects decreased purchasing power and economic uncertainty, creating a cycle that perpetuates deflationary pressures.

Why might Beijing delay fiscal measures to combat deflation?

Beijing might delay fiscal measures to combat deflation until clear signs of economic decline emerge. Economists suggest that the government prefers to assess the situation before implementing stimulus, especially in light of potential impacts on employment and consumer spending.

How do tariffs influence deflation in China’s economy?

Tariffs significantly influence deflation in China’s economy by choking overseas demand, leading to an oversupply of goods in the domestic market. This excess supply contributes to falling prices, worsened profit margins, and intensified competition among Chinese companies.

What are the implications of a declining producer price index in China?

The declining producer price index (PPI) in China, which has now fallen for 29 consecutive months, signals persistent deflation and weak industrial demand. As producers face lower prices for their goods, this may lead to reduced investment and increased unemployment, further straining the economy.

How does the dynamic of Chinese companies help or hinder efforts against deflation?

While some Chinese companies provide discounts to clear excess inventory, this strategy can trigger aggressive price competition that harms profitability. Thus, the cooperative efforts to stabilize exports and enhance domestic consumption may not suffice in curbing deflationary trends effectively.

| Key Points | Details |

|---|---|

| China’s Deflation Risk | As China shifts exports to the domestic market, deflation fears grow amid weak consumption and excess capacity. |

| Goldman Sachs Projections | Retail inflation expected to fall to 0% in 2025, with wholesale prices declining by 1.6%. |

| Economic Measures | Beijing may delay stimulus measures, observing economic conditions before acting. |

| Support for Exporters | Local governments and companies are aiding exporters in reaching domestic markets. |

| Price Wars | Discounted goods trigger fierce competition, affecting profitability and potentially employment. |

| Consumer Confidence Decline | Declining job prospects and income stability concerns dampen consumer demand. |

| Trade War Effects | Tariffs lead to further declines in wholesale prices and impact export orders. |

| Job Losses Forecast | Approximately 16 million jobs in China linked to U.S. exports might be at risk. |

| Long-Term Economic Outlook | Navigating trade pressures and low demand will remain challenges for China’s economy. |

Summary

China deflation poses significant risks to its economy as it reallocates exports intended for the U.S. to domestic buyers. This shift, driven by high tariffs and diminishing overseas demand, could deepen existing deflationary trends characterized by weak consumption and excess production capacity. While local support for exporters exists, the overall economic landscape remains precarious, potentially leading to job losses and a declining consumer price index. In conclusion, as China faces these economic challenges, it will have to balance stimulus measures carefully to stabilize its economy while dealing with the repercussions of ongoing trade tensions.