China Retail Sales Disappoint Amid Economic Challenges

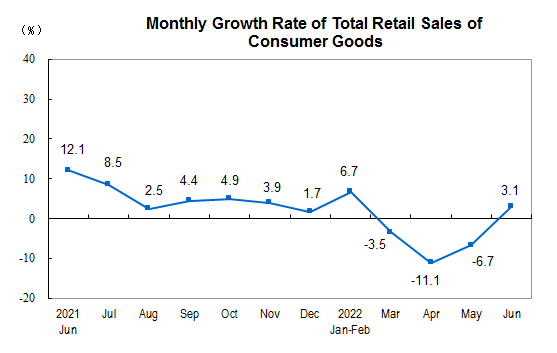

China retail sales have shown a significant yet cautious growth in recent months, reflecting the complex dynamics of the country’s economy. In April, retail sales witnessed a 5.1% increase from the previous year, narrowly missing analysts’ predictions of 5.5% growth, as noted by a Reuters poll. This modest uptick follows a stronger 5.9% rise in March, indicating that consumer spending is still under strain despite recent China stimulus measures aimed at boosting demand. Meanwhile, industrial output defied expectations with a 6.1% year-on-year growth, revealing resilience amid ongoing U.S.-China trade tensions. As the Chinese government strives to navigate these challenges, the health of China retail sales will be crucial for understanding the broader implications for the China economy, including industrial output growth and consumer confidence.

Exploring the landscape of retail commerce in China reveals vital trends that impact consumer behavior and economic forecasts. The nation’s consumer expenditure has been tinged with hesitance, as evidenced by the retail sector’s performance amidst various economic pressures, including foreign trade relations and governmental stimulus initiatives. While growth in consumer spending is crucial for a robust economy, external factors such as tariffs continue to shape the landscape, prompting adjustments in investment and policy. Enhanced production capabilities highlight the complex interplay between industrial performance and retail dynamics, indicating that the future trajectory of consumer sales in China hinges on effective governmental support and the resolution of trade disputes. Ultimately, analysing these interconnected elements is essential for anticipating shifts in the overall economic framework.

China’s Retail Sales Trends Amid Economic Uncertainty

In April 2025, China’s retail sales growth registered at 5.1%, a notable decline from the previous month’s growth of 5.9%. This deviation from market expectations has raised concerns regarding domestic consumption in the world’s second-largest economy. Market analysts had anticipated a growth rate of 5.5%, and the actual figures reflect the challenges facing consumers amidst an array of economic uncertainties. Despite the government’s recent stimulus measures aimed at boosting demand, it seems that these efforts have yet to translate into improved retail performance.

The sluggish retail sales growth is indicative of a larger trend within consumer behavior in China, further exacerbating worries about the sustainability of the economic recovery. The data points to underlying factors that may be inhibiting growth, such as rising unemployment and external pressures stemming from the ongoing U.S.-China trade relations. Without a strong rebound in consumer spending, it will be challenging for the Chinese economy to maintain a consistent growth trajectory, especially as stimulus measures may take time to yield visible results.

Impact of China Stimulus Measures on Economic Growth

China’s government has implemented a series of stimulus measures intended to invigorate its economy, focusing on boosting consumption and supporting sectors that have been adversely impacted by tariffs. Despite these initiatives, recent data suggests that such measures have not significantly spurred retail sales growth. Analysts are calling for a reevaluation of these strategies, emphasizing a need for more direct interventions that address consumer confidence and spending capabilities.

The efficacy of these stimulus efforts is further called into question as industrial output, which saw a robust growth of 6.1% in April, highlights a dichotomy in economic performance. While industrial sectors appear to show resilience, consumer-related sectors remain weak, revealing an inconsistency that could hinder overall economic health. The dual-stage growth warrants careful monitoring of the implementation and effectiveness of stimulus strategies, ensuring that they not only drive production but also re-engage consumer enthusiasm.

Industrial Output Growth in the Face of Tariffs

Despite a backdrop of rising U.S. tariffs, China’s industrial output demonstrated a year-on-year growth of 6.1% in April, surpassing market expectations. This resilience might suggest that Chinese manufacturers are adapting to the new trade landscape, finding alternative markets and modifying operational practices to mitigate tariff impacts. The uptick in industrial activity contrasts sharply with the subdued performance in the retail sector, raising questions about the overall stability of growth in the economy.

The industrial sector’s strong performance can provide a buffer against the negative effects of the trade conflict. Analysts anticipate that as businesses become more adept at navigating the challenges posed by U.S.-China trade relations, industrial output could maintain its momentum. However, sustaining this growth will necessitate ongoing support from the government through stimuli aimed at innovation and productivity enhancements, thus ensuring that the sector can thrive even in a fluctuating economic environment.

The Influence of US-China Trade Relations on Economic Growth

The evolving dynamics of U.S.-China trade relations play a crucial role in shaping the economic landscape of China. Recent trade negotiations, which saw a temporary rollback of tariffs, have stirred optimism among businesses and investors alike. However, the volatility of these relations continues to present a significant hurdle, with lasting implications for both retail and industrial sectors. The 21% drop in shipments to the U.S. in April servest as a stark reminder of the fragility of these trade dynamics.

Effective trade relations will be vital for securing long-term economic stability, especially in light of the current uncertainties affecting consumer behavior. The ability of Chinese manufacturers to establish a foothold in emerging markets may assist in offsetting declines in traditional export channels. As analysts project the potential for recovery, the importance of fostering resilient trade relationships becomes even more pronounced, with careful stewardship required to navigate an ever-changing global economic landscape.

Fixed Asset Investment Trends Amid Economic Challenges

In spite of a challenging economic environment, China’s fixed asset investment saw a rise of 4.0% year-on-year in the first four months of 2025. While this figure is slightly below analysts’ expectations, it indicates a degree of resilience in infrastructure and property investments that is critical for driving long-term economic growth. However, the ongoing downturn in the real estate sector, which fell by 10.3%, suggests that investment in this area remains fragile and could impede overall economic momentum.

The performance of fixed asset investments underscores the complexity of China’s economic recovery. While investments in infrastructure projects are crucial for sustaining growth, the difficulties experienced in the real estate market highlight potential vulnerabilities. A comprehensive strategy is necessary to stimulate investment flows in both sectors, ensuring that they contribute to a balanced economic recovery that supports consumer and industrial growth.

Consumer Behavior Amid Economic Reform: Insights and Implications

Consumer sentiment in China appears to be under strain as indicated by the weakened retail sales growth. Many factors contribute to this cautious behavior, including the rising cost of living, sluggish wage growth, and uncertainties related to employment levels amidst the backdrop of the trade war. As consumers pull back on expenditures, the immediate challenge for policymakers is to identify measures that can rekindle confidence and encourage spending.

In light of these insights, it is crucial for government initiatives aimed at boosting consumption to effectively address the underlying concerns of consumers. Programs that offer subsidies and incentives for purchasing goods, especially in large sectors like automobiles and electronics, may prove beneficial. Targeted support for low- to middle-income families could also enhance overall consumer confidence, ultimately fostering a more vibrant retail environment.

Deflationary Pressures and Their Impact on the Economy

China’s economy is currently facing deflationary pressure, as evidenced by consecutive declines in consumer prices this year. Such developments raise alarm among economists as they may deter spending and signal a stagnating economy. The recent statistics indicate a pressing need for the Chinese government to address these deflationary trends through effective monetary policies and stimulus packages designed to rejuvenate consumer demand.

Addressing deflation is vital for maintaining economic stability. As consumer prices decline, the risk of a deflationary spiral increases, where consumers defer spending in anticipation of lower prices. Policymakers must act decisively to implement strategies that not only stabilize prices but also reintegrate consumer spending into the economic cycle. Robust measures will be essential to restore consumer confidence, ensuring a turnaround in retail sales and fostering overall economic recovery.

Forecasts for China’s Economic Growth Amid Global Uncertainty

With the ongoing changes in U.S.-China trade relations and domestic economic conditions, various investment banks have cautiously revised their forecasts for China’s economic growth. The optimism following tariff negotiations suggests a potential stabilization, with predictions for GDP growth hovering around 4.6% in 2025. However, analysts emphasize that this growth must be approached with caution, taking into account the potential risks tethered to external trade dynamics and internal consumption patterns.

As forecasts are adjusted, there is an increasing call for proactive measures to underpin this growth trajectory. Investment in infrastructure, coupled with initiatives aimed at stimulating domestic consumption, will be crucial in maintaining momentum. Policymakers are urged to enhance fiscal support to solidify consumer and business confidence, ensuring that the foundations for sustainable growth are established even as global uncertainties continue to loom.

Strategic Responses to Economic Challenges

In light of the economic pressures stemming from both domestic and international sources, strategic responses from the Chinese government are pivotal. Understanding the nuances of the current economic climate, the government has initiated various measures aimed at buffering the impacts of external shocks like tariffs, while simultaneously fortifying internal market conditions. These strategies are designed not only to stimulate production but also to restore consumer confidence.

However, executing these strategies effectively necessitates a tailored approach that addresses the specific needs of various economic sectors. The integration of comprehensive plans that leverage fiscal tools to boost consumer demand and support struggling industries will be essential for achieving long-term recovery. Policymakers must remain vigilant and responsive to changes, ensuring that economic strategies evolve alongside the shifting landscape.

Frequently Asked Questions

What factors contributed to the recent slowdown in China retail sales growth?

China’s retail sales growth slowed to 5.1% in April, missing analysts’ expectations of 5.5%. This decline is attributed to ongoing concerns over consumer demand amidst external economic pressures, including the impact of U.S.-China trade relations and the effectiveness of recent China stimulus measures aimed at boosting consumption.

How do China stimulus measures affect retail sales growth?

China stimulus measures are designed to spur economic activity and consumer spending. However, the recent measures have shown limited success in driving retail sales growth, which only increased by 5.1% in April compared to the previous year. The lack of robust consumption signals a need for further policy adjustments to stimulate the China retail sales market.

How do industrial output growth and retail sales in China correlate?

Industrial output in China grew by 6.1% in April, indicating a strong manufacturing sector despite the retail sales growth deceleration. This suggests that while production may thrive, consumer spending remains sluggish, which can impact overall economic stability. A balanced recovery in both industrial output growth and retail sales is crucial for the health of the China economy.

What is the outlook for China retail sales amid US-China trade relations?

The outlook for China retail sales could be influenced by ongoing US-China trade relations. Recent reductions in tariffs may alleviate some pressure, but the overall economic sentiment remains cautious. Sustained growth in retail sales will depend on improved consumer confidence and effective government stimulus measures amidst these geopolitical tensions.

What role does consumer sentiment play in China’s retail sales growth?

Consumer sentiment plays a critical role in driving China retail sales growth. Factors such as employment stability, economic perceptions, and the effects of China stimulus measures largely determine consumer spending behaviors. A decline in consumer confidence, as seen in the recent retail sales slowdown, poses challenges to achieving desired growth in the retail sector.

What are the implications of recent economic data on future retail sales in China?

Recent economic data showcasing a deceleration in retail sales growth and varied industrial output growth suggests that immediate challenges exist for the China economy. The implications for future retail sales hinge on effective policy responses, successful stimulus measures, and improving consumer sentiment to encourage spending.

How does the performance of the retail sector impact the overall China economy?

The retail sector is a significant driver of the China economy, accounting for a large portion of GDP. Fluctuations in retail sales can reflect broader economic health; therefore, a slowdown in retail sales growth can signal potential challenges for economic stability, prompting the need for strategic stimulus measures and adjustments in economic policy.

| Key Point | Details |

|---|---|

| Retail Sales Growth | April’s retail sales grew by 5.1%, below the 5.5% forecast, down from 5.9% in March. |

| Industrial Output | Increased by 6.1% in April, surpassing the 5.5% forecast but slower than March’s 7.7%. |

| Fixed-Asset Investment | Grew by 4.0% in the first four months, slightly under the 4.2% expectation. |

| Urban Unemployment Rate | Fell to 5.1% in April from 5.2% in March amid trade war concerns. |

| Automobile Sales | Only grew by 0.7% in April compared to the 5.5% gain in March. |

| Real Estate Sector | Saw a significant downturn with a 10.3% decrease year-on-year. |

Summary

China’s retail sales showed disappointing results recently, with growth failing to meet expectations. Despite challenges in consumer confidence and the external environment, there are signs of resilience in other economic areas. The mixed performance of industrial output and fixed-asset investment, alongside ongoing adjustments in the real estate market, highlights the complexities facing China’s economy. As China retail sales continue to be a focal point, the government is implementing various stimulus measures to stimulate demand and support sectors impacted by recent market fluctuations.